🏁 The Market That Refuses to Die

After one of the most brutal flash crashes in recent memory, the crypto market just did what it always does best — it fought back.

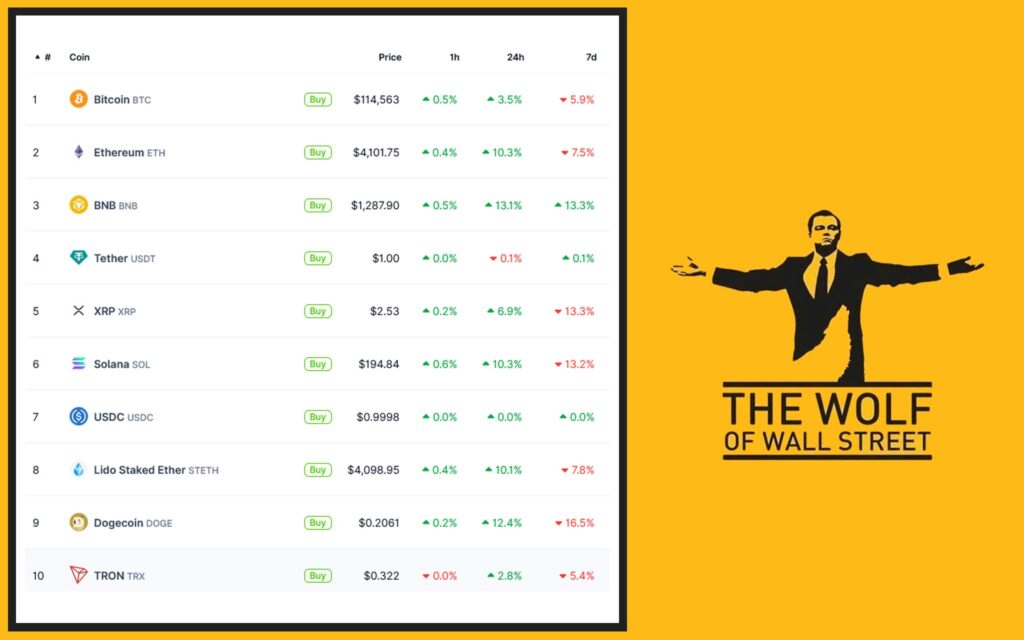

The global crypto market cap roared past $4 trillion, flipping fear into FOMO in less than 48 hours.

Ethereum, Binance Coin, and Dogecoin — three of the most recognisable names in the digital arena — didn’t just recover. They led the charge.

This wasn’t a fluke. This was a coordinated comeback powered by market psychology, institutional accumulation, and one of the most powerful technical setups we’ve seen all year.

If you blinked, you missed the entry of a lifetime.

💥 From Panic to Profit: The Big Crypto Bounce

When the market collapsed, retail investors panicked. But the wolves — they saw opportunity.

Triggered by a cocktail of Trump’s 100% China tariff, exchange glitches, and liquidation cascades, the market nosedived. Billions were wiped out in hours. Then — just as fast — billions flowed back in.

This wasn’t luck. It was market mechanics at play.

Every dip creates a new order book. Every panic triggers smart money accumulation.

The result? A jaw-dropping reversal that left latecomers chasing green candles and pros pocketing 20–30% returns overnight.

Want to understand these setups in real time? Stay locked into trending crypto updates and market insights.

🚀 Ethereum: The King Reclaims His Throne

Ethereum wasn’t just leading — it was dominating.

