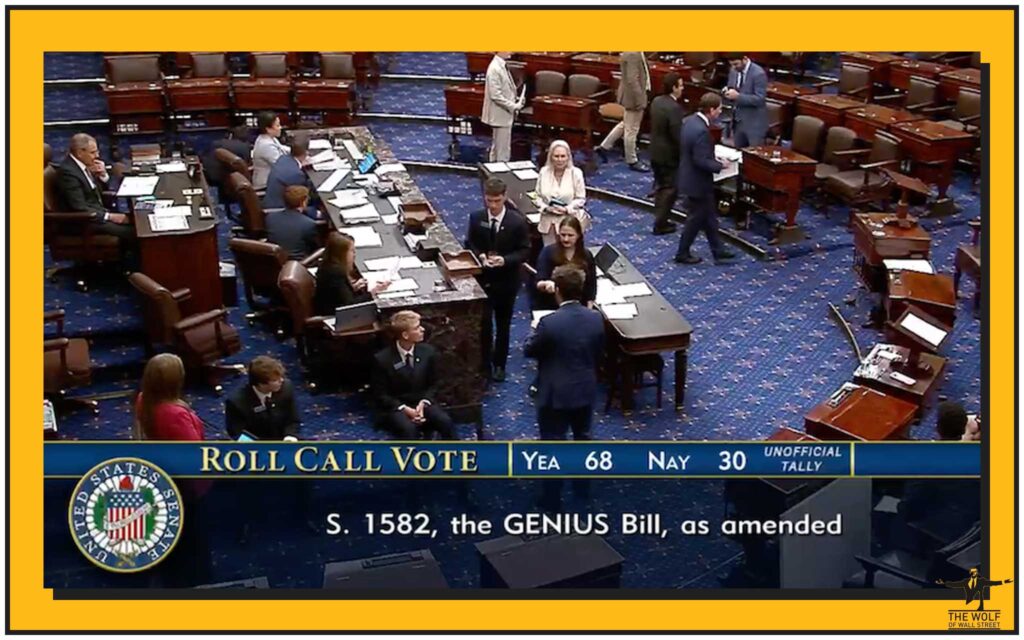

“Stablecoins”—it’s not just a buzzword. This is seismic. The U.S. Senate just passed the GENIUS Act—Guiding and Establishing National Innovation for US Stablecoins—with a robust 68–30 bipartisan vote. This isn’t theatre; it’s tectonic. If you’re in crypto, business, or policy, you’d better pay attention.

🏛️ The GENIUS Act – What It Really Means

The act crystalises stablecoins under federal law for the first time. It demands full reserve backing, comprehensive audits, and bears down on anti-money laundering obligations. For us traders, companies, regulators—it’s clarity in the chaos. You’re no longer flying blind in this volatile crypto storm.

The Senate vote? 68 in favour, 30 against. That’s rare unity when sausage gets made—and it signals momentum. No hiding in gray zones anymore: the ship is steering toward regulation, structure, legitimacy.

🧠 Who’s Behind the Curtain? Political Power Plays

Senator Bill Hagerty championed this bill, positioning the U.S. as a global crypto leader. But don’t sleep on the political tiger in the room: Trump’s ties. President Trump’s family remains entwined with World Liberty Financial, which issued a USD-denominated stablecoin earlier this year. Critics say there’s a conflict of interest— Democrats warned—it’s a rigged game, favouring insiders.

But Belfort-style? That’s half the allure. The political leverage, the power brokers—it’s a high-stakes poker game, and this is the ante.

💥 Market Impact: The New Gold Rush

Let’s not beat around the bush—the world is ripe for stablecoins. Clear rules = institutional capital rushing in. Legacy giants—Apple, Google, X, Airbnb—can now issue coins without regulatory fear. Imagine GooglePay remade with its own digital dollar. That’s not fantasy—that’s potential.

That traction? We’re talking trillions. And traders like us? We’re not just spectators—we’re in the front row, ready to ride the next wave.

Quick Internal Links for the Smart Reader

- Dive deeper into Cryptocurrencies to get foundational insight.

- Explore Layer‑1 and Layer‑2 Solutions to unpack scalability and real-time transactions.

🧮 What Does the Law Actually Require?

