Ethereum’s tenth anniversary isn’t just a celebration—it’s a seismic shift in the global financial order. Wall Street is no longer on the sidelines. The biggest players are buying in, the old rules are gone, and if you’re still sitting on your hands, you’re missing the mother of all opportunities. Let’s break it down—fast, hard, and with zero fluff.

🚀 Introduction: Ethereum’s 10-Year Bull Run – Ready for the Big Leagues

Ethereum’s tenth birthday in 2025 is more than a milestone—it’s a thunderous wake-up call for every corporate treasurer, institutional investor, and ambitious individual who thought crypto was a passing phase. We’re talking about a platform that’s evolved from hacker playground to the backbone of global finance, and the numbers don’t lie. Institutional adoption is exploding. Regulatory clarity has arrived. Technology upgrades are rewriting the rules. Ethereum isn’t just keeping pace—it’s pulling ahead.

Want in? This is your blueprint.

🌍 The Big Picture: Why 2025 Is the Year of Ethereum

The days of treating Ethereum as “the techy cousin of Bitcoin” are dead. In 2025, Ethereum is the engine of programmable finance, powering decentralised apps, tokenised assets, and institutional-grade transactions. While Bitcoin sits on its reputation, Ethereum is the platform Wall Street can’t ignore.

Just look at the money: institutional inflows have smashed through $6.2 billion. BlackRock’s ETHA alone manages over $9 billion—nearly a quarter of all ETH investment product assets. Major players aren’t dabbling. They’re betting big, and you better believe they’re not doing it for fun.

🏦 Institutional Money Talks: Who’s Actually Buying ETH?

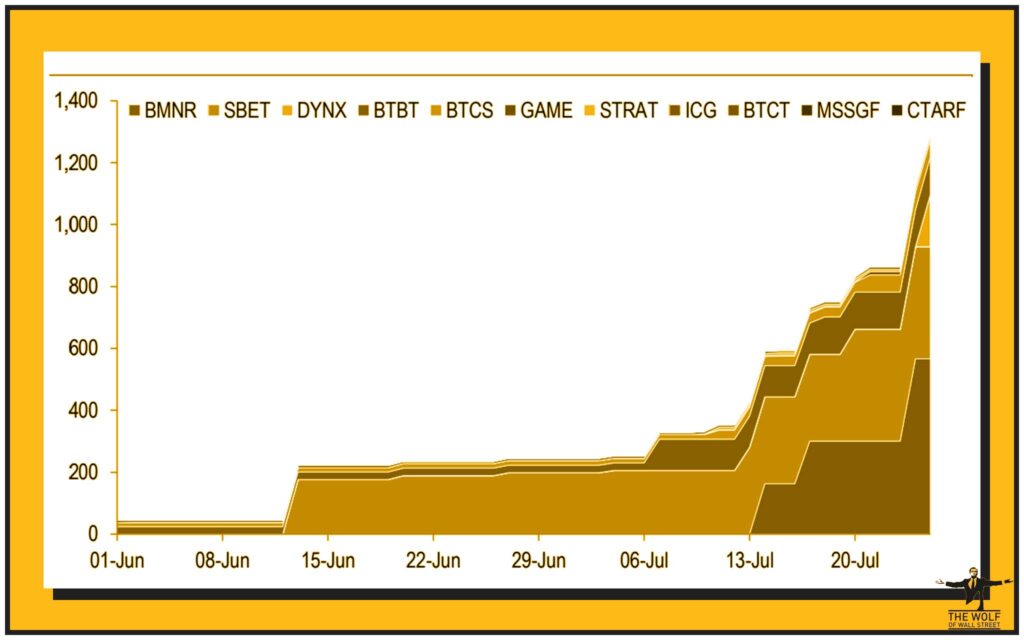

Let’s talk about the real whales in the room. Forget retail FOMO—this is the era of corporate accumulation. Who’s leading the charge?

- BitMine Immersion Technologies: Holding a whopping 625,000 ETH (that’s 0.52% of the total supply), BitMine is on a tear, even launching a $1 billion stock buyback and planning to accumulate up to 5% of all ETH in existence. Power move? Absolutely.

- SharpLink Gaming: 438,190 ETH locked in as their primary treasury asset. Their latest $290 million buy came in July at around $3,756/ETH. They’re not playing games.

