Listen—if you’re trading crypto in 2025, you already know this: the game changes fast. But when the Financial Action Task Force (FATF) fired off its latest warning about stablecoins, half the market panicked. The other half? They saw a window to win. Here’s the real story on stablecoin regulation, why it’s a game-changer (not a game-ender), and how you can turn FATF’s crackdown into your personal edge.

🚦 Why the FATF’s Stablecoin Warning Is a Game Changer

Forget the doom-and-gloom headlines. FATF’s warning isn’t some anti-crypto crusade. It’s a wake-up call—and if you’re serious about trading, you’re going to leverage it.

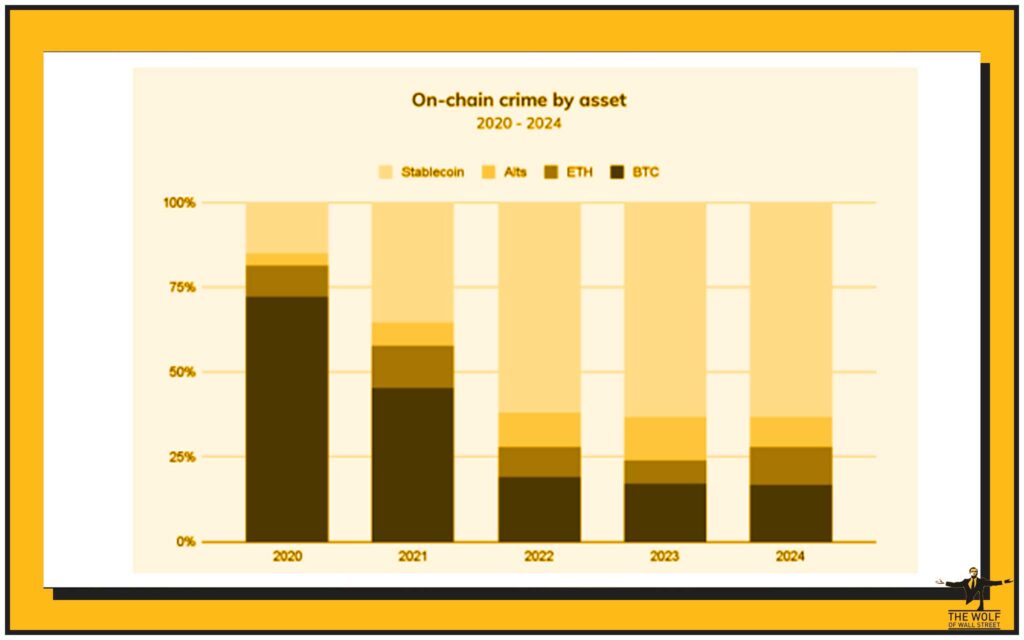

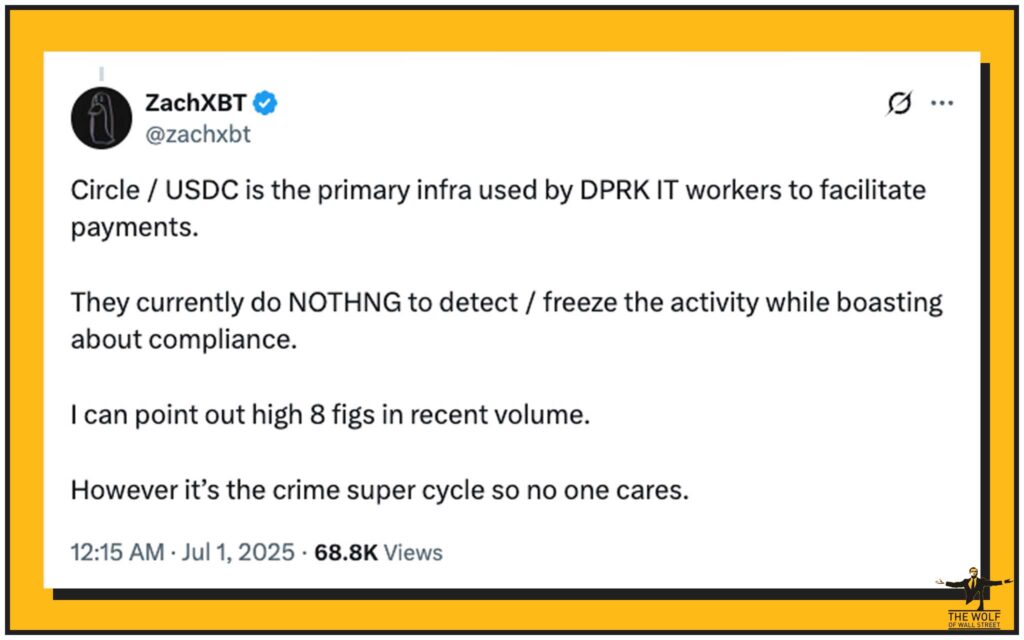

Let’s talk numbers: According to Chainalysis’s 2025 Crypto Crime Report, a jaw-dropping 63% of all illicit on-chain transaction volume now runs through stablecoins. Why? Because stablecoins offer fast, “dollar-pegged” transfers and have become the asset of choice for shady actors. The real story? With mass adoption knocking, the FATF’s message is clear: adapt or get left behind.

