🔥 Introduction – The Truth About the Numbers

In DeFi, numbers don’t lie — unless they’re designed to. The recent bombshell? DeFiLlama has officially delisted Aster’s perpetual futures volume data, shaking confidence in one of DeFi’s fastest-rising platforms. This isn’t just another chart tweak or backend update. It’s a line in the sand, a declaration that data integrity is the new currency of trust.

Aster looked like a breakout success story — billions in daily volume, a cult-like following, whispers of a Binance connection. But behind the curtain, something didn’t add up. And DeFiLlama just called it out, loud and clear.

💣 The Spark That Lit the Fuse: What Triggered DeFiLlama’s Decision

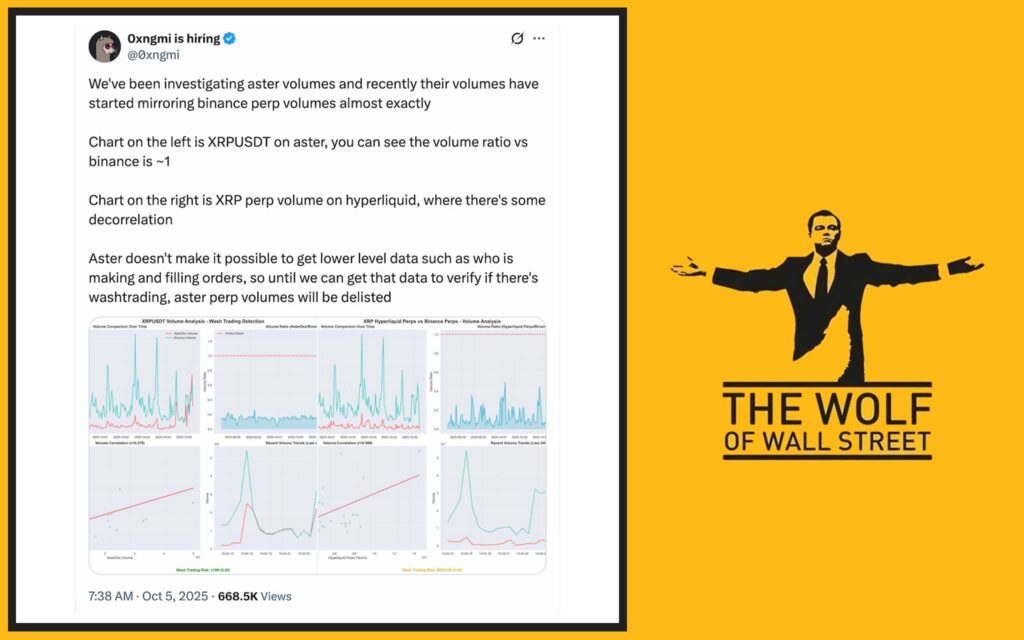

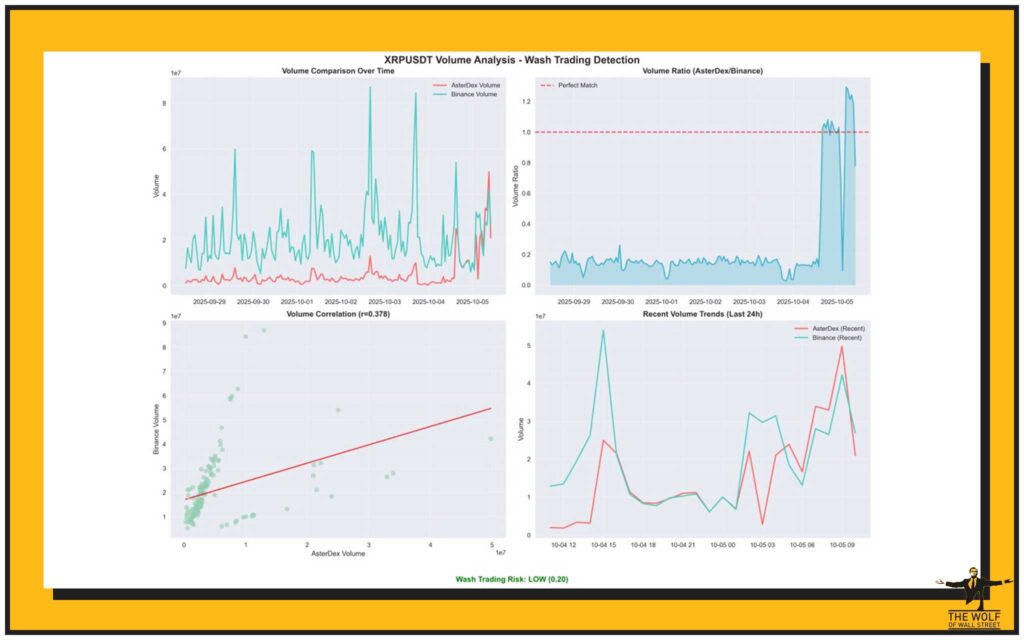

When DeFiLlama acts, the market listens. The platform delisted Aster’s perpetual data after spotting a near-perfect correlation with Binance Perp’s trading volumes. That’s not normal. In fact, it’s a statistical red flag so bright it could blind you.

Aster doesn’t provide user-level order data. Translation? No one outside the team can verify if trades are organic or orchestrated. For a data aggregator like DeFiLlama, that’s a nightmare. You can’t chart truth when your source is fogged by mystery.

And in crypto, lack of transparency is the fastest way to lose credibility.

💥 Inside the Mirage – How “Volume Mirroring” Works

Here’s the game: Aster’s reported volume patterns almost mirror Binance’s tick for tick. It’s like watching a reflection rather than a market. That’s called volume mirroring, and it’s a classic move in the wash trading playbook.

Wash trading artificially inflates volume to signal high demand. The crowd sees huge numbers and piles in, thinking they’re catching a rocket. But the truth? They’re feeding a machine built to look busy, not to make money.

It’s the same psychology that made people trust Wall Street tickers without asking who was behind the trades. But in DeFi, you don’t get bailout money when you get burned.

📊 The Numbers Don’t Add Up – Aster’s Volume Explosion

Let’s talk data. Aster’s open interest surged by 33,500% in just one week. On September 25, its daily perpetual trading volume peaked at $60 billion — putting it in the same league as Binance. But the problem is simple: there’s no proof that those trades were real.

Analysts are split. Some say Aster is an innovation magnet, pulling traders like moths to a flame. Others call it the next case study in manufactured hype. Either way, DeFiLlama wasn’t willing to gamble its credibility on unverified data. And that’s what separates the real players from the noise.