Get this etched in stone:

- Full Reserve Backing – Every coin must be backed by actual assets, no shortcuts.

- Mandatory Audits – Public trust = audited financial backing. No joke.

- AML/KYC Compliance – Follow the money. If you want to play, you play by rules.

No more rogue coins playing Houdini. This is regulatory clarity, not chaos.

⚖️ The Critics Are Barking – Let’s Hear Them

But wait—there’s always a flip side.

- Democratic Dissent: “This doesn’t go far enough. Corruption loopholes? Check.”

- Consumer Protections: Still murky. What happens if insolvency strikes?

- Political Ties: Trump’s family links raise red flags. Insider access? Some say it reeks of conflicted control.

This is more than policy—it’s a powder keg of reform vs indulgence. Belfort would say: fuelling the fire’s part of the game. Just be brave enough to follow the flame.

📈 The $3.7 Trillion Opportunity

Treasury officials anticipate stablecoins could explode into a US$3.7 trillion market by 2030. That’s not speculation—it’s Treasury Secretary Scott Bessent talking fact. The GENIUS Act paved the runway; now the jets are coming in hot.

If you’re a trader, founder, or investor, this is your moment. Position yourself on the growth vector. Profit follows clarity.

🔥 What Could Go Wrong? The Fine Print

The Senate paved the way. But the House? Different animal entirely.

- Republicans hold a slim majority—easy amendments, unexpected roadblocks.

- Opposing voices could insert stricter provisions or even stall the bill.

- International benchmarks: EU, UK, Japan—they’re drafting already. If the House stalls, U.S. risks getting left behind.

Don’t underestimate Washington’s labyrinth. Bills die here. Stay alert.

🌍 Global Comparison: How the U.S. Stacks Up

- EU’s MiCA: Coming soon to regulate crypto markets.

- UK: Pioneering digital pound pilot studies.

- Japan: Strong licensing, conservative but active.

The U.S. now owns the moment, but only if this Act makes it across the finish line first.

💼 Real‑World Moves: What Companies Are Already Doing

Big players aren’t idle:

- Visa testing stablecoin rails for merchant settlements.

- Paypal doubling down on stablecoin integration.

Smaller outfits—DeFi platforms—are building strategies aiming at stablecoin yield farming. This isn’t future talk. It’s happening now.

🧠 The Wolf Of Wall Street Pro Tip Corner: Play This Smart

If you’re part of the The Wolf Of Wall Street community, you’re already ahead:

- VIP Signals – Exclusive proprietary crypto triggers tailor-made for GENIUS-centred trades.

- Expert Market Analysis – Data-driven breakdowns on how regulation affects volatility and spread.

- Essential Tools – Volume calculators, scenario modeling, 24/7 support—to make smart moves.

- Private Community – Over 100,000 traders sharing real-time strategies and momentum detection.

The Act isn’t just policy—it’s an opportunity. And in Belfort’s world, opportunity with preparation equals profit.

More Value from The Wolf Of Wall Street:

- Trading Insights to sharpen your mindset.

- Newbie section to fast-track your financial edge.

🧾 FAQs – Rapid Fire

Q: What is the GENIUS Act?

A landmark Senate bill providing a federal regulatory framework for stablecoins—with full reserve, audits, and AML/KYC.

Q: How do stablecoins actually work?

They’re digital currencies pegged 1:1 with real-world assets (dollars, gold), managed on a blockchain, and kept reliable through stringent oversight.

Q: What risks still remain?

House amendments, political entanglement, consumer protection gaps, and global competitive pressure.

💰 Final Word: Power, Profit & Political Poker

The GENIUS Act is transformational. It legitimises stablecoins, opens floodgates for institutional investments, and sets the stage for a trillion-dollar expansion. But it’s not risk-free—upcoming votes, regulatory hurdles, and consumer trust issues could trip it up.

That’s where you come in. Analysts, traders, strategists—you’re no longer spectators. Grab your edge, join the insiders, and position for the profit wave.

Action time: Don’t just watch history—trade it.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like‑minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our website: https://tthewolfofwallstreet.com/ for detailed information.

- Join our Telegram community: https://t.me/tthewolfofwallstreet for real‑time updates and discussions.

Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.