⚡ Introduction – The Shift Nobody Saw Coming

August 2025 flipped the crypto script on its head. Over $3.87 billion poured into Ether ETFs in just one month, while Bitcoin ETFs bled $751 million. That’s not just a number—it’s a paradigm shift. The tide of institutional money is turning, and it’s flowing straight into Ethereum.

The big boys on Wall Street have chosen their new darling. And if you’re not paying attention, you’re missing the biggest money-making wave since Bitcoin’s first ETF approval.

📈 Ether ETFs Take the Throne

Ethereum ETFs are smashing records while Bitcoin ETFs are limping. Why? Because Wall Street traders are sharks, and sharks smell blood. They see Bitcoin stagnating, stuck in its narrative of “digital gold.” Meanwhile, Ethereum is becoming the backbone of decentralised finance, gaming, NFTs, and tokenisation. Institutions want growth and upside—and ETH screams both.

This isn’t just about numbers; it’s about sentiment. The guys managing billions aren’t looking for safe havens—they’re chasing asymmetric upside. And right now, ETH delivers.

🏦 Spot vs. Futures ETFs – The Real Game

Let’s cut the crap. Futures ETFs are smoke and mirrors. They’re paper bets with no direct impact on supply. Spot ETFs are the real deal. They pull ETH off exchanges and lock it up. That means tighter supply, higher volatility, and explosive upside when inflows accelerate.

This is why institutions are throwing billions at Ether spot ETFs. They’re not here to play games—they’re here to own the underlying asset. Want to understand this difference better? Check our ETPs vs ETFs ultimate crypto guide.

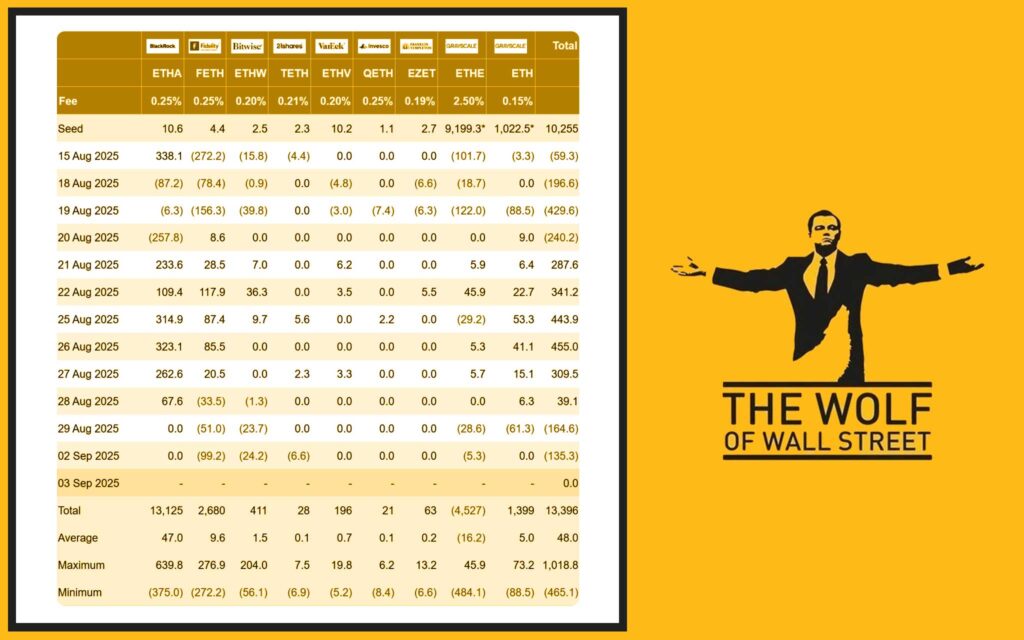

💰 The Billion-Dollar Players – BlackRock, Fidelity, Grayscale

Follow the money. BlackRock, Fidelity, Grayscale—these titans now control ~$28 billion in Ether ETFs. And here’s the kicker: they’re not just experimenting. This is the same playbook they used when they turned Bitcoin ETFs into multi-billion-dollar machines. Except this time, ETH has real-world utility behind it.

