🏦 Intro: The Money Vacuum Left by SVB’s Collapse

Listen up—Silicon Valley Bank collapsed in 2023, and the fallout created a gaping hole in venture‑backed funding. Think crypto, AI, defence, advanced manufacturing—they were stranded. Traditional banks stamped “too risky” and shut the door. Now, Erebor storms in like a predator, ready to devour the opportunity.

🏦 Erebor Enters Like a Shark Smelling Blood

Erebor isn’t just another digital bank—it’s a beast. Backed by a tech billionaire brain trust, this bank is laser‑focused on the risky, high‑growth sectors that others abandoned. This plays out like The Wolf of Wall Street, but instead of penny stocks, we’re talking high‑stakes innovation.

🧠 Meet the Billionaire Brain Trust Behind Erebor

- Peter Thiel – PayPal co‑founder, Palantir co‑founder, Founders Fund investor. Thiel isn’t just rich; he’s a crypto realist and a Web3 visionary.

- Palmer Luckey – Oculus pioneer turned defence‑tech overlord with Anduril. He knows how to build unicorns from thin air.

- Joe Lonsdale – Palantir co‑founder and 8VC mastermind. He eats complex systems for breakfast and spits out billion‑dollar companies.

These are the heavy hitters. When they gather to found a bank, the market stands at attention—because they don’t gamble on losing hands.

💸 The Startup Sectors Erebor Is Betting Big On

This isn’t about retail banking. Erebor focuses on:

- Crypto projects—With a nod to blockchain’s future.

- AI companies—The next tech overlords.

- Defence contractors—Where patriotism meets profit.

- Advanced manufacturing—Factories 4.0 demanding flexible banking tools.

These are sectors that traditional banks ran from, but Erebor charges straight into—guns blazing.

🔐 Why Stablecoins Are at the Core of Erebor’s Strategy

Erebor is applying for a national banking charter, but more importantly, it pledges to be “the most regulated entity conducting and facilitating stablecoin transactions.” This is huge. We’re not talking cosy stablecoin support—we’re talking full‑scale, compliance‑first infrastructure that legitimises digital assets.

Stablecoins = digital liquidity with banking‑grade trust. Combine that with on‑ramps, custody, and regulated support—Erebor is rewriting the game rules for crypto finance.

🌐 Erebor’s All‑Digital Banking Model

Headquartered in Columbus, Ohio, with an operation office in New York—they’re digital‑first, full‑stop. No legacy branches, no brick‑and‑mortar overhead; everything’s online, agile, scalable.

This is banking designed for founders and traders who demand speed, uptime, and instant access. If you’re living in Slack threads and Discord chats, Erebor shows up where you are—no branches, no waiting rooms.

🧭 The Co‑CEOs Driving the Ship

- Jacob Hirshman, ex‑Circle executive—crypto experience? Check.

- Owen Rapaport, previously at Aer Compliance—knows how to walk the tightrope of regulation.

- Mike Hagedorn, from Valley National Bank—brings seasoned banking operations to the table.

Imagine a Venn diagram overlap of crypto strategy, compliance protocols, and banking muscle. That’s your leadership right there.

⚔️ Bridging Traditional Finance and Web3

This is the battlefield edge: decentralised assets meet centralised trust. Erebor doesn’t just custody tokens—it’s building rails for payroll, lending, stablecoin settlements, all under one roof.

Startups? DAO treasuries? Web3 syndicates? They’re getting access to services that were once pipe dreams—banking tools with cryptographic muscle and regulatory certification.

🚨 The Real Market Gap: Who Erebor Is Saving

SVB collapse = startups stranded without payroll, credit, or banking partners. They scrounged for alternatives. Enter Erebor.

It’s more than a bank—it’s a lifeline. Loans? Covered. Bank accounts? Handed out. Blockchain‑native operations? Ready to roll. Traditional banks walk away while Erebor pounces.

📊 Erebor vs SVB: What’s Actually Different?

| Feature | Erebor | SVB (pre‑2023) |

|---|---|---|

| Stablecoin Focus | ✅ Regulated, compliance⌛ | ❌ N/A |

| On‑chain Payroll | ✅ Built-in | ❌ None |

| Startup Loans | ✅ Risk‑tolerant | ⚠️ Risk‑averse |

| Digital‑only Ops | ✅ Agile / fast | ⚠️ Physical branches |

| Stablecoin Custody | ✅ Core competency | ❌ Not offered |

This isn’t incremental improvement. It’s a redesign of banking from the ground up.

🧨 How Erebor Could Set Off a Banking Revolution

Watch regulators, fiat bankers and fintechs pivot fast. Once Erebor hits its stride—serving billions in crypto deposits—they’ll scramble to catch up.

Here’s the kicker: once regulators approve Erebor’s charter, the floodgates open. Other incumbents must either adapt or get left in the dust. This could be the catalyst for a Web3‑compliant banking era.

