Introduction: Welcome to the New Frontier

Listen up! If you’re still analysing Bitcoin like it’s 2017, you’re leaving money on the table—period. This is the era of speed, precision, and cutting-edge tools. In the wolfpack of crypto trading, those who move first, with the best intel, eat first. And if you want to trade like a savage, you need a partner that never sleeps, never misses a signal, and always delivers insight faster than any human analyst ever could.

Enter ChatGPT: your new secret weapon for Bitcoin trend analysis. It’s not just an AI—it’s the ultimate deal-closer, ready to process mountains of data and spit out value in seconds. Don’t let the old guard fool you: this isn’t about “following your gut”—it’s about getting paid for being right.

🧠 Why Every Smart Bitcoin Trader Needs an Edge

Let’s cut through the noise. There’s no honour in trading blind, and “gut feelings” are a one-way ticket to financial ruin. The smart money knows: winning in crypto means stacking every advantage in your favour. The difference between success and mediocrity? Data, strategy, and execution.

The right analysis doesn’t just improve your odds—it changes the game. In a market where one tweet or flash crash can wipe you out, there’s no excuse for going in unarmed. Tools like The Wolf Of Wall Street’s exclusive VIP signals and deep-dive analytics set winners apart from wannabes. This is how you build wealth, not just chase pumps.

🚀 Meet Your AI Power Broker: ChatGPT Explained

Let’s get one thing straight: ChatGPT isn’t just a chatbot. This beast is a generative AI, powered by OpenAI’s most advanced language model. Feed it data—historical prices, technical indicators, market sentiment—and it’ll chew through the noise and spit out patterns that the average trader would miss in a lifetime.

But don’t get starry-eyed. ChatGPT isn’t plugged directly into the market’s heartbeat. It doesn’t “see” real-time prices on its own. What it does—better than anything else—is synthesize structured data you provide and translate it into actionable insights, razor-sharp summaries, and code snippets for backtesting. Think of it as your personal market analyst—on steroids, and never off the clock.

Want to see what’s really moving the markets? Check the latest crypto news for context, then let ChatGPT turn the chaos into clarity. Looking to sharpen your skills? Browse proven crypto trading strategies and feed that knowledge straight into your AI setup.

🔍 How ChatGPT Analyzes Bitcoin Trends—Step by Step

Here’s where it gets beautiful: ChatGPT can’t read your mind, but it can work miracles if you give it the right prompts and data. The process is brutally simple:

- Collect Your Data: Download historical price charts, on-chain analytics, Twitter sentiment feeds, or whatever edge you have.

- Feed the Beast: Enter the data into ChatGPT with specific prompts—“Analyse Bitcoin’s 30-day volatility and spot trend reversals,” for example.

- Get Gold: Receive rapid, structured analysis—summaries, trading hypotheses, even Python scripts to automate technical indicator scans.

- Refine: Ask ChatGPT to clarify, compare, or backtest. The more detailed your questions, the more precise the answers.

The best traders know: the right input equals the right output. General questions get you general answers. Specifics bring you the kill.

💸 Data in, Dollars Out: Feeding ChatGPT What Matters

ChatGPT is only as smart as the data you give it. Want game-changing insight? Use structured information:

- Historical Prices: Upload candlestick data and ask for moving average crossovers.

- Technical Indicators: Feed in RSI, MACD, or custom metrics.

- Sentiment Data: Paste in social sentiment scores or news headlines.

- On-Chain Metrics: Whale wallet moves, hashrate, exchange flows—whatever you can dig up.

Most pros use dashboards and APIs to gather this data before passing it to ChatGPT. Platforms like TradingView, Glassnode, or LunarCrush let you extract data in seconds. For the ultimate edge, study MACD indicator momentum signals or master RSI crypto trading strategies to enhance your prompts.

Pro tip: The Wolf Of Wall Street’s community shares proprietary tools—volume calculators, sentiment analysis, and more. Leverage these resources to give ChatGPT real substance, not just theory.

🏆 Real-World Wins: Case Studies from the Trenches

Enough theory—here’s where the Wolfpack eats. Imagine a trader, drowning in data, using ChatGPT to analyse two years of Bitcoin price action. Instead of endless charts, he asks:

“ChatGPT, find the five most reliable trend reversals from 2022-2024 and backtest a Bollinger Bands strategy.”