💡 Decoding FATF’s Message: Not Hostile, Just Hardcore

Who’s FATF? Only the world’s financial watchdog—the body that sets the anti-money laundering (AML) rules for everyone. And when they talk, regulators, banks, and governments listen.

Here’s the big play: The FATF isn’t trying to bury crypto or kill innovation. Their pitch? Stronger regulation, real-time oversight, and uniform licensing for stablecoin issuers across all jurisdictions. This isn’t about shutting you out. It’s about creating a transparent, legit environment where real players thrive and frauds get burned.

Ready for a deep dive on policy moves? Check out our crypto policy insights.

🏦 Stablecoins Under the Spotlight: The Numbers & The Narrative

Let’s cut to the chase: Why have stablecoins become the weapon of choice for illicit finance?

Because they’re liquid, borderless, and for a while, they flew under the regulatory radar.

- Chainalysis 2025 Report: Stablecoins now dominate the dark side—$1.46 billion in hacks (the Bybit exploit, North Korean-linked cyberattacks), and rapid money movements through on-chain tokens.

- The myth that stablecoins are “untraceable” is dead. Law enforcement can—and does—follow the money.

Hackers love stablecoins, but so do regulators. The transparent nature of the blockchain means every transaction leaves a footprint. The Bybit hack? It didn’t vanish into thin air. Smart tracing tools brought the truth to light, freezing funds in their tracks.

🧩 How Regulation Can Make Crypto Stronger, Not Weaker

Let’s get one thing straight: regulation done right doesn’t stifle innovation—it strengthens it.

Transparency is your new weapon.

Unlike cash or physical assets, stablecoin transactions are logged on-chain, permanently. For the serious trader, this is gold: less fraud, more credibility, and a better shot at institutional adoption.

You want proof? Look at Tether and Circle. These centralised stablecoin giants have shown they can freeze illicit funds in real time. When $225 million in criminal money showed up, Tether slammed the brakes. Circle’s $57 million freeze? Same story. This isn’t weakness—it’s leadership.

Want to level up your trading strategy with smarter tools? Get actionable trading insights now.

🌍 Comparing Global Regulatory Moves: US, EU, Asia

You want to know where the real action is? It’s not just about what the FATF says—it’s how the world reacts.

| Region | Approach | Progress |

|---|---|---|

| US | Licensing, strict enforcement, active FATF compliance. | Ahead |

| EU | MiCA framework, stablecoin controls, active AML updates. | Fast progress |

| Asia | Mixed bag: Singapore is progressive, Hong Kong emerging, others lagging. | Fragmented |

The message? Jurisdictions moving fast are attracting more legit volume and institutional interest. Those lagging are the playgrounds for illicit actors. The FATF wants everyone to catch up, fast.

🔍 The Enforcement Gap: Challenges and Opportunities

Let’s be real: regulation is only as good as its enforcement.

The challenge? While rules get drafted, many countries drag their feet on implementation. This creates cracks in the system—cracks that hackers and launderers exploit.

The upside? This gap is narrowing as tools get better and international cooperation tightens. The winners will be those who embrace compliance, not dodge it. Want to avoid becoming the next headline? Make enforcement work for you, not against you.

⚡ Tech in Action: Traceability, Freezes, and Fighting Crime

You hear “blockchain” and think anonymity. That’s old news. Here’s the new reality:

Stablecoin transactions can be tracked, mapped, and frozen.

How it works:

- Every stablecoin transfer is recorded, open for audit.

- Advanced analytics track wallets, flag suspicious flows, and link activity across chains.

- When suspicious activity is detected, issuers like Tether and Circle can freeze those assets instantly.

Case in point: Tether’s $225 million freeze was possible because of real-time monitoring and law enforcement collaboration. This is what keeps the market clean and trustworthy.

🔗 Community, Tools, and Smart Trading: Outperform the Market

Here’s where most traders drop the ball—they try to go solo.

But in the new world of crypto, community is leverage.

