🧨 Introduction

There’s a storm brewing in crypto — and it’s not another market crash. It’s regulation. The phrase “DeFi regulation 2025” isn’t just a buzzword; it’s the next battlefield for digital freedom. Governments are circling decentralised finance like hawks over a carcass, ready to swoop in with control, compliance, and a laundry list of new laws.

Here’s the truth: DeFi was never meant to be comfortable. It was built for rebels — the ones who refuse to play by the old rules of finance. And just like the stock market wolves of Wall Street, the smart traders see opportunity in the chaos.

This article will break down what’s coming, who’s fighting, and how you can turn regulation into your edge. Welcome to the new age of crypto warfare — and the wolves are winning.

🔥 The Setup: How the Senate Lit the Fuse

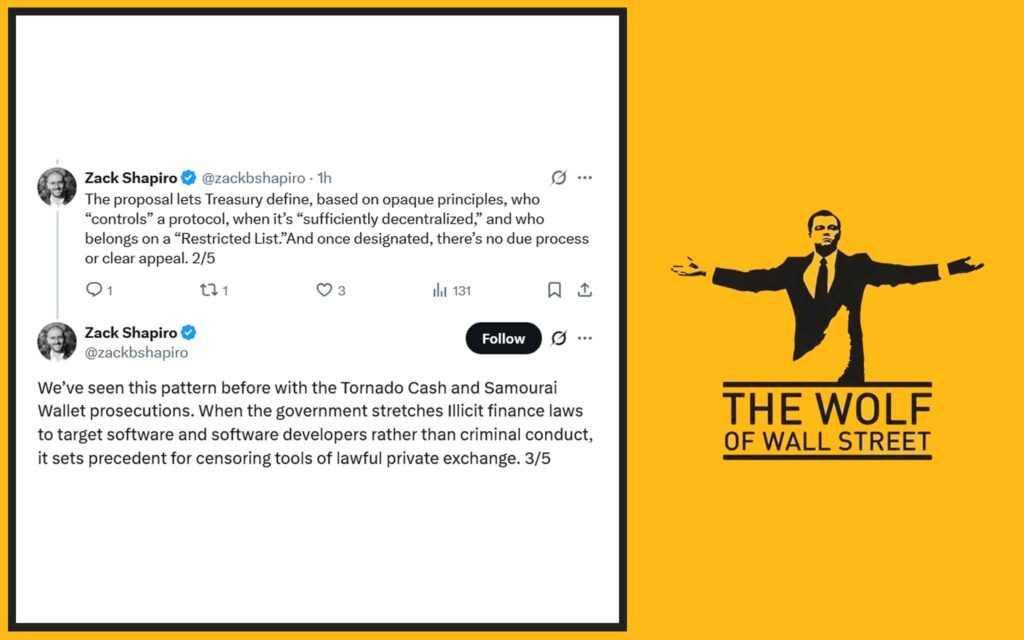

In early 2025, reports surfaced that Senate Democrats were floating a “restricted list” for DeFi protocols — a move that sent shockwaves across the crypto industry. According to multiple outlets, including Punchbowl News and The Block, the proposal aimed to enforce Know Your Customer (KYC) compliance directly on decentralised applications.

Translation? Your favourite DeFi front-end could be forced to verify every wallet address before you make a single trade. Imagine MetaMask asking for your passport before a swap — that’s the future some policymakers are pushing.

Crypto lawyer Jake Chervinsky didn’t mince words: he warned that such a move could “kill DeFi” entirely, calling it “an unconstitutional overreach.” Even the Digital Chamber of Commerce urged caution, arguing that innovation shouldn’t be buried under bureaucratic fear.

Sound familiar? It should. We’ve seen this movie before — every time a new technology threatens the old financial order, the establishment hits back hard.

👉 For deeper context on past attempts to regulate innovation, check out the Clarity Act on Crypto Regulation 2025.

🎯 DeFi in the Crosshairs

Here’s the kicker: “restricted list” isn’t just political theatre. It’s a blueprint for control.

Under this concept, regulators could designate specific DeFi protocols as “too risky” — effectively blacklisting them from U.S. financial access points. Think of it as a blacklist for innovation. Developers could be held liable for any project that fails to register with oversight bodies.

This isn’t about stopping crime — it’s about consolidating control. Because let’s face it, decentralisation terrifies central planners. No middlemen. No gatekeepers. No cut for the house.

But make no mistake — every restriction, every compliance barrier, is a profit opportunity for those who play it right. When rules change, markets shift. And the smart money — your money — moves faster than the legislation ever can.