Boom—minutes later, the AI spits out a summary, code for backtesting, and an edge that took others days to see. Result? Actionable trades, higher win rates, and real profits.

Or take the scenario of integrating social sentiment. A trader combines Twitter API data with on-chain whale movement and asks ChatGPT:

“When have negative social sentiment and whale inflows aligned with market bottoms?”

The result: a new trigger for entries that’s backtested, clear, and totally overlooked by 99% of the herd. This isn’t luck. It’s weaponised information.

🤖 AI vs Trading Bots: Know the Difference

Don’t get it twisted—ChatGPT isn’t just another trading bot. Most bots run on rigid scripts: “If this, then that.” ChatGPT, by contrast, is an adaptive analyst. It interprets patterns, context, and nuance across multiple data types.

Trading bots execute; ChatGPT thinks. But with great power comes great responsibility: it’s not immune to bad inputs or hallucinated outputs. Human oversight is critical. If you want to learn the real nuances between AI and bots, check out our deep dive on trading bots vs AI agents.

🔥 How the Pros Maximize ChatGPT (Without Getting Burned)

Here’s where you separate the sharks from the minnows:

- Validate Everything: Treat AI outputs as hypotheses, not gospel. Always cross-check with market data or other tools.

- Use Backtesting: Don’t act on a strategy ChatGPT suggests without running historical simulations.

- Mix Signals: Combine ChatGPT’s analysis with expert market commentary or premium signal services like The Wolf Of Wall Street for confirmation.

- Document Outcomes: Keep track of what works and what doesn’t. Continuous learning is the name of the game.

Risk Mitigation Checklist:

- Double-check AI-generated trade ideas.

- Use stop-loss orders and strict risk limits.

- Don’t ever allocate capital based on AI alone.

- Cross-verify with real-world data from sources like crypto news or trading dashboards.

🛠️ Advanced Setups: Integrating ChatGPT with Pro Tools

Want to play in the big leagues? Here’s how advanced traders push ChatGPT to the next level:

- API Integrations: Use Python or third-party platforms to pull data from TradingView, LunarCrush, or Glassnode into structured spreadsheets for ChatGPT to analyse.

- Multi-Source Synthesis: Ask ChatGPT to compare signals from different timeframes, indicators, or news events for multi-dimensional insight.

- Automate Prompting: Build templates that let you paste fresh data each day, so your AI analysis keeps up with the market.

To master technical setups, dig into Elliott Wave theory or explore trendline analysis—then feed these perspectives into ChatGPT for even richer outputs.

📚 Prompt Library: Unlocking Maximum Value from AI

ChatGPT’s output is only as good as your questions. Here’s how the Wolfpack crafts prompts:

- “Analyse the last 100 daily closes—find all RSI divergences that led to >10% moves.”

- “Compare sentiment shifts on Reddit with price volatility for Bitcoin in Q1 2024.”

- “Simulate a crossover strategy with 20/50 MA using historic BTC data from Jan–Jun 2023.”

- “Below is a table of Bitcoin daily closing prices for the past 30 days, along with trading volume and social sentiment scores.

Analyse the volatility, spot any clear trend reversals, and summarise the most significant market moves.

Highlight patterns, anomalies, and major support/resistance zones.” - “Based on the data above, what technical indicators (such as RSI, MACD, moving averages) confirm the observed trends?

Can you provide a summary of likely bullish and bearish signals?

