🌍 Introduction: The Green Question in Crypto

Here’s the deal. Everyone’s asking the same damn question: How green is Ethereum? For years, crypto’s been slammed as a climate villain — “Bitcoin burns more power than countries,” headlines screamed. And they weren’t wrong. Proof-of-work (PoW) mining was a furnace.

But Ethereum flipped the game. With the September 2022 Merge, it went from being one of the biggest polluters in crypto to the poster child for sustainability. We’re talking a 99%+ cut in energy use. That’s not just a change. That’s a revolution.

So let’s break it down — no fluff, no jargon, just the straight numbers, the strategy, and the future.

⚡ Ethereum at a Glance

Ethereum was born in 2015, thanks to Vitalik Buterin and a team of visionaries who saw Bitcoin’s limits. Instead of just being “digital gold,” Ethereum became the backbone for smart contracts, NFTs, DeFi, and entire ecosystems.

Fast-forward to May 2024: Ethereum boasts a $466.67 billion market cap, second only to Bitcoin. But unlike Bitcoin, it’s reinvented itself for the green era.

If Bitcoin’s the OG, Ethereum’s the disruptor — leaner, cleaner, and gearing up for mass adoption.

🔋 Proof-of-Work: Ethereum’s Old Energy Monster

Before the Merge, Ethereum used Proof-of-Work — the same system Bitcoin still runs on. Miners would run massive GPU rigs, guzzling electricity to solve cryptographic puzzles.

The result? A huge carbon footprint.

Ethereum’s PoW consumption rivalled mid-sized countries. And while Bitcoin hogged the spotlight, Ethereum wasn’t far behind.

Want a refresher on consensus models? Check out Proof-of-Activity hybrid blockchain consensus to see how different chains tackle this challenge.

🌱 The September 2022 Merge: Ethereum’s Green Revolution

Here’s where Ethereum pulled the trigger. The Merge switched the network from PoW to Proof-of-Stake (PoS). Instead of miners, you’ve got validators. Instead of burning megawatts, you stake ETH.

Impact? Energy consumption dropped by over 99%. Imagine shutting down an entire city of power plants overnight. That’s what the Merge achieved.

Ethereum didn’t just make itself sustainable. It gave crypto a PR facelift when the world was demanding greener solutions.

📉 How Much Energy Does Ethereum Use Now?

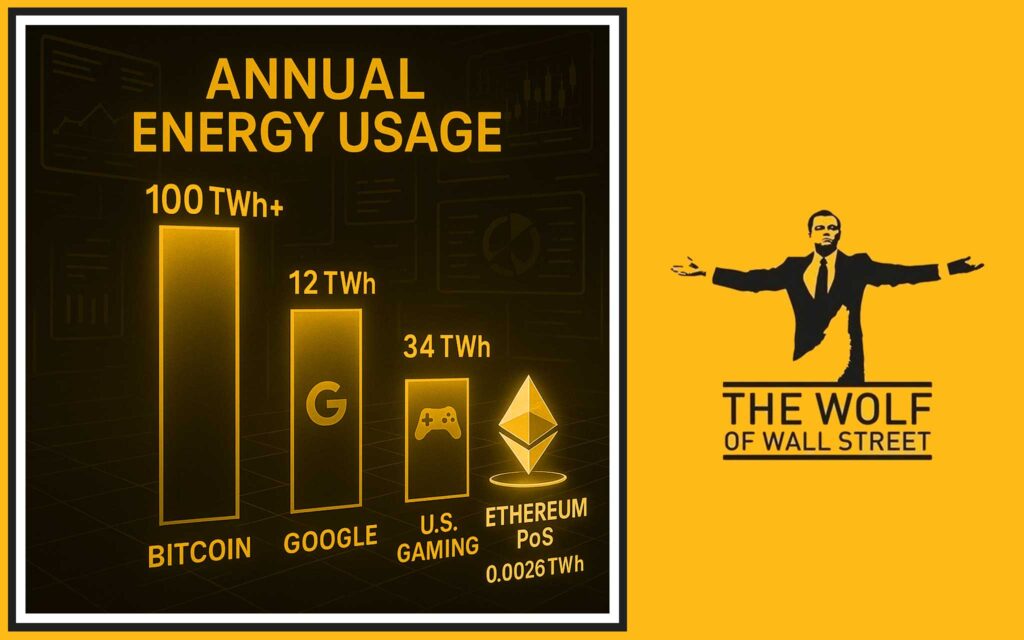

Let’s talk numbers. Post-Merge, Ethereum consumes just 0.0026 TWh per year.

Compare that to:

- Bitcoin: Over 100 TWh/year.

- Google: 12 TWh/year.

- U.S. video gaming: 34 TWh/year.

Ethereum’s entire network now uses less power than most tech giants’ office lights. That’s not greenwashing. That’s transformation.

🔋 Ethereum’s Renewable Energy Mix

Nearly 48% of Ethereum’s energy sources come from renewables like wind and nuclear. The rest? Natural gas, coal, and oil still play a role.

But here’s the kicker — Ethereum’s trajectory is pointed upwards. Unlike Bitcoin, which is still locked in PoW’s wasteful cycle, Ethereum is future-proofing itself with green alignment.

Cardano and Solana may talk greener, but Ethereum has the adoption, liquidity, and upgrades to back its case.

