⚡️ The $198M Power Move That’s Got Wall Street Watching

You want to know what real conviction looks like? It’s DeFi Development Corp, a Nasdaq-listed heavyweight, dropping nearly $200 million in a single week to push its Solana treasury to a jaw-dropping 999,999 SOL. This isn’t just a headline—it’s a strategic sledgehammer, and every crypto insider, fund manager, and boardroom executive is watching. If you’re still playing safe on the sidelines, you’re missing the kind of moves that create legends—and fortunes.

Let’s break down how this audacious play is flipping the script on corporate crypto, why Solana is the asset of choice, and what every sharp trader can learn (and leverage) from this historic deal.

🚀 The Evolution: From Real Estate Tech to Crypto Juggernaut

Most public companies tiptoe into crypto. Not DeFi Development Corp. They scrapped the old real estate software model, ripped up the roadmap, and went all-in on crypto. This pivot didn’t happen in a vacuum. The company saw the writing on the wall: traditional yields are dead, volatility is opportunity, and Web3 is where the smart money flows.

DeFi Development Corp’s transformation is a masterclass in corporate reinvention. While others debated, they acted. The result? A first-mover advantage on a scale the crypto sector hasn’t seen from Wall Street in years.

💼 The Mechanics: How DeFi Development Corp Acquired 999,999 SOL

Let’s get tactical. You don’t stack a million SOL by accident. This was a calculated operation—spot buys during market lulls, scooping up discounted locked tokens, and racking up staking rewards like a high-roller comping chips in Vegas.

- Spot Buys: Strategic accumulation during price retracements.

- Discounted Locked Tokens: Leveraging illiquid markets for price breaks.

- Staking Rewards: Every SOL is immediately put to work—no dead weight.

The process is relentless, disciplined, and always one step ahead of retail FOMO. It’s about turning every market inefficiency into profit.

🔑 Why Solana? The Yield, the Volatility, the Institutional Magnetism

Ask yourself—why Solana? The answer is the “institutional trifecta”: native yield, volatility, and ecosystem momentum.

- Yield: Solana staking isn’t just passive income; it’s scalable, automated, and feeds the treasury.

- Volatility: Where others see risk, DeFi Development Corp sees the raw material for profit. “Volatility gets monetised for the benefit of shareholders,” CEO Joseph Onorati declared.

- Ecosystem: Solana isn’t just another blockchain. It’s a developer magnet, a transaction monster, and the hotbed of NFT, DeFi, and real-world adoption.

That’s why they’re not hedging into other coins. Solana is the main event.

📈 Market Shockwaves: Solana’s 12% Rally—Coincidence or Catalyst?

Timing isn’t luck—it’s skill. The $198 million buy came right before Solana pumped 12% to over $202, clocking a weekly gain of 25%. Was DeFi Development Corp the spark? Maybe. Did they ride the rocket? Absolutely.

Nansen data confirms the price action. The market felt the supply squeeze. Institutions followed, and retail traders scrambled to catch the move. This is how real market leadership looks in crypto.

Want the latest DeFi power plays? Check out our DeFi insights and trending crypto news.

🏦 Corporate Treasury Goes Crypto: The New Normal

Why keep cash in a bank that bleeds value to inflation? Smart companies are deploying idle capital in crypto, chasing yield and price upside. It’s not about speculation—it’s about survival and outperformance.

Public company treasuries are moving on-chain, staking, lending, and flipping volatility into shareholder returns. DeFi Development Corp isn’t the first, but their scale sets a new bar for Wall Street and beyond.

🏆 Setting the Benchmark: Nearly 1 Million SOL—First-Mover Advantage

Let’s put this in perspective. A Nasdaq-listed firm with almost 1,000,000 SOL is an industry benchmark. They didn’t wait for a consensus—they created it. This is how institutional adoption happens: bold, concentrated, conviction bets that change what’s “normal” for everyone else.

Others talk about diversification. DeFi Development Corp talks about domination.

💰 The Staking Game: How the Treasury Prints Native Yield

Here’s where it gets interesting. Every SOL in the treasury isn’t just sitting there—it’s staked, compounding native yield 24/7. This isn’t your bank’s 1% interest. We’re talking 4-7% annualised returns just for supporting network security.

- Immediate staking after every acquisition.

- Compounded rewards boost the treasury over time.

- Institutional-grade custodianship minimises risk.

Yield isn’t optional anymore—it’s the baseline.

🧠 Volatility Monetised: Why Risk = Opportunity

Let’s get real. The market rewards courage and precision. While other firms hide from volatility, DeFi Development Corp runs toward it. Here’s the play: use market swings to mint convertible debt, roll profits, and grow the asset base.

