🚀 Introduction: So, You Wanna Be a Crypto God?

You’ve tasted the action buying crypto, maybe made a few smart moves, seen your portfolio swell. Good for you. But let me tell you, that’s just dipping your toes in the water. The real power, the ultimate flex in this digital wild west, isn’t just holding assets – it’s creating them. That’s right, I’m talking about forging your own crypto token.

Why now? Because the game has changed. You don’t need to be some MIT-graduated, code-slinging genius anymore. The barriers to entry have been smashed to smithereens. The tools are accessible, the platforms are hungry for new blood, and the market? The market is always looking for the next big thing. This isn’t just some tech fad; launching your own token is your golden ticket to the big leagues, a chance to build a community, a brand, an empire. If you’ve got the vision and the guts, I’m about to show you exactly how to create a crypto token.

🪙 Coins vs. Tokens – Know Your Damn Arsenals!

Before you charge into battle, you need to understand your weaponry. Not all digital assets are created equal. There’s a fundamental difference between coins and tokens, and knowing this distinction is step one to not looking like a clueless amateur.

What’s a Coin? Think Bitcoin, Think Ethereum – The Kings of Their Own Castles

A coin, my friend, is the native asset of its own blockchain. Think Bitcoin (BTC) – it runs on the Bitcoin blockchain. Think Ether (ETH) – it powers the Ethereum blockchain. These are the sovereigns, the monarchs of their own digital realms. They are the foundational layer, the bedrock upon which other things can be built. Creating a new coin from scratch means building an entirely new blockchain. That’s heavy lifting, complex, and usually reserved for those with serious technical firepower and a revolutionary idea.

What’s a Token? Your Key to Building on Their Kingdoms

Now, a token is a different beast altogether. Tokens don’t have their own blockchain. Instead, they live on existing blockchains. They’re like tenants in a skyscraper, leveraging the infrastructure, security, and network effects of an established platform. This is where the opportunity lies for most aspiring crypto creators.

- The Power of Existing Blockchains: Riding on the Shoulders of Giants

Why reinvent the wheel when you can hitch a ride on a Ferrari? Building a token on an established blockchain like Ethereum, BNB Smart Chain, or Solana means you inherit their security, their user base, and their development tools. It’s a massive shortcut. - ERC-20, BEP-20, SPL: Your Alphabet Soup for Success

These are token standards. ERC-20 tokens run on Ethereum, BEP-20 on BNB Smart Chain, and SPL on Solana. These standards ensure compatibility, meaning your token can easily be listed on exchanges, stored in wallets, and interact with other applications within that ecosystem. Think of them as pre-approved blueprints for your token.

For ninety-nine percent of you, creating a token is the smarter, faster, and more strategic route to market. It allows you to focus on your project’s utility, community, and marketing, rather than getting bogged down in the monumental task of building and maintaining a new blockchain.

🛠️ Choosing Your Blockchain Battlefield – Where Will Your Token Reign?

Alright, so you’re going the token route – smart move. Now, you need to pick your kingdom. The blockchain you choose will define your token’s capabilities, its transaction costs, its speed, and the community you can tap into. This isn’t a decision to take lightly.

Ethereum: The OG, The Secure Behemoth (But Watch Those Gas Fees!)

Ethereum is the undisputed king of smart contract platforms. It’s where DeFi was born, where NFTs exploded. It’s battle-tested, secure, and has the largest developer community on the planet.

- Pros: Unmatched security due to its massive, decentralized network. The largest and most active ecosystem of DApps, exchanges, and users. Mature development tools and a vast pool of developer talent. Strong reputation and high investor confidence.

- Cons: Gas fees! Transaction costs on Ethereum can be notoriously high, especially during peak times. This can make your token expensive to trade or use for small transactions. Scalability has been an issue, though upgrades are addressing this.

If your project demands the highest security and you’re targeting users who are already comfortable in the Ethereum ecosystem (and can stomach the fees), it’s a powerful choice.

BNB Smart Chain (BSC): The Cost-Effective Challenger

BNB Smart Chain (formerly Binance Smart Chain) emerged as a faster, cheaper alternative to Ethereum, largely compatible with Ethereum’s tools (EVM compatible).

- Pros: Significantly lower transaction fees compared to Ethereum. Faster transaction speeds. A rapidly growing ecosystem with strong backing from Binance, one of the world’s largest crypto exchanges. Easy for users to switch from Ethereum.

- Cons: It’s less decentralized than Ethereum, which can be a concern for purists. It has faced scrutiny regarding the number of scam projects that initially flocked to it due to low barriers to entry.

BSC is a strong contender if your token requires frequent, low-cost transactions and you want to tap into a large, retail-focused user base.