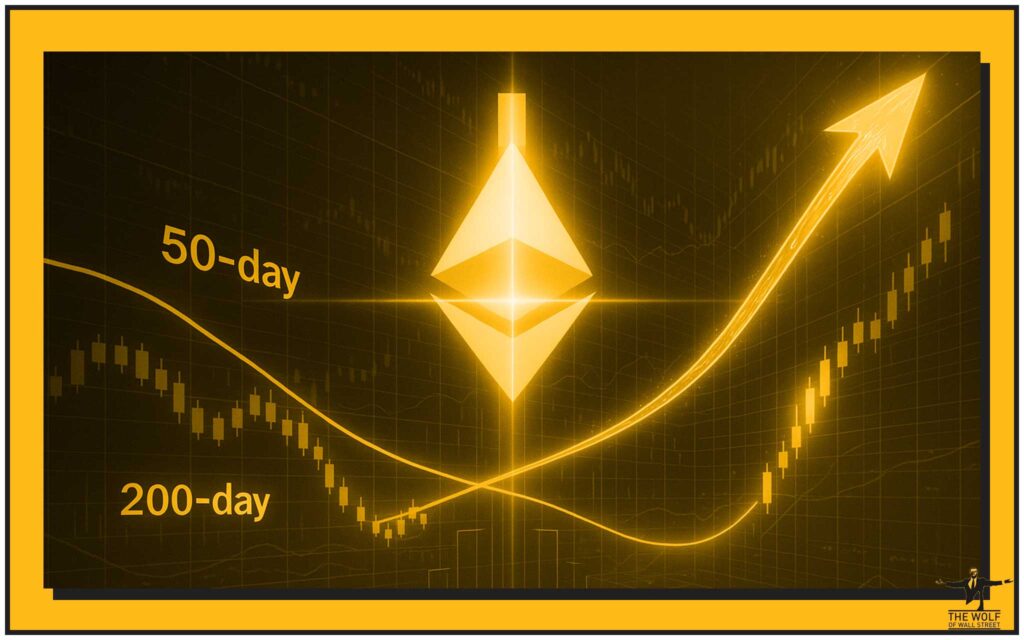

The coin surged over 10% in 24 hours, reclaiming dominance and cementing its role as the smart money’s favourite playground. The golden cross formation — where the 50-day moving average crosses above the 200-day — flashed bullish. Historically, that signal precedes massive rallies.

Institutional wallets and whale accounts showed heavy ETH inflows following the dip. Analysts called it the “smart money rotation”.

And with the upcoming Ethereum Fusaka Upgrade boosting scalability and staking rewards, ETH’s narrative is more compelling than ever.

For those who understand moving averages and trend dynamics, this setup screamed momentum.

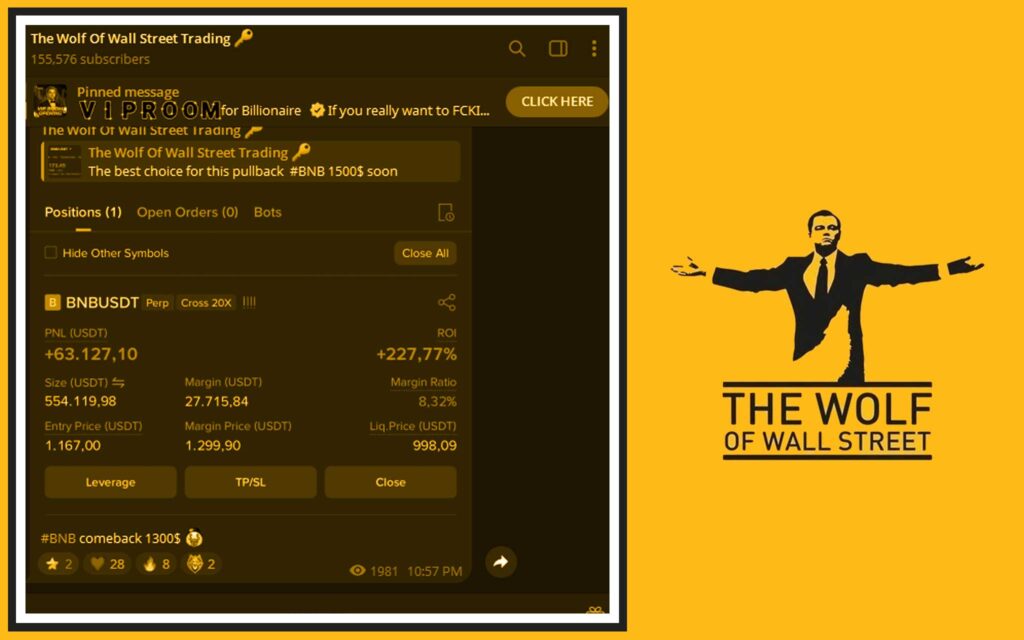

🔥 BNB: The Comeback of a Titan

If you thought Binance was done after its front-end glitch chaos — think again.