💣 Why This Feels Like 2008 All Over Again

Back in 2008, Wall Street’s greed burned the economy to the ground — and who cleaned it up? The taxpayers. The government. The same institutions now telling DeFi how to behave.

The irony? DeFi was created to prevent that kind of disaster. Transparent, trustless systems. No bailouts. No hidden leverage. Yet, the same people who let Wall Street implode are now claiming they’ll “protect” the public from decentralisation.

Sound familiar? It’s the same fear, wrapped in a different acronym.

The wolves of finance learned something back then — power never leaves quietly. It must be taken, not requested. And DeFi’s rise is the biggest power shift since the birth of the internet.

🐺 The Industry Fights Back

Crypto leaders aren’t staying quiet. From blockchain developers to policy think tanks, the resistance is loud and growing.

Jake Chervinsky called the proposed DeFi rules “the most aggressive anti-crypto framework in modern history.” The Digital Chamber of Commerce fired back, demanding a balanced, risk-based approach instead of sweeping bans.

Why? Because innovation can’t survive in a padded cell. DeFi represents open access to financial tools, community-driven governance, and programmable wealth — all the things traditional finance fears.

For a deeper dive into the roots of this movement, explore the Cypherpunk Crypto Revolution — where digital freedom was born.

And if you think this is just about money, think again. It’s about control. About who decides what freedom looks like in a digital world.

🤫 Behind Closed Doors: Political Interests and Fear

Let’s pull back the curtain. Why are lawmakers really targeting DeFi?

The answer: fear and influence. DeFi eliminates intermediaries — and that means fewer profits for the old guard. Major banks, hedge funds, and payment processors have deep ties to lobbying groups that shape regulation.

When a decentralised protocol offers 10% yield while the bank gives you 0.5%, it’s not hard to see who’s sweating.

Money talks in politics. And the louder DeFi roars, the harder the old system fights back. Behind every “consumer protection” bill is a lobbyist writing the fine print.

⚖️ Why DeFi Needs Regulation — But the Right Kind

Now, let’s be real — not all regulation is bad. Scams, rug pulls, and market manipulation are real problems. A degree of oversight could help filter out bad actors.

But what we need is smart regulation, not suffocation. Instead of banning innovation, lawmakers should be building frameworks that protect users and empower builders.

Regulation should serve as the safety rails of the highway — not a concrete wall blocking the exit.

The right balance would bring institutional capital, user trust, and long-term growth. That’s the kind of DeFi regulation 2025 needs — precise, transparent, and forward-thinking.

🌊 The Ripple Effect on Traders

Let’s talk about traders — the real soldiers in this war.

When laws tighten, liquidity shifts. Tokens delist. Volume migrates offshore. Exchanges adapt or die.

Overregulation could mean fewer trading pairs, stricter onboarding, and KYC for even basic DeFi swaps. But smart traders will do what wolves always do — adapt.

Study how regulation impacts price action, volatility, and opportunity zones.

For example, see how traders navigated the derivatives market in our Bitcoin Spot Derivatives Trading Guide.

And don’t overlook institutional shifts — our piece on Crypto Hedge Funds’ Market Shift shows how major players are already preparing for this new world.

🧠 Survival of the Smartest: How Traders Adapt

The wolves of Wall Street don’t panic; they pivot.

When the rules change, the winners are those who anticipate — not react. DeFi traders must now integrate compliance tools, analytics dashboards, and real-time signal tracking to stay profitable.