Volatility isn’t just weather to be endured—it’s an asset to be monetised. That’s the difference between trading scared and trading like a pro.

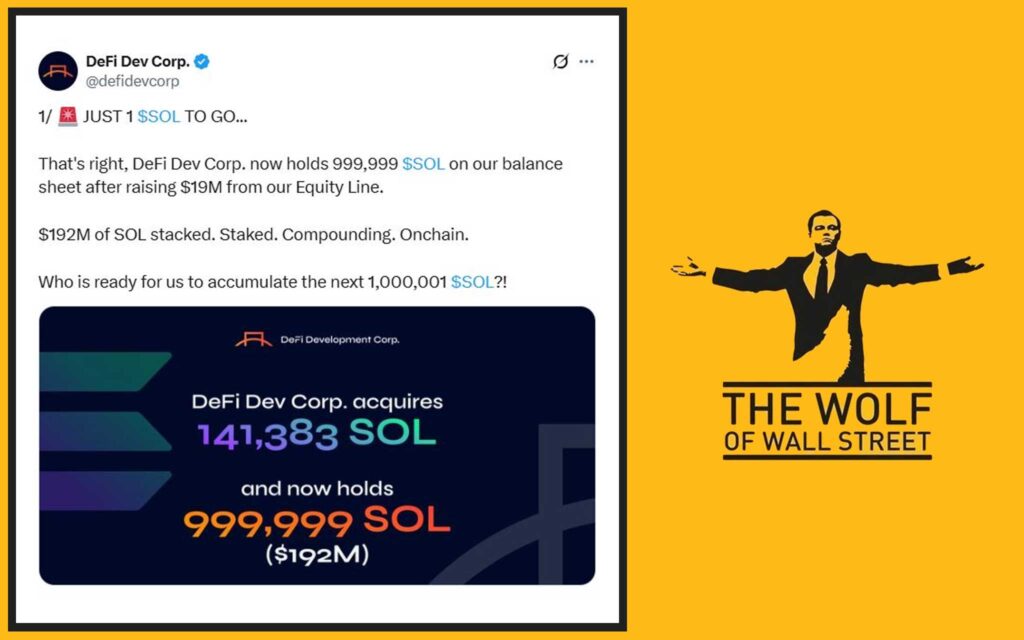

📊 Show Me the Numbers: Stock Price, Capital Raise, and the $19.2M War Chest

Money talks. Let’s run the scoreboard:

- $198 million for 141,383 SOL in July—largest buy yet.

- $19.2 million raised from a 740,000 share offering.

- $5 million left to deploy—enough for another ~24,752 SOL at current prices.

- Stock dipped 3.65% on the announcement day but partially recovered in after-hours trading.

The numbers are aggressive. The execution is clinical.

🥊 Competitive Arena: Bit Mining, MemeStrategy & The Solana Treasury Arms Race

It’s not just DeFi Development Corp making moves. The arms race is on.

- Bit Mining: Gunning to raise $300 million for its own Solana treasury.

- MemeStrategy: First Hong Kong-listed SOL treasury—raising the international stakes.

Everyone’s chasing the alpha, but few have pulled off a nearly million-SOL war chest. That’s leadership—pure and simple.

🕵️ Risks & Red Flags: What Could Go Wrong?

Let’s not sugar-coat it—there’s danger in concentration:

- Regulatory: Compliance headaches if laws change.

- Volatility: Solana isn’t Bitcoin. Price swings can cut both ways.

- Operational: Staking and custody risks aren’t for amateurs.

But the flip side? Big risk, big reward. The playbook here is about managing risk, not avoiding it.

👥 Shareholder Reality Check: Crypto Gains, Equity Pains?

Here’s the kicker. Solana soared. The company’s stock… didn’t. On announcement, shares dropped 3.65% before some after-hours relief. What gives?

- Disconnect: Equity markets lag crypto performance.

- Narrative gap: Investors struggle to price concentrated crypto treasuries.

- Long game: It takes time for Wall Street to catch up.

This is the pain (and opportunity) of being a first-mover. Stay patient. The market rewards results.

🌍 Institutional Adoption: The Bigger Trend in Corporate Finance

This isn’t an isolated story—it’s a tidal wave. Companies worldwide are starting to wake up to on-chain asset management, staking, and DeFi as real, scalable treasury strategies.

What’s next? Expect more headlines, more adoption, and more mainstream money chasing blockchain-based returns.

