The world of IPOs just got a whole lot more exciting. eToro, the social trading giant, stormed onto the Nasdaq with a bang, upsizing its IPO to a staggering $620 million, selling over 11.92 million shares at $52 each. This move pushed its market cap to a jaw-dropping $5.5 billion, with shares soaring to a high of $74.26 before settling at $67.

This IPO isn’t just another debut – it’s a comeback story. After the 2021 SPAC deal collapse, eToro has clawed its way back to the top, leveraging the booming crypto market and a rapidly expanding user base. But what does this mean for the broader fintech landscape? And how does it stack up against the competition? Let’s dive in.

🔗 Crypto Market Analysis | Trending News

🚀 The IPO Playbook: How eToro Pulled Off a $620M Power Move

In the world of trading, timing is everything – and eToro nailed it. After a volatile period marked by Trump’s tariffs and global economic instability, eToro’s decision to go public in 2025 was a calculated move.

Why the Upsize?

- Initial IPO plans aimed for $500 million, but overwhelming investor demand pushed it to $620 million.

- The IPO saw 11.92 million shares hitting the market, priced at $52 each, up from the expected $47–$50 range.

- Heavyweights like BlackRock committed to purchasing up to $100 million worth of shares, a massive vote of confidence in eToro’s future.

With its IPO proceeds, eToro is set to fuel expansion, deepen its crypto offerings, and continue its aggressive push into the US market.

🔗 Trading Insights | Newbie Guide to IPOs

💼 The Wolf of Wall Street’s Perspective: Why eToro’s IPO is a Game Changer

Let’s be real – eToro isn’t just another fintech. It’s a powerhouse in the crypto trading space, and its IPO debut is a clear signal that the market is hungry for more crypto exposure.

Why eToro Stands Out:

- Crypto Dominance: With crypto revenue surging from $3.4 billion in 2023 to $12.1 billion in 2024, eToro is riding the digital asset wave like a pro.

- Robinhood Rivalry: While Robinhood’s shares declined by 1.9% during eToro’s debut, eToro’s stock shot up by almost 30% – a powerful indicator of where investor sentiment is heading.

- Global Reach: eToro’s massive international user base gives it a strategic advantage in tapping into emerging markets, especially in crypto-hot regions like Asia and the Middle East.

🔗 Bitcoin Trading Strategies | Altcoin Analysis

📉 The IPO Landscape: Winners, Losers, and Missed Opportunities

eToro’s IPO wasn’t just about cashing in – it was a bold power play in a market full of contenders and pretenders.

Winners:

- eToro: With a $620 million war chest and a market cap of $5.5 billion, eToro has cemented itself as a major player in the crypto-fintech space.

- BlackRock: Grabbing a $100 million stake, the investment giant is banking on eToro’s continued crypto dominance.

Losers:

- Robinhood: eToro’s IPO debut underscored Robinhood’s ongoing struggles, as its shares slipped 1.9% to $61.39.

- SPAC Investors: eToro’s abandoned 2021 SPAC deal, initially valued at $10 billion, ended up a distant memory as the IPO came in at nearly half that valuation.

💡 Inside eToro’s Financials: What the Numbers Say About Future Growth

Now, let’s get down to the nitty-gritty – the financials. eToro’s revenue model is a tale of two worlds: crypto trading and traditional assets. But crypto is the real cash cow here.

Key Metrics:

- 2024 Crypto Revenue: $12.1 billion (up from $3.4 billion in 2023)

- 2024 Traditional Asset Revenue: $4.8 billion

- Total 2024 Revenue: $16.9 billion

- Net Income: $1.2 billion

What does this tell us?

- eToro is doubling down on crypto, and it’s paying off big.

- The company is positioning itself as a go-to platform for crypto trading, putting heavyweights like Robinhood and Kraken on notice.

🧐 Risk Analysis: Can eToro Maintain Its Momentum Post-IPO?

Okay, so the IPO was a smash hit – but what’s next? Can eToro sustain its momentum, or is this a classic pump-and-dump scenario?

Risks on the Horizon:

- Regulatory Scrutiny: The SEC is watching every move in the crypto space, and eToro’s explosive growth makes it a prime target.

- Crypto Volatility: Crypto trading is a double-edged sword. A market downturn could slam eToro’s revenue growth.

- Increased Competition: With Kraken, Circle, and even Binance eyeing IPOs in 2025, eToro will have to fight to stay at the top.

🌐 Market Impact: What eToro’s IPO Means for Crypto and Fintech

eToro’s IPO isn’t just a win for the company – it’s a win for the entire crypto-fintech ecosystem.

Why It Matters:

- Increased Market Legitimacy: eToro’s IPO success sends a clear signal – crypto is here to stay.

- Investor FOMO: The surge in eToro shares will likely fuel more IPO interest in crypto firms, with Kraken and Circle already positioning for potential 2025 debuts.

- Regulatory Spotlight: The SEC’s eyes are now on eToro, and how it navigates compliance could set the tone for other crypto IPOs.

