💰 Introduction: The Fed’s Hand in Your Pocket? Not Anymore!

You think the Federal Reserve is just some suit-and-tie club? Think again! These guys hold the keys to the financial kingdom, and when they cut interest rates, it’s like they’re handing you a golden ticket. We’re gonna break down exactly how these Fed rate cuts work, how they juice up traditional markets, and most importantly, how they can make you filthy rich in the crypto space. Forget what you think you know, because we’re about to open your eyes to real wealth creation. This isn’t about playing it safe; it’s about seizing the moment.

📈 Understanding the Beast: What Are Fed Rate Cuts, Really?

The Mechanics: Lowering the Cost of the Game

When the Fed slashes its benchmark interest rate – that’s the federal funds rate, for you newbies – they’re essentially making it cheaper for everyone to borrow money. Think of it: cheaper loans for businesses, cheaper mortgages for homeowners. What does that mean? More spending, more investing, more economic activity! It’s their play to ignite the economy when things are sluggish, or inflation is a sleeping giant. It’s about injecting liquidity, and where there’s liquidity, there’s opportunity. This is big news in the financial world, and you need to pay attention.

Why They Do It: Fueling the Fire

The Fed doesn’t just cut rates for kicks. They do it to kickstart economic growth, to get the money flowing. When the economy is sputtering, a rate cut is like a shot of pure adrenaline. Businesses can expand, consumers can spend, and that energy? It reverberates through every corner of the market, right down to your crypto holdings.

🏢 Traditional Markets: The Old Guard Gets a Jolt

Equities: The Stock Market Boom

Lower rates mean companies can borrow money cheaper. That’s more cash for expansion, innovation, and ultimately, bigger profits. When profits are up, what happens to stock prices? They go through the roof! It’s basic economics, but the kind that makes you serious money. You want to be holding those stocks when the floodgates open.

Bonds: The Safe Bet Gets Less Safe

With new bonds offering lower yields, the existing bonds with higher yields suddenly become more valuable. It’s simple supply and demand. But let’s be real, who wants to settle for scraps when there’s a feast to be had? Smart money shifts, and that’s where you come in.

Investor Behavior: Shifting Gears to Go for Gold

When the safe bets aren’t paying off, where do investors go? To the riskier assets, the ones with the real upside. They’re looking for returns, and when bonds are yielding peanuts, they’re hungry for something with some meat on its bones. That’s your cue to get into the game. Learn about fundamental approaches to market analysis like Dow Theory market trend analysis or how to understand moving averages market trends to spot these shifts. This is prime trading insights you can’t afford to miss.

⛓️ Crypto Markets: The Wild West Gets Wilder!

Increased Liquidity: Crypto’s Green Light

This is where it gets good. When the Fed pumps money into the system, that liquidity spills over into the cryptocurrencies market. Why? Because traditional safe yields are in the gutter. Crypto, once seen as a niche, becomes the prime destination for those looking for real gains. It’s an undeniable magnet for capital.

Price Surges: Ride the Bull

History doesn’t lie. Look back at 2020, look at 2024. Aggressive rate cuts? They ignited massive bull runs in crypto. We’re talking Bitcoin and the altcoins shooting for the moon! The market cap of cryptocurrencies, excluding the top ten, surged by over 87% after the 2024 cut alone! You can track these movements using onchain vs. trading volume crypto mastery techniques. This isn’t a maybe, it’s a when. This is exactly why you need to be in the trending topics of the market.

Volatility: Embrace the Chaos 🌪️

Sure, it’s a rollercoaster. Rate cuts can drive prices through the roof, but they also crank up the volatility. We’re talking speculative bubbles, sharp corrections. But listen, fear is for the weak. You gotta be in it to win it. The smart money knows how to navigate this, how to use tools like the Bollinger Bands trading strategy or the RSI crypto trading strategies to their advantage. This is where you separate yourself from the herd. You’re not just a newbie anymore; you’re a player.

Institutional Involvement: The Big Dogs Are Here

The big players, the institutions, they’re not just dipping their toes in anymore. They’re diving in headfirst. They treat crypto like any other asset in their massive portfolios. When the Fed moves, they move, and that means even more capital flooding into our market. This isn’t just about retail investors anymore; it’s about a global shift.

📊 Recent Action: Proof in the Pudding

The 2024 Rate Cut: A Crypto Bonanza

September 2024. The Fed slashes 50 basis points. What happened? A broad crypto rally, plain and simple. Bitcoin, the major indices, they all posted strong gains. This isn’t theory, it’s fact. The market cap of cryptocurrencies, excluding the top ten, went ballistic! This kind of activity makes the market hot.

