Listen up. You bought crypto. Good. You’re HODLing. Smart. But is your crypto just sitting there like a lazy bum? It could be working for you, grinding out passive income 24/7, even while you sleep. Forget just waiting for the price to go up; this is about making your assets generate more assets. This guide shows you exactly how to earn crypto without selling, from the basics to the advanced plays. But make no mistake – this isn’t free money; it requires smarts and managing risk.

💰 Beyond HODLing: Why Active Earning Matters

The old “buy and hold” strategy – or HODLing as it’s known in the crypto world – has its merits. Many have built fortunes by simply holding onto assets like Bitcoin for the long term. But in a market as dynamic as cryptocurrency, just holding means you might be leaving money on the table. Your assets could be productive, generating additional returns on top of any potential price appreciation.

Active earning strategies allow you to compound your holdings, generate a form of passive income (though ‘passive’ often requires significant upfront research and ongoing management), and potentially offset some of the market’s volatility. Instead of your crypto just being a speculative bet on future price, it becomes a working asset. This is about moving from a purely speculative mindset to an investor’s mindset.

🛡️ Staking: Earning Rewards by Securing Networks

Staking is one of the most popular and accessible ways to earn rewards on your crypto, especially with Proof-of-Stake (PoS) blockchains.

What is Staking?

In Proof-of-Stake systems, instead of miners using computational power (like in Bitcoin’s Proof-of-Work), network participants called validators lock up (or ‘stake’) their own coins to get a chance to validate new transactions, add them to the blockchain, and earn rewards. Staking helps secure the network and maintain its integrity.

How Staking Works: Locking up Your Coins.

To stake, you typically need to hold a specific PoS cryptocurrency. You can either run your own validator node (which usually requires significant technical expertise and a large amount of coins) or, more commonly, delegate your coins to an existing validator or a staking pool. When you delegate, you’re essentially lending your voting power to a validator who does the technical work, and you share in the rewards they earn. Many exchanges also offer staking services, making it very easy for users.

Rewards:

The rewards for staking typically come from a combination of:

- Inflationary rewards: New coins created by the network and distributed to stakers.

- Share of transaction fees: A portion of the fees users pay to make transactions on the network.

- Block rewards: Specific rewards for successfully validating a block of transactions.

The Annual Percentage Yield (APY) for staking varies greatly depending on the specific cryptocurrency and network conditions.

Risks:

- Slashing: If a validator you’ve delegated to misbehaves (e.g., validates fraudulent transactions or has significant downtime), a portion of their staked coins (and thus yours) can be ‘slashed’ or forfeited as a penalty.

- Liquidity lockups: When you stake your coins, they are often locked up for a specific period, during which you cannot sell or move them. If the price drops dramatically during this lockup, you can’t react.

- Validator issues: The performance of your chosen validator (uptime, commission rates) directly impacts your rewards. Poor validators mean lower returns.

