🚀 Introduction: The $8.9 Billion Lesson No One Saw Coming

Here’s the truth: the crypto world doesn’t forgive weakness.

One moment, you’re a visionary — the next, you’re the villain in your own story. That’s what happened to Sam Bankman-Fried (SBF), the once-celebrated founder of FTX, who went from crypto prodigy to prisoner in record time.

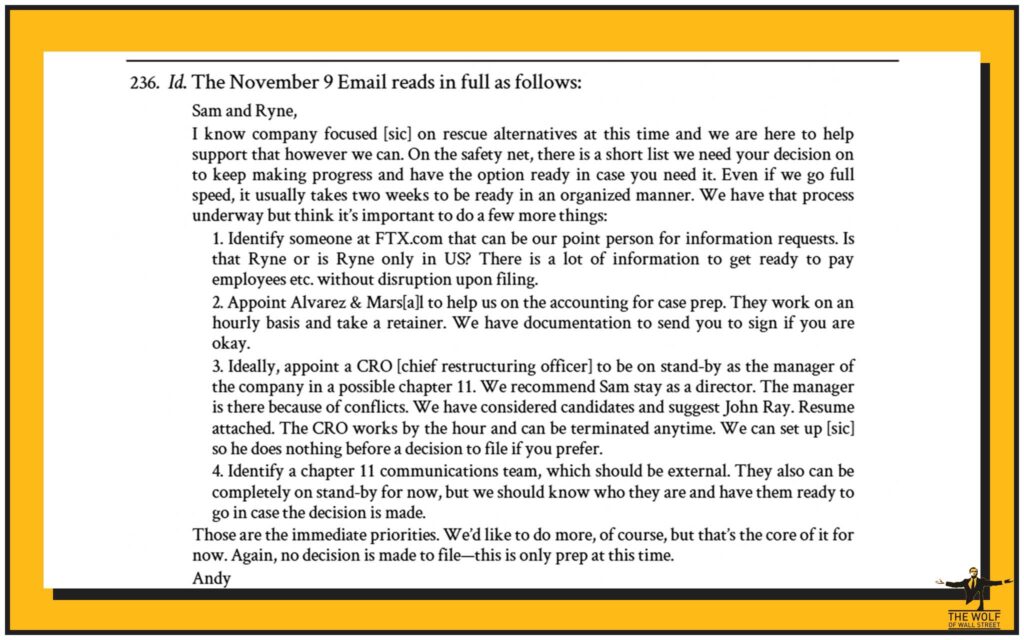

His empire imploded, taking $8.9 billion of investor funds with it and dragging the entire digital asset market into chaos. The mistake? According to SBF himself — handing control of FTX to John J. Ray III just before the company filed for bankruptcy.

This isn’t just a story about greed or failure — it’s a masterclass in what happens when you lose control of your own empire. And if you’re trading crypto today, you’d better pay attention.

💥 The Domino Falls: Inside the Moment SBF Lost It All

Picture this: it’s November 11, 2022. FTX is teetering on the edge. Billions in liquidity holes, terrified investors, and an entire crypto ecosystem holding its breath.

SBF steps down, handing the keys to John J. Ray III — the same man who cleaned up Enron. Minutes later, he gets word: an external investor might be ready to inject billions and save FTX. But it’s too late. The papers are filed, the empire is gone.

It’s the financial equivalent of dropping your parachute right before the plane catches fire.

As Jordan Belfort would say — never hand over the wheel when the ship’s still moving. Because when you give up control in a crisis, the market eats you alive.

🧠 The Psychology of Power: When Confidence Turns Into Catastrophe

Confidence is what separates the winners from the wannabes. But when that confidence mutates into arrogance — you stop listening, you stop verifying, and eventually, you stop winning.

SBF wasn’t just running an exchange; he was running a cult of personality. The guy was everywhere — lobbying politicians, donating millions, and playing chess with billions of other people’s money.

But power without discipline is a ticking time bomb.

As the Wolf says: “Act as if you’re the smartest person in the room, but never forget that the market doesn’t care.”