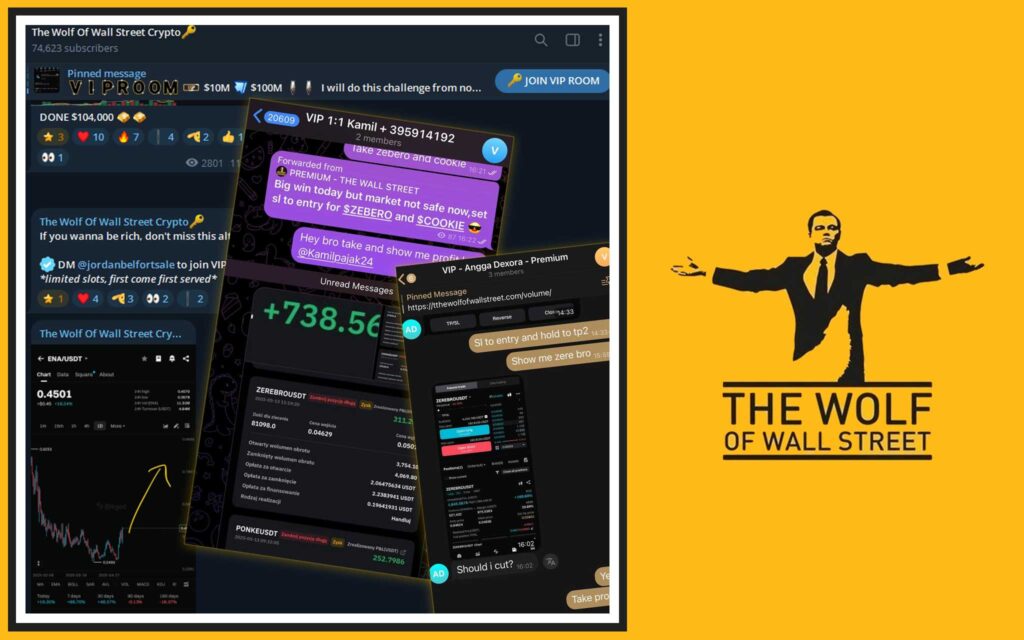

🛠️ Tools, Communities & Getting Ahead: Don’t Trade Blind

Want an edge like the pros? Stop trading solo. The The Wolf Of Wall Street crypto trading community gives you:

- VIP Signals: Proprietary, profit-driven calls.

- Expert Analysis: Learn from real market veterans.

- Community: 100,000+ traders. Shared insights. Zero hype, all action.

- Essential Tools: Calculators, trackers, and 24/7 support.

Stay sharp. Stay informed. Join The Wolf Of Wall Street on Telegram and never trade in the dark again.

Dig deeper into layer 1 and layer 2 solutions and follow the altcoin market for the next big move.

🧩 The Playbook: What Can You Learn from DeFi Development Corp’s Move?

Here’s your cheat sheet:

- Be decisive: Waiting for consensus is for losers.

- Pick your winners: Focus beats diversification in volatile markets.

- Stake everything: Idle assets are a liability.

- Monetise volatility: Don’t fear swings—milk them for yield and growth.

- Track the big players: Institutional moves create opportunity for those paying attention.

Apply the playbook. Don’t get left behind.

🔥 Key Takeaways: DeFi Development Corp’s Bet—Big, Bold, Risky, Rewarding

DeFi Development Corp’s near-million Solana stash isn’t just a flex—it’s a blueprint for the future of corporate treasury management. Solana’s native yield and volatility are now institutional-grade tools. The move highlights the upside—and risks—of conviction bets in crypto. Winners won’t wait for permission; they create it.

❓ FAQs

Q1: Why did DeFi Development Corp choose Solana over Bitcoin or Ethereum?

A: Solana offers higher native yield, faster transaction speed, and more volatility—perfect ingredients for treasury growth and active management.

Q2: How does staking SOL benefit a public company’s treasury?

A: Staking generates consistent, compounding returns, turning the treasury into an income engine instead of idle storage.

Q3: What are the biggest risks for public companies holding large crypto reserves?

A: Regulatory crackdowns, price volatility, and custody risks. Only disciplined, well-resourced firms should play this game.

Q4: How does DeFi Development Corp’s strategy compare to MicroStrategy’s Bitcoin approach?

A: Both are concentrated bets, but DeFi Development Corp leans into staking and volatility. MicroStrategy goes for Bitcoin’s blue-chip stability.

Q5: Can retail investors benefit from these institutional moves?

A: Absolutely—by tracking treasury buys, market timing, and using community insights like those from The Wolf Of Wall Street, retail can ride institutional waves.

🚀 Ready to Play Offence?

Don’t just watch. Take action.

- Check out trading insights

- Join the The Wolf Of Wall Street Telegram community

The winners aren’t waiting. Neither should you.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service

- Join our active Telegram community: https://t.me/tthewolfofwallstreet

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”