🎯 The Big Wake-Up Call

October 29, 2025 — that’s not just a date on the calendar. It’s the day the crypto wallet market on Google Play changes forever. If you’re a developer, this isn’t just a policy tweak — it’s the line in the sand. You’re either ready to dominate… or you’re about to watch your app vanish from the store faster than a pump-and-dump coin on a red day.

Here’s the kicker: Google’s coming after custodial wallets only — not non-custodial ones. That one sentence just saved half the industry from a compliance nightmare, but if you’re on the custodial side, you better buckle up.

Before we go deeper, let’s set the record straight:

- Custodial wallet: You control the user’s keys, meaning you’re responsible for their funds. Think Coinbase Wallet (custodial version).

- Non-custodial wallet: Users hold their own keys. You’re just the tech provider. Think MetaMask, Trust Wallet.

If you’re in the first category, congratulations — you’ve just been invited to the regulatory cage match.

⚖️ The New Rules of the Game

Google’s Big Announcement

Google Play will require custodial crypto wallet apps in more than 15 jurisdictions to obtain local regulatory licensing. Effective date? October 29, 2025.

Why? Because regulators want their pound of flesh. And Google, the gatekeeper of Android apps, is more than happy to act as the bouncer.

Custodial vs. Non-Custodial – Know Which Side You’re On

If you hold the keys, you’re in the firing line. If you don’t, you’re safe — for now. Google went out of its way to clarify this after developers nearly lost their minds over the initial policy draft.

Translation:

Non-custodial wallet devs — relax, keep shipping.

Custodial wallet devs — get legal, get licensed, or get out.

🌍 Who’s in the Firing Line?

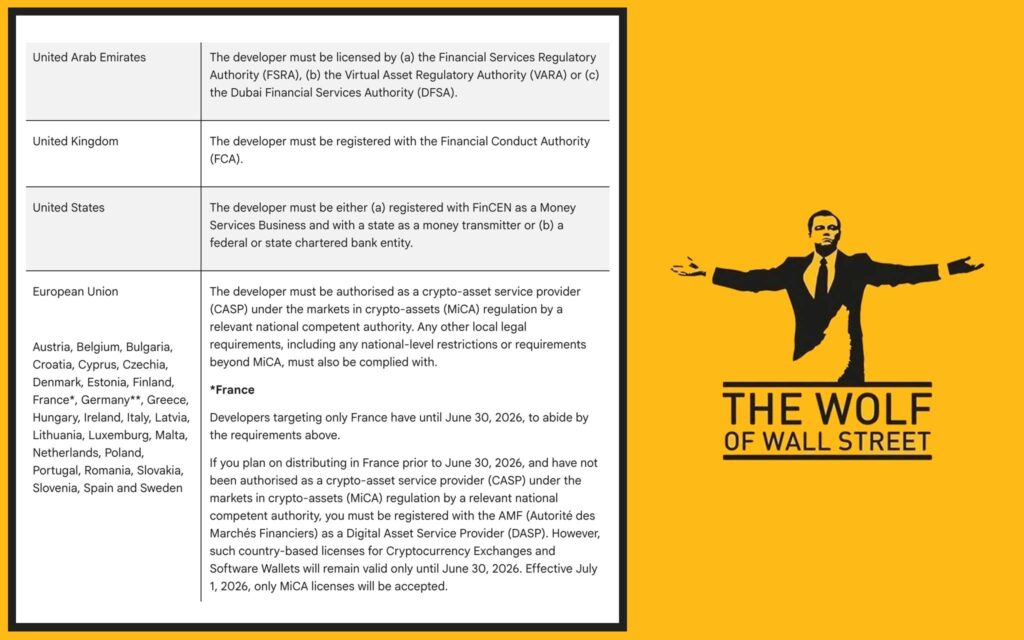

Jurisdictions Under the Hammer

The rules apply in 15+ regions including:

- United States

- European Union

- Plus key global markets that aren’t public yet but are likely in the pipeline.

US Developers: The FinCEN Gauntlet

To play ball in the US, custodial wallet devs must:

- Register as a Money Services Business (MSB) with FinCEN.