When the giants buy in, smaller funds copy. Pension funds, hedge funds, and even insurance companies start dipping their toes. The domino effect is unstoppable once the leaders plant their flag.

🚀 Single-Day Inflows and Price Explosions

On multiple occasions in August 2025, Ether ETFs pulled in over $700 million in a single day. And each time, ETH’s price surged, culminating in its record-breaking push toward $5,000. That’s no coincidence—it’s pure market mechanics.

ETFs are the trigger, spot markets are the powder keg, and traders who know how to ride the wave are cashing in big.

🔥 Momentum, Volatility, and Trader Goldmines

Here’s the truth: ETF inflows aren’t just “news”—they’re trading signals. Every billion sucked into Ether ETFs drains supply from exchanges. That’s rocket fuel for momentum traders. But volatility cuts both ways—when inflows stop, prices can nosedive just as fast.

For the wolves out there, this is opportunity. Momentum plays, scalps, and swing trades are all on the table. If you’re serious about this game, dive into trading insights to sharpen your edge.

📊 The Mechanics – Why Inflows Move Markets

ETFs are black holes for liquidity. Once ETH enters an ETF, it doesn’t leave unless investors redeem shares. That means:

- Supply drops. Less ETH on exchanges.

- Volatility spikes. Prices swing harder.

- Institutional demand drives momentum.

This isn’t speculation—it’s supply and demand 101. The less ETH floating around, the more brutal the price moves.

🕴️ Corporate Treasuries Betting Big on ETH

Here’s where it gets really interesting: companies are now putting ETH on their balance sheets. SharpLink Gaming and BitMine Immersion Tech have already announced big ETH allocations. This is déjà vu of the Bitcoin corporate adoption wave. Only this time, ETH brings smart contracts, tokenisation, and DeFi utility.

Corporate treasuries are making ETH mainstream. Once CFOs and boards wake up to the performance potential, expect a flood of copycats.

🌍 Macroeconomic Shocks – The Wild Card

Crypto may be decentralised, but don’t kid yourself—macro data moves ETFs like stocks. Late August proved it: after hot U.S. inflation numbers, both Ether and Bitcoin ETFs saw rare simultaneous outflows.

Inflation, Fed policy, and economic shocks aren’t just Wall Street problems anymore. They ripple through crypto ETFs instantly. Smart traders are already tracking inflation prints and macro trends. Want to dig deeper? Check crypto macro indicators.

⚖️ Regulatory Roulette

Regulation remains the biggest wildcard. U.S. lawmakers are drafting bills to clarify ETF rules, but the SEC still holds the cards. Approvals, rejections, or sudden rule changes can shift flows overnight.

Globally, regulators in Europe and Asia are watching closely. Approval in one jurisdiction often triggers a domino effect elsewhere. But make no mistake—regulation is both the risk and the catalyst.

📉 Risk Factors Traders Can’t Ignore

Every opportunity comes with risk. With Ether ETFs, watch out for:

- Sudden outflows after bad macro data.

- ETF premiums/discounts creating arbitrage traps.

- Market makers either cushioning or amplifying volatility.

The market isn’t always rational, but it always punishes unprepared traders. If you’re serious about survival, read understanding market makers and takers in crypto.

🎯 Options, Volatility & Arbitrage Opportunities

ETF inflows don’t just move spot prices—they jack up implied volatility. And when IV rises, options traders smell blood.

That opens the door to advanced plays:

- Momentum calls on inflow days.

- Protective puts when inflows stall.

- Arbitrage between ETF premiums and spot ETH.

The wolves who understand volatility don’t just ride waves—they own them.

🌐 The Long Game – ETH as 5% of Its Own Market Cap

Here’s the bombshell: Ether ETFs now hold over 5% of ETH’s market cap. That’s insane. It means ETFs alone are shaping ETH’s destiny.

This isn’t just short-term hype—it’s the maturation of ETH as an institutional asset. At this pace, ETH could challenge Bitcoin’s dominance in ETF flows within the next cycle.

🛠️ Wolf’s Trading Toolbox – How to Ride the ETF Wave

Want to trade like a wolf, not a sheep? Here’s the playbook:

- Watch ETF inflow dashboards daily.

- Combine flow data with technical tools like RSI crypto strategies and MACD momentum signals.

