Perfect. Buckle up—you’re about to get a masterclass in crypto strategy, Ethereum’s next evolution, and why only amateurs sleep on network upgrades. This is not your typical dry explainer—this is The Wolf on the Ethereum beat, with actionable insights, real talk, and zero wasted words. Let’s roll.

🚀 Introduction: Ethereum’s Next Big Move

Here’s the deal: Ethereum just put the entire crypto market on notice. Vitalik Buterin—yes, that Vitalik—wants to slam down a hard cap on gas for every single transaction. You think that’s just tech nerd talk? Wrong. This is a seismic shift that shakes up security, stability, and your bottom line if you’re anywhere near smart contracts, DeFi, or crypto trading.

Miss this, and you risk getting left in the dust while real players capitalise. Want to win? Stay sharp. Stay tuned. Or get all the latest news and never miss a beat.

🔥 What Is Gas, and Why Does It Matter?

Let’s make this simple. Gas on Ethereum is like petrol for a Ferrari—except you’re driving a decentralised money machine. Every single thing you do—sending ETH, trading NFTs, launching a DeFi protocol—costs gas. Run out? Your ride stops dead.

But it’s more than just fees. Gas is a resource war. It’s who gets their transaction through now and who gets jammed in the slow lane. For traders, this is the difference between profit and pain. For developers, it’s about user experience and network health. In short: gas is what separates winners from whiners.

🧠 Vitalik Buterin’s Vision: Keep It Lean, Keep It Clean

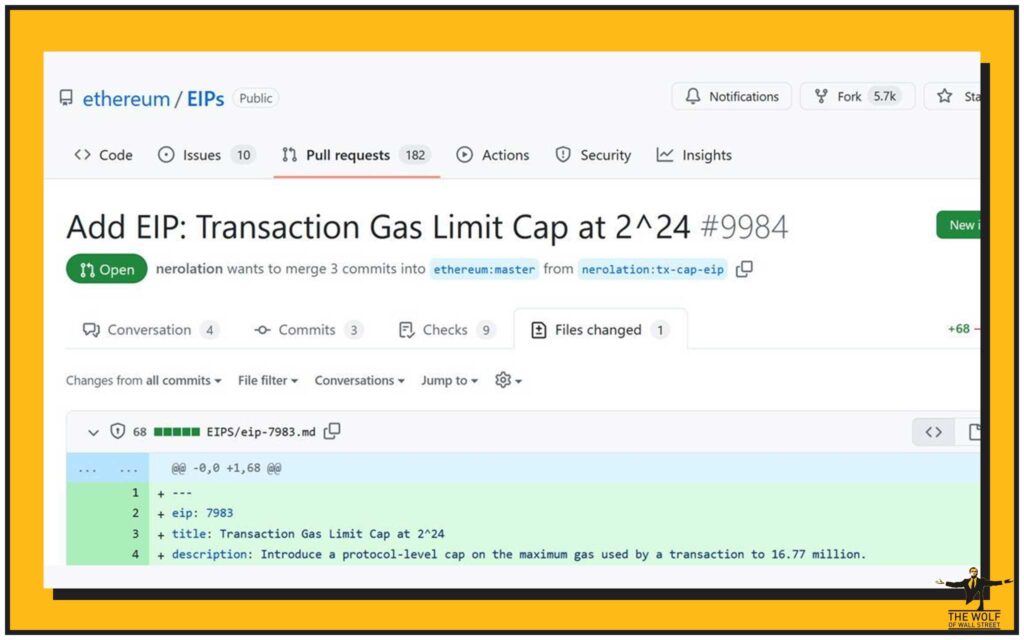

This isn’t just another upgrade. Vitalik Buterin, Ethereum’s architect, wants to simplify the system—like Bitcoin, but with more muscle. Alongside researcher Toni Wahrstätter, he’s pushing EIP-7983: a protocol-level gas cap. It’s the type of radical, strategic move that keeps Ethereum in the lead.