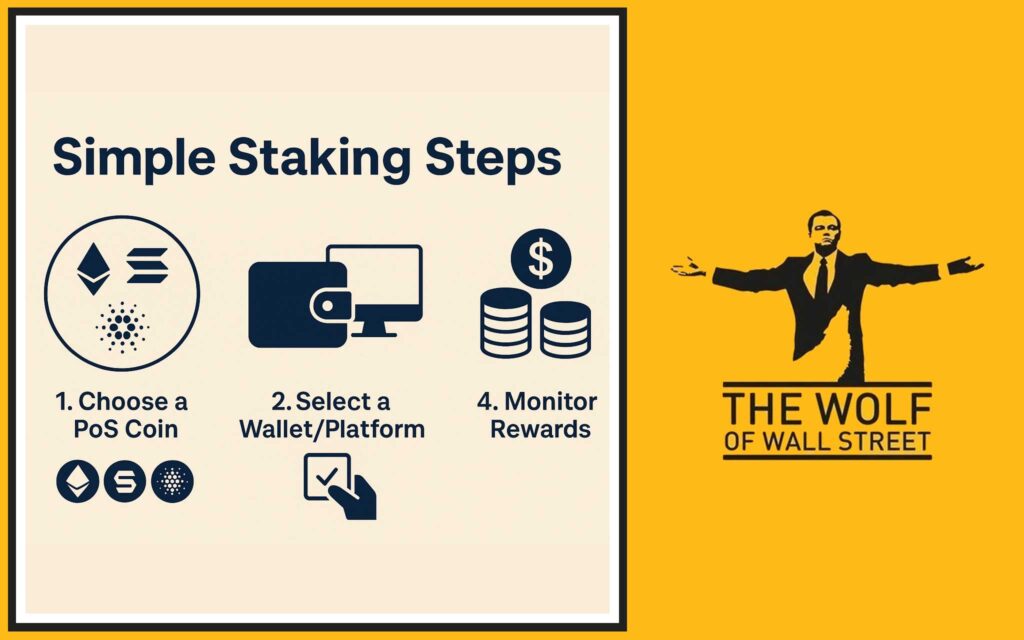

Step-by-Step Guide for Staking:

- Choose a PoS Coin: Research reputable Proof-of-Stake Cryptocurrencies like Ethereum (ETH), Solana (SOL), Cardano (ADA), or others.

- Select a Wallet/Platform: Use a wallet that supports staking for your chosen coin, or stake directly through a reputable exchange.

- Delegate or Stake: Follow the platform’s instructions to delegate your coins to a validator pool or stake them directly. Research validators carefully.

- Monitor Rewards: Keep an eye on your earned rewards and the performance of your chosen validator.

🚜 Yield Farming: Providing Liquidity for High Returns

Yield farming is a more advanced, often higher-risk, higher-reward strategy within the DeFi space. It involves providing liquidity to decentralised protocols.

What is Yield Farming?

Yield farming means lending or staking your cryptocurrency in a decentralised finance (DeFi) protocol to earn rewards. Most commonly, it involves providing liquidity to Liquidity Pools (LPs) on Decentralised Exchanges (DEXs). Users deposit pairs of tokens (e.g., ETH/USDT) into an LP, and traders use this liquidity to swap between the two tokens.

Rewards:

Yield farmers are compensated for providing liquidity:

- Share of transaction fees: They earn a percentage of the trading fees generated by the liquidity pool they contribute to.

- Bonus tokens: Many DeFi protocols incentivise liquidity providers by distributing their native governance tokens as additional rewards. These tokens themselves can then be staked or sold.

Risks:

- Impermanent Loss: This is a unique risk to providing liquidity. If the price ratio of the two tokens you deposited into a pool changes significantly, the value of your withdrawn assets (when you exit the pool) can be less than if you had simply held the original tokens. It’s a complex concept that many beginners overlook.

- Smart Contract Vulnerabilities: DeFi protocols are built on smart contracts. Bugs or vulnerabilities in the code can be exploited by hackers, leading to the loss of all deposited funds.

- Rug Pulls: A scam where malicious project developers attract liquidity to their pool and then suddenly withdraw all the funds, leaving liquidity providers with worthless tokens.