Market Dynamics: Future Forward, Future Rich

The crypto market is always looking ahead. It’s not waiting for the Fed to act; it’s anticipating. Even the expectation of a rate cut can send prices soaring. But be warned, unexpected policy signals or bad economic data? That can cause pullbacks. You need to be sharp, informed, and ready to act. You need to understand master crypto order types trading and how to profit from understanding market makers takers crypto.

🚀 Long-Term Game: Beyond the Hype

Potential for Bubbles: Don’t Get Caught Holding the Bag

Look, I’m gonna be direct. Prolonged low rates can lead to excessive speculation. Bubbles can form, and corrections will happen. That’s why you need to know when to exit. Are you going to be focused on day trading vs. hodling crypto? Are you going to stick around for the long haul, or are you going to take your profits and run? You need a strategy for when to sell crypto strategies.

Innovation and Adoption: The Real Revolution

Beyond the quick gains, low rates encourage investment in what really matters: blockchain and DeFi projects. This isn’t just about trading; it’s about building the future of finance. This fosters innovation and broader adoption. This is where the real long-term wealth is built within these new ecosystems and layer-1-and-layer-2-solutions. Interested in how to create crypto token wolf guide? This is your chance.

Regulatory and Economic Factors: The Other Players

Rate cuts aren’t the only game in town. Regulatory changes, broader economic conditions – they all play a role. Sometimes, these factors can even overshadow the impact of the Fed. You need to keep your eyes open, stay informed on policies, and be ready for anything.

💡 Summary Table: Your Quick Reference Guide to Riches

| Market Type | Typical Reaction to Rate Cuts | Risks/Considerations |

|---|---|---|

| Equities | Stock prices rise, growth projects expand | Overvaluation, bubbles possible |

| Bonds | Prices rise, yields fall | Lower income from new bonds |

| Crypto | Prices surge, increased liquidity, volatility | Speculative bubbles, sharp drops |

🌪️ The Bottom Line: Don’t Just Watch, ACT!

Here’s the deal: Fed rate cuts are a golden opportunity. They inject liquidity, they pump up markets, and they create chances for massive gains, especially in crypto. But you gotta be smart. You gotta be informed. You gotta understand the risks, embrace the volatility, and have a strategy. This isn’t a playground; it’s a battlefield, and only the prepared will conquer.

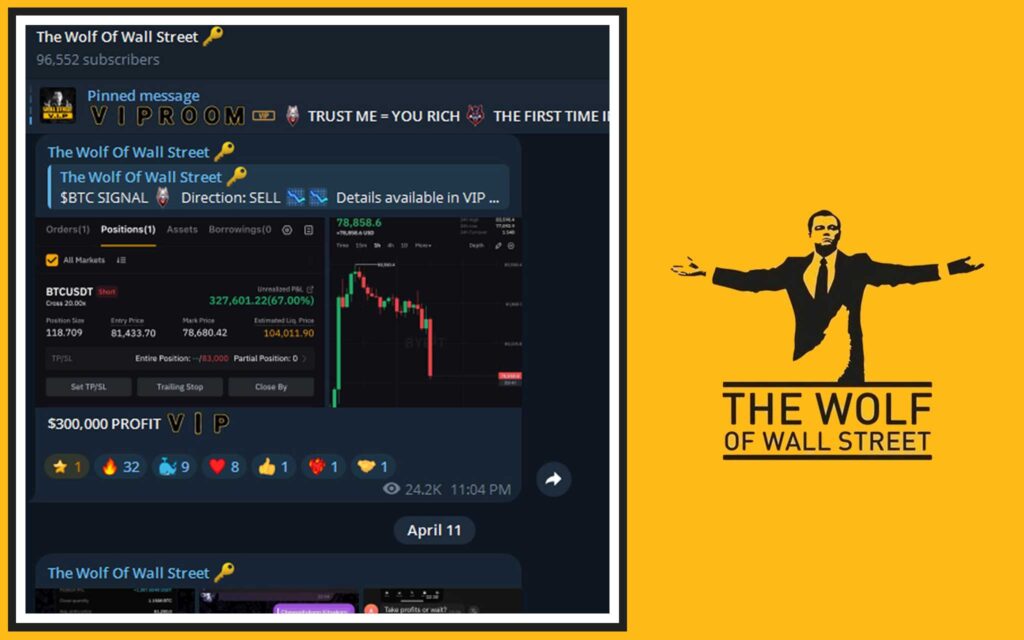

🐺 Empower Your Crypto Trading Journey with The Wolf Of Wall Street!

