🚀 Introduction

Picture this: Latin America isn’t just riding the crypto wave—it’s grabbing the board, breaking the rules, and setting the new standard. Right now, over 20% of adults in the region own crypto. That’s not hype—that’s a revolution driven by inflation, banking black holes, and the promise of financial freedom. But what’s the catch? Regulation. It’s messy, complex, and if you’re not paying attention, you’ll get left holding the bag while everyone else cashes out.

This isn’t your average “let’s wait and see” market. Latin America is the Wild West of crypto—high risk, high reward, and absolutely not for the faint of heart. If you’re serious about dominating the game, you need to know exactly who’s building the on-ramps, who’s putting up the roadblocks, and where your next opportunity is hiding.

Let’s tear the lid off and see how every major player is treating digital assets, taxes, compliance, and the future of decentralised finance in 2025.

🌎 The Latin American Crypto Landscape: Market Drivers

Here’s the bottom line: Crypto isn’t just cool in Latin America. It’s necessary. High inflation? Check. Broken banking? You bet. Remittances draining billions in fees? Welcome to reality.

People here aren’t just speculating—they’re protecting their life savings, sending money home, and building side hustles the banks can’t touch. This grassroots demand has forced governments to pay attention, whether they like it or not.

⚖️ Four Shades of Regulation: Who’s Hot, Who’s Not

There’s no one-size-fits-all in this region. Forget simple categories. Here’s how the regulatory map really looks:

- Embracing: Governments rolling out the red carpet.

- Progressive: Walking the tightrope—pro-innovation, but with limits.

- Cautious: Watching from the sidelines, scared to commit.

- Restrictive: Pulling up the drawbridge and banning what they fear.

🔥 Embracing Crypto: The Early Adopters

Let’s start with the wolves—the countries that went all-in.

El Salvador: The Bitcoin Rollercoaster

Remember when El Salvador made Bitcoin legal tender? It was headline gold. In practice, it’s been a wild ride. First, full legal status. Then, regulatory pivots, tax tweaks, and a growing tension with international lenders. By mid-2025, the government reversed parts of the law, but crypto commerce is still alive—just with tighter oversight and clearer KYC/AML requirements.

Brazil: From Hype to Framework

Brazil leads Latin America in trading volume and wallet adoption. Their regulators aren’t just playing catch-up—they’re setting the rules, issuing VASP licences, and aligning tax laws with global standards. Capital gains taxes apply (ranging from 15–22.5%), but exemptions exist for small holders and long-term investors. The market here isn’t just big—it’s bankable.

Want to see how asset classes stack up? Check out The Wolf’s Guide to Asset Classes in Crypto Wealth.

📈 Progressive Players: Regulation with a Growth Mindset

These countries know innovation means profit—but they’re not handing out blank cheques.

Mexico: The AML Playbook

Mexico’s fintech law is a case study in balanced regulation. Virtual Asset Service Providers (VASPs) need a licence. There are robust AML checks, KYC requirements, and ongoing reporting obligations. The upside? Institutional investors are moving in, and cross-border payment startups are scaling up fast.

Paraguay: Mining Mecca

Paraguay legalised crypto mining years ago, leveraging cheap hydroelectric power. Regulators now monitor operations, require business registrations, and demand transparent reporting. The legal framework is evolving, but the signal is clear: “Build here, play by the rules, and you’re in.”

Want the latest on compliance? Don’t miss the Crypto AML Guide: Compliance and Security 2025.

🕵️♂️ Cautious but Curious: Waiting in the Wings

Some governments are watching, learning, and hedging their bets.

Argentina: Taxman’s Paradise

Crypto is huge in Argentina, driven by runaway inflation. But the government sees digital assets as a tax goldmine. Gains are taxed as income, reporting is mandatory, and unregistered platforms face crackdowns. Yet, enforcement is inconsistent. With new presidential leadership in 2025, expect further shakeups—either a regulatory breakthrough or a major clampdown.

Uruguay: Sandbox Innovator

Uruguay is running regulatory sandboxes—real-world pilots for fintechs to test products with minimal red tape. Early feedback suggests the government will move toward light-touch regulation, focusing on AML and consumer protection.

