Listen up. Financial markets are changing, and nations are fighting for dominance. The UK? They’re not just watching. They’re making a bold move with the Digital Gilt Instrument (DIGIT). This isn’t just government debt; it’s a strategic play to put Distributed Ledger Technology (DLT) right into the heart of sovereign finance. Get this right, and the UK reinforces its position as a global financial powerhouse. This is about efficiency, transparency, and a future where money moves smarter.

🇬🇧 The UK’s Bold Move: Why a Digital Gilt?

The UK government, through HM Treasury (HMT) and the UK Debt Management Office (DMO), is leading a significant trial known as the Digital Gilt Instrument (DIGIT). This initiative is about more than just issuing government bonds; it’s a fundamental reimagining of how sovereign debt can be managed in the digital era.

Modernising Sovereign Debt: Why it Matters.

The current system for issuing and managing government debt, while robust, relies on decades-old infrastructure and processes. These can be slow, complex, and sometimes costly. In a world where financial transactions are increasingly digital and instant, sovereign debt markets need to keep pace. Modernising these systems promises not just efficiency gains but also increased resilience against disruptions. It’s about building a financial backbone that can handle the speed and demands of tomorrow.

For those looking to understand how technical analysis can aid in identifying market trends during financial transitions, explore our guide on Trendlines Charting Market Direction.

The Ambition: UK as a Global Financial Hub.

The UK has long been a leading global financial centre. To maintain that position in a rapidly digitising world, innovation isn’t optional; it’s a necessity. The DIGIT trial signals the UK’s ambition to be at the forefront of digital finance, proving that traditional financial instruments can be safely and effectively issued and managed using cutting-edge technology. This move aims to show the world that the UK is not just open to, but actively shaping, the future of finance.

🚀 Distributed Ledger Technology (DLT): The Engine for Modern Debt

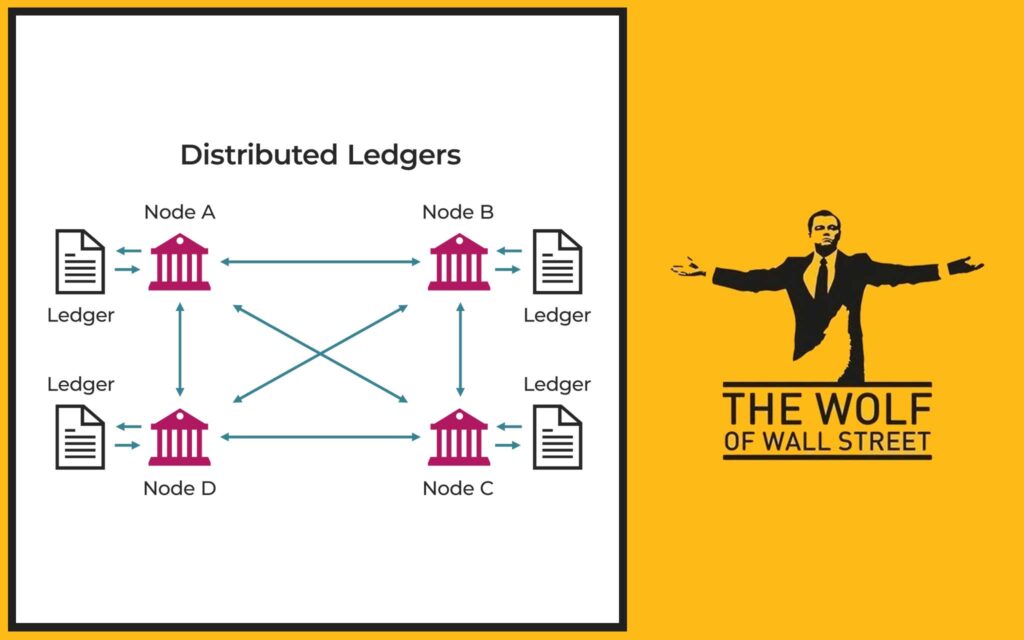

At the heart of DIGIT lies Distributed Ledger Technology (DLT), the same underlying technology that powers cryptocurrencies and blockchain networks. But here, it’s applied in a controlled, permissioned environment suitable for sovereign debt. DLT offers compelling advantages over traditional systems.

Unlocking Efficiency: Automation and Speed.

DLT can automate many manual processes currently involved in the lifecycle of a bond. Think about settlement, coupon payments, and redemptions. With DLT, smart contracts can be programmed to automatically execute these actions when predefined conditions are met. This drastically reduces manual intervention, minimises errors, and speeds up the entire process from days to potentially mere seconds. This means less cost, less waiting, and smoother operations.

