🔥 Introduction: Ethereum’s Wolf of Wall Street Moment

Ethereum isn’t just another blockchain anymore — it’s the Wall Street token. Forget the noise, forget the hype cycles. We’re talking about banks, institutions, and corporate treasuries pouring billions into ETH like it’s the financial backbone of tomorrow. And guess what? They’re not wrong. With regulatory clarity, ETFs attracting billions, and stablecoin rails running on Ethereum, this isn’t a game — it’s a revolution. The question is: are you strapped in, or are you about to get left behind?

🚀 Executive Insights: VanEck’s Bold Call

Jan van Eck, CEO of VanEck, put it bluntly: Ethereum is the Wall Street token. Period. Not Bitcoin, not Solana, not some shiny new chain. Ethereum has become the trusted, regulated playground for the biggest sharks in finance. Why? Because Wall Street doesn’t care about memes — they care about rails that actually move trillions securely. ETH is that rail.

Bitcoin is digital gold. Ethereum? It’s the global financial operating system.

📜 Regulatory Game-Changer: The Genius Act

Here’s the spark that lit the fire: The Genius Act. The first US federal law laser-focused on stablecoins. This single piece of legislation cracked the dam wide open. Banks, once paralysed by uncertainty, now have the green light. Stablecoins are officially in the game, and guess who’s powering 90% of them? Ethereum.

Legal clarity equals Wall Street adoption. Simple equation.

🏦 Stablecoins: The Trojan Horse of Banking

Don’t get it twisted — stablecoins aren’t just “crypto toys.” They’re the Trojan horse. Banks don’t adopt “crypto.” Banks adopt dollars on-chain. And right now, that’s $280B in supply, growing faster than ever.

Here’s the kicker: Fireblocks data shows 90% of institutional players are actively testing stablecoins. That’s not retail degens aping in; that’s the largest financial firms in the world setting up to settle billions daily on Ethereum.

💰 Wall Street Money Floods In

Ethereum ETFs? Exploding. VanEck’s ETH ETF alone pulled in over $284M in assets. Multiply that across BlackRock, Fidelity, and the rest, and you’ve got billions locked into ETH exposure. That’s Wall Street officially betting on Ethereum’s future.

And it doesn’t stop there. Corporations — real businesses with payrolls and balance sheets — are buying ETH for treasuries. This isn’t a speculation play; it’s a balance-sheet strategy. You don’t park billions on something unless you believe it’s safe, scalable, and here for the long haul.

👉 Want sharper strategies? Dive into Trading Insights and stay ahead of these institutional moves.

Also check the latest News shaping the markets.

📈 Market Madness: ETH’s New All-Time High

August 2025. Ether breaks $4,946 and sets a new all-time high. This wasn’t retail mania like 2021. This was Wall Street, corporates, and banks quietly stacking. The smart money moves first. Retail FOMO comes later.

This ATH is different — because now it’s not just “number go up.” It’s adoption, legal frameworks, and billion-dollar firms pushing the market higher.

🏗️ Ethereum as Financial Infrastructure

Ethereum isn’t an asset. It’s the infrastructure. Payment rails? Ethereum. Tokenized assets? Ethereum. Stablecoin settlements for billion-dollar banks? Ethereum. When the backbone of global finance quietly runs on one network, you know who’s in control.

We’re seeing banks leverage Ethereum for:

- Treasury settlements

- Tokenized bonds

- Cross-border payments

- Programmable contracts for compliance

This isn’t hype. It’s a financial system upgrade in real time.

⚡ Layer 2 Solutions: Scaling for Wall Street Speed

Institutions don’t play with congested chains and $50 gas fees. Enter Layer 2. zkSync, Optimism, Arbitrum — compliance-friendly scaling solutions that keep Ethereum fast, secure, and regulator-approved.

Banks are testing on zk-rollups, asset managers are building on Optimism. This is institutional DeFi — and it’s all tethered back to Ethereum’s base layer.

Learn more about the ecosystem’s evolution in Layer 1 and Layer 2 Solutions.

🔥 Competitive Landscape: Who’s Chasing Ethereum?

Sure, Stellar is trying to corner payments. Avalanche pushes speed. Solana runs at high throughput. But none have the trifecta: regulatory clarity, institutional trust, and proven uptime. That’s Ethereum’s moat.

The others will survive in niches. But Ethereum? It’s the main stage. The rest are side shows.

🏢 Corporate Treasuries Are Going All In

This is the signal most people miss. Corporations like BitMine and SharpLink are stockpiling ETH for their treasuries. We’re talking billions. Why? Because ETH is “digital oil.” It fuels the infrastructure these very companies depend on.

When corporate CFOs are buying ETH, you know it’s not just hype — it’s risk management. Ethereum has moved from speculation to necessity.

Get deeper insights into emerging assets in Altcoins.

📊 Institutional Analysis: Why ETH Wins Long-Term

Wall Street doesn’t gamble. They hedge, they calculate, they move where the rules are clear. Ethereum has three things that institutions love:

- Reliability (99.9% uptime)

- Security (battle-tested for a decade)

- Regulatory alignment (now blessed by US law)

It’s not perfect. But it’s the best option on the table. And in finance, “good enough” isn’t enough — it has to be bulletproof. Ethereum fits that bill.