⚡ The CZ Connection – Hype, Influence, and the Shadow of Binance

Here’s where the story gets spicy. Aster’s momentum wasn’t entirely organic. Its rise was fueled by a narrative link to Binance’s CZ, which turned every mention into free publicity. Traders saw it as the next Hyperliquid — or even the next Binance itself.

But here’s the truth: association doesn’t equal authenticity. The DeFi space has seen this movie before. Hype pushes numbers, FOMO fuels entries, and when the smoke clears, only the transparent projects survive.

📉 DeFiLlama Draws the Line – Integrity Over Popularity

DeFiLlama’s co-founder, 0xngmi, didn’t mince words: if data can’t be verified, it doesn’t belong on the platform. Period. This move isn’t just about Aster. It’s about setting a new standard.

In a market where perception drives price, DeFiLlama is betting on something far more valuable — trust. And it just put every analytics platform on notice: transparency isn’t optional. It’s survival.

This stance aligns with DeFiLlama’s long-term play: becoming the gold standard of verified data in crypto. And traders love it. Integrity, it turns out, is bullish.

🚨 Aster’s Silence – When No Response Speaks Volumes

The Aster team’s response? Crickets. Not a tweet, not a statement, not even a denial. In a market that moves at light speed, silence reads like guilt.

Perception matters. In crypto, if you don’t control the narrative, someone else will. Aster’s choice not to speak is fueling speculation faster than any data feed could. And investors hate uncertainty more than they hate bad news.

💬 Market Sentiment – Fear, Doubt, and Opportunity

Here’s the wild part: even after the delisting, traders are divided. Some dumped their tokens and ran. Others saw the chaos as an entry point, expecting a massive rebound. Analysts predict anywhere from a 35% to 480% upside depending on how the narrative evolves.

Volatility is the trader’s playground. But smart money knows that speculation without transparency is gambling. That’s why top traders lean on verified data sources and trusted communities like The Wolf Of Wall Street — where information isn’t just shared, it’s dissected.

📈 Analysts’ Predictions – Is Aster Still a Play Worth Watching?

Despite the delisting, analysts haven’t written Aster off. They’re watching to see if the team comes clean with data or doubles down on the mystery. If the manipulation allegations fade, the token could rebound hard.