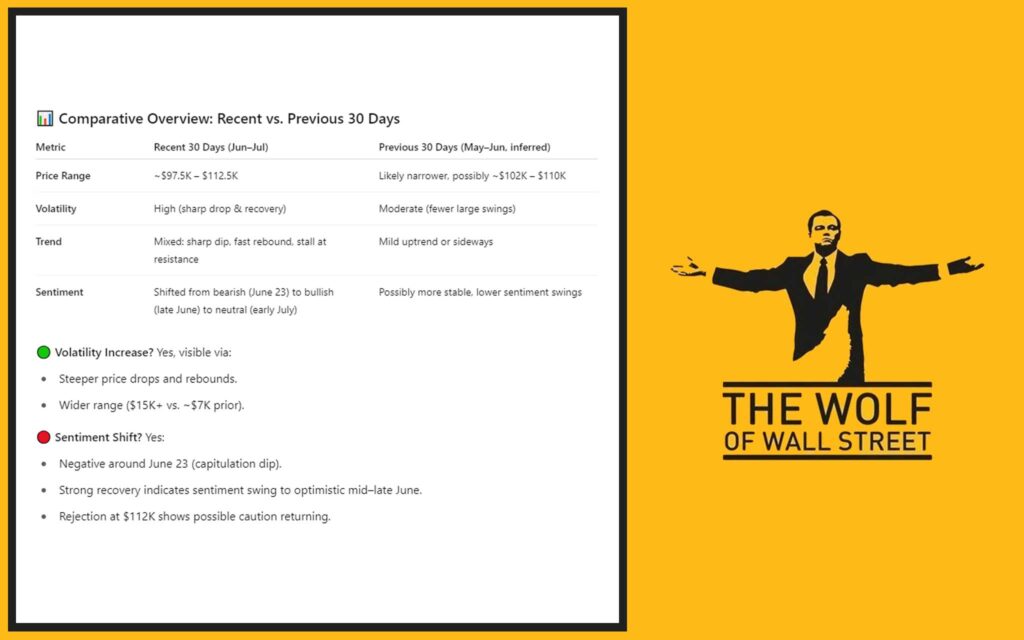

If possible, generate a simple Python script to backtest a trend-following strategy using this dataset.” - “Compare the recent Bitcoin price action with the previous 30-day period.

Has there been an increase in volatility, or a shift in sentiment?

Which indicator or combination of factors would have best predicted the last major price swing?

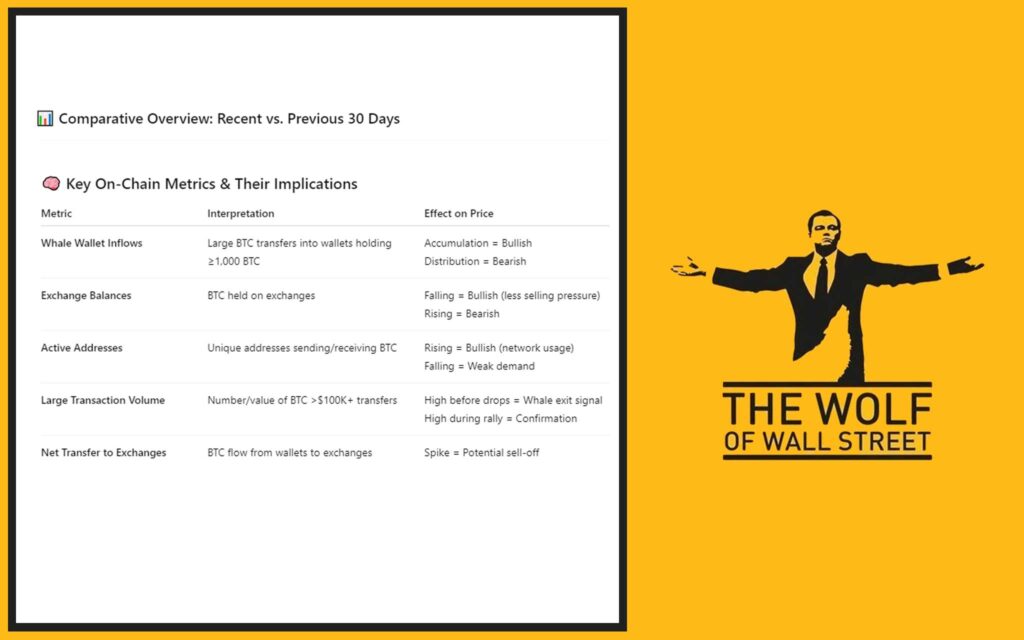

Suggest improvements or alternative strategies, and list any potential risks in following these signals.” - “Using the on-chain analytics provided (e.g. whale wallet inflows, active addresses, exchange balances),

analyse how these metrics correlate with recent price movements.

Can you identify leading indicators or warning signs for possible trend reversals?”