Solana: The Speed Demon for High-Volume Hustles

Solana is built for speed and scale. It boasts incredibly high transaction throughput and rock-bottom fees, making it attractive for projects that need to handle massive volume.

- Pros: Lightning-fast transaction speeds (thousands per second). Extremely low transaction costs, often fractions of a penny. A burgeoning ecosystem, particularly strong in areas like high-frequency trading, gaming, and certain types of DeFi.

- Cons: It’s a newer blockchain compared to Ethereum and has experienced some network outages and stability issues in the past, raising concerns about its reliability under extreme load. The developer ecosystem, while growing, is not as mature as Ethereum’s.

If your token is designed for high-volume applications, like a game with many micro-transactions or a DeFi protocol needing rapid execution, Solana is definitely worth a look. Understanding the nuances of different blockchains is key; you can gain more insight by exploring various Layer 1 and Layer 2 Solutions to see how these foundational platforms differ and evolve.

💥 The “No-Code” Revolution – Minting Tokens Without Being a Nerd (Pump.fun Style)

Now, let’s get to the juicy part. You’re probably thinking, “This sounds great, Wolf, but I can’t code my way out of a paper bag!” Ten years ago, you’d be right to worry. Today? Forget about it. The game has been democratized. You can now create a crypto token with just a few clicks, no PhD in computer science required.

The Game Changer: Tools That Let Anyone Create a Token

Welcome to the era of no-code and low-code token generation platforms. These services abstract away all the complex smart contract coding, offering you a simple web interface to define and deploy your token.

- Introducing Pump.fun: Your Express Lane to Token Creation

Platforms like Pump.fun have exploded in popularity, especially on Solana, precisely because they make token creation absurdly easy. You connect your wallet, fill in a few fields – token name, ticker symbol, total supply, maybe a picture – pay a small fee, and BAM! Your token is live. It’s almost too easy. - The “Quant Kid” Story: If a 13-Year-Old Can Do It (And Rug It), So Can You (But Play It Straight!)

You might have heard stories, like the one about the “Quant Kid,” a 13-year-old who reportedly created a meme token and then “rugged” (pulled the liquidity, making the token worthless). While the ethics are highly questionable and illegal, it illustrates a critical point: the barrier to technical creation is incredibly low. The real challenge, and where you differentiate yourself as a legitimate player, is in building real value, a solid community, and operating with integrity. Don’t be a chump looking for a quick scam; aim to build something lasting.

Step-by-Step: How to Use Pump.fun Like a Boss (Conceptual Overview)

While specific steps vary slightly between platforms, the general flow is similar:

- Get a Compatible Wallet: You’ll need a web3 wallet compatible with the blockchain you’ve chosen (e.g., Phantom for Solana, MetaMask for Ethereum/BSC). Fund it with a small amount of the native currency for gas fees (e.g., SOL, ETH, BNB).

- Connect Your Wallet: Navigate to the token creation platform (like Pump.fun) and connect your wallet. This grants the platform permission to interact with your account to deploy the token.

- Filling in the Blanks: Name, Ticker, Supply – Your Token’s DNA:

- Name: What’s your token called? Make it memorable, relevant to your project.

- Ticker Symbol: The 3-5 letter abbreviation (e.g., BTC, ETH, WOLF). Keep it short and catchy.

- Total Supply: How many tokens will ever exist? This is a crucial part of your tokenomics.

- Decimals: How many decimal places can your token be divided into? (e.g., 18 is common for Ethereum).

- (Optional) Logo/Image: Give your token some visual flair.

- Paying the Piper: The (Small) Price of Creation: There will be a fee to deploy the smart contract, usually paid in the native currency of the blockchain. On platforms like Pump.fun, this can be very low.

- Deploy! Click the button. The platform handles the smart contract deployment. Within minutes, your token exists on the blockchain.

Limitations: What You Get, and What You Don’t (Customization vs. Speed)

These easy-to-use platforms are fantastic for getting a basic token off the ground quickly, especially for meme coins or simple community tokens. However, the trade-off for this simplicity is limited customization. You usually get a standard token contract. If you need advanced features like governance mechanisms, automated buybacks, reflection rewards, complex vesting schedules, or unique tax functions, these template-based creators won’t cut it. For that, you need to go pro.

If you’re just starting out and want to dip your toes in, these platforms are a fantastic way to learn. For more foundational knowledge, especially if you’re new to the crypto space, exploring our Newbie section can provide a solid grounding.

👨💻 Going Pro – Smart Contracts for the Serious Player

So, the “easy button” on Pump.fun isn’t enough for your grand vision? You want a token that does more than just exist? You want a token with unique features, custom-tailored tokenomics, something that screams “premium”? Then, my friend, you need to dive into the world of custom smart contracts.

