🔥 Introduction: Bitcoin – The Financial Earthquake Nobody Saw Coming

Picture this: It’s 2008. The world is drowning in financial chaos. Banks are collapsing, Wall Street is being bailed out, and the average person is left holding the bag. Out of this chaos emerges a ghost, a pseudonym—Satoshi Nakamoto—with a radical blueprint that would unleash the biggest financial revolution since the creation of the stock market.

That blueprint? Bitcoin.

But let’s get one thing straight: Bitcoin isn’t just digital money. It’s a declaration of war against central banks, corrupt governments, and the financial cartels that have ruled the system for centuries. It’s not just technology—it’s ideology, it’s rebellion, it’s freedom coded into blocks.

This article? It’s not a textbook. It’s a deep dive into the raw, unfiltered history of Bitcoin—how it was born, what battles it fought, and how it grew into the most unstoppable force in finance today.

🧠 The Ideological DNA of Bitcoin

Before there was Bitcoin, there was anger. Anger at governments debasing currencies. Anger at banks treating your money as their playground. And most importantly, a vision that technology could liberate humanity from financial slavery.

The roots go deep—cypherpunks and extropians. These weren’t your average tech geeks; they were rebels, futurists, and privacy warriors. They believed:

- Technology wasn’t just a tool; it was the sword to cut down tyranny.

- Privacy wasn’t a luxury; it was a right.

- Money shouldn’t be controlled by central bankers—it should be owned by the people.

The cypherpunks didn’t sit around writing code for fun. They wrote manifestos declaring financial freedom as a human right. They wanted to build systems where the government couldn’t inflate your savings away with a keystroke.

Bitcoin was their destiny.

👉 For a deeper look at this movement, check out the Cypherpunk Crypto Revolution.

🧩 The Pre-Bitcoin Experiments – Failed Blueprints That Paved the Way

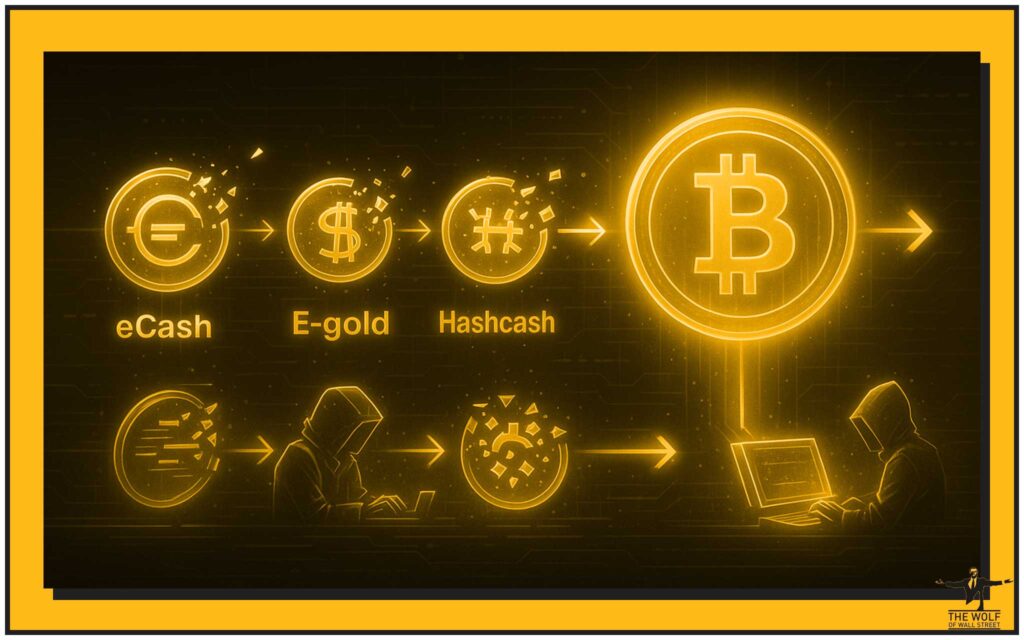

Here’s the truth: Bitcoin didn’t appear out of thin air. It was built on the shoulders of giants—brilliant, crazy, misunderstood geniuses who tried to reinvent money and failed. Their failures became Bitcoin’s foundations.

- David Chaum’s eCash (1990s): The first real attempt at digital money. Brilliant on privacy, but too centralised—it needed banks to run. The government crushed it.