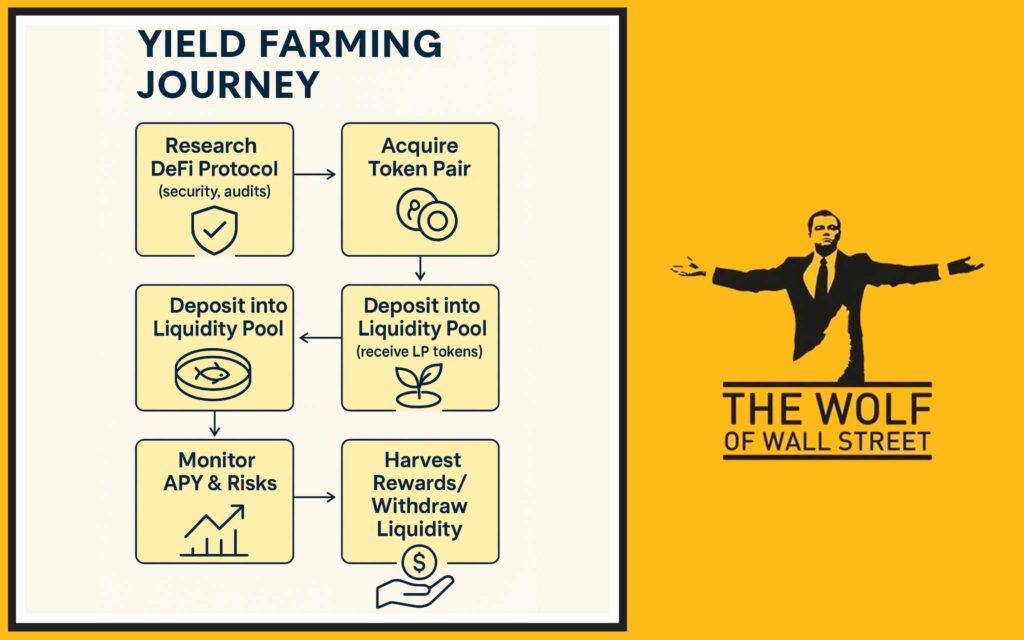

Step-by-Step Guide for Yield Farming:

- Research DeFi Protocol: Thoroughly investigate the platform’s security, audits, team, and community reputation.

- Acquire Token Pair: You’ll need both tokens for the liquidity pool you choose.

- Deposit into Liquidity Pool: Connect your wallet to the DeFi platform and deposit your tokens to receive LP (Liquidity Provider) tokens in return, representing your share.

- Stake LP Tokens (Optional): Some protocols allow you to stake your LP tokens to earn additional rewards.

- Monitor and Harvest: Regularly check your earnings and the Annual Percentage Yield (APY), which can fluctuate wildly. Be aware of impermanent loss.

💸 Crypto Lending: Making Your Coins Work for Others

Crypto lending is another way to earn passive income by lending out your digital assets to borrowers in return for interest payments.

What is Crypto Lending?

You can lend your crypto through either centralised platforms (like some exchanges) or decentralised lending protocols (like Aave or Compound). Borrowers typically provide collateral (often other crypto assets) to secure the loan.

How it Works:

You deposit your crypto onto a lending platform. The platform then matches you with borrowers or pools your funds with others to lend out. You earn interest based on the amount you lend and the prevailing rates.

Rewards:

You earn a fixed or variable interest rate on your deposited crypto. Rates vary by platform and the specific cryptocurrency being lent.

Risks:

- Platform Risk: If using a centralised platform, you face the risk of the platform being hacked or becoming insolvent (the “not your keys, not your coins” principle).

- Borrower Default: While loans are usually over-collateralised, in extreme market volatility, the value of the collateral could drop below the loan value before it can be liquidated, potentially leading to losses for lenders.

- Smart contract risk: For DeFi lending protocols, bugs in the smart contracts can be exploited.

Step-by-Step Guide for Lending:

- Choose a Lending Platform: Research and select a reputable centralised or decentralised platform.

- Deposit Your Crypto: Transfer the crypto you wish to lend to the platform.

- Set Lending Terms (if applicable): Some platforms allow you to set terms like interest rates or loan duration.

- Monitor Interest Earned: Track your earnings.

🎁 Airdrop Farming: Hunting for Free Tokens

Airdrops are essentially free distributions of new tokens, often used by new projects to bootstrap their community and generate awareness. “Farming” airdrops involves actively seeking out and qualifying for these distributions.

What Are Airdrops?

Projects distribute tokens to the wallets of existing blockchain users (e.g., users of a specific network, holders of a certain token, or early users of a new protocol).

How to Find and Qualify:

- Interact with new protocols or testnets: Many projects reward early users who test their platforms.

- Hold specific tokens: Some airdrops are distributed to holders of particular cryptocurrencies.

- Participate in governance or community activities: Being an active community member can sometimes qualify you.

- Follow airdrop announcement channels and websites.

Rewards:

You receive free tokens that could potentially become valuable in the future. Some airdrops have been worth thousands of dollars.

Risks:

- Scams: Many fake airdrops exist, designed to trick users into revealing their private keys or sending crypto to scammer wallets. Be extremely vigilant.

- Low-Value Tokens: The vast majority of airdropped tokens have little to no real value or utility.

- Significant Time Investment: Actively hunting and qualifying for legitimate airdrops can be very time-consuming.

🖼️ Tokenized Assets and NFTs: New Earning Frontiers

The world of tokenisation and Non-Fungible Tokens (NFTs) is opening up new avenues for earning, though often with higher risk and less predictability.

Fractional Ownership and Royalties.

Projects are tokenizing real-world assets like real estate or art, allowing fractional ownership. Some platforms enable token holders to earn a share of rental income or royalties. This space is still nascent.

NFT Staking and Renting.