The moment you stop questioning yourself — that’s when you lose everything.

⚖️ The Legal Bloodbath: From Crypto King to Courtroom Villain

The fall from grace was swift. SBF faced seven felony charges, from fraud to conspiracy, and now serves a 25-year prison sentence.

His replacement, John J. Ray III, wasted no time filing for Chapter 11 bankruptcy, starting the long, painful process of rebuilding what was left.

Meanwhile, legal sharks circled. The law firm Sullivan & Cromwell, which earned $171.8 million in fees for their work on FTX’s bankruptcy, found itself accused of having “looked the other way” during the fraud — though those lawsuits were later dismissed.

The message? In this market, the real winners are the ones who understand the rules — and when to bend them.

Want to stay ahead of regulatory storms? Study the evolving crypto policies and compliance landscape. It’s not glamorous, but it’s how pros stay in the game when others fold.

📉 The Aftershock: How the FTX Collapse Shook the Crypto Market

The FTX collapse didn’t just crush one company — it crushed confidence across the entire crypto sector. Bitcoin nosedived to around $16,000, DeFi liquidity evaporated, and major institutions paused or dumped their crypto exposure.

Retail traders panicked. Exchanges scrambled to prove their reserves. The domino effect tore through the market — and it took nearly a year before we saw signs of recovery.

For a detailed breakdown of how these price shifts unfolded, check out Bitcoin’s market movements and trends. History doesn’t repeat — but it rhymes, and those who study it profit.

🏛️ The New CEO, John J. Ray III: The Man Who Cleaned Up Enron… and FTX

When you hire a man who handled Enron’s collapse, you know things are bad. Ray called FTX “the worst corporate failure” he’d ever seen.

But he also did what SBF couldn’t — he brought order to chaos.

Under his leadership, the team uncovered $16.5 billion in recoverable assets, with over $7.8 billion repaid to creditors by September 2025.

He wasn’t a visionary — he was a cleaner. The kind of professional who doesn’t promise hype, just results. And in this game, that’s what matters.

💸 $171.8 Million in Legal Fees: The Price of Cleaning Up Chaos

Let’s talk about cost.

The FTX cleanup became one of the most expensive legal events in crypto history. Sullivan & Cromwell, alongside other firms, billed hundreds of millions.

Critics called it profiteering off pain. Others called it justice served. Either way — it’s proof that when empires fall, the lawyers always eat first.

And if you don’t want to end up paying for someone else’s clean-up, it’s time to trade smarter. Build discipline, learn the signals, and make every move with intent.

💰 The Redemption Arc: How FTX Plans to Pay 118% of Customer Funds

Here’s the shocker: FTX’s bankruptcy estate expects to repay 98% of its customers — with 118% of their original account value.

It’s a bittersweet victory. For most traders, the recovery will arrive years after the damage. But it proves something powerful: even in crypto’s darkest hour, the system finds balance — eventually.

The next time markets dip, remember this: panic never pays. Preparation does.

💀 Alameda Research: The Fatal Flaw in the System

FTX’s real poison pill wasn’t its exchange — it was Alameda Research, the trading firm SBF secretly funnelled billions into.

When Alameda started losing, FTX customer funds filled the gap.

That’s like covering a roulette table loss with your client’s pension fund. It’s reckless. It’s arrogant. It’s the ultimate betrayal of trust.

The Wolf’s rule? Leverage is your best friend — until it turns into your executioner.

Want to master market timing and avoid SBF-style wipeouts? Dive into crypto trading insights and risk management strategies.

📊 Lessons from the Collapse: What Every Trader Must Learn from SBF’s Mistakes

Let’s cut the fluff.

Here are the real lessons traders should take from this disaster:

- Always verify custody. If you don’t hold your keys, you don’t own your coins.

- Transparency beats trust. Audited exchanges and on-chain proof-of-reserves are non-negotiable.

- Risk management is everything. One bad position can erase a year’s gains.

- The crowd isn’t always right. If everyone’s euphoric, you should be cautious.