- E-gold: Digital gold backed by physical reserves. It grew fast—millions of users. But regulators couldn’t stomach the competition. Shutdown.

- Hashcash: Adam Back’s proof-of-work algorithm. Originally designed to fight email spam, but this little invention would later become Bitcoin’s engine.

- B-money & Bit Gold: Crazy ideas floating in mailing lists. Nick Szabo’s Bit Gold came closest—a system of digital scarcity. But it never got traction.

Each of these was like a failed prototype car before the invention of the Lamborghini. On their own, they were flawed. Together, they laid the bricks for the Bitcoin cathedral.

👉 Want to know why these cryptographic ideas mattered? Read B-money Overview: Bitcoin Influence.

🚀 Satoshi Nakamoto – The Ghost Who Changed Money Forever

Then comes the enigma: Satoshi Nakamoto.

No face. No voice. Just a series of emails, forum posts, and one PDF—the Bitcoin White Paper released on October 31st, 2008.

It was simple, but it was a nuclear bomb in the financial world. A peer-to-peer system of cash that didn’t need banks, middlemen, or trust. Money backed not by governments, but by mathematics.

What’s even more powerful? Satoshi vanished.

Like a phantom, he—or she, or they—built Bitcoin, nurtured it for a short while, and then disappeared in 2011, leaving the world with a gift: a decentralised system that nobody could shut down.

And here’s the kicker: if Satoshi had stayed around, governments could’ve targeted him. By disappearing, he made Bitcoin untouchable.

👉 Learn more about this mystery in Satoshi Nakamoto: Bitcoin Creator Mystery.

🧱 The Genesis Block – A Political Statement Hidden in Code

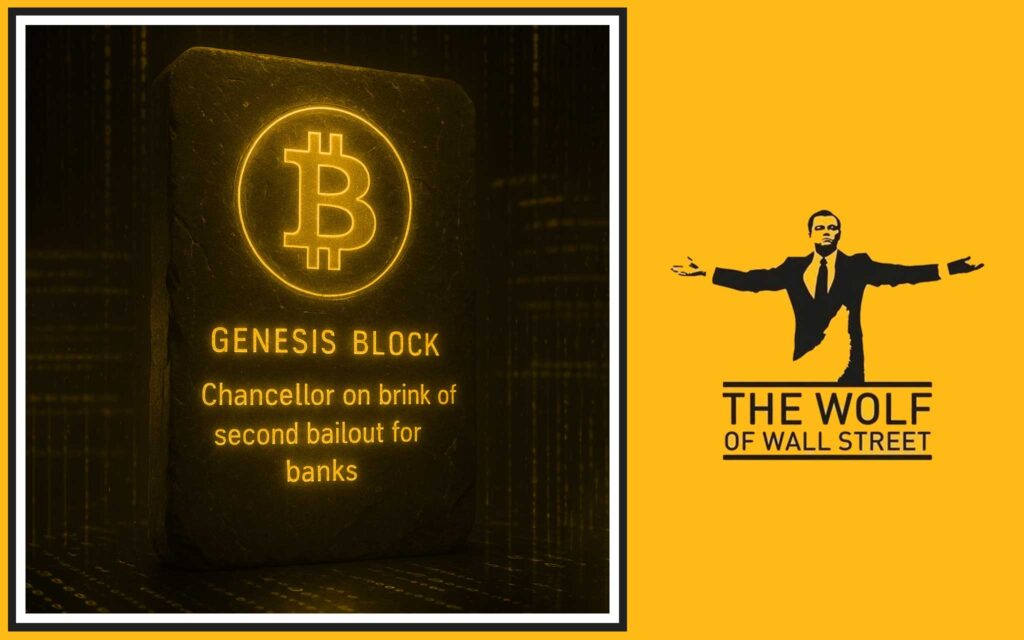

On 3rd January 2009, the world changed forever. Block 0—the Genesis Block—was mined.

But this wasn’t just code. It was a message. Embedded in that block was a newspaper headline:

“Chancellor on brink of second bailout for banks.”

Boom. Right there in the DNA of Bitcoin, Satoshi carved a statement: Bitcoin was created to fight the broken banking system that keeps robbing the people.

Bitcoin wasn’t just money. It was protest.

🍕 Pizza for 10,000 BTC – The First Commercial Transaction

Every revolution needs a story, and Bitcoin’s came in 2010.