Want more? There are entire libraries and community forums where power users share high-conversion prompts and automation workflows. Explore resources like our crypto trading insights section or newbie guides to build your own arsenal.

🐺 Wolf-Level Trading: Combining ChatGPT with The Wolf Of Wall Street Community

Now, this is where you go from analyst to alpha. The The Wolf Of Wall Street crypto community isn’t just a group—it’s an entire trading ecosystem built for aggressive winners:

- VIP Signals: Get access to trade signals you won’t find anywhere else.

- Expert Analysis: Learn from seasoned pros breaking down complex moves in plain English.

- Essential Tools: Use The Wolf Of Wall Street’s calculators and resources to perfect your risk management and position sizing.

- 24/7 Support: Got a question? There’s always a Wolf ready to answer.

Combine The Wolf Of Wall Street’s proprietary signals and tools with ChatGPT’s analytical power, and you’re not just guessing—you’re executing with confidence, every single trade.

🚨 Risks, Limitations, and Red Flags

Let’s get brutally honest: ChatGPT is not a crystal ball.

Risks to watch:

- Overconfidence: The AI sometimes makes outputs sound more certain than they are. Treat its forecasts as educated opinions, not facts.

- “Hallucinations”: Sometimes ChatGPT will invent patterns or explanations—always double-check against actual market data.

- No Real-Time Feeds: If you need instant alerts, pair ChatGPT with real-time dashboards or professional signal groups like The Wolf Of Wall Street.

Ignore these warnings, and you’re setting yourself up to lose. Respect the tool, respect the process.

⚖️ Legal, Ethical, and Regulatory Considerations

AI in finance isn’t the Wild West anymore. Here’s what you need to know:

- Always comply with trading platform T&Cs and local financial regulations.

- Disclose any use of AI-driven decision tools if required—especially in managed portfolios.

- Avoid black-box trading: know what your AI is analysing, and be ready to justify your trades.

- Stay up-to-date on regulatory news and developments affecting digital assets and trading technology.

🔮 Quick-Start Guide: Setting Up Your ChatGPT Bitcoin Analysis

Want to get started today? Here’s how—step by step:

- Choose Your Data Sources: TradingView for charts, LunarCrush for sentiment, Glassnode for on-chain metrics.

- Gather and Export Data: Download to CSV or spreadsheet.

- Craft Your Prompt: E.g., “Based on this price action and RSI/MACD, identify the next likely Bitcoin trend reversal.”

- Feed to ChatGPT: Use the prompt and attach your data.

- Review Output: Compare with your own research and The Wolf Of Wall Street signals.

- Backtest: Run suggested strategies on historical data—don’t just trust, verify.

- Refine and Repeat: Adjust your prompts, add new indicators, level up every day.

For deeper dives, check out our guides on moving averages and market trends and the crypto order types every pro should master.

✅ Conclusion: The Wolf’s Final Word

Let’s call it straight. In 2025, the Bitcoin market is a battleground. The traders who thrive? They don’t play by old rules—they use every edge. ChatGPT gives you analysis at the speed of thought, The Wolf Of Wall Street hands you exclusive community intelligence, and you—armed with both—can dominate like a true Wolf of Wall Street.

Remember: AI isn’t about replacing you. It’s about unleashing your full potential. Pair it with real-world market insight, rigorous risk management, and the network firepower of The Wolf Of Wall Street, and you’ll stop chasing trends—you’ll start setting them.

FAQs: Everything Traders Ask About AI & Bitcoin

Q: Can ChatGPT predict the next Bitcoin move?

A: Not directly—it analyses structured data and identifies trends, but human validation is essential. Check trading insights for context.

Q: How do I avoid bad AI advice?

A: Validate every output, use backtesting, and compare with The Wolf Of Wall Street VIP signals or market news.

Q: Can beginners use ChatGPT for trading?

A: Absolutely! Start with our newbie crypto guides and build your prompt-writing skills.

Q: Is it safe to automate trading decisions with AI?

A: Only with strict risk controls and oversight. AI is a tool, not a replacement for good judgment.

Q: Where can I find more learning resources?

A: Explore defi strategies, market analysis guides, and The Wolf Of Wall Street’s Telegram community.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.