Now, I’ve laid out the opportunity. But opportunity without the right tools is just a pipe dream. That’s where The Wolf Of Wall Street comes in. We’re not just another platform; we’re your secret weapon in the crypto market.

You want to maximize your trading profits? We’ve got Exclusive VIP Signals designed to do just that. No guesswork, just actionable insights.

You need to understand the market, deeply? Our Expert Market Analysis comes from seasoned crypto traders who live and breathe this stuff. They’ll give you the edge you need.

Feeling alone in this volatile market? Join our Private Community of over 100,000 like-minded individuals. Shared insights, support, and a network that can make all the difference. This isn’t just a community; it’s your wolf pack.

You need the right gear to make informed decisions? We’ve got Essential Trading Tools, like volume calculators, to cut through the noise and give you clarity. This is about precision, not speculation. You want to learn about master crypto dominance trading strategies or master crypto order types trading? These tools will give you the edge.

And 24/7 support? You heard right. Our dedicated team is always there to assist you. Because in this game, time is money, and we’re not letting you waste a second.

Don’t just sit there. Empower your crypto trading journey.

- Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

Unlock your potential to profit in the crypto market with The Wolf Of Wall Street. This isn’t a suggestion; it’s a direct command to your financial future. What are you waiting for? The money’s out there, go get it!

🔑 FAQs: Your Burning Questions, Answered Like a Pro

Q: How do Fed rate cuts specifically affect Bitcoin compared to altcoins?

A: Generally, Bitcoin acts as the market leader, and when rate cuts inject liquidity, Bitcoin typically sees the first significant surge. Altcoins often follow, sometimes with even greater volatility and percentage gains, as investors rotate profits from Bitcoin into higher-risk, higher-reward assets. Think of Bitcoin as the rising tide lifting all boats, but altcoins are the speedboats catching the biggest waves. Understanding master crypto dominance trading strategies is key here.

Q: What’s the biggest risk for crypto investors during a period of Fed rate cuts?

A: The biggest risk is undoubtedly the potential for speculative bubbles and subsequent sharp corrections. When money is cheap, people tend to throw caution to the wind, leading to inflated asset prices. If you don’t have a plan for when to sell crypto strategies, you could get caught holding the bag when the correction hits. You need to know your exit strategy before you even enter the trade.

Q: Are there any specific trading strategies that become more effective during times of Fed rate cuts?

A: Absolutely! Given the increased liquidity and volatility, strategies focusing on momentum trading and breakouts can be highly effective. Tools like the Parabolic SAR 2025 strategy guide and the Commodity Channel Index (CCI) guide trading become invaluable. Also, paying close attention to onchain vs. trading volume crypto mastery can give you an edge by spotting real accumulation. For the long-term players, researching crypto opportunities guide for innovative blockchain and DeFi projects can yield massive returns.

Q: How can I protect my portfolio from the increased volatility that comes with rate cuts?

A: Protection comes from smart risk management. Diversification is key – don’t put all your eggs in one basket. Consider stablecoins to take profits or rebalance during pullbacks. Implementing stop-loss orders is non-negotiable. Understanding P2P vs. centralized crypto exchanges profit guide can also help you manage risk and access liquidity when you need it most. It’s about preserving capital so you can live to fight another day, and profit even more.

Q: What role do institutional investors play in the crypto market’s reaction to Fed policy?

A: A massive one! Institutional investors are no longer just dabbling; they’re deploying serious capital into crypto. Their movements are often more calculated and based on broader economic indicators and monetary policy shifts. When they see rate cuts as a green light, they pour in billions, which can significantly amplify price movements. Their involvement lends legitimacy and substantial liquidity, impacting everything from Bitcoin spot derivatives trading to the emergence of Bitcoin Ethereum ETFs guide. Their reactions to Fed policy are now a major driver in the crypto market.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crYou think the Federal Reserve is just some suit-and-tie club? Think again! These guys hold the keys to the financial kingdom, and when they cut interest rates, it’s like they’re handing you a golden ticket. We’re gonna break down exactly how these Fed rate cuts work, how they juice up traditional markets, and most importantly, how they can make you filthy rich in the crypto space. Forget what you think you know, because we’re about to open your eyes to real wealth creation. This isn’t about playing it safe; it’s about seizing the moment.ypto trading journey:

- Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”