🏁 Introduction: The Ethereum “100-Bagger” Bet — Is It Hype or the Opportunity of a Lifetime?

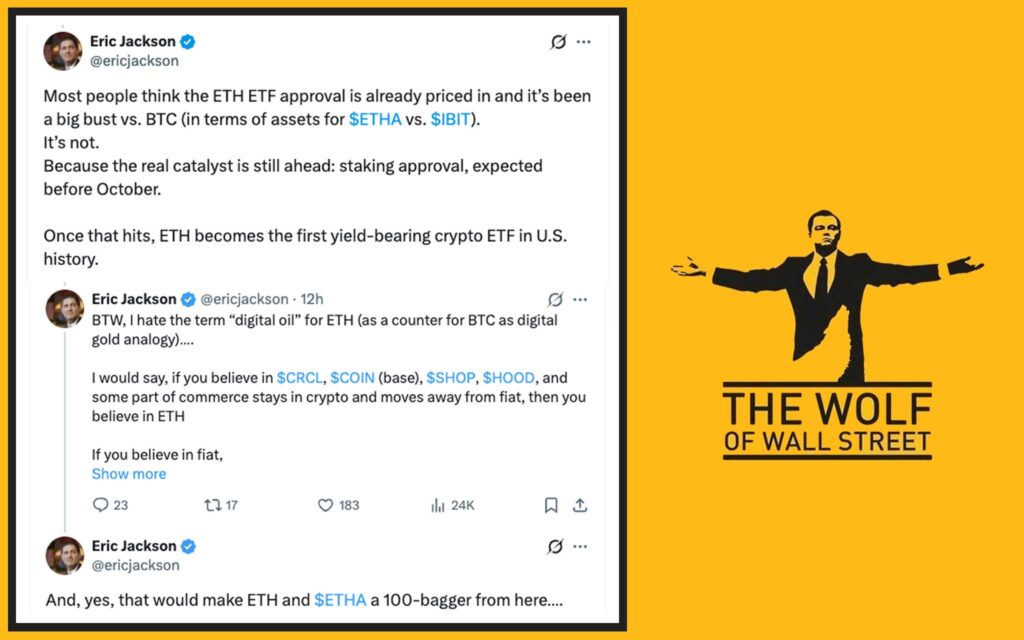

Let’s cut through the noise: you’re here for results, not fairy tales. Eric Jackson, founder of EMJ Capital, just put his reputation on the line with a headline that’s turning every head in the crypto space: Ethereum at $1.5 million per token. You read that right—this isn’t a typo, this isn’t a fantasy. Jackson’s “100-bagger” call isn’t just big, it’s the kind of boldness that splits the market into believers and doubters.

The question isn’t “Is it possible?”—it’s “Are you ready to profit if it is?”

Welcome to the playbook for catching a once-in-a-generation wave. Let’s break down how and why this insane ETH price target could become your ticket to real wealth.

🚀 The Genesis of a $1.5 Million Ethereum Prediction

Here’s the reality: most crypto price forecasts are conservative, even timid. Analysts stick their necks out with calls for $4K, maybe $10K by 2030, then hide behind “market uncertainty.” Jackson? He torches the playbook. His thesis: the world’s not just underestimating Ethereum—it’s fundamentally mispricing it, and the fuse is already lit.

So, where does this “100-bagger” talk come from? Simple. Jackson is betting big on two things the crowd is missing:

- The coming wave of staking-enabled ETH ETFs

- The tsunami of institutional and commercial adoption about to hit the market

He’s not just talking about price. He’s talking about a structural shift in the entire financial system. When that happens, the numbers get silly—and the upside gets real.

🏦 ETF Approval: The Institutional Floodgates Are Opening

Let’s get this straight: ETFs (Exchange-Traded Funds) are the bridge between Wall Street and crypto. When the SEC greenlights a spot ETF for Ethereum—especially one that allows staking—it’s not just another product. It’s the starting gun for the “big money” to pour in.

Right now, Ether ETF volumes are peanuts compared to Bitcoin ETFs. The only thing holding back institutional money? Staking approval. Once that drops, ETH stops being just an asset—it becomes an institutional-grade yield machine. Suddenly, you’re not just betting on price appreciation; you’re earning while you hold. For funds, that’s catnip.

Jackson’s call: the approval of staking-enabled ETH ETFs is the single most powerful catalyst on the horizon. And the market? Still asleep at the wheel. You can’t afford to be.

💹 Ethereum’s Network: Underpriced, Underestimated, Unstoppable

Let’s talk fundamentals. Ethereum isn’t a meme coin, a short-term play, or a tech demo. It’s the backbone of decentralised finance and the infrastructure for a new era of commerce.