💸 Gas Fees: Did the Merge Fix Costs?

Let’s kill the myth: the Merge did NOT magically slash gas fees. Prices fell because demand cooled, not because of PoS.

Gas fees today? Still higher than early Ethereum years, though upgrades are making progress.

Want to sharpen your trading edge while navigating Ethereum’s gas fees? Check out our trading insights and tactical plays like Stochastic indicator trading strategies.

🚀 Network Speed & Scalability: The Real Bottleneck

The Merge cleaned Ethereum’s energy bill. But speed? Not yet.

Transaction throughput stayed largely the same. But here’s the Wolf’s rule: in business, you build the foundation before the skyscraper. The Merge set the stage for scalability.

That skyscraper’s coming.

🔧 The March 2024 Dencun Upgrade & Proto-Danksharding

Next step: the Dencun Upgrade with proto-danksharding.

Think of it like Layer-2 superchargers. By optimising how data is stored, Ethereum dramatically lowered transaction costs on L2 networks like Arbitrum and Optimism.

Gas relief? Check. Scalability? Check.

⚡ Full Danksharding: Ethereum at 100,000+ TPS

Now picture Ethereum running 100,000+ transactions per second. That’s what full danksharding promises.

For context:

- Visa processes ~65,000 TPS max.

- Ethereum today does ~15 TPS.

Once danksharding is live, Ethereum won’t just be green. It’ll be the fastest, leanest settlement layer on Earth.

🌐 The Bigger Picture: Ethereum’s Environmental Impact

Post-Merge Ethereum consumes less energy than Google, Netflix, or video gaming.

But here’s the catch: dApps and Web3 projects also add to the footprint. As DeFi, NFTs, and gaming explode, their energy impact can’t be ignored.

Ethereum’s green foundation is strong. But the ecosystem must evolve with equal efficiency.

🛡️ Ethereum’s Roadmap: Beyond Just Green

Ethereum isn’t stopping at energy cuts. The roadmap targets:

- Censorship resistance

- Stronger decentralisation

- Lower computational costs

This isn’t just a tech upgrade. It’s about building resilience in a decentralised financial future.

📊 Regulation & Institutional Adoption

Here’s where it gets juicy. In 2024, the SEC approved spot Ether ETFs.

Translation? Ethereum just got a green light to hit Wall Street portfolios.

Institutions love two things: profits and sustainability. Ethereum’s green shift makes it prime ESG material.

Check our Bitcoin & Ethereum ETFs guide to see how ETFs are reshaping crypto markets.

🕹️ The Human Side: Ethereum, dApps, and User Impact

For the everyday user, Ethereum’s greener stance matters less than gas fees and usability.

NFT minting, gaming, and DeFi all need to be cheap, fast, and eco-conscious. Danksharding could finally deliver this.

The Wolf’s call? Mass adoption follows affordability.

🧩 Ethereum vs Competitors: Who’s the Greenest?

- Solana: Blazing fast, greener than pre-Merge Ethereum, but plagued by outages.

- Cardano: Highly efficient PoS, but slow adoption.

- Avalanche & Polkadot: Scalable, but smaller ecosystems.

Ethereum wins because it’s not just green — it’s liquid, trusted, and battle-tested.

🔑 Lessons for Traders & Investors

Ethereum’s green narrative = bullish long-term signal.

Institutions care about optics, ESG funds care about sustainability, and traders care about momentum.

Forget hype coins. Ethereum’s roadmap is real, credible, and profitable.

Want to profit like a wolf? Master the timing of entries and exits with our crypto profit-taking guide.

🐺 Wolf’s Crypto Strategy: How to Profit from Ethereum’s Green Evolution

The Wolf’s rulebook:

- Narratives move markets. Ethereum’s green pivot is a goldmine.

- Layer-2s are leverage. Ride the scaling solutions.

- Don’t just HODL — trade smart. Use market psychology to your advantage.

Stay ahead of the curve with strategies like Trading bots vs AI agents 2025.

❓ FAQs

1. Is Ethereum really eco-friendly now?

Yes. Energy use dropped by 99% post-Merge. It’s one of the greenest large blockchains.

2. Will gas fees ever drop significantly?

Yes — danksharding aims to slash costs, especially on L2s.

3. What is danksharding in plain English?

It’s Ethereum’s data-scaling method, boosting speed to 100,000+ TPS.

4. Does Ethereum use more green energy than Bitcoin?

Yes. Ethereum leans ~48% renewable. Bitcoin? Far less.

5. How do Ether ETFs affect Ethereum’s growth?

They bring institutional capital — making ETH more mainstream.

🏁 Conclusion: How Green Is Ethereum, Really?

So, how green is Ethereum?

The Wolf’s verdict: It’s gone from a gas-guzzling monster to a lean, sustainable machine. Energy cut by 99%, roadmap locked for scalability, and institutions finally buying in.

Ethereum isn’t perfect. But it’s leading the pack. And if you’re a trader, investor, or builder? You bet your ass this matters.

Ethereum’s not just greener. It’s built for the future of finance.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals to maximise trading profits.

- Expert Market Analysis from seasoned crypto traders.

- Private Community of 100,000+ members.

- Essential Trading Tools (volume calculators, resources).

- 24/7 Support from a dedicated team.

👉 Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street Service

- Join Telegram: The Wolf Of Wall Street Community

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.