BNB shot up 13.6% in one day, flipping panic into profit. While mainstream headlines screamed “Binance broken,” the pros knew better. The glitch was temporary, sentiment was emotional, and whales swooped in fast.

Confidence returned as liquidity normalised, and traders betting against BNB got steamrolled.

Smart traders followed dominance patterns similar to those in our crypto dominance trading strategies, and once again, the wolf pack outplayed the herd.

🐕 Dogecoin: The Meme That Refuses to Fade

Dogecoin isn’t a joke anymore — it’s a market psychology masterclass.

In a world of utility-driven assets, DOGE thrives on community momentum. When traders panic, Dogecoin hodlers double down. And it worked — DOGE spiked over 12%, fuelled by retail enthusiasm and increasing transaction volumes.

This isn’t nostalgia; it’s liquidity flow. DOGE is an emotional asset, and emotion drives volume.

For those tracking memecoins, it’s another reminder that sentiment is a tradable edge.

DOGE isn’t dying anytime soon — it’s just evolving into the wolf of retail psychology.

⚙️ Chaos Catalyst: Tariffs, Glitches & Fear

So what triggered the collapse before this glorious rebound?

First, Trump’s 100% tariff on China targeting rare-earth exports shook global markets. Investors fled risky assets, triggering automated liquidations across exchanges.

Then, reports of a Binance front-end “zero-price” glitch and a USDe synthetic dollar depeg hit social feeds, intensifying fear.

While verification is ongoing, the chain reaction was clear — panic spread faster than the blockchain itself.

Traders who understood market makers and takers saw the setup: cascading stops, leveraged wipeouts, and pure opportunity.

The brave bought blood. The fearful sold strength. You already know who won.

📈 The Golden Cross and Market Psychology

The golden cross — that magic technical formation — is the market’s way of flashing a green light to those paying attention.

Every cycle, it separates the emotional traders from the logical strategists.

The cross doesn’t cause rallies; it confirms momentum. Smart traders accumulate before it happens.

For those following trendlines and momentum indicators or MACD signals, the writing was on the wall long before the headlines broke.

The golden cross isn’t a prediction — it’s confirmation that confidence is back.

🏦 Institutional Whales Move In

When fear dominates, institutions accumulate.

BitMine Immersion Technologies reportedly bought 128,700 ETH (worth nearly half a billion dollars).

MicroStrategy and other treasury-focused entities are quietly expanding crypto exposure — the classic “buy the dip” playbook.

Institutional accumulation always precedes retail confidence.

You see it in wallet flows, on-chain data, and treasury reports — just like the principles outlined in the treasury model of corporate crypto holdings.

When the big players move, it’s not speculation — it’s strategy.

🧠 The Wolf’s Playbook: Trading the Rebound

Let’s cut the fluff. You want to win in this game? Follow this blueprint:

- Don’t sell into fear. The pros are buying your panic.

- Study the signals. The golden cross isn’t a myth — it’s market confirmation.

- Follow institutions. When the sharks move, swim with them.

- Leverage volatility. The biggest profits hide in chaos.

- Join communities that have your back.