Laszlo Hanyecz, a programmer, paid 10,000 BTC for two pizzas. That’s right, he bought dinner with Bitcoin. At the time, it was worth about $41.

Today? That’s over $600 million.

This moment, now celebrated as Bitcoin Pizza Day, proved Bitcoin wasn’t just code or theory—it was money.

And that transaction kicked off the global obsession: people started asking, “If I can buy pizza with Bitcoin, what else can I buy?”

Spoiler: A lot. From Lamborghinis to real estate, Bitcoin became the currency of dreams.

⛏️ Mining: From Bedroom Hobby to Billion-Dollar Industry

In the early days, mining Bitcoin was so easy you could do it on a crappy laptop while watching cat videos on YouTube. A few nerds in bedrooms across the world were minting coins like they were printing monopoly money.

But then the stakes changed.

- Phase 1: CPU Mining (2009): Just your average PC. Anyone could play.

- Phase 2: GPU Mining (2010): Gamers discovered their graphics cards could hash way faster than CPUs. Suddenly, the race was on.

- Phase 3: ASIC Mining (2013): Specialised machines built purely for mining blew GPUs out of the water. At this point, mining was no longer a hobby—it was an industry.

Then came mining pools—groups of miners joining forces. The first? Slush Pool in 2010. Suddenly, Bitcoin wasn’t just a grassroots experiment; it was evolving into a professional operation.

Fast-forward a decade: billion-dollar mining farms now hum like data fortresses in China, Texas, and Kazakhstan. Bitcoin went from being mined in basements to being mined in warehouses that look like they belong in a sci-fi movie.

👉 Curious about profiting from Bitcoin’s mining infrastructure today? Read our Lightning Node Passive Income Guide.

🕵️ Silk Road – Bitcoin’s Infamous Dark Chapter

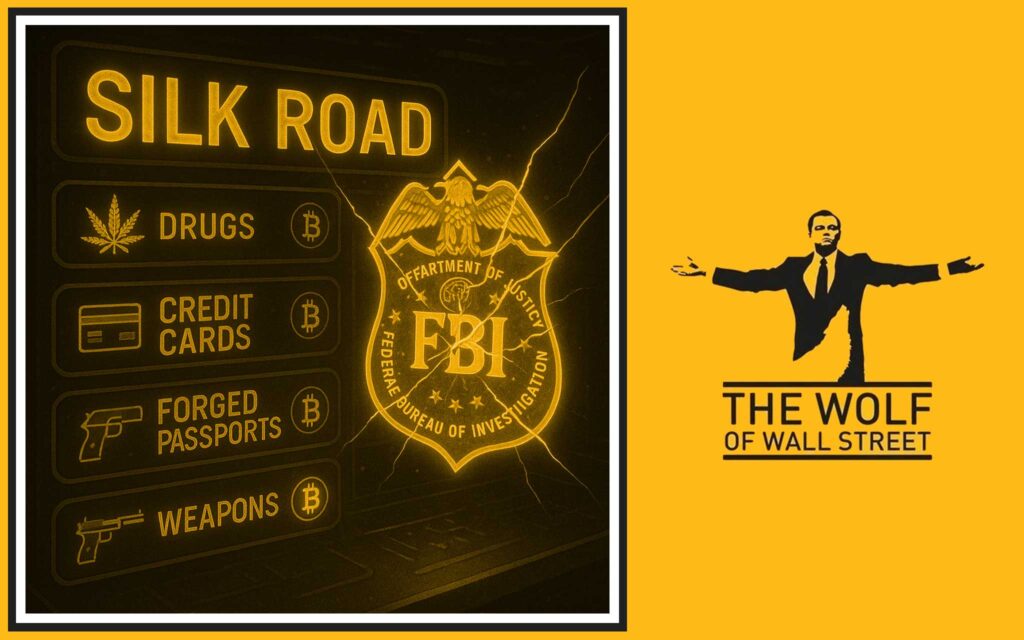

Now let’s talk controversy.

Bitcoin didn’t first make headlines because of Wall Street—it made headlines because of the Silk Road.

Launched in 2011 by Ross Ulbricht (aka “Dread Pirate Roberts”), Silk Road was an online black market. Drugs, fake passports, hacking tools—you name it, Silk Road sold it. And the currency fueling it all? Bitcoin.

The libertarians loved it: Bitcoin being used to bypass government control. The media hated it: “Bitcoin is for criminals!” The government went nuts.

