🏙️ Introduction: This Isn’t Just Real Estate – It’s a Revolution

Dubai just dropped a financial bombshell—the first licensed tokenised real estate project in the entire MENA region.

Let me be clear: this isn’t just another shiny press release. This is the evolution of property investment, and it’s built for a new breed of investor—you. Fractional ownership, blockchain validation, iron-clad regulation—it’s the perfect storm of innovation and opportunity.

And here’s the kicker: you can get in for just AED 2,000. That’s less than your weekend brunch bill if you live in the Marina.

So, what’s happening? Who’s behind it? And more importantly—how do you make money from it? Let’s dive in.

🔑 What’s Happening? The Tokenised Property Breakdown

This game-changer is powered by a dream team of heavyweight institutions:

- Dubai Land Department (DLD)

- Prypco (the platform brains)

- Zand Digital Bank (banking the deals)

- Ctrl Alt, VARA, UAE Central Bank, Dubai Future Foundation—the regulators are not just watching; they’re building.

They’ve launched Prypco Mint, a blockchain-based platform on the XRP Ledger (yeah, that XRP). Why? Because it’s fast, secure, and integrates directly with official land records. You’re not buying funny money; you’re buying regulated, recognised real estate shares.

🪙 Fractional Ownership: Turning AED 2,000 into Real Estate Power

Gone are the days when real estate was only for the rich. Dubai just flipped the table.

For AED 2,000 (~$545), you can own a fraction of a legally recognised property. We’re talking about actual property, fully licensed and registered with the Dubai Land Department.

You’re not buying into a fund. You’re not betting on a REIT. You’re owning a slice of the pie—complete with your name on the digital title.

This is democratised real estate, and if you’re not paying attention, you’re already behind.

👉 Want more alpha on fractional investing? Check out our Newbie Guides

🧾 No Crypto? No Problem. But Here’s the Catch

Let’s address the elephant in the room: you can’t pay in crypto during the pilot phase. All transactions go through in AED only.

Does that suck for crypto-native investors? Maybe. But here’s the thing: this is regulated to the core. The Central Bank’s involved. Funds go through Client Money Accounts (CMAs)—meaning your cash is locked until the deal closes.

That’s institutional-level security. That’s how you get the suits and whales involved.

Global expansion is already on the radar. When they greenlight crypto payments—boom. You’re going to wish you were in before the rocket launched.

📊 Who’s in Control? The Regulation That Actually Works

This isn’t some wild west ICO. The regulators are running the show, and that’s a good thing.

- DLD handles the physical property

- VARA oversees the digital assets

- The UAE Central Bank ensures financial transactions are bulletproof

Your funds are held safely. Transactions are clear. Ownership is ironclad. And if anything smells fishy? You’ve got legal backing.

Compare that to some random DeFi project and you’ll see why this is the future of serious tokenised investment.

👉 Curious about regulation and digital assets? We’ve got you covered in our Policies Section

🧠 Transparency Like Never Before – Data, Details, Dollars

No hidden fees. No ambiguous returns. Every investment comes with:

- Full property pricing

- Detailed risk factors

- Ownership breakdowns

- Rental income projections

- Technical specifications

This isn’t just transparency—it’s investor empowerment. You see everything before you buy, just like inspecting a Lamborghini before you take it for a spin.

💸 How Do You Profit? Rental Income + Appreciation

Two revenue streams:

- Rental income – You get your slice of the monthly cake

- Property appreciation – When the property value goes up, so does your return

And yes, your legal ownership is on-chain and in Dubai’s official property registry. This isn’t just paper talk—it’s written in blockchain and law.

🌎 Dubai’s Grand Plan – Real Estate 3.0

By 2033, Dubai projects 7% of its real estate market will be tokenised. That’s AED 60 billion or $16 billion.

This aligns with the Dubai Economic Agenda D33 and Real Estate Strategy 2033, both aimed at digital transformation, global investment, and liquidity expansion.

When the city’s blueprint is that bold—you bet there’s money on the table.