Enhancing Transparency: Single, Immutable Record.

In traditional systems, different parties might hold separate records of ownership and transactions, leading to reconciliation issues. DLT provides a single, shared, and immutable record of all transactions. Every participant in the network can view the same, verified data simultaneously. This enhances transparency, reduces disputes, and significantly simplifies auditing. Everyone is on the same page, all the time.

Improving Resilience: Reducing Single Points of Failure.

Traditional systems often rely on centralised databases, which can be vulnerable to single points of failure (e.g., cyberattacks, system outages). DLT, by its very nature, distributes the ledger across multiple nodes. If one node goes down, the system continues to operate because other nodes hold copies of the ledger. This distributed structure significantly enhances the system’s resilience and reduces operational risks.

DLT isn’t just transforming government debt. It’s also revolutionising crypto trading strategies. Check out our comprehensive take on RSI Crypto Trading Strategies to see how similar principles apply in the crypto market.

Beyond the Basics: Deeper Technical Insights:

DLT’s application goes beyond just a shared record. Consider the technical mechanisms that enable these benefits:

* Automating coupon payments and redemptions via smart contracts: Smart contracts are self-executing agreements stored on the DLT. They can be programmed to release coupon payments automatically to bondholders on scheduled dates, or to redeem the bond upon maturity, without human intervention. This ensures timely and error-free execution.

* Immutable record-keeping for clear ownership and real-time reconciliation: Once a transaction is recorded on a DLT, it cannot be altered or deleted. This immutability ensures a tamper-proof audit trail. Every change of ownership is transparently logged, making real-time reconciliation among all parties possible and significantly reducing discrepancies.

* The concept of tokenisation for debt instruments: Debt instruments, like gilts, can be ‘tokenised’ – represented as digital tokens on a DLT. Each token represents ownership of a specific portion of the bond. This allows for fractional ownership, easier transferability, and potentially greater liquidity, transforming the debt instrument into a more liquid digital asset. This can also allow for programmability within the instrument itself.

For deeper insights into technical analysis, explore the Bollinger Bands Trading Strategy.

⚙️ DIGIT’s Design: Key Choices Made So Far

The design of DIGIT is being carefully considered, with HMT and the DMO engaging closely with market participants to refine its structure and technological approach.

Digitally Native, Short-Dated Instrument: Focus of the initial trial.

The initial focus of the DIGIT trial is on a digitally native, short-dated debt instrument. ‘Digitally native’ means it will be issued directly on DLT, rather than being a digitised version of an existing paper bond. A short-dated instrument allows for faster testing and iteration of the system, enabling rapid learning about its functionality and efficiency in a live environment without committing to long-term liabilities on the new infrastructure.

Short-dated instruments provide a unique testing ground. Traders can leverage strategies like those outlined in the Parabolic SAR 2025 Strategy Guide to identify short-term market trends.

Role of HM Treasury (HMT) and UK Debt Management Office (DMO): Leadership and responsibilities.

HMT is spearheading the policy and strategic direction of the initiative, working to ensure it aligns with the UK’s broader financial services strategy. The DMO, as the government’s debt manager, is responsible for the practical implementation and operational aspects of the trial, including market engagement and technical design. Their joint leadership ensures both policy objectives and operational realities are addressed.

Procurement Process: Engaging the Private Sector: The ongoing search for partners and technology providers.

A crucial part of the DIGIT initiative is the ongoing procurement process. The DMO is actively seeking proposals from private sector firms with expertise in DLT and digital finance. This isn’t about the government building everything internally; it’s about leveraging the innovation already happening in the private sector.

* Types of firms invited to participate: This includes DLT platform providers, digital asset exchanges, financial institutions with DLT capabilities, and technology consultancies specializing in blockchain solutions.

* Key capabilities being sought: Firms are expected to demonstrate robust DLT infrastructure, proven security measures, scalability for high-volume transactions, interoperability solutions, and a deep understanding of financial market operations and regulatory requirements.

* General timeline for vendor selection: While precise dates are subject to the procurement process, the DMO is working towards selecting partners to begin the pilot phase within the coming months, indicating a swift, yet considered, approach to implementation.

🧪 The Digital Securities Sandbox (DSS): Testing the Waters

The Digital Gilt Instrument (DIGIT) trial will operate within the UK’s Digital Securities Sandbox (DSS). This regulatory sandbox is a critical enabler for financial innovation.

Purpose of the DSS: A safe space for live testing of digital asset systems.