In 2013, the FBI shut Silk Road down and arrested Ulbricht. The story went mainstream, painting Bitcoin as the “currency of crime.”

But here’s the truth: Was Bitcoin used on Silk Road? Yes. Does that define Bitcoin? Hell no. The U.S. dollar is used in more drug deals every single day than Bitcoin ever was.

Silk Road gave Bitcoin notoriety, but it also gave it relevance. Suddenly, everyone knew Bitcoin existed.

💥 Mt. Gox Collapse – The Wake-Up Call

If Silk Road was Bitcoin’s wild west, Mt. Gox was its Wall Street—and it blew up in spectacular fashion.

By 2013, Mt. Gox handled over 70% of all Bitcoin trades worldwide. Think about that—seven out of every ten Bitcoin transactions went through one exchange. It was the exchange.

Then came disaster.

- 2011: First major hack. Bitcoin stolen.

- 2014: The big one—850,000 BTC vanished. Value? About $450 million at the time. Today? Tens of billions.

Users were locked out. Funds were gone. Panic ensued.

Mt. Gox’s collapse was Bitcoin’s first Lehman Brothers moment. But it also delivered a lesson that still echoes today:

👉 If your Bitcoin isn’t in your wallet, it’s not your Bitcoin.

That’s why the rallying cry became: “Not your keys, not your coins.”

👉 For strategies to protect yourself, read our Self-Custody vs Centralised Crypto Cards Guide.

📜 Regulations, BitLicense, and the War on Crypto

Governments hate what they can’t control, and Bitcoin is the ultimate untamable beast. So, of course, the regulators came for it.

The most infamous regulation? The BitLicense.

Introduced in New York in 2015, it basically told crypto companies: “If you want to operate here, jump through our hoops, file mountains of paperwork, and let us watch your every move.”

Some businesses complied. Others just packed up and left New York entirely. It was a message to the world: governments weren’t going to roll over while Bitcoin threatened their monopoly.

And since then, it’s been a patchwork of regulation:

- Some countries embrace Bitcoin (El Salvador made it legal tender).

- Others ban it (China’s mining ban in 2021).

- Most? They try to regulate it to death without fully killing it.

But here’s the kicker: every time a government tries to ban Bitcoin, it only makes it stronger. Bitcoin adapts. The network lives on.

👉 Dive deeper with Cryptocurrency Regulations in Latin America 2025.

⚔️ The Scaling Wars – Civil War Inside Bitcoin

By 2015, Bitcoin had a new problem: it was too popular. Transactions piled up. Fees skyrocketed. Suddenly, Bitcoin wasn’t scaling.

This sparked an internal war—the Scaling Wars.

- One camp argued: Increase the block size! Make transactions bigger, faster.

- The other camp screamed: No! That centralises Bitcoin. Keep it lean, build solutions off-chain.

The fight was brutal. Forums turned into battlefields. Developers raged. The community split.

Out of this chaos, two big outcomes emerged:

- The Lightning Network: A Layer-2 solution enabling instant, cheap Bitcoin payments off-chain.

- Bitcoin Cash Fork (2017): The rebels who wanted bigger blocks split off and created their own chain.

It was messy, but here’s the lesson: decentralisation means fights. But fights mean survival. No dictator runs Bitcoin. The community battles it out, and the best ideas rise.

📈 Bitcoin Post-2018 – From Fringe to Mainstream Asset

Here’s where the story shifts gears.

For years, Bitcoin was dismissed as a nerd’s toy, a scam, or “rat poison squared” (thanks, Warren Buffett). But post-2018, the narrative flipped. Bitcoin was no longer just for hackers and libertarians—it was becoming an institutional asset.

Key moments that changed the game:

- 2017 Bull Run: Bitcoin smashed through $20,000. Media attention exploded. The world couldn’t ignore it anymore.

- Tesla & Elon Musk (2021): Tesla bought $1.5B worth of Bitcoin. Musk became the loudest—and sometimes most chaotic—cheerleader.

- MicroStrategy & Michael Saylor: A listed company betting its treasury on Bitcoin? Unheard of. Saylor turned into Bitcoin’s corporate evangelist.

- Bitcoin ETFs (2024–2025): Once Wall Street packaged Bitcoin into ETFs, game over. Suddenly pension funds, family offices, and institutions could buy Bitcoin exposure without touching a private key.