Some NFT projects or platforms allow you to ‘stake’ your NFTs to earn utility tokens or other rewards. In certain blockchain games or metaverses, you might be able_to rent out your in-game NFTs_ (like land or characters) to other players for a fee.

Risks:

- Volatility and Illiquidity: Both tokenized assets and NFTs can be extremely volatile and highly illiquid, making them hard to sell quickly without a significant price drop.

- Demand Risk: The earning potential is often dependent on the popularity and continued demand for the specific NFT, game, or underlying tokenized asset.

⚠️ Advanced Strategies: For Experienced Players Only

These strategies carry higher risk and require significant expertise and capital. They are not recommended for beginners.

Basis Trading: Spot Holding + Derivatives Shorting.

This involves buying an asset on the spot market while simultaneously shorting a futures or perpetual contract for the same asset. The aim is to profit from the ‘basis’ – the difference between the spot price and the futures price, or more commonly, by collecting the funding rate paid by shorts to longs (or vice versa) in perpetual contracts. This strategy is complex and requires a deep understanding of Bitcoin Spot vs. Derivatives Trading.

Crypto Index Funds and Tokenized Bonds:

Some platforms offer products that behave like crypto index funds (giving diversified exposure to a basket of assets) or tokenized bonds (offering fixed-income like returns). These can be accessed via ETPs or directly through DeFi protocols. Understanding products like ETPs vs. ETFs is relevant here. Risks include underlying market downturns or issuer/protocol defaults.

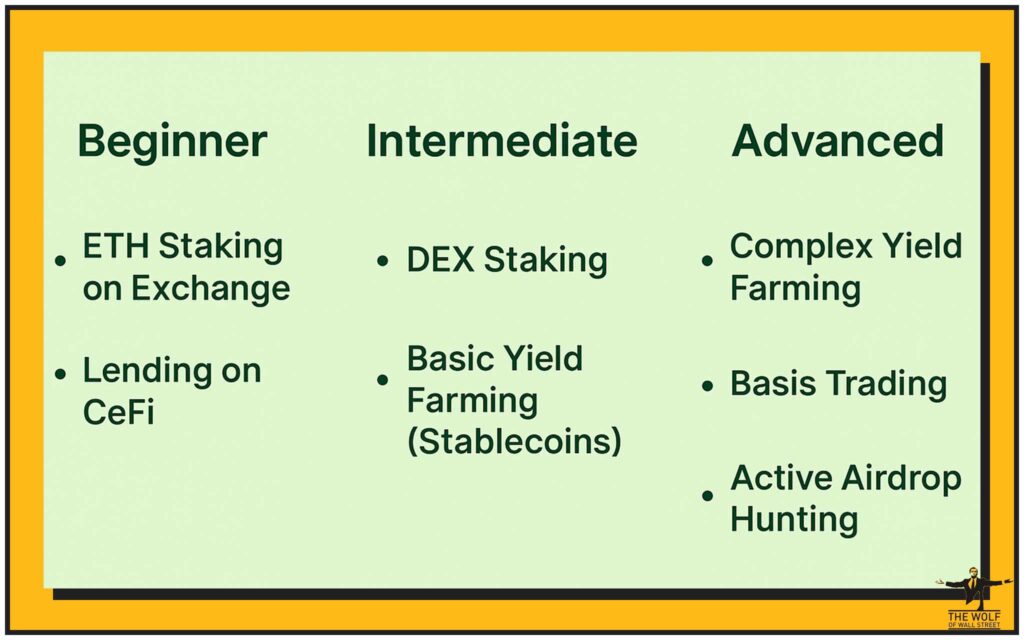

🎯 Matching Strategy to Profile: Beginner vs. Advanced

Not every earning strategy is suitable for every investor. Your risk tolerance, technical knowledge, and time commitment should guide your choices.

Beginner-Friendly:

- Staking well-established PoS coins (like Ethereum) through reputable exchanges or user-friendly wallets.

- Lending on major, audited centralised platforms (though always be aware of counterparty risk).

Intermediate:

- DEX Staking for more control and potentially higher rewards (but more technical steps).

- Basic Yield Farming on well-known, audited DeFi protocols, perhaps starting with stablecoin pairs to reduce impermanent loss risk.

Advanced:

- Complex Yield Farming strategies involving multiple protocols, leverage, or newer, less-audited platforms.