Why do this? Because complexity is the enemy of speed and security. The goal: cut out the fat, kill attack vectors, and pave the way for mass adoption. If you care about scaling, speed, or your next DeFi launch, you should be obsessed with this vision.

Want more insights into protocol upgrades and next-gen scalability? Check out Layer 1 and Layer 2 solutions.

💣 EIP-7983 Explained: The 16.77 Million Gas Cap

Let’s cut through the noise:

EIP-7983 sets a hard cap—16.77 million gas (2²⁴)—on every transaction. Period. If your transaction demands more, it gets rejected. No discussion.

Why 16.77 million? It’s high enough to handle all but the most massive, complex transactions. Think of it as a velvet rope at a club—keeps out the trouble, lets the party roll.

Old World vs. New World—Typical Transaction Sizes

| Transaction Type | Typical Gas Used | Safe Under EIP-7983? |

|---|---|---|

| ETH Transfer | 21,000 | Yes |

| Basic ERC-20 Swap | ~100,000 | Yes |

| Complex DeFi (Old) | 1–2 million | Yes |

| Mega Contract Deployments | 8–12 million | Yes |

| Overengineered Mammoth TXs | 20+ million | No—Must Split Up |

This isn’t about squeezing the little guy—it’s about putting guardrails on excess so the network stays fast, fair, and bulletproof.

Internal links? This is where you spot DeFi opportunities or keep up with ecosystem updates.

🎯 Why Now? The Security and Scalability Play

Ethereum’s been growing like a rocket, but that brings new risks. Ever heard of a Denial-of-Service (DoS) attack? That’s when a bad actor hogs resources, jamming up the network for everyone else. Think one customer buying every seat at a boxing match just to leave the stadium empty.

With EIP-7983, one transaction can’t hijack the whole block. Security goes up, costs become more predictable, and the blockchain runs like a Swiss watch. It’s not just about patching holes—it’s about building a fortress.

This isn’t just good for Ethereum—it sets a new bar for cryptocurrencies everywhere.

📉 Winners and Losers: Who’s Impacted?

Let’s talk winners and losers—Wolf style.

- Everyday users: If you’re moving tokens, swapping coins, or minting NFTs, you won’t even notice. Your flows are way under the cap.

- Power users and DeFi devs: Running fat, complex contracts? Now you’ve got to split them into bite-sized chunks. Adapt or get left behind.

- Traders: Faster blocks, fewer jams, more predictable fees. That means more clarity for your trading insights.

Pro tip: Smart developers already optimise contracts to fit under the limit—it’s just good business.

Sidebar: Quick Glossary

- Gas: The “fuel” for running transactions or contracts on Ethereum.

- zkVM: Zero-Knowledge Virtual Machine—makes smart contracts private, fast, and scalable.

- DoS Attack: An attack that tries to overwhelm a system, blocking legit users.

- Block Gas Limit: The total gas allowed in a single block, adjustable by validators.

🛠️ The zkVM Revolution and Next-Gen Tech

Zero-knowledge tech is the next gold rush. zkVMs promise private, scalable, and lightning-fast dApps—but they often require fat transactions. EIP-7983 forces even these cutting-edge contracts to break things up, boosting parallelism and speed.

This isn’t just a technical fix—it’s a green light for the next wave of altcoin innovation, privacy apps, and unstoppable DeFi.

🏆 The Wolf Of Wall Street Community Take: Navigating Volatility Like a Pro

Let’s be blunt: The pros play different. The The Wolf Of Wall Street crypto trading community is the secret weapon of over 100,000 traders who don’t just survive the chaos—they thrive on it.

Here’s how The Wolf Of Wall Street helps you profit from Ethereum’s changes:

- Exclusive VIP signals: Catch the moves before the crowd.

- Expert analysis: Know what matters—and what’s just noise.

- Essential tools: Volume calculators, portfolio insights—your edge over the amateurs.

- 24/7 support: Real people, real answers, any time.

When the network changes, the smart money moves first. Join the The Wolf Of Wall Street Telegram for real-time updates, or get more details at our service page. This is how you unlock your potential.