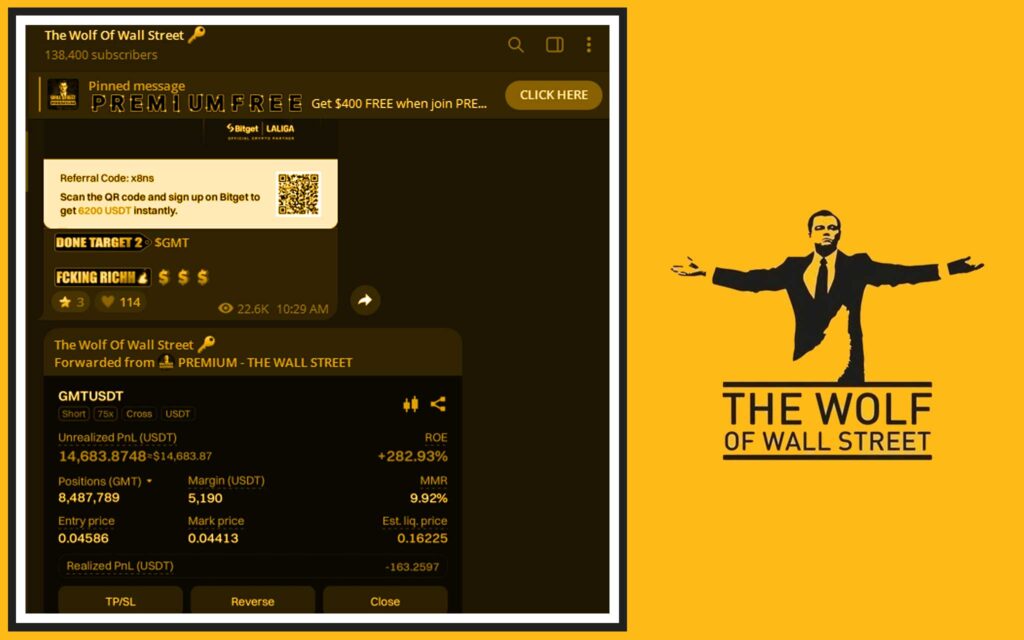

The The Wolf Of Wall Street crypto trading community is a living case study. If you’re tired of following the herd, here’s what The Wolf Of Wall Street gives you:

- Exclusive VIP Signals: Cut through the noise with actionable, profit-driven alerts.

- Expert Market Analysis: Get ahead of the crowd with deep-dive breakdowns from traders who’ve been through every storm.

- Private Community: Tap into a 100,000+ strong network—everyone from rookies to pros, sharing wins and wisdom.

- Essential Trading Tools: Use volume calculators and live dashboards to make decisions with precision.

- 24/7 Support: Questions? Crises? The team’s on call, all day, every day.

Want more? Check out our full service platform or if you’re new, jump into our crypto community and start building your edge right now.

🔮 What’s Next? The Future of Stablecoins and Regulation

Let’s zoom out. The next 12–24 months will be the make-or-break era for stablecoins.

- Growth: Expect stablecoin adoption to explode—especially as compliance and transparency become selling points.

- Regulation: FATF standards will get tighter, with uniform rules across borders.

- Opportunity: Traders who embrace this new era will have less competition from bad actors and more trust from the big money.

What should you do?

- Stay compliant.

- Join a community that puts you ahead of the curve.

- Leverage new tech and market analysis.

📈 Best Practices for Traders in the New Era

- Stay Informed: Follow news updates and regulatory shifts.

- Be Proactive: Choose exchanges and platforms with robust compliance.

- Leverage Community: Don’t trade in the dark. Use networks like The Wolf Of Wall Street for actionable signals and support.

- Use Smart Tools: Volume calculators, real-time dashboards, and expert analysis are now essential.

- Plan for Change: As new rules drop, be ready to adapt fast.

💬 Voices from the Front Line: Experts, Traders, and Regulators

- Blockchain Intelligence Execs: “Regulation isn’t a roadblock—it’s the foundation for long-term growth and institutional adoption.”

- DeFi Developers: “Transparency lets us build systems that scale and withstand attacks.”

- Elite Traders: “Compliance gives us the confidence to go big, knowing the market isn’t a free-for-all.”

The message? The smart money is getting smarter.

📝 FATF’s Top Recommendations (Bullet List)

- Uniform licensing and supervision of stablecoin issuers across all regions.

- Real-time monitoring and enforcement of AML standards.

- International collaboration to prevent regulatory gaps.

- Transparency and traceability as non-negotiables for market growth.

- Active fund freezing for suspicious or illicit activity.

🚀 Ready to Win? Your Call to Action

Here’s the bottom line:

Don’t sit back and wait for the market to tell you what’s next.

Act now. Learn the new rules. Embrace community. Leverage tech. Stay hungry.

Dive into hot crypto trends or turbocharge your next trade with the latest trading insights.

Don’t let the future happen to you—own it.

❓ Frequently Asked Questions

Q: Does FATF want to ban stablecoins?

A: No. FATF wants stablecoins regulated, monitored, and transparent—so crypto can grow, not vanish.

Q: Can stablecoin transactions really be traced?

A: Absolutely. Every transfer is logged on-chain and can be mapped and frozen by issuers and law enforcement.

Q: How can traders stay safe and profitable?

A: Use compliant platforms, follow news in crypto policies, join elite communities, and never stop learning.

Q: Where can I join a legit crypto community?

A: Start with The Wolf Of Wall Street’s private group or our service platform.

🔗 Related Topics for Further Reading

- Crypto News

- DeFi Developments

- Ecosystem Insights

- Bitcoin and Altcoins, Altcoins

- Memecoins, NFTs & Gaming

- Layer 1 & 2 Solutions

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market.

Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.