🚀 Introduction: The New Wolf of Wall Street Game

Forget IPOs. Forget ICO scams. The new financial jungle is ruled by Equity Token Offerings (ETOs) — the lovechild of Wall Street’s old-school equity and blockchain’s disruptive firepower. If you want to survive, thrive, and dominate in the next wave of financial innovation, you’d better pay attention.

Here’s the play: ETOs are tokenised shares of real companies. They’re compliant with securities law, they grant actual ownership rights, and they open the door to global investors at lightning speed.

This isn’t some pie-in-the-sky crypto fad. This is regulated, revenue-generating, shareholder-backed digital equity. In this article, I’m going to break down what ETOs are, why they exist, the benefits, the risks, and how you — yes, you — can position yourself to profit.

💡 What is an Equity Token?

At its core, an equity token is a blockchain-based certificate of ownership in a company. Think of it as a digital twin of the paper shares traded on stock exchanges, but instead of living in a filing cabinet or a brokerage account, it’s locked onto a distributed ledger.

Key characteristics:

- Ownership rights: Just like traditional equity, holders get dividends and voting power.

- Blockchain security: Transactions are verifiable and transparent.

- Liquidity potential: Tokens can be traded peer-to-peer or on regulated exchanges faster than paper shares.

Don’t confuse equity tokens with utility tokens (which give you access to a product or service) or scammy ICO coins that promise the moon and deliver nothing. Equity tokens are tied directly to real-world company value.

🎯 Why Equity Tokens Exist: Cutting Through the Noise

The financial system is broken in two ways:

- IPOs: They’re insanely expensive, bureaucratic, and reserved for elite corporations with deep Wall Street connections.

- ICOs: They were the Wild West — billions raised, billions lost, zero regulation.

ETOs were designed to cut through both extremes. They give companies a way to raise capital quickly, legally, and globally — without handing control over to the investment banking cartel.

It’s like IPO muscle meets Silicon Valley speed. The wolves who get in early will ride this wave while the sheep are still waiting for their brokers to fax them paperwork.

🏛️ The Regulatory Foundation

Here’s the beauty of ETOs: they’re built for compliance.

- In the EU, the MiFID II directive sets the standard for financial securities — and ETOs slot right into it.

- In Germany, regulators already recognise tokenised shares under securities law.

- In Switzerland, exchanges like SIX are opening the gates for ETO trading.

- In the US, things are slower thanks to the SEC, but security tokens and ETOs are edging into the spotlight.

Bottom line: ETOs aren’t trying to dodge regulation. They’re designed to play by the rules while still disrupting the old game.

🔑 How Equity Tokens Are Issued

There are two main ways companies roll out equity tokens:

1. Private Token Sales

This is like venture capital, but tokenised. Instead of a few VCs holding all the cards, companies can sell equity tokens directly to accredited investors.

- Example: Solana raised funds with private token sales before exploding in value.

2. Public Offerings on Regulated Exchanges

Think IPOs but faster. Regulated platforms handle compliance, and smart contracts enforce investor rights. This is the future of cross-border capital raising — frictionless and transparent.

⚡ The Benefits of Equity Tokens

Why should investors and companies care about ETOs? Let me spell it out:

- Speed: Forget the 18-month IPO grind. ETOs can launch in weeks.

- Cost savings: No $50M investment bank fees.

- Investor rights: Dividends, voting, equity — all locked on-chain.

- Liquidity: Sell your equity on secondary markets anytime.

- Global access: Borders vanish. Anyone with internet and compliance checks can invest.

- Transparency: Blockchain auditing keeps the books honest.

For companies, this is fundraising without bending the knee to Wall Street. For investors, this is access to deals that were once locked up for hedge funds only.

⚠️ The Challenges & Drawbacks

Of course, nothing in finance is pure sunshine. Here are the storm clouds:

- Regulation is messy: Different countries, different rules.

- Privacy issues: Blockchains are transparent, which can expose investor data.

- Tech adoption: Not every exchange is ready for full ETO support.

- Bad actors: Just because it’s legal doesn’t mean scammers won’t try to mimic it.

Smart investors understand risk. ETOs are powerful, but you need to navigate carefully.

🔍 Comparing ETOs vs IPOs vs ICOs

| Feature | IPO | ICO | ETO |

|---|---|---|---|

| Regulation | Strict | None | Strong, securities-based |

| Investor Rights | Yes | None | Yes |

| Costs | High | Low | Low–moderate |

| Audience | Accredited | Anyone | Retail + Institutional |

| Best For | Giants | Startups | Growth Companies |

ETOs are the sweet spot. They have the trust of IPOs without the cost and the flexibility of ICOs without the fraud.

📈 Real-World Case Studies

- Solana: Raised millions via private token sales, avoiding IPO dilution.

- Swiss Exchanges: Already experimenting with regulated ETO listings.

- German Market: Early regulatory green lights are setting the pace for Europe.

This isn’t theory. This is happening — and it’s scaling.

🔮 The Future of ETOs

Here’s my prediction: ETOs will eat IPOs alive.

- As global regulations mature, tokenised equity will become the default.