Peru & Colombia: The Long Game

Both countries are drafting bills, consulting industry, and learning from neighbours. The private sector is pushing for clarity, but policymakers are in no rush.

Need an edge on travel rule compliance? See Crypto Travel Rule Compliance Strategy 2025.

🚫 Restrictive Regimes: The Blockers

Let’s not sugarcoat it: Some countries are building walls, not bridges.

Venezuela: Innovation to Control

Once a crypto innovator (remember the Petro?), Venezuela now runs a tightly controlled market. All exchanges must register, the state owns all mining rights, and non-compliance means jail time. Citizens still trade—often underground.

Bolivia & Honduras: Hard No

Bolivia and Honduras outright ban the use, holding, and trading of cryptocurrencies. Enforcement varies, but don’t expect to see regulated exchanges or institutional adoption here anytime soon.

💸 Crypto Taxation: The Profit Trap or Wealth Engine?

This is where the rubber meets the road—and where most traders get burned.

Brazil: 15–22.5% capital gains tax, but long-term holders can snag reductions.

Argentina: Treated as regular income—no mercy from the taxman.

El Salvador: Exempted gains initially, but recent policy shifts added reporting and selective taxes.

Mexico: Capital gains rates vary, with new reporting standards for businesses.

Uruguay & Paraguay: Drafting new rules, but most gains are currently taxed as business income.

Bottom line? Don’t assume tax-free status anywhere—always check the latest law.

Planning your profit exit? Master timing with Tax Year vs Tax Season: Crypto Tax Compliance 2025.

🔍 AML, KYC, and the Travel Rule: Compliance or Chaos?

2025 is the year Latin America gets serious about compliance.

- FATF Travel Rule: Rolling out region-wide, forcing exchanges to share transaction data.

- VASP Licensing: Standard in Brazil, Mexico, and the Bahamas—soon the regional norm.

- AML/KYC Upgrades: Countries are adding biometric ID, advanced screening, and automated reporting.

For users, this means more paperwork—but greater safety, legitimacy, and less risk of hacks or fraud. For businesses, failing to comply isn’t just risky; it’s game over.

🏝️ Caribbean Case Studies: The Island Innovators

You want innovation? Look to the islands.

Bahamas: CBDC Trailblazer

The Bahamas stunned the world by launching the Sand Dollar, the first central bank digital currency (CBDC) in the Americas. It’s legal, widely accepted, and fully regulated. Crypto exchanges are licensed, AML is enforced, and cross-border payment startups are multiplying.

Cayman Islands & Bermuda: Clarity vs Caution

The Cayman Islands have one of the clearest VASP frameworks in the world, attracting global players. Bermuda is cautious—focused on compliance and insurance, but open to innovation under strict controls.

Other islands, like Jamaica and Barbados, are watching closely and running pilot programs.