- Implement a written AML program that satisfies federal guidelines.

- Potentially run KYC checks on users.

This isn’t just paperwork — this is ongoing compliance, audits, and risk management. Slip up once, and you’ll be out faster than a scam token after rug-pull day.

EU Developers: The CASP Mandate

In the EU, the game is called CASP — Crypto-Asset Service Provider. Under MiCA regulations, you’ll need to:

- Register with your national regulator.

- Prove your systems meet AML/KYC standards.

- Maintain security protocols that could make a bank blush.

📈 Why Google’s Doing This – The Real Play

This isn’t about fairness or innovation. This is about aligning with global financial surveillance trends. AML, KYC, FATF guidelines — they’re all converging, and Google wants to stay ahead.

By excluding non-custodial wallets, they’re avoiding a PR nightmare while still tightening the noose on the part of the industry they can control.

📜 The History Lesson – Google Play vs. Crypto

Google’s relationship with crypto apps? Let’s just say it’s been… rocky:

- 2018: Mining apps banned.

- 2020: Bitcoin Blast and crypto news apps removed without explanation.

- 2021: Eight deceptive crypto apps banned.

- 2023: NFT games allowed under strict rules (full disclosure, no gambling mechanics).

Pattern? Tight control, selective permission, compliance-first.

🚀 What This Means for the Industry

The Compliance Crunch

- Increased costs for developers.

- Smaller teams could be priced out.

App Store Monopoly Moves

The fewer wallets on Google Play, the easier it is for big players to dominate. We could see a consolidation wave where only fully licensed, well-funded companies survive.

🛠️ The Developer’s Survival Blueprint

US Developer Checklist

- Register with FinCEN as MSB.

- Build and document your AML program.

- Integrate KYC processes where required.

EU Developer Checklist

- Register as CASP under MiCA.

- Maintain AML/KYC compliance reports.

- Invest in security infrastructure.

Global Best Practices

- Hire legal counsel specialising in crypto regulation.

- Maintain compliance logs and audits.

- Regularly review local and international rules.

💡 The Opportunity Behind the Chaos

Here’s where the Belfort mindset kicks in — most devs will see this as a roadblock. You? You see it as a barrier to entry that clears out the competition.

If you nail compliance, you’re not just another wallet. You’re a trusted, regulation-ready crypto on-ramp that users — and maybe even banks — will flock to.

🗣️ The Community’s Verdict

Initial reaction? Panic. The fear was that non-custodial wallets would be collateral damage. Once Google clarified they’re exempt, the mood shifted from outrage to cautious optimism.

Still, there’s suspicion. In crypto, “for now” is the operative phrase. Policies can expand faster than memecoin hype on launch day.

💎 The Wolf Of Wall Street Insider Advantage – Trading in a Tightening Market

While devs are scrambling, traders have a different opportunity: to profit in the chaos. That’s where The Wolf Of Wall Street comes in:

- Exclusive VIP Signals to spot market moves before they happen.

- Expert Market Analysis from seasoned traders.

- Private Community of over 100,000 crypto players sharing intel.

- Essential Tools like volume calculators to sharpen your trades.

- 24/7 Support so you’re never flying blind.

Join the action in our Telegram group and be the one calling the shots while others play catch-up.

⏳ Final Word – Don’t Sleep on This

October 29 is not a suggestion. It’s a deadline. If you’re a custodial wallet dev, you have two choices:

- Treat compliance like a cost and get buried.

- Treat compliance like a moat and own the market.

Your move.

💬 FAQs

1. What’s the difference between custodial and non-custodial wallets?

Custodial wallets hold your keys for you; non-custodial wallets let you keep your own keys.

2. Does this policy affect iOS developers?

Not directly, but Apple’s App Store has its own strict rules, and similar changes could follow.

3. Will Google extend these rules to more jurisdictions?

Highly likely, given the global trend toward unified crypto regulation.

4. How will this impact crypto adoption?

Short term: friction. Long term: greater trust from mainstream users.

5. How can smaller developers afford compliance costs?

Partner with legal experts early and explore shared compliance services.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street

- Join our active Telegram community: The Wolf Of Wall Street Telegram

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.