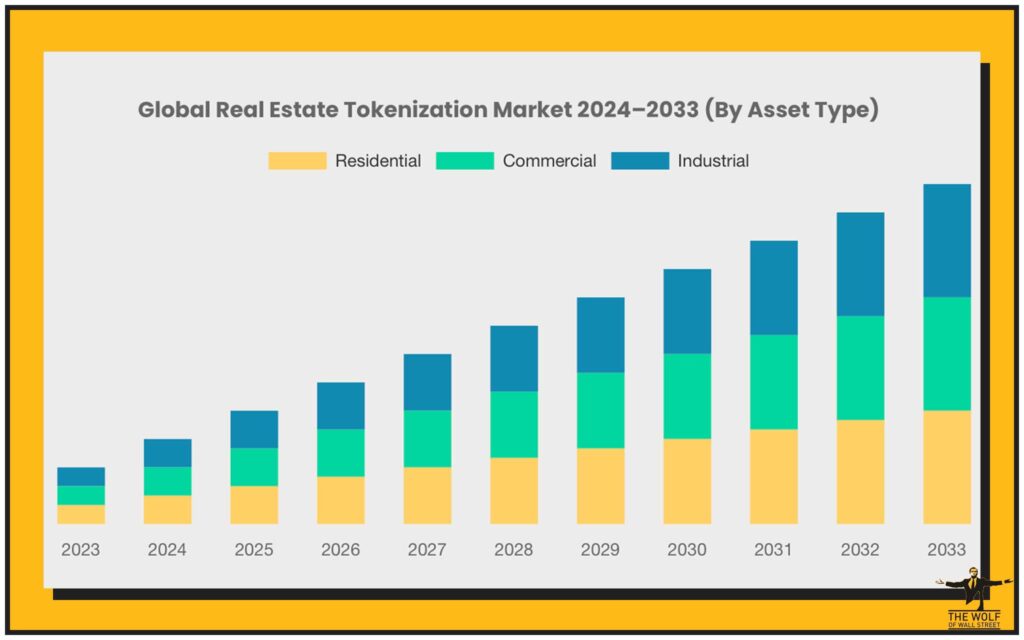

🚀 Market Trends: Why the Timing Couldn’t Be Better

Globally, real estate tokenisation is expected to hit $19.4 billion by 2033.

That’s a 21% compound annual growth rate (CAGR). Translation? It’s growing, and fast.

Dubai isn’t just catching up—it’s leading. And those who enter early ride the biggest wave.

📉 The Real Risks – And Why Dubai Might Have Solved Them

Let’s not sugar-coat it. Other tokenisation projects failed because:

- No legal clarity

- No registry integration

- Regulatory nightmares

Dubai said: “Hold my Arabic coffee.”

They integrated tokenised assets directly with the land registry. Every transaction is tracked, recorded, and government-approved. No more shady business. No more grey zones.

👉 For more insight into what separates solid projects from scams, check our Trending Insights

📡 Tech Meets Trust: Why XRP Ledger Is a Game-Changer

The XRP Ledger isn’t some random coin. It was selected for:

- Speed

- Scalability

- Integration power

This means low latency, high security, and a tech stack that institutions actually respect.

🌍 Why This Is Bigger Than Dubai

This project isn’t just a Dubai exclusive. It’s a template for how the world might tokenize real estate—legally and efficiently.

When this pilot succeeds (and it will), expect:

- Global adoption

- Open investment access

- Crypto payments

- Secondary trading platforms

🤝 Welcome to the Inner Circle: Why Smart Investors Move Now

Look, if you wait for the headlines, you’re already late.

Get in now. Benefit from first-mover advantage. Beat the crowd. When global access opens and crypto becomes eligible—you’ll already be holding.

🧠 The The Wolf Of Wall Street Connection: Dominate the Market with Precision

Let’s not ignore the obvious—crypto volatility is real, and trading it blind is financial suicide.

That’s where The Wolf Of Wall Street comes in:

- 🔥 VIP Signals that move markets

- 📊 Expert market analysis by top-tier traders

- 👥 A 100K+ strong private community

- 🛠️ Volume calculators and tools to trade smart

- 🕒 24/7 support—so you’re never alone in the chaos

Whether you’re flipping altcoins or making long-term real estate plays—The Wolf Of Wall Street is your unfair advantage.

🔗 Visit The Wolf Of Wall Street

📱 Join Telegram

🔥 Final Thoughts: Real Estate Just Went Digital. Are You In?

Dubai just rewrote the property playbook, and the world is watching.

This is the future of real estate: accessible, tokenised, regulated, and profitable. The question isn’t whether it works. The question is: are you getting in before the world catches up?

❓FAQs: Real Talk About Tokenised Real Estate

1. Is this legal in my country?

Right now, only UAE ID holders can invest, but expansion is coming.

2. What happens if the platform shuts down?

Funds are protected via regulated Client Money Accounts (CMAs), and ownership is on-chain + officially registered.

3. How is this different from REITs?

With tokenisation, you own direct property shares—not just fund exposure.

4. Will cryptocurrency ever be accepted?

Not yet, but VARA’s regulatory updates make it highly likely in future phases.

5. What if I want to cash out early?

Secondary markets are being developed post-pilot, pending regulatory approval.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

- Empower your crypto trading journey:

- 🔗 Visit: https://tthewolfofwallstreet.com/

- 📲 Telegram: https://t.me/tthewolfofwallstreet