And then—2025: Bitcoin overtakes Amazon in market cap. Yeah, you heard that right. A digital coin that started with pizzas was now bigger than one of the world’s largest corporations.

👉 For the full story, check Bitcoin Overtakes Amazon 2025.

Bitcoin went from outsider to insider. From rebellion to recognition. From “magic internet money” to digital gold.

⚡ Bitcoin Technology Today – Beyond Just Money

If you think Bitcoin is just about holding and waiting, you’re missing the bigger picture. Bitcoin has evolved into a technological ecosystem.

🔹 Lightning Network

This is Bitcoin on steroids. Lightning takes transactions off the main blockchain, processes them instantly, and then settles back on-chain. That means near-zero fees and speed faster than Visa.

Lightning isn’t just theory. It’s already powering payment apps in countries like El Salvador, where people buy coffee with Bitcoin every day.

🔹 Taproot Upgrade

In 2021, Bitcoin got its biggest upgrade in years. Taproot improved privacy, efficiency, and unlocked smart contracts. This wasn’t just a cosmetic change—it expanded Bitcoin’s capabilities into areas previously dominated by Ethereum.

🔹 DeFi & NFTs on Bitcoin

Yeah, you read that right. For years, Bitcoin was criticised as “boring” compared to Ethereum. But new protocols like Ordinals brought NFTs to Bitcoin. DeFi layers like Stacks are building financial ecosystems right on top of the Bitcoin blockchain.

Bitcoin isn’t just a store of value anymore—it’s becoming a financial operating system.

🌍 Bitcoin’s Global Impact – Money Without Borders

Here’s the real magic: Bitcoin isn’t just an investment for the rich—it’s a lifeline for the poor and oppressed.

Hyperinflation Hedge

In countries like Venezuela, Nigeria, and Argentina, local currencies collapse daily. Bitcoin gives people a way out. When your money loses half its value every month, Bitcoin isn’t speculation—it’s survival.

Freedom from Tyranny

In regimes where governments freeze bank accounts and censor transactions, Bitcoin becomes a weapon. You can’t freeze a Bitcoin wallet. You can’t stop a peer-to-peer transaction. Bitcoin is financial freedom, uncensorable and unstoppable.

Remittances Without Middlemen

Millions of migrant workers send money home. Traditionally, Western Union skims 10–15% in fees. With Bitcoin, it’s instant, cheap, and borderless.

This is why Bitcoin adoption in developing nations is skyrocketing—not because they’re speculating, but because they need it.

🎯 Common Misconceptions About Bitcoin

Bitcoin has been called a lot of things. Let’s clear the air.

- “Bitcoin is only for criminals.”

False. Yes, Silk Road used it. But guess what? The U.S. dollar is the #1 currency for crime, money laundering, and drugs. Bitcoin transactions are traceable. Criminals actually hate that. - “Bitcoin is too volatile to be real money.”

Partly true—but here’s the thing: volatility is the price of growth. Amazon stock was volatile as hell in the 2000s. Now it’s a trillion-dollar empire. Same path, different asset. - “Bitcoin wastes energy.”

Wrong. Bitcoin uses energy, but it doesn’t waste it. Bitcoin mining drives innovation in renewable energy, captures wasted power, and even stabilises grids. It’s not a bug—it’s a feature.

👉 Learn more in our deep dive: How Green is Ethereum? (and compare with Bitcoin’s energy use).

🔑 Lessons Learned from Bitcoin’s History

Looking back at two decades of Bitcoin, the lessons are crystal clear:

- Decentralisation is survival. Every time Bitcoin centralised (Mt. Gox, big mining farms), disaster struck. But the network endured because no single entity controls it.

- Self-custody is king. Exchanges fail, wallets get hacked, governments overreach. If you don’t own your keys, you don’t own your coins.

- Innovation beats regulation. Every attempt to ban or restrict Bitcoin has only pushed it to adapt, evolve, and grow stronger.

Bitcoin is antifragile. What doesn’t kill it makes it stronger.

🚀 Future of Bitcoin – Where Do We Go From Here?

So what’s next? Let’s cut through the hype and get real.

- Institutional Game Theory: Once corporations and governments start holding Bitcoin, they can’t dump it without tanking their own portfolios. The game theory locks them in.

- Reserve Currency Potential: It sounds crazy now, but so did “Bitcoin at $20,000” back in 2017. In a world of currency debasement, Bitcoin could become the backbone of global finance.