- Cross-border capital raising will become frictionless.

- Investors will demand blockchain-backed shares because of transparency.

Just like crypto challenged fiat, ETOs are coming for the IPO throne.

🧩 How to Get Started as an Investor

Want in? Here’s the step-by-step:

- Understand local rules: Check securities laws in your country.

- Choose regulated platforms: Don’t fall for shady Telegram pump groups.

- Do due diligence: Study the company’s fundamentals, not just token hype.

- Diversify: Don’t put all your money in one ETO basket.

- Leverage tools: Master indicators like RSI crypto trading strategies and Bollinger Bands trading strategy to time your trades.

The wolves who do their homework feast. The lazy sheep get slaughtered.

🛠️ Essential Tools for Navigating ETOs

The smart ETO investor uses more than instinct:

- On-chain explorers for transparency.

- Market sentiment trackers to catch trends.

- Technical analysis tools — check MACD momentum signals and moving averages to predict price swings.

- Community intelligence — tap into groups that share signals and insights.

🐺 Why You Shouldn’t Ignore ETOs

ETOs combine:

- The trust of Wall Street

- The speed of crypto

- The global scale of the internet

That’s not a trend — that’s a revolution. Ignore it, and you’ll watch others cash in while you sit on the sidelines.

🏦 The Wolf Of Wall Street Crypto Trading Community: Your Secret Weapon

Want an edge in this game? Don’t go alone.

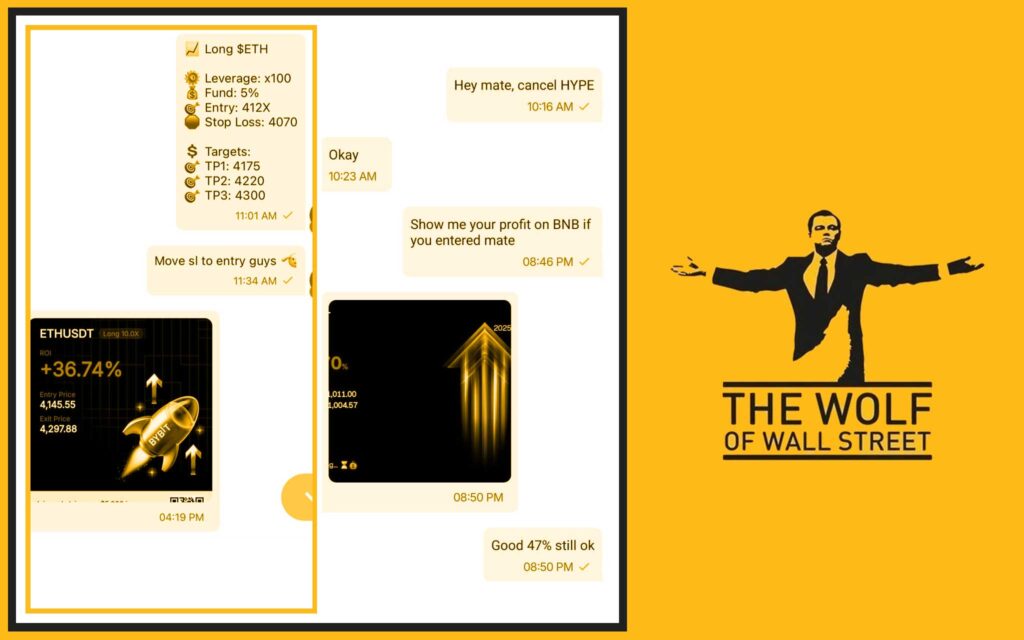

The The Wolf Of Wall Street crypto trading community gives you:

- Exclusive VIP Signals to capitalise on ETOs and other crypto plays.

- Expert market analysis from seasoned pros.

- Private community of 100,000+ traders sharpening each other’s edge.

- 24/7 support so you’re never lost in the noise.

- Essential trading tools like volume calculators to make informed moves.

👉 Visit The Wolf Of Wall Street service for full details.

👉 Join the active Telegram community for real-time updates.

This is where the wolves hunt together.

🧠 FAQs About Equity Token Offerings

1. Are equity tokens legal everywhere?

Not yet. Laws vary by country, but Europe and Switzerland are leading.

2. How do ETOs differ from tokenised securities?

They’re the same category — ETOs are one flavour of tokenised securities.

3. Can small investors join?

Yes, if the offering is retail-compliant. Many ETOs are open to both institutional and retail investors.

4. What risks should investors watch out for?

Regulation changes, illiquidity in early stages, and unverified platforms.

5. Could ETOs replace IPOs?

Absolutely. The tech and legal structures are aligning for ETOs to become the new standard.

🎤 Conclusion: The Next Wall Street Revolution

Equity Token Offerings are the bridge between old money and new tech. They’re fast, compliant, transparent, and global. They offer dividends, voting rights, and liquidity without the insane costs of IPOs or the scams of ICOs.

This is the next big play in finance. And like every revolution, it rewards the wolves who get in early and punishes the sheep who wait too long.

Remember: the wolves who understand ETOs today will own the financial jungle tomorrow.