But this isn’t a game for the naive. You need a plan. You need insight. You need a community like The Wolf Of Wall Street Telegram that spots opportunities before they go mainstream.

Because in crypto, information asymmetry equals profit.

🤎 Bigger Picture – What This Means for DeFi Analytics

This isn’t just about Aster or DeFiLlama. It’s about an entire industry growing up. As DeFi scales, data verification will define which platforms thrive and which vanish.

Transparency will become the benchmark. User-level access, audit trails, on-chain proof — these will be the new minimums. The Aster controversy is forcing DeFi to evolve.

It’s a painful but necessary evolution. The era of “fake it till you make it” is ending.

🔍 The Tools of Truth – How Traders Can Protect Themselves

If you trade DeFi assets, you need data discipline. Here’s how to avoid falling for fake numbers:

- Cross-check volume sources. Compare data between multiple platforms like DeFiLlama and CoinMarketCap.

- Avoid projects with no order transparency. If you can’t see who’s trading, assume someone’s playing you.

- Join verified communities. Platforms like The Wolf Of Wall Street offer VIP signals and expert analysis to help you trade smart, not blind.

- Use trading tools. Learn from guides like Bollinger Bands Trading Strategy and RSI Crypto Trading Strategies.

Because the real traders aren’t just reacting — they’re anticipating.

💼 The Competitive Arena – Aster vs. Hyperliquid

Every great story has a rival. Aster’s is Hyperliquid. While Aster got headlines for explosive growth, Hyperliquid earned respect for verified transparency. No data drama, no mystery — just clean execution.

This contrast is brutal but clear: hype builds fast, trust lasts longer. Traders are migrating to platforms that can prove their numbers, not just post them.

🧠 Strategy Session – What Smart Traders Are Doing Right Now

Here’s how the wolves of crypto are playing this:

- Rebalancing portfolios toward transparent platforms.

- Setting alerts and stop-losses around Aster’s volatile price zones.

- Tracking market reactions in real-time via The Wolf Of Wall Street Telegram.

- Using community-driven insights from Trading Insights to sharpen strategy.

Because in DeFi, the smartest traders aren’t guessing — they’re strategising.

🚀 The Future of DeFi Data – Trust as the New Currency

The next DeFi bull run won’t be built on hype. It’ll be built on verifiable truth. Platforms like DeFiLlama are pioneering a movement toward transparent analytics, forcing projects to earn trust, not fake it.

In this new era, traders won’t chase narratives. They’ll chase proof.

💬 The Wolf’s Take – Cut Through the Noise

Let’s get real. In this market, transparency isn’t optional — it’s survival. The Aster situation isn’t a scandal; it’s a signal. The smart money is already shifting toward verified data, smarter signals, and tighter communities.

As Jordan Belfort would say, the truth sells itself. You just have to recognise it before everyone else does.

The real wolves of crypto don’t chase hype. They hunt truth.

🔗 Conclusion – The Power of Verified Data

DeFiLlama’s delisting of Aster isn’t a punishment; it’s a wake-up call. It’s a reminder that transparency drives longevity, and hype burns fast. The platforms that survive the next DeFi wave will be those that build on integrity, not illusion.

If you want to navigate these markets like a pro, join The Wolf Of Wall Street — the crypto trading community built on truth, data, and performance.

Because in DeFi, trust isn’t given. It’s earned.

❓ FAQs

1. What exactly is wash trading in DeFi?

Wash trading is when fake or coordinated trades inflate volume to attract real investors. It’s market manipulation disguised as activity.

2. How can traders identify manipulated data?

Check for consistent patterns that mirror larger exchanges and avoid platforms without transparent order data.

3. Why did DeFiLlama’s decision matter so much?

Because DeFiLlama’s credibility sets the tone for the industry. If it questions data integrity, others will follow.

4. What happens next for Aster’s token?

That depends on whether Aster opens its books or doubles down on secrecy.

5. How can I join trusted DeFi trading communities?

Start with The Wolf Of Wall Street and connect on Telegram for live updates, signals, and mentorship.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market:

- Exclusive VIP Signals: Proprietary insights to maximise profits.

- Expert Market Analysis: Deep-dive analysis from veteran crypto traders.

- Private Community: 100,000+ active members sharing insights.

- Essential Trading Tools: Calculators, indicators, and AI trading resources.

- 24/7 Support: Constant assistance from dedicated teams.

Empower your crypto trading journey:

Visit The Wolf Of Wall Street Service | Join The Wolf Of Wall Street Telegram