- Bit Digital: 100,603 ETH in the vault. These guys pivoted their entire treasury strategy from Bitcoin to Ethereum after a $172 million equity raise. That’s not a small bet.

- BTCS Inc.: 70,028 ETH and counting, including a fresh $207 million raised just for this play.

- GameSquare Holdings Inc.: 12,913 ETH and a $250 million budget for digital asset management.

The bottom line? The biggest names aren’t just diversifying—they’re repositioning for a new financial era.

💼 Wall Street’s New Crypto Obsession

Here’s the cold truth: Ethereum has stormed the gates of Wall Street. ETF inflows have hit $6.2 billion in 2025. BlackRock’s ETHA now accounts for almost a quarter of all ETH investment product assets. Institutional money isn’t trickling in—it’s flooding the market.

Why? Because Wall Street finally sees Ethereum as the backbone of a programmable economy. It’s not just a speculative play. It’s the new infrastructure for digital money, smart contracts, and decentralised apps.

And if you’re wondering where the smart money is going next, check out the latest Ethereum news and cryptocurrency policy changes. The future is unfolding, and those paying attention are already reaping the rewards.

⚖️ The Regulatory Breakthrough: No More Guesswork

Regulation used to be the ball and chain for crypto. Not anymore. The GENIUS Act in the US and aggressive EU moves have created a regulatory framework that finally gives corporations the green light to go all-in.

This isn’t about vague promises. Stablecoins and tokenised assets are now fully legitimised on Ethereum. That’s unlocked a tidal wave of capital—because when the rules are clear, the money comes running.

Want to get started, but feel out of your depth? Grab the essentials in our crypto newbie guide. The window of uncertainty has slammed shut. It’s time to play by new rules—and win.

🛠️ Protocol Upgrades: Not Your Grandpa’s Ethereum

If you still think Ethereum is slow or expensive, you’ve missed the plot. The Pectra and Dencun hard forks have turned Ethereum into a speed demon—100,000 transactions per second, microscopic fees, seamless user experience.

Add in social recovery wallets (no more lost keys nightmares), protocol-level deflation (ETH supply is shrinking), and next-level staking opportunities, and you’ve got the most advanced crypto infrastructure on the planet.

Why does this matter? Because corporations and institutions demand scale, security, and simplicity. Ethereum delivers on every front.

🥊 ETH vs. Bitcoin: The New Treasury Asset Arms Race

Here’s where it gets spicy. For years, Bitcoin was the only game in town for corporate treasuries. Not anymore. The data is in: ether treasury acquisitions have outpaced those of Bitcoin-focused firms in recent months. Corporations are diversifying—and, in some cases, going all-in on ETH.

Why? Flexibility, yield from staking, the ability to tokenize assets and build applications directly on-chain.

Will Ethereum dethrone Bitcoin as the preferred corporate asset? The smart money is already moving.

Need the inside scoop? Our trading insights break down the trends—and how to position yourself ahead of the crowd.

📈 The Price Playbook: Targets, Catalysts, and Analyst Forecasts

Let’s talk numbers. ETH crossed $3,800 in July 2025, and analysts aren’t shy—some are calling for $5,000, even $13,000, by year’s end. What’s driving these forecasts? It’s not hype—it’s fundamentals:

- Explosive ETF and institutional adoption

- Ongoing protocol innovation and scalability

- Legal certainty boosting capital inflows

- Mainstream use cases multiplying by the week

Standard Chartered has set a $4,000 price target for year-end, with the upside open if the adoption wave continues. In other words, the catalysts are real—and the window to act is now.

🌐 Real-World Finance: DeFi, Tokenisation, and Bank Integrations

Ethereum is no longer just a playground for DeFi nerds. Banks and asset managers are rolling out payment rails, piloting tokenised treasuries, and deploying DeFi integrations. Cross-border settlements? Real-time, low-cost, unstoppable. It’s happening on Ethereum—today.

GameSquare Holdings and others are already managing digital treasuries on-chain. The integration between old and new finance isn’t coming. It’s here.

Want to see where innovation is exploding? Check the latest from our DeFi sector and layer-1 and layer-2 solutions.