- Hedge volatility with options.

- Use arbitrage when ETFs trade at premiums.

The wolves use data, tools, and discipline. The sheep chase pumps and get slaughtered.

🐺 The Wolf Of Wall Street – The Edge in Chaos

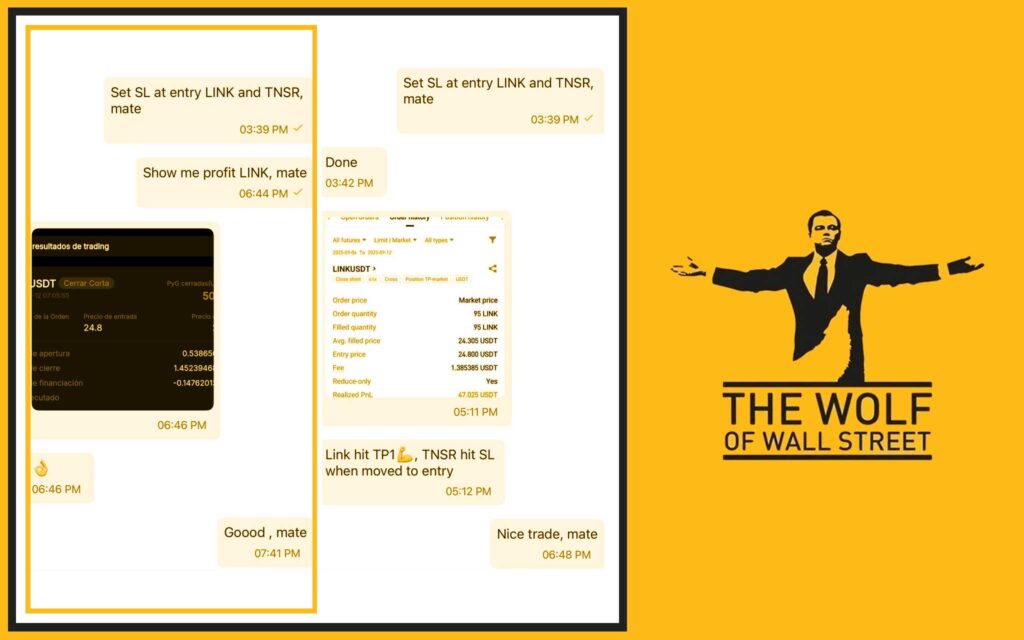

The market’s volatile. The game’s brutal. And the only way to thrive is with an edge. That’s where The Wolf Of Wall Street comes in:

- Exclusive VIP Signals: Designed to maximise trading profits.

- Expert Market Analysis: From seasoned crypto traders.

- Private Community: 100,000+ wolves sharing insights.

- Essential Tools: Volume calculators, precision resources.

- 24/7 Support: You’re never trading alone.

👉 Take your trading to the next level: The Wolf Of Wall Street Service and join the The Wolf Of Wall Street Telegram today.

🧠 FAQs – The Big Questions Answered

1. Why are Ether ETFs attracting more inflows than Bitcoin?

Because ETH offers growth, utility, and upside beyond “digital gold.” Institutions see more opportunity in ETH’s ecosystem.

2. Can ETF inflows alone push ETH to new highs?

Yes—reduced exchange supply plus inflows create powerful price pressure. But outflows can reverse momentum fast.

3. What risks should traders watch for in ETH ETFs?

Macro shocks, sudden redemptions, regulatory risks, and arbitrage traps.

4. How do institutions hedge their ETH ETF positions?

Options strategies, cross-hedging with BTC, and futures overlays.

5. Will regulatory shifts slow down the Ether ETF boom?

Possibly, but history shows regulation usually accelerates adoption after initial uncertainty.

🏁 Conclusion – The Wolf’s Verdict

Ether ETFs are no longer the underdog—they’re Wall Street’s hottest ticket. The inflows, the price surges, the institutional adoption—this is the big leagues now. If you want to win, you need to:

- Watch flows.

- Trade momentum.

- Hedge volatility.

- And most importantly—run with the right pack.

Because in this ETF-driven market, you’re either the wolf making money—or the sheep getting eaten alive.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”