- Basis Trading and other derivatives-based income strategies.

- Active Airdrop Farming requiring significant research and interaction.

🔒 Managing Risks and Security: Non-Negotiables

Earning crypto without selling often means interacting with third-party platforms, smart contracts, and new protocols. Security is paramount.

Smart Contract Risk and Due Diligence.

Before depositing funds into any DeFi protocol, research its security audits. Look for audits from multiple reputable firms. Understand that audits reduce risk but don’t eliminate it entirely.

Platform Risk: Not Your Keys, Not Your Coins.

When you use centralised platforms for staking or lending, you are trusting that platform with your assets. Exchange hacks and insolvencies are real risks.

Wallet Security Best Practices.

Use hardware wallets for significant holdings. Employ strong, unique passwords and two-factor authentication (2FA) everywhere. Be vigilant against phishing attacks and malicious links.

Avoiding Scams in DeFi and Airdrops.

If a promised APY seems unbelievably high, it’s likely unsustainable or a scam. Never share your private keys or seed phrases. Verify all airdrop announcements through official project channels.

⚖️ Tax and Legal Considerations: Staying Compliant

Earning crypto isn’t just about gains; it’s about meeting your legal and tax obligations.

Income from Staking, Lending, Farming as Taxable Events.

In many jurisdictions, the crypto earned through staking, lending, or yield farming is considered taxable income at its fair market value at the time it’s received. This is often the case even if you don’t sell the earned crypto.

Varying Rules by Jurisdiction.

Tax laws for cryptocurrencies are complex and differ significantly between countries. What constitutes a taxable event, how income is calculated, and the applicable tax rates can all vary.

Importance of Record-Keeping.

Meticulously track all your crypto earning transactions: the date, amount earned, value at the time of receipt, and any associated fees. This is crucial for accurate tax reporting. Consulting a tax professional familiar with crypto is highly recommended.

Glossary of Key Crypto Earning Terms:

To better understand the concepts in this article, here’s a quick rundown:

- Slashing: A penalty in PoS systems where a validator loses a portion of their staked coins for malicious behaviour or serious downtime.

- Impermanent Loss: A potential loss that liquidity providers in DeFi can experience when the price ratio of the tokens in a pool changes significantly compared to simply holding the assets.

- Smart Contract Bug: A flaw or vulnerability in the code of a smart contract that can be exploited by hackers.

- Rug Pull: A scam in DeFi where developers attract investment into a new project and then disappear with the funds.

- APY/APR (Annual Percentage Yield/Rate): The rate of return earned on an investment over a year. APY includes compounding effects, APR usually does not.

- TVL (Total Value Locked): The total amount of assets locked or staked in a DeFi protocol, often used as a measure of its size and adoption.

- LP (Liquidity Provider) Token: Tokens received by users who deposit assets into a liquidity pool, representing their share of that pool.

- Funding Rate: Periodic payments between long and short positions in perpetual futures contracts.

- Airdrop: A distribution of free tokens, usually by a new project to build a community.

Frequently Asked Questions (FAQs)

- What is the safest way to earn passive income with crypto?

While no method is entirely risk-free, staking well-established Proof-of-Stake cryptocurrencies on reputable platforms or through your own secure wallet (if you have the technical knowledge) is generally considered one of the lower-risk passive income strategies. - Can I lose my initial investment when yield farming?

Yes, yield farming carries significant risks, including impermanent loss, smart contract vulnerabilities, and rug pulls, any of which could lead to the loss of your initial investment. - Are airdrops always free money?

While airdropped tokens are received for free, they don’t always have immediate or significant value. Many are worthless, and some airdrop campaigns are scams designed to steal your data or assets. - How is income from staking or lending typically taxed?

In many jurisdictions, crypto earned from staking or lending is treated as taxable income at its fair market value when received. Tax laws vary greatly, so professional advice is crucial. - What is ‘impermanent loss’ in yield farming?

Impermanent loss is the difference in value between holding tokens in a liquidity pool versus simply holding them in your wallet. It occurs when the price ratio of the tokens in the pool changes significantly.

The bottom line on how to earn crypto without selling? It’s about being smart, doing your homework, and understanding that every reward comes with a risk. Choose wisely, manage carefully, and let your crypto work for you.

“The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team./n/nEmpower your crypto trading journey:

- Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street””