🧰 Tools of the Titans: Winning in Crypto Like a Pro

You want an edge? You need the right tools. That’s where elite trading communities come in—like the The Wolf Of Wall Street crypto trading community.

Here’s what separates pros from the rest:

- Exclusive VIP Signals: Proprietary intel that puts you ahead of the herd.

- Expert Market Analysis: Get actionable insights from traders who’ve seen every bull and bear.

- Private Community: Over 100,000 members sharing real-time knowledge and strategies.

- Essential Tools: From volume calculators to risk management dashboards, you’re never trading blind.

- 24/7 Support: When the market moves, you get answers—fast.

Don’t waste another trade. See the difference yourself—visit The Wolf Of Wall Street services or join the live Telegram community. This is how winners stay ahead.

🛑 Challenges, Risks & The Roadblocks Ahead

Let’s get real: nothing is risk-free. Ethereum’s rise faces challenges—volatility, regulatory shifts, custodial complexities, and ever-present competition. But here’s the truth: risk is the price of entry, and the biggest winners are those who navigate it with discipline and the right support.

Trading communities like The Wolf Of Wall Street don’t just give you tips—they give you collective intelligence, keeping you ahead of risks that take down the uninformed. Don’t be a statistic. Be a wolf.

🤝 The Network Effect: How Community Fuels the Ethereum Boom

Ethereum isn’t just about technology—it’s about people. The strongest trends are social. Over 100,000 strong, the best trading communities multiply your brainpower and your profit potential.

When markets turn volatile, group insight can be the edge between panic and profit. In 2025, the lone wolf gets eaten. The pack leads the hunt.

For more on how community-driven intelligence shapes the crypto world, visit our cryptocurrencies ecosystem hub.

🔮 The Future: Is Ethereum Set to Become Wall Street’s Global Settlement Layer?

The writing’s on the wall: Experts and institutions now view Ethereum not as a speculative side bet, but as a core layer for the global financial system.

Programmable money, yield through staking, instant settlement, tokenisation—this is where the world is heading.

The only question is, are you going to ride the wave or get left behind?

🏁 Conclusion: Ready to Ride the Next Wave?

The verdict is in: Ethereum is the new playground for the world’s biggest players—corporations, institutions, and smart individuals who aren’t afraid to act. With explosive adoption, regulatory clarity, and unstoppable technology, this isn’t a fad. It’s the next evolution in finance.

So here’s the play:

Don’t just watch from the sidelines. Get involved, get educated, and use every edge you can.

Start with proven communities like The Wolf Of Wall Street, leverage their tools, and never stop learning. The future belongs to those who move first.

❓ FAQs

1. Why are corporations buying Ethereum now?

Because Ethereum delivers scalability, programmability, and yield—all with growing regulatory clarity and institutional backing.

2. Is Ethereum safer for treasury than Bitcoin?

Both have risks, but Ethereum’s utility, staking rewards, and regulatory acceptance make it highly attractive for progressive treasury strategies.

3. What new tech upgrades should investors watch?

Watch for scalability improvements (like Pectra and Dencun), wallet innovations, and evolving staking protocols.

4. How do trading communities like The Wolf Of Wall Street give you an edge?

Access to expert signals, market analysis, and group intelligence—plus 24/7 support—keeps you informed and ahead of sudden market moves.

5. What are the biggest risks for ETH holders in 2025?

Volatility, evolving regulations, custody challenges, and rapid market shifts. Smart community support and tools make all the difference.

Further Resources & Internal Links

- Get the latest DeFi sector updates

- Explore altcoins and Layer 1s

- Track trending insights

- Discover more hot crypto topics

About the The Wolf Of Wall Street Crypto Trading Community

The The Wolf Of Wall Street crypto trading community offers a complete platform for dominating the volatile crypto market. You’ll gain:

- Exclusive VIP Signals to maximise your profits

- Expert Market Analysis from seasoned traders

- Private Community of 100,000+ members

- Essential Trading Tools to keep you sharp

- 24/7 Support from a dedicated team

Ready to empower your trading journey?

- Check out The Wolf Of Wall Street services

- Join our Telegram community

- Unlock your full crypto profit potential with The Wolf Of Wall Street

There it is—the blueprint, the roadmap, the playbook for winning in Ethereum’s new era. Want in? Step up. The wolves are already running.