The DSS is designed to allow firms to test innovative digital securities technologies and business models in a live environment, but within controlled parameters. It provides a temporary regulatory framework that allows for deviations from existing rules where necessary to facilitate experimentation with new technologies like DLT. This minimises the risk of unforeseen consequences to the wider financial system while still allowing for practical testing.

Flexibility for Innovation: How the sandbox allows regulatory adaptation for new technologies.

The sandbox allows regulators (the Financial Conduct Authority and the Bank of England) to adapt and provide waivers or modifications to existing rules that might otherwise hinder DLT innovation. This regulatory flexibility is essential because many current financial regulations were written long before DLT existed. The DSS creates a space where new approaches can be tested without immediately requiring wholesale changes to the entire regulatory framework.

DIGIT’s Place within the DSS: Operating under modified rules to test its viability.

By operating within the DSS, the DIGIT trial can test key aspects of DLT-based debt issuance under a bespoke regulatory regime. This allows HMT and the DMO to gather real-world data and experience on how DLT performs for sovereign debt, how it interacts with market participants, and what regulatory adjustments might be needed for broader adoption. It’s about building evidence in a controlled environment.

Testing innovative systems in controlled environments isn’t new. See how trading tools like the Commodity Channel Index (CCI) Guide have been tested and applied in volatile markets.

🌍 Global Precedents: UK Learning from Others

The UK isn’t operating in a vacuum. Other nations and institutions have already taken steps into the world of digital bonds, providing valuable lessons and demonstrating the feasibility of DLT in debt markets.

Slovenia’s Digital Bond with wCBDC: A pioneer in digital sovereign debt.

Slovenia was a pioneer in issuing a sovereign digital bond, which was settled using a wholesale central bank digital currency (wCBDC) platform. This demonstrated a fully digital end-to-end process for government debt, from issuance to settlement, using DLT and central bank money. It’s a clear proof-of-concept for the UK’s ambitions.

While the UK explores digital bonds, other nations are advancing in crypto adoption. Learn how Bitcoin and Altcoins are shaping global financial systems.

European Investment Bank’s Digital Bond: Using both private and public blockchains.

The European Investment Bank (EIB) has issued digital bonds on both private (permissioned) and public blockchain networks. This shows that DLT can be used by major institutions and that different types of DLT (private vs. public) can be employed, each with its own advantages and considerations regarding security, privacy, and decentralisation.

Jamaica’s Digital Bond (JAM-DEX): An example from an emerging market.

Jamaica, through its central bank, has also issued a digital bond. This example from an emerging market demonstrates that the benefits of DLT in debt issuance are not limited to large, developed economies. It highlights the potential for greater financial inclusion and efficiency gains in diverse economic contexts.

Other Nations on the DLT Path: Nuancing global leadership.

While the UK aims to be the first G7 nation to issue a digitally native sovereign bond, it’s important to recognise the significant strides being made elsewhere. Financial centres like Luxembourg, Switzerland, and Singapore are also making substantial progress in exploring and adopting DLT for securities issuance and settlement. This creates a collaborative global innovation landscape where jurisdictions learn from each other, fostering a competitive yet cooperative environment for digital finance advancements. This isn’t a solo race; it’s a global push.

🏦 The Bigger Picture: Complementary UK Initiatives

The DIGIT trial doesn’t exist in isolation; it’s part of a broader, cohesive strategy by the UK to explore and implement digital finance solutions across the economy.

Bank of England’s wCBDC Research: Potential Integration.

The Bank of England is actively researching a wholesale central bank digital currency (wCBDC). This could be a digital form of central bank money accessible to financial institutions, operating on DLT. A wCBDC could provide a highly efficient and risk-free settlement layer for digital gilts issued on DLT, creating a truly end-to-end digital financial ecosystem. The integration of DIGIT with a future wCBDC is a key long-term vision.

Stay updated on emerging Layer 1 and Layer 2 Solutions.

Stimulating Private Sector Innovation: Beyond Government Use.

The DIGIT trial is not just about government debt. By providing a clear signal of government interest and creating a sandbox for testing, it aims to stimulate private sector innovation in DLT platforms and digital securities more broadly. Success in DIGIT could pave the way for private companies to issue corporate bonds, equities, and other securities on DLT, creating a more efficient and liquid digital capital market. This is a deliberate effort to foster a thriving ecosystem of digital financial services in the UK.

⚠️ Potential Challenges and Risks: The Road Ahead

While the potential benefits of DIGIT are significant, integrating DLT into the core of sovereign debt management is a complex undertaking with inherent challenges and risks.

Scalability Concerns: Ensuring DLT can handle the volume of sovereign debt.