- Layer 2 Explosion: Lightning, DeFi, NFTs—Bitcoin’s second layer is where the real innovation will happen.

- Scarcity Play: 93% of Bitcoin has already been mined by 2025. That means the remaining supply is a race. When the big players realise how rare Bitcoin truly is, the price action will make the 2017 bull run look like a warm-up.

👉 Explore: 93% of Bitcoin Mined 2025 Scarcity Impact.

✅ Conclusion – Bitcoin: The Wolf That Broke the System

Bitcoin isn’t just another asset. It’s not just tech. It’s not just money.

It’s a revolution—a digital wolf that broke into the financial henhouse and rewrote the rules of the game.

From pizza to billion-dollar ETFs, from Silk Road to Wall Street, Bitcoin has proven one thing: you can’t stop an idea whose time has come.

So here’s the call-to-action: don’t sit on the sidelines. Get educated. Get positioned. Get serious. Because history doesn’t wait—and Bitcoin is history in motion.

❓ FAQs

- Who created Bitcoin and why did they stay anonymous?

Satoshi Nakamoto created Bitcoin in 2008 and vanished to protect the project’s decentralisation. By disappearing, they ensured no single point of failure. - What was the significance of the Bitcoin Pizza Day transaction?

It proved Bitcoin could function as real money. The first recorded commercial exchange cemented its role as currency. - Why did Mt. Gox collapse and what did it teach us?

Mt. Gox was hacked and mismanaged, losing 850,000 BTC. The lesson: never trust centralised custody. Always use self-custody. - How do regulations affect Bitcoin adoption worldwide?

They slow down innovation in some regions but accelerate it in others. Bitcoin adapts. Regulations can’t kill it, only shape its trajectory. - Is Bitcoin really a hedge against inflation?

Yes. Unlike fiat currencies, Bitcoin has a hard cap of 21 million coins. That scarcity makes it a long-term hedge against endless money printing.

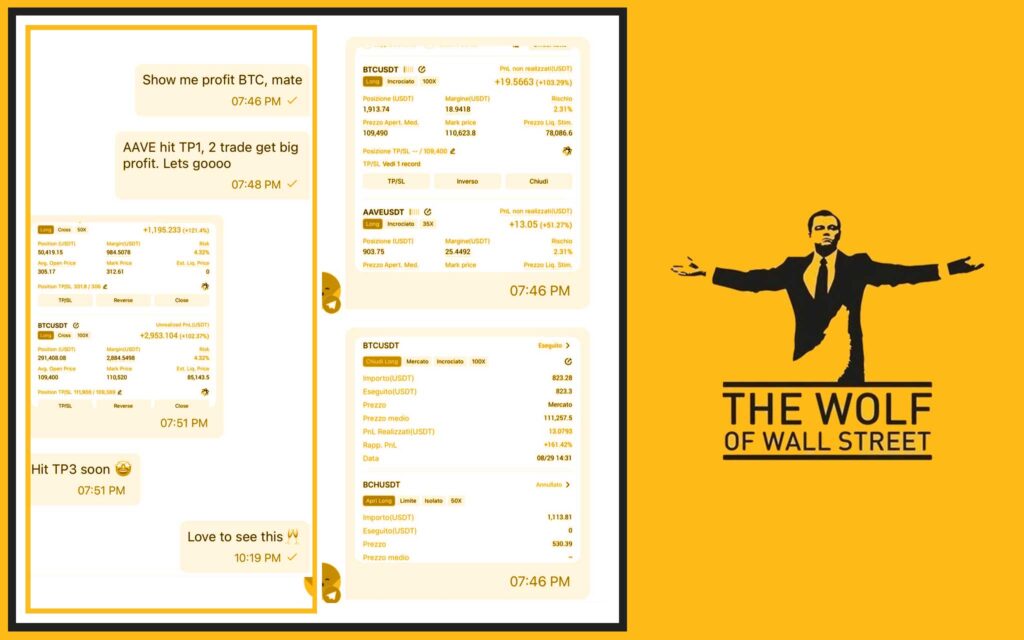

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join 100,000+ like-minded traders for insights and support.

- Essential Trading Tools: Use volume calculators and more to sharpen decisions.

- 24/7 Support: Non-stop assistance from a dedicated team.

👉 Visit: The Wolf Of Wall Street Service

👉 Join: The Wolf Of Wall Street Telegram