Deflationary tokenomics—this is your secret weapon. As more ETH gets locked up for staking and gas fees, the circulating supply shrinks. Basic economics: less supply, same or more demand = price explosion.

But here’s where Jackson leaves the crowd behind: he sees Ethereum as not just a crypto, but the world’s new “operating system for value.” And right now, ETH is dramatically underpriced for what it enables. Look at the numbers:

- Bitcoin ETFs: $6.9 billion in volume

- Ether ETFs: $1.41 billion and lagging

That’s not a weakness. It’s an opportunity, because the catalyst (staking) hasn’t even hit yet. The upside is all ahead of us.

📈 Scenario Planning: Base Case, Bull Case, Moon Case

Don’t want pipe dreams? Good. Here’s how Jackson breaks it down:

- Base Case: $10,000 ETH by the end of this market cycle (March 2026). Yes, that alone would make ETH holders rich.

- Bull Case: $15,000 if Layer 2s and institutional inflows accelerate.

- 100-Bagger Case: The full “$1.5 million per ETH” scenario. What gets us there?

- Ethereum becomes the default infrastructure for global commerce.

- Major companies (think: Circle, Coinbase, Shopify, Robinhood) fully onboard.

- Fiat money steadily flows into crypto as commerce shifts digital.

- Staking becomes the norm, turning ETH into the yield product of choice for funds worldwide.

Sound wild? Of course it does. That’s why most miss the train—they can’t imagine the world changing until it already has.

🔑 The Real Drivers: Institutional and Commercial Adoption

Ethereum is no longer just for coders and degens. Major companies are building on it.

- Circle—USD Coin runs on Ethereum.

- Coinbase—huge ETH reserves, building its own Layer 2 (Base).

- Shopify—experimenting with ETH payments.

- Robinhood—rolling out ETH to retail traders.

This is infrastructure-level adoption. The rails of tomorrow’s financial system are being laid today. The more value that flows through Ethereum, the higher the price must go.

And remember, ETH isn’t just a store of value. It’s a productive asset—stake it, earn yield. That’s what will pull in the pension funds, the endowments, the insurance giants. These aren’t traders, they’re whales. And when they move, they move markets.

🛡️ Risks & Skepticism: Why Most Analysts Say “No Way”

Let’s address the elephant in the room—not everyone’s a believer. The consensus view?

- 2025 targets: $2,000–$6,000

- 2030 long-term: $9,000–$11,000

Why so conservative?

- Regulatory risk—Governments could move the goalposts overnight.

- Tech risk—Ethereum has to scale and upgrade without bugs or delays.

- Market risk—A global recession, a new “crypto winter,” black swan events.

But here’s what separates winners from spectators: calculated risk. Jackson isn’t blind to the downsides, but he’s betting that the upside is so huge it dwarfs the risk. If you’re waiting for certainty, you’ll never buy anything that matters.

🏆 Community & Tools: How to Ride the Ethereum Wave Like a Pro

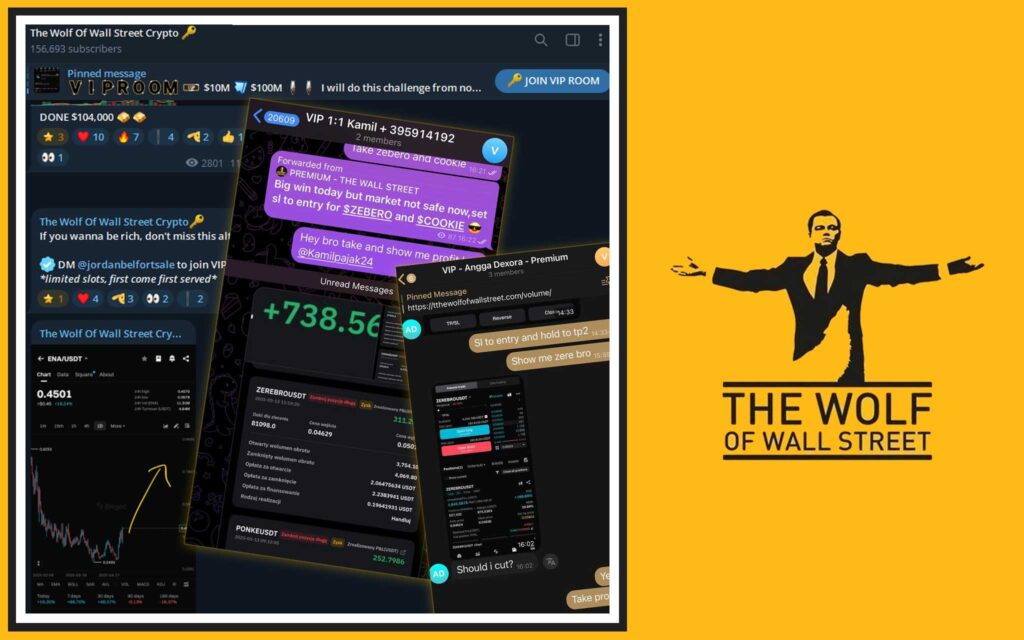

Nobody goes it alone in the crypto jungle. Volatility is opportunity, if you know how to use it. That’s where communities like the The Wolf Of Wall Street crypto trading community are pure gold:

- Exclusive VIP Signals: Proprietary calls you won’t get on public Twitter threads

- Expert Market Analysis: From traders who’ve been through bull and bear cycles, not armchair “influencers”

- 100,000+ Member Network: Power is in numbers—shared insights, collective wisdom, and real-time reactions

- Essential Trading Tools: Volume calculators, on-chain analytics, real-time price alerts—everything you need to move like a pro

- 24/7 Support: Because the market never sleeps, and neither should your information flow

Want to go deeper? Explore our service or join our Telegram community for real-time updates, signals, and the kind of edge that wins in crypto.

🧠 Layer 2, DeFi, and Beyond: What the Market Isn’t Pricing In

Here’s where even most bulls don’t grasp the full picture. Ethereum isn’t just a blockchain—it’s the foundation for Layer 2s (like Arbitrum, Optimism, Base) that multiply throughput and lower costs. Every transaction, every new DeFi protocol, every NFT launch that settles on Ethereum… that’s more value flowing into the ecosystem.

But the market is barely pricing in:

- Layer 2 scaling—the real driver of mainstream adoption

- DeFi’s growth—every DEX, lending protocol, and stablecoin adds to ETH’s use case

- Ecosystem expansion—from gaming to social to identity, ETH is the backbone

Most “price models” ignore these wildcards. But that’s where true 100-bagger upside hides.

Want to learn more about Layer-1 and Layer-2 solutions or the future of DeFi? Get informed, get positioned.

🔥 How to Position Yourself: Smart Moves for Retail and Institutional Investors

Listen—Ethereum’s rise isn’t just for techies or whales. Anyone can ride this wave with the right approach:

- Educate yourself: Use newbie resources to build your foundation.

- Stay informed: Follow trading insights and market updates daily.

- Diversify: Yes, ETH is king, but the whole ecosystem is where the next breakout will come from.

- Use the right tools and communities: Don’t trade blind. Leverage expert analysis, VIP signals, and never ignore risk management.

The difference between winning and whining is preparation. The market rewards those who act before the news breaks.

🗣️ FAQs: Your Burning Ethereum Questions Answered

Can Ethereum really hit $1.5 million per token?

It’s a wild prediction—but history’s biggest trades always sound impossible before they happen. Jackson’s logic: if ETH becomes global commerce infrastructure, it’s not about speculation—it’s about usage and value.

How do ETH staking ETFs work?

They let institutional money earn passive yield—without running their own staking setups. It’s a game-changer for big money, bringing in demand and locking up more supply.

What are the main risks to this thesis?

Regulatory clampdowns, technical hiccups, market crashes, and “unknown unknowns.” But with great risk comes great reward.

How can communities like The Wolf Of Wall Street help me profit?

By giving you an edge: exclusive signals, timely analysis, and a network of traders who’ve seen it all. It’s the difference between riding the trend and missing the move.

Is now the right time to buy ETH?

No guarantees—but opportunity rarely knocks politely. Study, prepare, and act when conviction is high. Use The Wolf Of Wall Street insights to stack the odds in your favour.

🏁 Conclusion: The Verdict on Ethereum’s “100-Bagger” Potential

Let’s call it straight: Most people will read about $1.5 million ETH, laugh, and walk away broke. Winners see the upside, weigh the risk, and get in early—or get left behind. Jackson’s “100-bagger” isn’t just hype; it’s a blueprint for where value and technology are converging.

But here’s the secret: only those willing to learn, adapt, and act will grab this opportunity. The rest? They’ll read about it in history books.

Ready to make your move? Join The Wolf Of Wall Street, tap into exclusive trading signals, and never trade blind again. The next big run won’t wait for your doubts.

📚 References & Further Reading

- Latest crypto news

- Cryptocurrency updates

- Altcoin deep-dives

- Layer-1 and Layer-2 solutions

- Trading Insights

- DeFi Strategies

For a deeper understanding of Ethereum ETFs, visit the official SEC site or CoinGlass ETF tracker. And always keep your finger on the pulse of trending crypto topics and hot sectors.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain: Exclusive VIP Signals (designed to maximise trading profits), Expert Market Analysis (from seasoned traders), Private Community (over 100,000+ members for shared insights), Essential Trading Tools (volume calculators and more), and 24/7 Support. Empower your crypto trading journey: Visit our service for details or join our active Telegram community for real-time updates and discussions. Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.