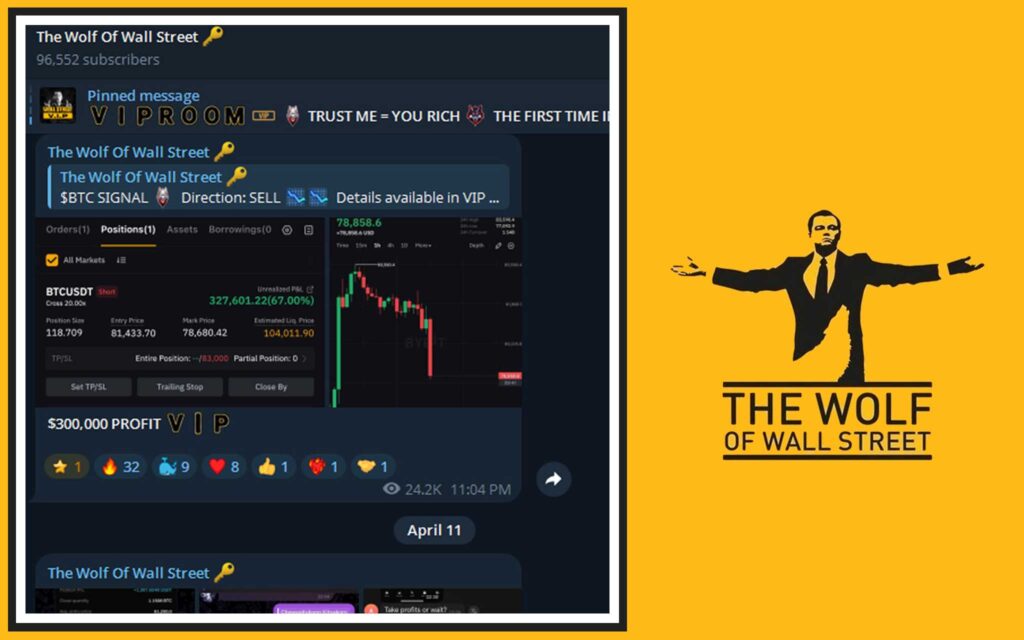

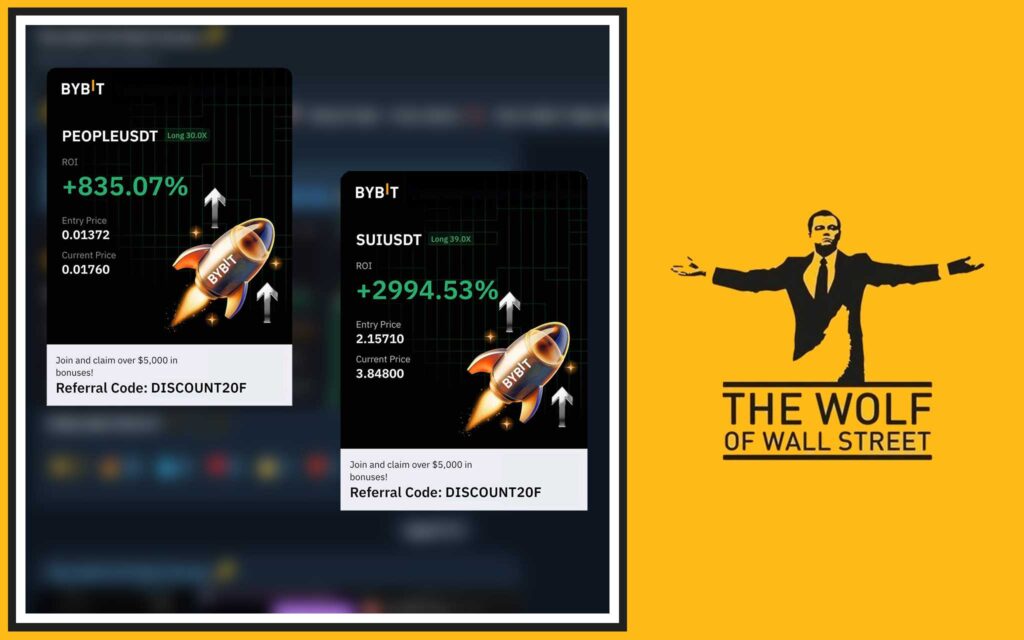

💥 The Wolf Of Wall Street Crypto Trading Community: Power Up Your Trading Game

Feeling the heat? Want to level up your trading game? The Wolf Of Wall Street is the ultimate platform for traders looking to ride the crypto wave:

- VIP Signals: Get insider data that the pros are using.

- Expert Analysis: Stay ahead of the market with seasoned crypto experts.

- Private Community: Network with 100,000+ traders – you’re not trading alone.

- 24/7 Support: The market never sleeps – neither does The Wolf Of Wall Street.

🔗 Join the The Wolf Of Wall Street Community for real-time market updates.

🔥 The Bottom Line: Why eToro is Just Getting Started

Here’s the kicker – eToro’s IPO isn’t the endgame. It’s the launchpad. With $620 million in fresh capital, a rapidly expanding crypto user base, and a proven growth strategy, eToro is primed to make even bigger moves.

But in the high-stakes world of fintech and crypto, nothing is guaranteed. The next 12 months will be critical as eToro navigates regulatory scrutiny, crypto market volatility, and a growing list of competitors itching to steal its thunder.

FAQs

1. Why did eToro upsize its IPO to $620 million?

Investor demand surged, prompting a $120 million increase.

2. How did Robinhood’s stock react to eToro’s IPO?

Robinhood shares dropped 1.9% during eToro’s debut.

3. What was eToro’s valuation during its SPAC merger attempt?

$10 billion, but the IPO came in at $5.5 billion.

4. How is eToro’s crypto revenue driving its overall growth?

Crypto revenue jumped from $3.4 billion to $12.1 billion in a year.

5. What’s next for eToro after the IPO?

Expansion into new markets, enhanced crypto trading tools, and more.