When “Easy Mode” Isn’t Enough: Advanced Customization

A standard token is fine for a laugh, but if you’re building a serious project – a DeFi protocol, a gaming ecosystem, a DAO – you’ll need a smart contract that reflects your specific needs. This is where you bake in the rules, the logic, and the unique selling propositions of your token.

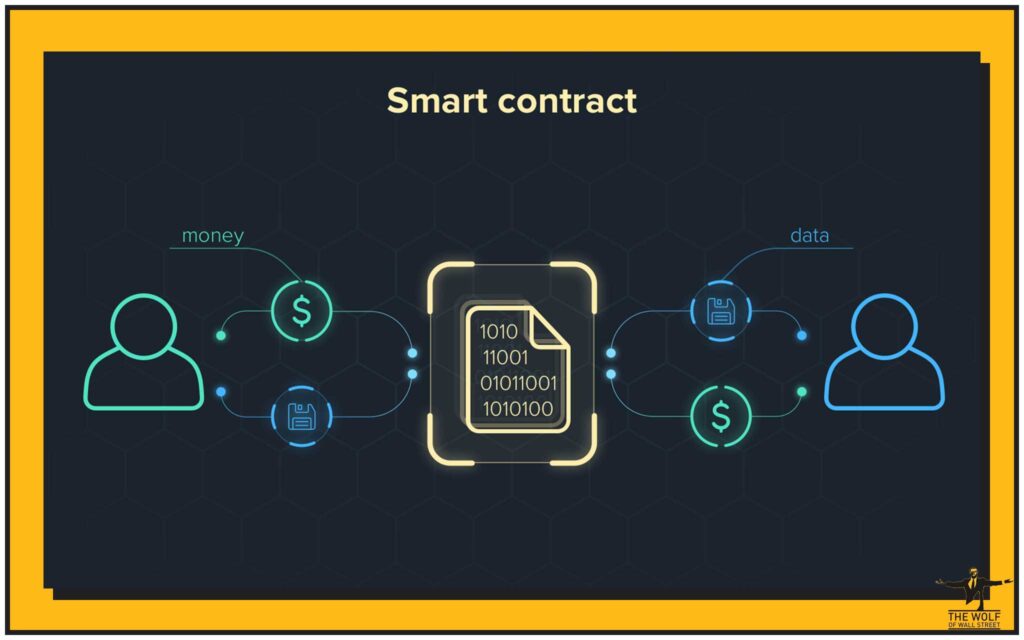

What is a Smart Contract? Your Token’s Rulebook, Written in Code

Think of a smart contract as a digital vending machine or a self-executing agreement. It’s a piece of code that lives on the blockchain and automatically enforces the terms of an agreement or the rules of your token. Once deployed, it runs exactly as programmed, without the need for intermediaries. This is where the true power of blockchain technology shines.

Key Features You Might Want: Governance, Custom Tokenomics, Vesting Schedules

With a custom smart contract, the sky’s the limit (almost):

- Governance: Allow token holders to vote on key project decisions.

- Custom Tokenomics: Implement features like transaction taxes that fund marketing or liquidity, reflection rewards that distribute tokens back to holders, or burn mechanisms that reduce supply over time.

- Vesting Schedules: Lock up tokens for team members or early investors, releasing them gradually over time to prevent premature sell-offs.

- Staking Mechanisms: Allow users to lock up their tokens to earn rewards.

- Integration with other DApps: Design your token to interact seamlessly with other protocols.

Finding a Developer: Don’t Get Fleeced – Hire Smart, Not Cheap

Unless you’re a seasoned Solidity (for Ethereum/BSC) or Rust (for Solana) developer, you’ll need to hire someone. This is a critical step. Do not cheap out here. A poorly written smart contract can have bugs that lead to catastrophic losses or vulnerabilities that hackers will exploit.

- Look for developers with a proven track record and public portfolios (e.g., GitHub).

- Check references. Ask for examples of similar projects they’ve completed.

- Be wary of anonymous developers or those promising impossibly fast turnarounds at rock-bottom prices.

The Audit: Your Non-Negotiable Shield Against Disaster

Once your smart contract is written, GET IT AUDITED. I cannot stress this enough. A smart contract audit is a thorough review by a reputable third-party security firm that specializes in blockchain code. They will scrutinize your contract line by line, looking for vulnerabilities, bugs, and potential exploits. An audit report from a respected firm builds trust with your community and investors. It’s an investment, not an expense.