Sovereign debt markets involve massive volumes of transactions. A key challenge for DLT is proving it can scale to handle the sheer throughput and storage requirements without sacrificing speed or efficiency. The technology must be robust enough for national-level financial infrastructure.

Interoperability: Connecting new DLT systems with existing financial infrastructure.

The financial system is a complex web of interconnected legacy systems. Integrating a new DLT-based sovereign debt system with existing clearing houses, payment systems, and investor platforms will be a major technical and operational hurdle. Seamless communication between old and new technologies is critical.

Cybersecurity and Data Security Risks: Protecting sensitive financial data on new platforms.

Any new digital system, especially one handling national debt, presents new cybersecurity vulnerabilities. Ensuring the DLT platform is impervious to hacks, data breaches, and other cyber threats is paramount. Protecting sensitive transaction data and investor information requires world-class security measures.

Regulatory Hurdles and Legal Frameworks: Adapting laws to digital instruments and DLT.

Current legal frameworks for financial instruments are largely based on traditional paper-based or centralised digital systems. Adapting these laws to accommodate digitally native, tokenised debt instruments and the unique characteristics of DLT (like decentralised governance or smart contract enforceability) presents significant regulatory challenges. Clarity and legal certainty are essential for market confidence.

Market Acceptance and Participant Readiness: Ensuring primary dealers and investors adopt the new system.

Even with a technologically sound system, success hinges on market adoption. Primary dealers, institutional investors, and other market participants need to be willing and able to connect to, understand, and use the new DLT platform. This requires significant education, training, and potentially investment in new infrastructure on their part. Resistance to change or a lack of understanding could hinder adoption.

🔮 Future Vision and Stakeholder Impact

The Digital Gilt Instrument trial is just the beginning. The long-term vision sees DLT fundamentally reshaping the UK’s government debt issuance and potentially influencing broader financial markets.

Anticipated Next Steps for DIGIT: What comes after the initial pilot.

Following the initial trial, if successful, the DMO will evaluate the findings. Future steps could involve expanding the scope to include longer-dated gilts, increasing the volume of issuance, and integrating more participants into the DLT ecosystem. A phased approach will likely be adopted to minimise risk and allow for continuous learning.

Long-Term Vision for UK Government Debt: How DLT could reshape future issuance.

In the long term, DLT could create a more efficient, transparent, and potentially liquid market for UK government debt. This could lead to lower issuance costs for the government, faster settlement for investors, and improved data analytics for market participants. It’s about bringing the UK’s sovereign debt into the 21st century.

Impact on Primary Dealers and Institutional Investors: Changes to their workflows and operations.

For primary dealers and institutional investors, DIGIT implies a shift in operational workflows. They will need to adapt their systems, integrate with new DLT platforms, and potentially re-skill their teams. While challenging initially, this could lead to significant cost savings in the long run through automation and reduced reconciliation efforts. It also opens up new possibilities for product offerings and market participation.

Broader Financial Market Ecosystem Effects: Potential for wider adoption of digital securities.

A successful DIGIT trial could act as a strong precedent for the wider UK financial market. It could accelerate the tokenisation of other securities (corporate bonds, equities) and stimulate investment in DLT infrastructure and expertise across the private sector. This initiative has the potential to kickstart a broad shift towards a more digitally native capital market ecosystem in the UK, reinforcing its global leadership in digital finance.

Frequently Asked Questions (FAQs)

- What is the primary goal of the Digital Gilt Instrument (DIGIT) trial?

The primary goal is to test the integration of Distributed Ledger Technology (DLT) into the issuance and management of UK sovereign debt to enhance efficiency, transparency, and resilience. - What is the Digital Securities Sandbox (DSS)?

The DSS is a controlled regulatory environment in the UK that allows firms to test innovative digital securities technologies and business models in a live setting under modified rules. - How does DLT improve efficiency in debt issuance?

DLT improves efficiency through automation of processes like settlement and coupon payments via smart contracts, reducing manual intervention and speeding up transactions. - Are other countries also exploring digital bonds?

Yes, countries and institutions like Slovenia, the European Investment Bank, Jamaica, Luxembourg, Switzerland, and Singapore are also exploring or have issued digital bonds using DLT. - What are some key challenges for DLT in sovereign debt?

Key challenges include scalability for large transaction volumes, interoperability with existing legacy systems, cybersecurity risks, and adapting regulatory and legal frameworks.

There you have it – the Digital Gilt Instrument (DIGIT). A bold play, a necessary move. The UK is making its stand for financial leadership in the digital era.

“The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

* Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

* Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

* Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

* Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

* 24/7 Support: Receive continuous assistance from our dedicated support team./n/nEmpower your crypto trading journey:

* Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

* Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

* Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street””