⚖️ Comparisons: How Does Ethereum Stack Up Against Other Blockchains?

Solana? Fast, but centralisation risk.

Binance Smart Chain? Cheap, but prone to spam and downtime.

Ethereum, with EIP-7983, is walking a razor’s edge: scaling and decentralisation. The gas cap model makes sure no one player—no matter how big—can dominate the network. That’s real resilience, and it’s why institutions and serious devs keep building here.

For more on comparative strategies, dive into trading insights.

🔄 The Proposal Pipeline: What Happens Next?

This isn’t set in stone—yet. EIP-7983 will get battle-tested on testnets, debated by the community, then—if it passes muster—activated on mainnet. Expect a few months of heated feedback and technical tuning.

Watch this space:

- Testnets first

- Developer feedback

- Mainnet rollout (late 2024/early 2025 if all goes to plan)

Stay ahead by watching category/news for updates.

🛑 Potential Drawbacks and Criticism

No move is perfect. Critics argue:

- Some mega-DeFi contracts might have to completely refactor code.

- Edge cases could get messy if transactions are just above the cap.

- Extra transaction splitting could introduce new costs for devs.

Community pulse: Devs are mostly supportive—security matters. But they want more guidance on splitting transactions and tooling.

Solutions?

- Toolkits and libraries for chunking transactions

- Dev education from category/newbie resources

- More analytics and simulation tools, possibly through the The Wolf Of Wall Street platform

💻 Real-World Scenarios: Before & After the Gas Cap

Before:

A DeFi app launches a monster liquidity pool in one shot—uses 18 million gas, pushes block limits, risks slowing the network.

After:

Same app splits the deployment across two transactions—each under 10 million gas. Both run faster, network never hiccups, costs are more predictable.

NFT minting? Swaps? 99% of these are already well under the cap. Only power users and big contract deployers need to rethink workflows.

🗣️ User Stories and Quotes: Voices from the Ecosystem

“Honestly, my DEX hasn’t noticed a thing—everything runs smoother, less lag.”

— Sasha, DeFi Developer“Trading feels fairer. No more whales hogging the blocks.”

— Jun, Retail Trader“As a newbie, I just want the network to work. Anything that stops attacks? I’m in.”

— Priya, First-time ETH User

Get more newbie guidance or share your own experience in the The Wolf Of Wall Street community.

🔮 Future Outlook: Where Does Ethereum Go From Here?

This gas cap isn’t the finish line—it’s just the next milestone. Ethereum is on a multi-year push toward leaner, faster, and more user-friendly protocols. Expect:

- More EIPs focused on simplicity and security

- Mass adoption of zkVMs and rollups

- DeFi and NFT ecosystems getting even broader

If you want to stay on top (and not get run over by protocol upgrades), get in the loop with ecosystem news and The Wolf Of Wall Street market analysis.

❓ FAQs: The Burning Questions

Q: Will this make my ETH transactions cheaper?

A: Not directly, but it keeps fees predictable and network healthy.

Q: Do I need to change anything if I just use ETH or swap tokens?

A: No. Most basic actions are already under the cap.

Q: Who’s at risk?

A: Power users deploying huge contracts. But splitting is easy—and now safer.

Q: Where can I get expert support and the latest strategies?

A: The Wolf Of Wall Street crypto trading community and trading insights.

🛡️ Conclusion: Don’t Get Left Behind—Move Fast, Stay Smart

Here’s the bottom line. Ethereum’s gas cap proposal is a game-changer—if you’re a trader, dev, or even a newbie, you need to act. Network upgrades separate the winners from the wishful thinkers.

Adapt, optimise, and—above all—leverage the best tools and communities out there.

Join The Wolf Of Wall Street for signals, analysis, and real-time updates, and turn volatility into profit.

Ready to play with the big dogs? Start here. Because when Ethereum evolves, the smart money evolves faster.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service page for detailed information.

- Join our active Telegram community for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.