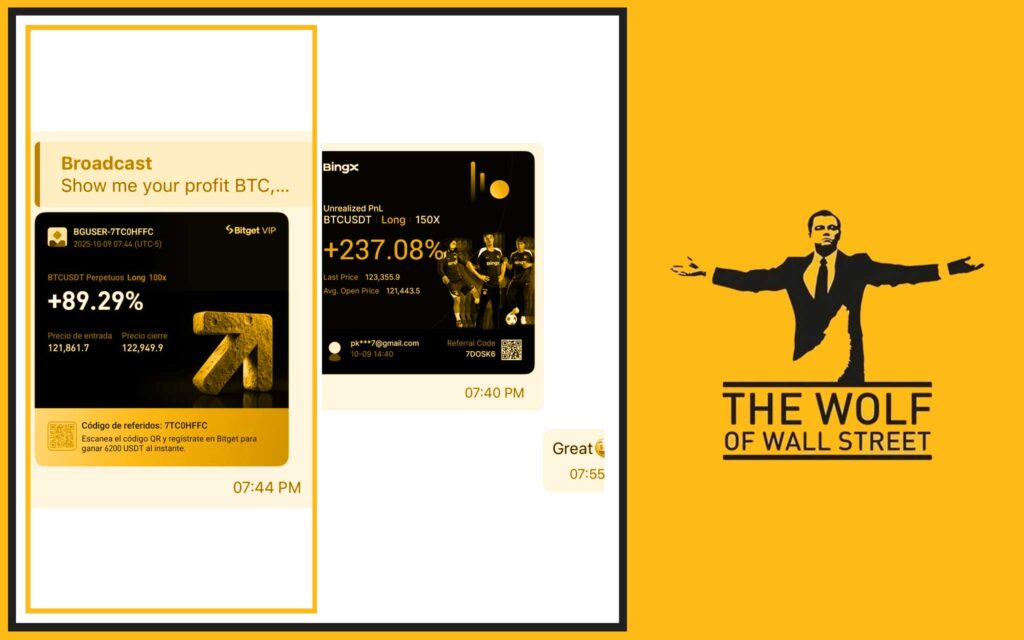

That’s where The Wolf Of Wall Street comes in — a powerhouse crypto community with VIP trading signals, expert analysis, and real-time support.

For those hunting edge and education, start with advanced trading insights and learn to master your crypto order types.

💬 Analysts, Bulls & The Brave

Crypto analysts split into two camps this week:

- The Bulls, like Mister Crypto and Alex Becker, who see this rebound as the prelude to the next mega rally.

- The Cautious, who warn of short-term consolidation before new highs.

But here’s the truth: neither camp matters if you’re prepared.

Because when you have the tools, strategy, and mindset of a wolf, you’re not guessing — you’re executing.

🧩 What Happens Next

Bitcoin’s holding steady around $115,000, roughly 9% below its weekly high.

Analysts expect sideways action before another leg up.

Altcoins are rotating, liquidity’s returning, and institutional sentiment is bullish.

But caution remains — global tariffs, liquidity tightening, and exchange volatility could slow momentum.

Still, the structure looks solid.

For traders eyeing DeFi opportunities and Layer 1 ecosystem growth, the setup ahead is primed for accumulation.

📊 Key Takeaways: Fear to Fortune

- Market cap rebounded above $4 trillion.

- ETH, BNB, and DOGE dominated the rebound.

- Tariffs and exchange glitches triggered the crash.

- Institutional buyers loaded up heavy.

- Technicals confirmed bullish strength via golden cross.

Volatility didn’t destroy wealth — it transferred it.

❓ FAQs

1. What caused the crypto crash and rebound?

A mix of macro policy (Trump tariffs), exchange issues, and leveraged liquidations caused the crash. Strong fundamentals and institutional buying drove the rebound.

2. Is the golden cross reliable?

Historically, yes — but it’s confirmation, not prediction. Use it with momentum indicators for precision.

3. Which coins led the comeback?

Ethereum, Binance Coin, and Dogecoin saw the strongest recovery with 10–13% daily gains.

4. What role do institutions play?

Whales and corporate treasuries often set the tone. When they buy, sentiment flips fast.

5. How can traders stay ahead?

Join The Wolf Of Wall Street — gain VIP trading signals, analysis, and access to a 100,000-strong community.

🧱 Conclusion – Wolves Thrive in Volatility

This wasn’t luck. It was discipline, psychology, and strategy in motion.

The smart traders stayed calm. The wolves circled the blood in the water.

While the herd panicked, the elite executed.

And if you’re ready to stop watching from the sidelines, now’s the time to act.

Join the movement. Learn from the best. Dominate your next trade with The Wolf Of Wall Street — the ultimate crypto trading community.

The Wolf Of Wall Street Crypto Trading Community empowers traders with:

- Exclusive VIP Signals for high-precision trades

- Expert Market Analysis from professionals

- Private Network of 100,000+ traders

- Essential Tools like volume calculators

- 24/7 Support from dedicated experts

🔹 Visit: tthewolfofwallstreet.com/service

🔹 Join Telegram: t.me/tthewolfofwallstreet