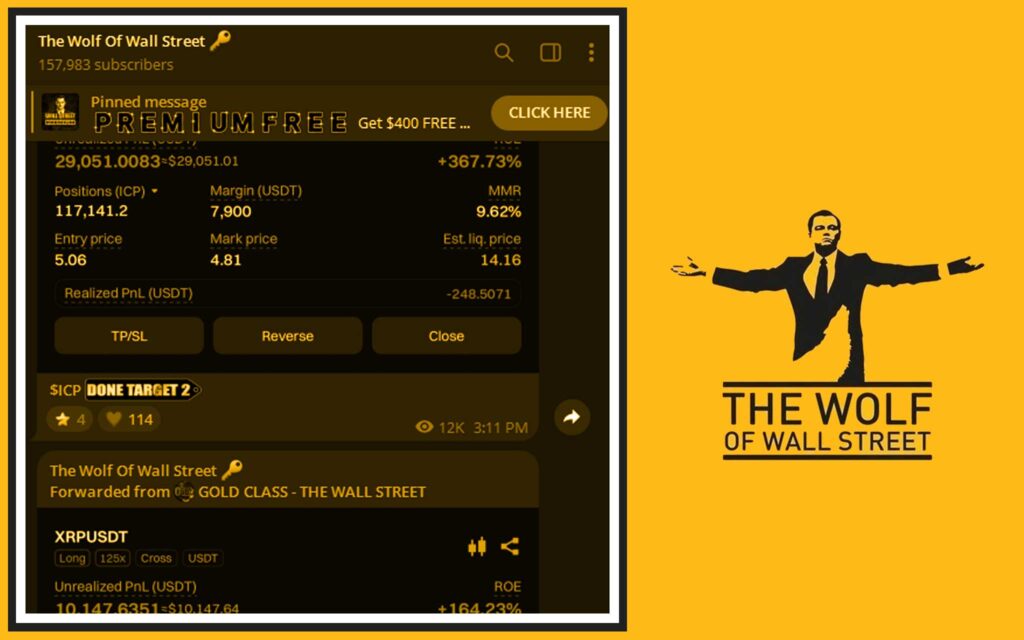

🧠 How Smart Traders Play Erebor’s Wave with The Wolf Of Wall Street

Now we get tactical. The The Wolf Of Wall Street crypto trading community is already locked in on exactly this kind of shift. They’re using:

- Exclusive VIP Signals to surf market moves triggered by Erebor’s announcements.

- Expert Market Analysis to build plays in crypto pairs tied to stablecoin flows—BUSD, USDC, USDT.

- Private Community of 100,000+ people, bouncing intel and trade setups.

- Trading Tools—volume calculators, trend scanners, smart charts—to confirm momentum.

- 24/7 Support, because when Erebor breaks news, The Wolf Of Wall Street members need real-time briefing.

Smart traders aren’t watching from the sidelines—they’re positioning before the herd.

🔥 The The Wolf Of Wall Street Advantage in a Volatile Banking Landscape

When Erebor announces a partnership—or gets green‑lit for its charter—markets move fast. The Wolf Of Wall Street’ VIP signals catch it first. Members get real‑time trade direction, backed by deep technical insight.

And if you’re new to crypto? You’re not alone. The Trading Insights section and Trending content get you up to speed. Learn the dynamics—then apply that signal logic.

🗣️ Real Talk: Is Erebor Too Good to Be True?

No system is flawless. Erebor faces risks:

- Regulatory hurdles—national charter isn’t guaranteed; delays can stall momentum.

- Market trust—can founders switch banks for a new player? They need stability.

- Crypto volatility—stablecoins face their own controversies.

But The Wolf Of Wall Street shows its members how to hedge these bets. You don’t leap in blind—you trade with stops, size smart, adapt to news—like a wolf, not sheep.

🔮 Future Outlook: Erebor, Crypto, and the Battle for Capital

Five years from now, banking for blockchain will be table stakes. If Erebor nails compliance, custody, and lending—it could go IPO, or be snatched by big banks.

Meanwhile, The Wolf Of Wall Street traders will be 100 steps ahead: front-runners in the stablecoin game, leveraging network insights before regulators blink. Because once banking meets blockchain, there’s no turning back.

Conclusion: Don’t Miss the Shift – Play Smart, Play Bold

Here’s the bottom line: Erebor is not just another bank—it’s the next seismic shift in capital flow, a digital‑asset-friendly institution crafted by tech titans. For startups, it’s salvation. For traders, it’s your payday.

If you want to fish where the sharks are, you need tools, intel, and guts. That’s why The Wolf Of Wall Street is your unfair advantage—VIP signals, expert analysis, trading tools, and a 100k‑strong private community all backing you up.

Make your move now—because in a world where banking innovation meets blockchain, the first wave makes the biggest splash.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”