Real professionals build systems — not superstitions.

🧩 Rebuilding Trust: The Future of Crypto After the FTX Fallout

Crypto isn’t dead — it’s evolving.

The FTX collapse triggered a mass shift toward decentralised finance (DeFi), self-custody, and transparent protocols.

Traders no longer want to rely on centralised gatekeepers. They want proof, not promises. And projects like DYDX’s decentralised trading platform are leading the charge.

The new crypto ethos? Verify everything. Assume nothing.

🐺 Enter the Wolf: Why Smart Traders Now Follow the Pack, Not the Hype

Here’s where The Wolf Of Wall Street comes in — the antidote to blind speculation.

While the world panics, the The Wolf Of Wall Street crypto trading community thrives by focusing on data, strategy, and precision.

With over 100,000 active traders, VIP signals, and expert market analysis, The Wolf Of Wall Street is where smart money congregates. You get 24/7 support, cutting-edge volume calculators, and a network that actually moves with the market — not against it.

So, don’t trade alone. Join the pack.

Visit the The Wolf Of Wall Street Service or connect directly with their Telegram community and start trading with real insight.

🔍 Expert Market Analysis: From Chaos to Clarity

Every trader wants clarity. Few achieve it.

Why? Because they chase signals instead of understanding them.

The Wolf Of Wall Street flips that script by helping traders dissect the charts — not react to them. From order flow to volume spikes, support zones to momentum shifts, this community builds discipline the Wolf would be proud of.

Want to upgrade your edge? Learn how to master crypto order types and control your entries like a pro.

🔥 The Wolf’s Playbook: Turning FTX’s Downfall Into Your Competitive Edge

Here’s how to win where others fail:

- Think like a strategist. Every market move should serve a long-term plan.

- Exploit emotion. Fear and greed drive others — you move when logic says go.

- Be a predator, not prey. Wait for setups, strike with precision.

You want to know how to turn volatility into profit? Start with the Wolf’s guide to profit-taking. This isn’t about luck — it’s about control.

📈 From Collapse to Comeback: The New Era of Smart Crypto Wealth

We’re entering a new phase of crypto — cleaner, smarter, more professional.

Institutions are returning, ETFs are booming, and retail traders are finally learning what the Wolf’s been saying all along: you win when you play smart, not emotional.

The next bull run won’t be built on hype — it’ll be built on discipline, transparency, and education.

To stay ahead, explore how Layer 1 and Layer 2 innovations are redefining blockchain scalability in 2025: read here.

💬 FAQs: Your Burning Questions Answered

1. What caused the FTX collapse?

The misuse of customer funds at Alameda Research and poor internal controls.

2. How much will creditors get back?

Around 98% of customers are expected to receive 118% of their balances.

3. Could another FTX happen again?

Yes — if traders ignore transparency and accountability.

4. What’s the main lesson for investors?

Trust systems, not personalities. Verify proof-of-reserves.

5. How do I trade smarter now?

Join structured communities like The Wolf Of Wall Street and use verified analysis tools.

🏁 Conclusion: The Wolf’s Final Word — Control Your Mind, or It’ll Control Your Money

Here’s the hard truth: Sam Bankman-Fried didn’t lose billions because of bad luck — he lost it because he broke the golden rule. He gave up control.

In trading, the moment you stop leading your decisions, you start losing your destiny.

The market rewards clarity, conviction, and calculation — not chaos. So, if you’re serious about building wealth in crypto, stop gambling and start strategising.

Join a community that actually knows how to play this game — The Wolf Of Wall Street. Because in the jungle of trading, you either hunt like a Wolf, or you get eaten like sheep.

📚 The Wolf Of Wall Street Crypto Trading Community

The Wolf Of Wall Street Crypto Trading Community offers:

- Exclusive VIP Signals for maximising profits

- Expert Market Analysis by seasoned traders

- Private Community of 100,000+ members

- Essential Trading Tools including volume calculators

- 24/7 Dedicated Support

Empower your crypto trading journey:

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street