🏆 Who’s Winning? Crypto Adoption and Market Growth

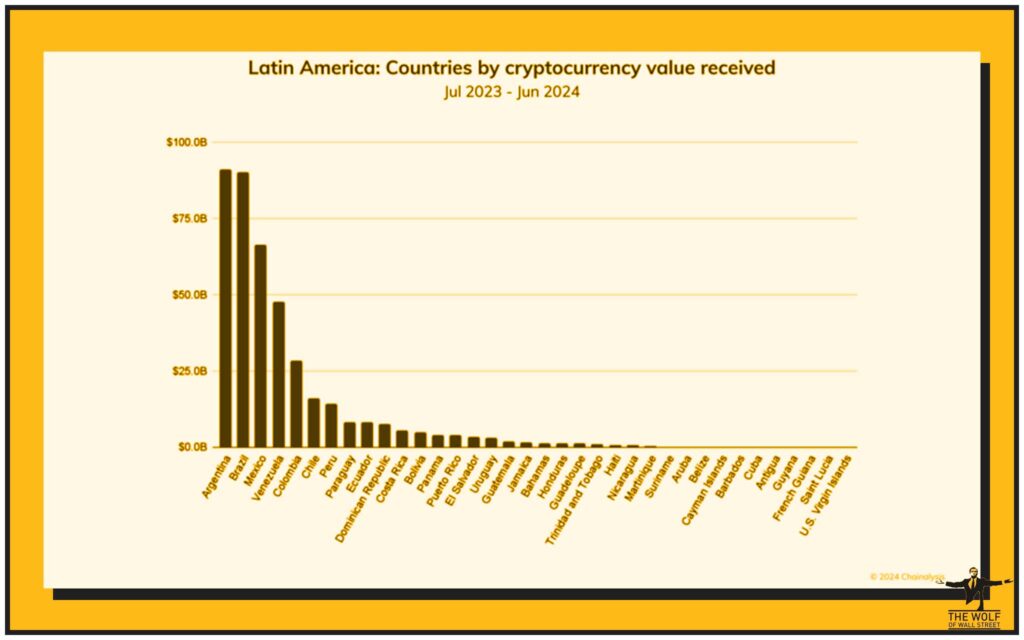

Let’s talk numbers and real market action:

- Brazil: The juggernaut—leads in volume and wallet creation.

- Argentina: Huge grassroots movement, especially in stablecoins.

- El Salvador: Bold but bumpy, still driving innovation.

- Caribbean: Bahamas setting standards, Cayman Islands attracting global talent.

Startups are thriving where regulation is clear and taxes are fair. Countries with heavy-handed bans? Crypto activity just moves underground.

Scouting your next move? See the Research Crypto Opportunities Guide.

🔥 What’s Driving Change? Regional Trends and Catalysts

- Economic Instability: Inflation, currency crises, and political swings drive adoption.

- Grassroots Demand: Unbanked populations are leapfrogging old systems.

- Global Pressure: FATF, IMF, and other bodies push for AML and KYC.

- Tech Innovation: Blockchain-based remittances and DeFi platforms are booming, especially where regulators give the green light.

🛠️ Challenges, Pitfalls, and the Road Ahead

Latin America is the land of opportunity—but also of risk.

- Legal Uncertainty: Frequent policy shifts leave businesses and traders guessing.

- Enforcement Gaps: Some laws exist only on paper, leading to “grey markets.”

- Tax Complexity: Ambiguous or conflicting rules trip up even the pros.

- Business Risks: Exchanges have been shuttered overnight, assets frozen, or taxed out of existence.

If you’re operating here, knowledge isn’t power—it’s survival. And the wolves always eat first.

Want to lock in profits and avoid pitfalls? Read Crypto Profit Taking: The Wolf’s Guide.

💡 Final Take: Betting on the Future or Playing with Fire?

Here’s the straight talk: Latin America is where crypto fortunes will be made—or lost. The regulatory climate is evolving fast. Ignore it, and you’ll pay the price. Stay informed, join the right networks, and play by the rules, and you can ride this wave all the way to the top.

Don’t gamble solo. Plug into a community, track regulatory shifts, and keep your edge sharp. If you want VIP signals, pro-level analysis, and a network of 100,000+ traders, get involved with the The Wolf Of Wall Street crypto trading community—because in this market, information is profit.

For hands-on resources, exclusive signals, and non-stop market insights, check the The Wolf Of Wall Street Crypto Trading Community Service.

🤔 FAQs

1. What are the main regulatory trends for crypto in Latin America?

Countries are moving toward stricter AML/KYC compliance, VASP licensing, and, in some cases, legalising crypto for commerce and investment.

2. How do tax policies on cryptocurrencies differ across the region?

There’s massive variation—some treat it as income, others as capital gains, and a few offer tax breaks or exemptions.

3. Which country is most crypto-friendly in Latin America?

Brazil and the Bahamas stand out for their clear rules and active ecosystems, while El Salvador remains bold but volatile.

4. How are Caribbean nations handling crypto?

Leaders like the Bahamas have launched CBDCs and licensing regimes; others remain cautious but curious.

5. What are the risks of trading crypto in highly restrictive countries?

You face legal action, asset seizures, and the risk of losing access to regulated platforms. Always check local laws first.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”

Ready to unleash your next move? The wolves are hungry—make sure you’re running with the right pack.