🌍 Industry Impact: Banking Reinvented on Ethereum

Stablecoins are just the beginning. Tokenized treasuries, automated compliance, programmable finance — this is the new Wall Street stack. Imagine instant settlement of $10B trades without counterparty risk. That’s not sci-fi. That’s Ethereum in action.

Fintechs are scrambling to integrate. Banks that hesitate risk disruption by crypto-native competitors. This is the Amazon moment of finance. Adapt or die.

🎯 Strategic Outlook: ETH’s Next Decade

By 2030, Ethereum won’t just be “the Wall Street token.” It will be the global financial internet. Tokenized real estate, AI-powered trading strategies, on-chain derivatives — all running on ETH rails.

Could another chain rise? Sure. But institutions have already picked their winner. And the winner doesn’t switch horses mid-race.

📚 FAQs

1. Why is Ethereum called the “Wall Street token”?

Because it’s the blockchain banks and institutions actually trust for stablecoins, ETFs, and settlement.

2. What’s the Genius Act and why does it matter?

It’s the first US law giving stablecoins federal clarity — unlocking institutional adoption.

3. Which banks are already using Ethereum for stablecoins?

While names are under wraps, multiple US and global banks are piloting ETH-based payment rails.

4. How high can ETH realistically go with Wall Street adoption?

Analysts argue ETH could mirror treasury market sizes — multi-trillion valuation is on the table.

5. Is Ethereum safer than other blockchains for institutions?

Yes. Proven uptime, stronger security, and regulatory recognition make ETH the safest bet.

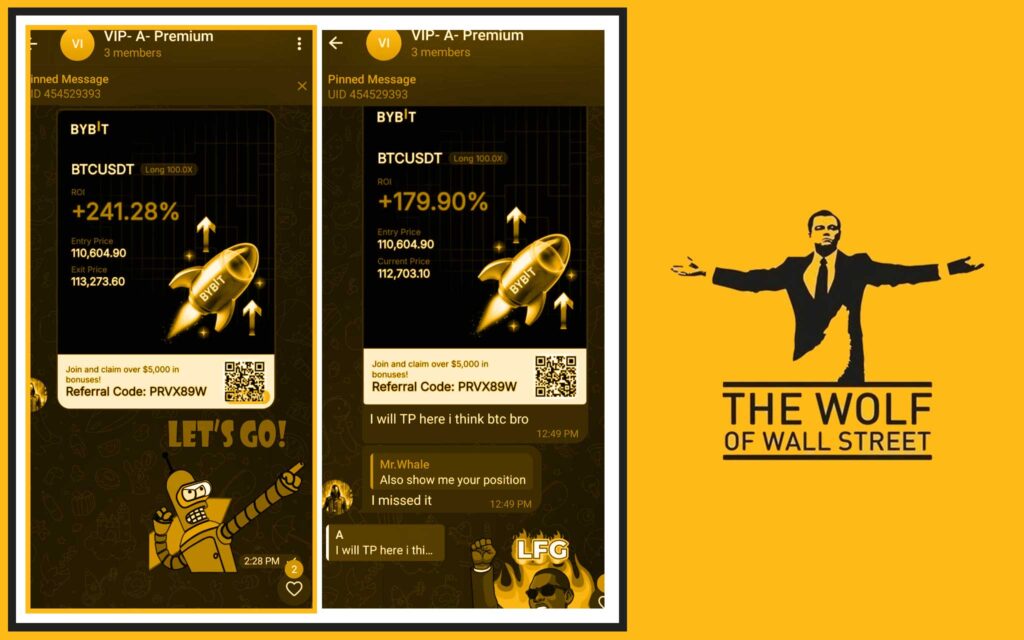

🔥 The The Wolf Of Wall Street Advantage for Traders

Now here’s the kicker: institutions move markets, but you can ride the wave too. That’s where The Wolf Of Wall Street comes in.

The The Wolf Of Wall Street crypto trading community gives you:

- Exclusive VIP Signals – proprietary insights to capitalise on ETH moves.

- Expert Market Analysis – from seasoned traders who decode institutional behaviour.

- Private Community – 100,000+ traders sharing alpha and strategies.

- Essential Tools – calculators, trackers, everything you need to trade smart.

- 24/7 Support – never trade blind again.

👉 Join the movement: Explore The Wolf Of Wall Street Services

👉 Stay connected: Join The Wolf Of Wall Street Telegram

Don’t just watch Wall Street — trade alongside it.

🏆 Conclusion: Ethereum – The Wolf of Wall Street Token

Ethereum has crossed the line from “crypto experiment” to Wall Street infrastructure. With the Genius Act in play, stablecoins dominating, ETFs pumping billions, and corporations stacking ETH, the verdict is clear: Ethereum isn’t just surviving. It’s winning.

Wall Street has chosen its blockchain. The only question is: are you playing the same game — or are you just watching from the sidelines?