💥 The Calm Before the Crypto Storm

Let’s get one thing straight — when 95% of all corporate ETH buys happen in one quarter, you’re not looking at a coincidence… you’re looking at a signal.

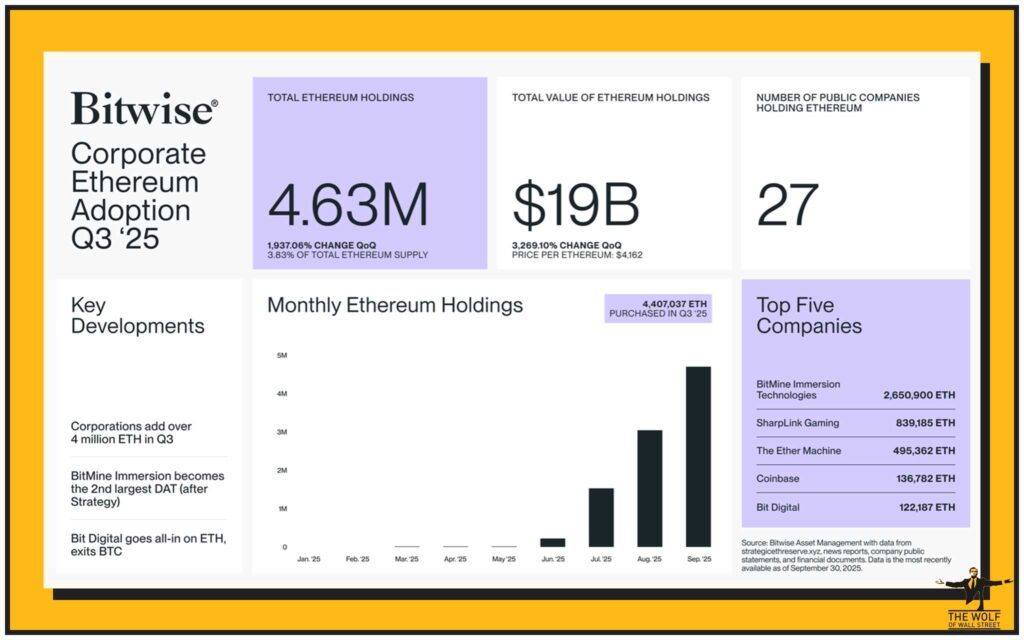

According to Bitwise, public companies now hold 4.63 million ETH — roughly $19 billion worth of Ethereum — and the majority of that was scooped up in Q3 2025. That’s not retail traders throwing darts at the board. That’s institutional conviction.

While the masses sleep on sideways charts, the wolves are circling the opportunity. The next supercycle? It’s not about hype. It’s about smart money positioning — and it’s starting with Ethereum.

🚀 95% of Corporate ETH Buys Happened in Q3 — Here’s Why That Matters

BitMine Immersion, Sharplink Gaming, and The Ether Machine — these aren’t random names; they’re the new corporate whales of crypto. Together, they’ve piled billions into ETH, front-running what analysts are calling a structural shift in digital asset strategy.

Why? Because Ethereum isn’t just a coin — it’s infrastructure. It powers DeFi, NFTs, smart contracts, and now, institutional-grade staking strategies. These corporations aren’t gambling — they’re building exposure to the rails of digital finance.

This kind of buying doesn’t come from speculation. It comes from allocation. The kind that moves markets.

For traders hungry to identify these high-level market pivots, check out advanced tools and insights in the trending market section or learn how to research crypto opportunities like a pro.

💡 The Institutional Playbook — From Bitcoin to Ethereum

We’ve seen this movie before. Bitcoin was the first act — the hedge against inflation. But now, ETH is the sequel — yield-generating, utility-driven, programmable money.

Institutions are pivoting because ETH offers something BTC can’t: passive income through staking and a backbone for Web3 innovation. With over 40% of ETH supply locked or staked, liquidity is tightening, creating the perfect setup for upward pressure.

Want to see how Layer 1 and Layer 2 ecosystems are scaling this demand? Dive into our Layer 1 & Layer 2 guide.

🔥 What’s Fueling the “Supercycle” Narrative?

Analysts like Arthur Hayes and Tom Lee are calling for ETH to hit $10,000–$12,000 before the year ends. That’s not hopium — that’s math meeting momentum.

Between ETF inflows, scarcity from staking, and institutional accumulation, Ethereum’s supply-demand curve is bending in one direction. Add in the Fusaka upgrade rolling out this November, and we’ve got another catalyst tightening the spring.

This isn’t about hype cycles anymore. It’s about leverage meeting perfect timing. You don’t wait for the storm to pass — you sail into it with a plan.

Curious about alt season plays and protocol upgrades? Check our deep dive into altcoin season signals and strategies and the Ethereum Fusaka upgrade.

⚠️ The Other Side of the Trade — Risks & Reality Checks

Even wolves hedge their bets. While Q3 was bullish, Q4 historically hasn’t been ETH’s strongest — CoinGlass data ranks it the second-worst performing quarter. Add macro pressure, regulatory fog, and the volatility we all love to hate, and you’ve got a cocktail that can shake even confident traders.

The message? Play bold but play smart. Diversify exposure, manage entries, and don’t let FOMO drive your strategy.

Institutional players hedge with funds; you hedge with insight. Learn how hedge funds adjust during volatility in our crypto hedge funds market shift analysis and stay compliant with our crypto AML and security guide.

💎 From Insight to Action — How Traders Can Ride the Next Wave

Now, here’s where the rubber meets the road. You’ve seen the institutional accumulation. You’ve seen the supply squeeze. So what’s next? Execution.

And that’s where the The Wolf Of Wall Street crypto trading community comes in — your backstage pass to the same kind of data-driven precision institutions use.

Inside The Wolf Of Wall Street, you’ll get:

- Exclusive VIP signals that deliver actionable entries and exits.

- Expert analysis from seasoned crypto traders who’ve lived through every cycle.

- A private community of over 100,000 sharp traders sharing intel daily.

- Essential trading tools like volume calculators and risk metrics to keep you razor-sharp.

- 24/7 support, because opportunities don’t wait for office hours.

You’re either watching the market move or you’re part of the movement. Visit The Wolf Of Wall Street Service to level up your strategy, and join the The Wolf Of Wall Street Telegram to plug into real-time market updates.

🏁 The Wolf’s Final Word — Don’t Watch the Wave, Ride It

The Ethereum supercycle isn’t just a buzzword — it’s a manifestation of institutional intent, technological scarcity, and conviction-based capital.

While others argue over headlines, the pros are accumulating, staking, and leveraging their edge. Don’t get left holding hindsight.

As Jordan Belfort would say: “Act as if.”

Act as if the next wave is already forming — because it is. And when it breaks, those prepared will be the ones surfing, not sinking.

Fortune doesn’t wait for the cautious — it rewards the calculated.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market:

- Exclusive VIP Signals to maximise trading profits

- Expert Market Analysis from seasoned crypto traders

- Private Community of 100K+ members

- Essential Tools like volume calculators

- 24/7 Support for consistent guidance

👉 Visit The Wolf Of Wall Street Service

👉 Join the The Wolf Of Wall Street Telegram Community