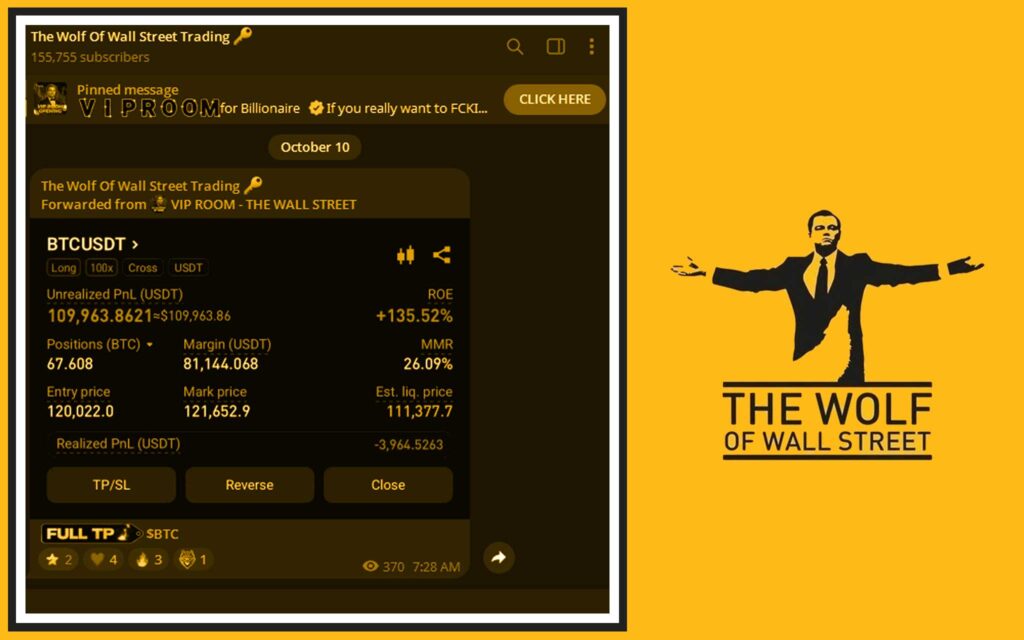

That’s where communities like The Wolf Of Wall Street shine. They give traders the edge — not by guessing, but by executing with precision.

The Wolf Of Wall Street members get access to VIP signals, expert market analysis, and 24/7 guidance. The difference between luck and skill? Information.

And information is what the wolves feast on.

🐺 Enter the Wolfpack: Inside The Wolf Of Wall Street Crypto Trading Community

If you want to survive in the age of DeFi regulation 2025, you need a pack.

The The Wolf Of Wall Street crypto trading community isn’t just another signal group. It’s a full-scale platform built for traders who want to thrive in volatile markets.

Here’s what The Wolf Of Wall Street delivers:

- Exclusive VIP Signals – precise, data-driven insights designed to maximise profits.

- Expert Market Analysis – deep dives from seasoned traders who’ve weathered every cycle.

- Private Network Access – over 100,000 like-minded members sharing strategies and updates.

- Essential Trading Tools – calculators, analytics, and volume indicators that give you clarity before you act.

- 24/7 Support – because the market never sleeps, and neither should your strategy.

Join the The Wolf Of Wall Street Telegram community for real-time updates and insights from the wolves themselves.

🧩 Mastering the Game: Turning Regulation into Opportunity

Here’s the mindset: you don’t fear the rules — you use them.

When regulation shakes the weak hands out of the market, volatility spikes. That’s where money is made.

Traders who understand policy impacts on liquidity, sentiment, and institutional flow can dominate this new landscape.

The wolves aren’t leaving. They’re evolving.

💰 The Psychology of Fear in Markets

The market doesn’t reward emotion; it punishes it.

When fear spikes — whether from new laws or FUD — smart traders go contrarian. They buy blood, sell euphoria, and hold conviction.

Behavioural finance tells us the same story: fear of loss outweighs the potential for gain. But when everyone’s scared, that’s your entry signal.

DeFi regulation 2025 may cause panic, but the wolves know — that’s when the real profits begin.

🔮 The Future of DeFi: From Rebellion to Reinvention

DeFi isn’t dying. It’s transforming.

Expect a new generation of hybrid systems — protocols integrating zero-knowledge proofs, decentralised identity, and compliant on-ramps. The DeFi of tomorrow will be smarter, faster, and more resilient.

Regulation will push innovation to evolve — just like every disruptive force before it.

And those who adapt first? They’ll own the next cycle.

🏁 Conclusion

The battle for DeFi regulation 2025 isn’t just about technology — it’s about ideology.

Freedom vs control. Innovation vs fear. Wolves vs lawmakers.

DeFi isn’t over — it’s just getting started. The ones who stay informed, connected, and decisive will thrive while others freeze.

So, here’s your move: join the wolves, stay sharp, and turn the chaos into your competitive edge.

Because in this game, the strong don’t survive — the smart do.

❓FAQs

1. What is the “restricted list” for DeFi protocols?

It’s a proposed government framework that could blacklist specific DeFi apps considered “too risky” or “non-compliant.”

2. Why are Democrats targeting DeFi in 2025?

They claim it’s to curb illicit activity, though many experts believe it’s an attempt to control decentralised innovation.

3. How does regulation affect crypto traders?

It increases compliance hurdles but also creates volatility — which skilled traders can exploit for profit.

4. How can I protect my investments amid new crypto laws?

Stay informed, diversify your portfolio, and follow expert insights from trading networks like The Wolf Of Wall Street.

5. Why join the The Wolf Of Wall Street crypto community?

Because knowledge is leverage — and The Wolf Of Wall Street gives you both.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market.

What you gain:

- Exclusive VIP Signals

- Expert Market Analysis

- Private Community of 100,000+ members

- Essential Trading Tools

- 24/7 Support

Empower your trading journey: