Listen up. If you’re serious about making not just good money, but life-changing, obscene amounts of wealth, you need to understand the battlefield. The financial market isn’t a playground for amateurs; it’s a warzone where fortunes are won and lost in the blink of an eye. The most critical decision you’ll make is choosing your weapon, and today we’re breaking down the ultimate ETFs vs. Mutual Funds showdown.

🚀 Introduction: Stop Playing in the Minors, It’s Time to Hit Wall Street

What the Hell Are We Even Talking About?

Forget your savings account. Forget that piggy bank your nan gave you. We’re talking about real financial instruments, the kind of tools that separate the boardroom predators from the pavement-level prey. Exchange-Traded Funds (ETFs) and Mutual Funds are pools of money. Think of them as giant war chests funded by thousands of investors, all aimed at one thing: market domination. They take that pooled capital and buy a diversified portfolio of assets – stocks, bonds, and yes, the new king of volatility and profit, cryptocurrency.

Why You Need to Listen to Me, and Listen Good.

Pay close attention, because what I’m about to tell you is the key to the kingdom. This isn’t some dry, university lecture. This is a masterclass in financial weaponry. Understanding the intricate differences between these two giants is not just about investing; it’s about creating a dynasty. It’s about knowing which tool to use to carve out your slice of the market with surgical precision. Get this right, and you’re on the fast track. Get it wrong, and you’re just another casualty.

🎟️ The Lowdown on Exchange-Traded Funds (ETFs): Your Ticket to the Big Leagues

How ETFs Work: The Simple, No-BS Version.

An ETF is a work of pure genius. It’s a fund that trades on a stock exchange, just like a share in Apple or Tesla. You can buy it at 9:31 AM and sell it at 9:32 AM. This intraday liquidity is its superpower. You see an opportunity, you strike. No waiting. ETFs are designed to track a specific index, like the S\&P 500 or, more excitingly, a basket of top-tier crypto assets. You get instant diversification without having to buy dozens of individual assets yourself. It’s a way to own the entire haystack instead of searching for the needle. For a more detailed breakdown of similar products, our guide on ETPs vs. ETFs lays it all out.

Traditional ETFs: The Slow, Steady Money-Printing Machine.

Your standard ETF is a beautiful, passive beast. It doesn’t try to be clever. It simply mirrors a market index. The goal isn’t to beat the market; it’s to be the market. And because there’s no high-flying, ego-driven fund manager making bets, the fees—the expense ratios—are dirt cheap. This is the cornerstone of a solid portfolio, a relentless, compounding force that builds wealth while you sleep. It’s your base of operations, the foundation upon which you build your empire.

Cryptocurrency ETFs: The New Frontier of Raw, Unadulterated Profit.

Now we’re talking. This is the main event. Crypto ETFs are your ticket to the explosive world of digital assets without the headache of wallets, private keys, and shady exchanges. They provide exposure to titans like Bitcoin and Ethereum, all wrapped up in a neat, regulated package you can buy from your standard brokerage account. When the Bitcoin and Ethereum ETFs finally hit the mainstream, they unleashed a tsunami of capital. This is where the real adrenaline is. It’s volatile, it’s electrifying, and for those with the guts to get in, it’s a goldmine.

🏛️ Unpacking Mutual Funds: The Old Guard’s Playbook

The Guts of a Mutual Fund: What You’re Really Buying.

A mutual fund is the establishment’s weapon of choice. It’s also a pool of investor capital, but it operates on a different rhythm. You buy in, and you sell out, but only at a single price calculated at the end of the trading day—the Net Asset Value (NAV). There’s no rapid-fire trading here. You’re placing your bet and waiting for the day’s results. It’s a slower, more deliberate game.

Active Management: Is Your “Genius” Fund Manager Worth the Hefty Price Tag?

Here’s the sales pitch for mutual funds: a brilliant, seasoned fund manager who actively picks and chooses assets to outperform the market. They’re the supposed masters of the universe, the wizards behind the curtain. The problem? These geniuses are expensive. Their salaries, their research teams, their steak dinners—it all comes out of your pocket in the form of higher expense ratios. And the dirty little secret is that the vast majority of them fail to beat the simple, passive index funds over the long run. You’re often paying a premium for subpar performance.

Crypto Mutual Funds: A Whole New Beast in the Financial Jungle.

Crypto mutual funds take this active approach and apply it to the digital asset wilderness. The manager tries to time the chaotic swings of the crypto market, jumping on hot altcoins and navigating DeFi trends. The potential for massive gains is there, but so is the risk of catastrophic losses. You are betting everything on one person’s ability to predict the unpredictable. It’s a high-stakes gamble that requires absolute faith in your chosen pilot.

🥊 Head-to-Head: The Main Event Showdown

Let’s cut the crap and put these two titans in the ring.

- Trading Mechanics: Speed is Money. Who’s Faster?

- ETFs: You trade them all day long. The price moves with the market in real-time. You want in? You’re in. You want out? You’re out. Instantly. This is for hunters and traders who act on intelligence.

- Mutual Funds: You’re stuck. You place your order, and you wait until the market closes to get your price. You could lose your shirt in the hours between, and there’s nothing you can do about it. Advantage: ETFs, by a knockout.

- Management Style: Are You a Passenger or Paying for a Pilot Who Can’t Fly?

- ETFs: Typically passive. They track an index. It’s a simple, transparent, and proven strategy. You know exactly what you own.

- Mutual Funds: Actively managed. You’re paying for a star manager’s “expertise.” It’s a black box, and more often than not, you’re just funding someone else’s ego. Advantage: ETFs, for their brutal efficiency.

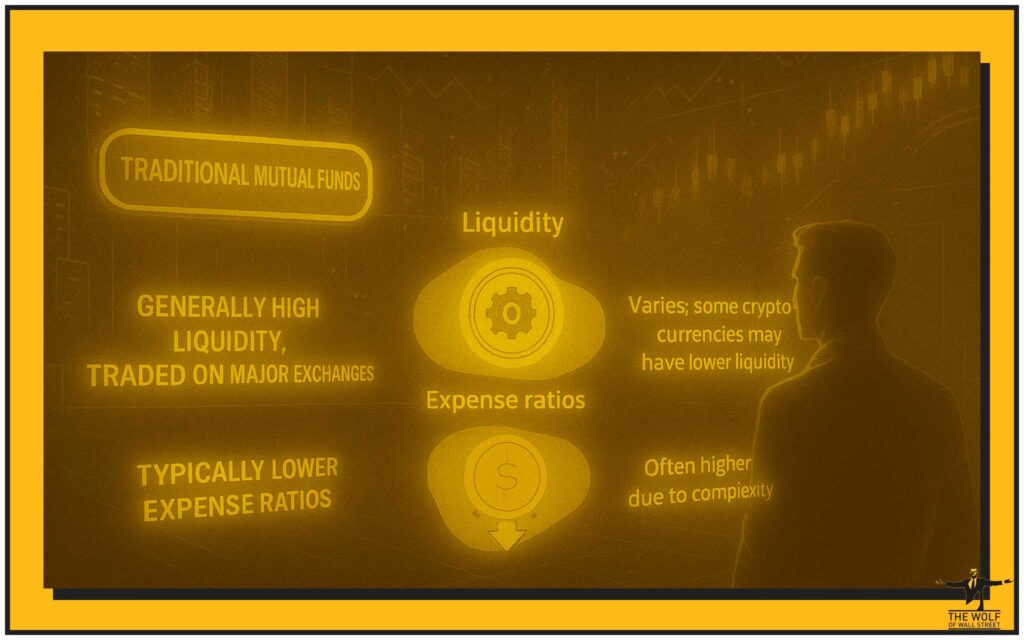

- Liquidity: Getting Your Hands on Your Cash When You Damn Well Please.

- ETFs: As liquid as the stocks they trade like. You can sell and have your cash ready to deploy in seconds.

- Mutual Funds: You have to wait until the end of the day. Need money fast? Too bad. Wait in line. Advantage: ETFs.

- The Cost of Doing Business: Don’t Let Fees Bleed You Dry.

- ETFs: Lower expense ratios are the name of the game. Average fees are a fraction of what mutual funds charge. Less money for them means more money for you.

- Mutual Funds: Higher fees to pay for the active management, marketing, and operational bloat. They are a constant drag on your returns, a leak in your financial battleship. Advantage: ETFs.

- Tax Implications: Keeping the Taxman’s Greedy Hands Out of Your Pockets.

- ETFs: Generally more tax-efficient. The way they are structured allows them to minimise capital gains distributions to shareholders. You sell when you want to, giving you control over your tax bill.

- Mutual Funds: The fund manager’s trading activity can trigger capital gains for all shareholders, even if you haven’t sold a single share. You can get hit with a tax bill because of someone else’s decisions. Advantage: ETFs.

💎 The Crypto Twist: This is Where the REAL Money is Made

Navigating the Regulatory Minefield Without Getting Blown Up.

Both crypto ETFs and mutual funds operate under the watchful eye of regulators like the SEC. This provides a layer of transparency and protection you don’t get when you’re navigating the Wild West of decentralised exchanges on your own. They require disclosures, regular reports, and compliance with securities laws. It’s the difference between fighting in a sanctioned ring and a back-alley brawl. For anyone serious about this game, understanding compliance, like the Crypto AML Guide, is non-negotiable.

Why Digital Assets Change the Entire Goddamn Game.

Crypto is not stocks. It’s not bonds. It’s a new financial paradigm. Its volatility is terrifying to the weak but a ladder of pure opportunity for the strong. Whether you choose an ETF for broad, passive exposure or a mutual fund for targeted, active bets, you are tapping into the single greatest wealth-creation event of our generation. To truly dominate, you need to understand the full spectrum of asset classes available in crypto.

💰 The Bottom Line: Which One Makes You Richer?

The Investor Profile: Who Should Be Buying ETFs?

ETFs are for the intelligent, strategic, and cost-conscious predator. They are for the investor who wants control, transparency, and low-cost diversification. They are for the trader who needs liquidity to strike at a moment’s notice. If you believe that a low-cost, systematic approach is the path to victory—and history proves it is—then ETFs are your weapon of choice. This is especially true if you’re just getting started and need to avoid the classic newbie mistakes.

The Big Spender: When Do Mutual Funds Actually Make Sense?

A mutual fund only makes sense if, and it’s a big if, you find a true killer. A fund manager who is a genuine prodigy, a one-in-a-million talent who can consistently navigate the chaos and deliver alpha. These individuals exist, but they are incredibly rare. If you’re going to bet on one, you better have done your homework and be prepared to pay the price of admission.

Don’t Just Invest. Dominate with The Wolf Of Wall Street.

Alright, you’ve got the theory. Now it’s time for execution. Knowing the difference is one thing, but having the right intel and tools is everything. The team at The Wolf Of Wall Street crypto trading community offers precisely that. This isn’t just a group; it’s an arsenal.

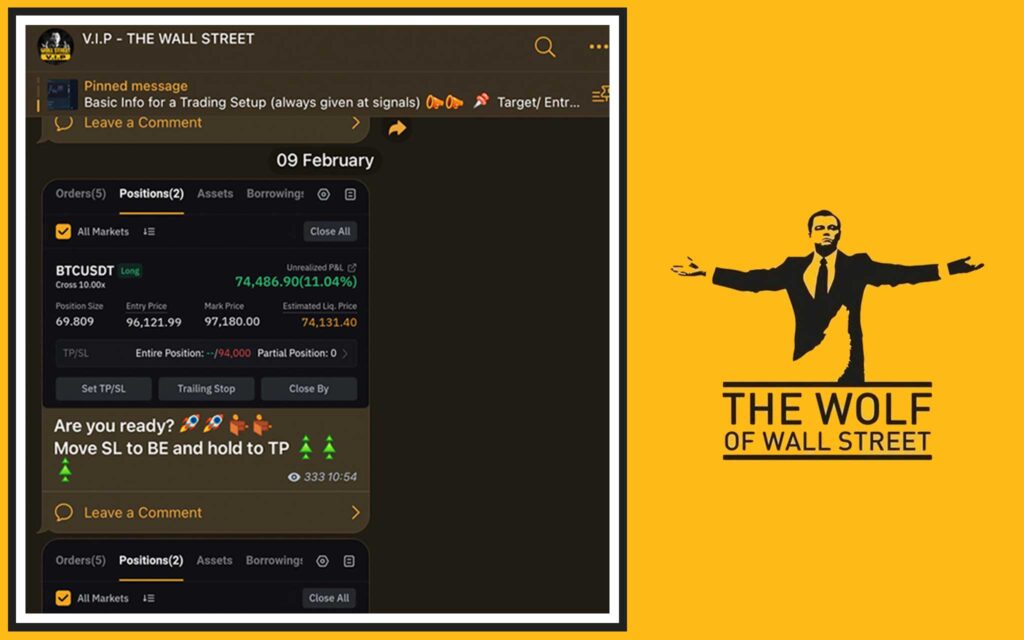

- Exclusive VIP Signals: Stop guessing. Get proprietary signals designed to maximise your profits.

- Expert Market Analysis: Let seasoned traders feed you the in-depth analysis you need to make killer decisions.

- Private Community: Network with over 100,000 other wolves. Share insights, strategies, and conquer the market together.

- Essential Trading Tools: Use volume calculators and other resources to execute with precision.

- 24/7 Support: Never fly solo. Get constant assistance from a dedicated team.

Empower your journey. Visit the The Wolf Of Wall Street service page for the full briefing and join the action on their Telegram community. This is your chance to unlock your true potential.

🐺 Conclusion: Your Path to Financial Dominance Starts Now

The debate over ETFs vs. Mutual Funds is about more than just investment vehicles; it’s about choosing your philosophy for wealth creation. Do you want the lean, efficient, high-speed power of an ETF, or are you willing to bet on the expensive promise of a star manager with a mutual fund? For the modern investor, especially in the electrifying crypto arena, the evidence is overwhelming. ETFs offer the control, cost-efficiency, and liquidity you need to build a financial empire. The choice is yours. Now stop reading and start doing.

🤔 Frequently Asked Questions (FAQs)

What’s the number one mistake rookies make choosing between these funds?

The biggest mistake is chasing last year’s winner. Rookies pile into a mutual fund that just had a hot streak, right as the manager’s luck runs out, all while paying exorbitant fees. They ignore the slow, relentless power of low-cost ETFs, which is how real wealth is built.

Can I really get filthy rich with Crypto ETFs?

Let’s be clear: the potential is absolutely there. Crypto ETFs give you exposure to one of the most explosive asset classes in history. But riches are not guaranteed. It requires strategy, timing, and the stomach to handle gut-wrenching volatility. It’s a high-risk, high-reward game.

How do I know if a fund manager is a wolf or a sheep?

Look at their long-term track record, not just one good year. A true wolf delivers consistent returns across different market cycles. Read their investor letters. Do they sound like a clear-thinking strategist or a marketing mouthpiece? And most importantly, check their fees. A real pro knows their value but doesn’t need to fleece their clients to prove it.

Are ETFs safer than holding crypto directly on an exchange?

In terms of regulation and custody, yes. A regulated ETF is custodied by established financial institutions, reducing your risk of losing everything to a hack or exchange collapse. You trade the complexity of self-custody for the safety of the traditional financial system, which is a trade-off many smart investors are willing to make.