📣 Marketing Your Masterpiece – From Launch to Legend

Alright, so you’ve minted your token. Congratulations. Now for the hard part: making people give a damn. You can have the most technically brilliant token in the world, but if nobody knows about it, or worse, nobody wants it, you’ve just created digital dust. Marketing isn’t an afterthought; it’s the fuel that launches your rocket.

Build It and They Will Come? Don’t Be a Fool!

This is the biggest lie in the startup world, and it’s doubly true in the hyper-competitive crypto space. You need to hustle. You need to create a narrative. You need to build a tribe.

Community is King: Telegram, Discord, Twitter – Your Digital Army

Your community is your lifeblood. These are your evangelists, your early adopters, your defenders.

- Telegram & Discord: These are the HQs for most crypto projects. Create active, moderated groups. Engage with your community daily. Answer questions, share updates, build rapport.

- Twitter (X): Your megaphone to the wider crypto world. Share news, create engaging content, run polls, and interact with influencers and other projects.

- Creating Buzz: AMAs, Giveaways, Early Access:

- AMAs (Ask Me Anything): Host sessions on platforms like Twitter Spaces or in your Telegram group to directly engage with potential users and investors.

- Giveaways & Airdrops: Strategically distribute a small portion of your tokens to generate initial interest and reward early community members. Be careful with airdrops to avoid attracting only “airdrop hunters.”

- Early Access/Whitelists: Offer perks or guaranteed allocation to early supporters.

Social Media Blitz: How to Make Your Token Go Viral (The Right Way)

Create high-quality, shareable content. Think memes (used strategically), infographics, short videos explaining your project, and testimonials. Run targeted ad campaigns if you have the budget, but focus on organic reach first. Identify the platforms where your target audience hangs out.

Influencers and Partnerships: Leveraging Other People’s Audiences (Carefully!)

Crypto influencers can provide massive exposure, but tread carefully.

- Due Diligence: Research influencers thoroughly. Do they have genuine engagement? Do their values align with your project? Are they known for shilling scams?

- Transparency: Ensure any paid promotions are clearly disclosed.

- Strategic Partnerships: Collaborate with other legitimate projects in your ecosystem for cross-promotion.

Whitepapers and Websites: Your Token’s Professional Face

- Whitepaper: This is your project’s bible. It should clearly articulate the problem your token solves, its utility, your tokenomics, your roadmap, and your team (if not anonymous). It needs to be professional, well-written, and convincing.

- Website: Your digital storefront. It should be clean, informative, easy to navigate, and clearly present your value proposition and call to action (e.g., how to buy your token, join your community).

Understanding the entire journey, including how your token might eventually be listed, is beneficial; our insights on the Crypto Token Listing Process: The Real Game Behind the Glitz can offer a broader perspective on a token’s lifecycle.

⚖️ The Legal Gauntlet – Don’t End Up in Handcuffs

Now for the part that makes most people sweat, and for good reason. The legal and regulatory landscape for cryptocurrencies is a minefield, a constantly shifting patchwork of rules that vary wildly by jurisdiction. Ignoring this can lead to catastrophic consequences: crippling fines, project shutdowns, and yes, even jail time.

The Elephant in the Room: Securities, Regulations, and a Whole Lot of Grey Area

The biggest question often boils down to this: Is your token a security? In the US, authorities like the SEC use the Howey Test to determine this. If people are investing money in your token with the expectation of profits primarily from the efforts of others (i.e., your team), it’s likely to be considered a security. Selling unregistered securities is a serious crime.

The Risks are Real: Lawsuits, Fines, and Jail Time (Just Ask the Pump.fun Guys)

Don’t think you’re too small to get noticed. Regulators are increasingly cracking down. We’ve seen lawsuits against platforms like Pump.fun itself, highlighting that even facilitators aren’t immune. Project founders have faced severe penalties. This isn’t fear-mongering; it’s a dose of reality.

Due Diligence: Your Only Defense – Consult Legal Professionals!

I am not a lawyer, and this is not legal advice. Before you even think about launching a token that could attract investment, consult with a qualified lawyer specializing in cryptocurrency and securities law in your jurisdiction and any jurisdiction you plan to target. This is non-negotiable. They can help you structure your project, your tokenomics, and your marketing in a way that minimizes legal risk. It will cost you money, but it could save your ass.

Transparency: Your Best Friend in a Skeptical Market

Be honest and upfront about your project, its risks, and your team (if you’re not anonymous). Misleading claims or promises of guaranteed returns are red flags for regulators and will destroy trust with your community. Clear disclaimers are essential.

To stay informed on the broader regulatory trends and discussions that might impact your project, it’s wise to keep an eye on developments in Policies.

💡 Post-Launch Power Plays – Keeping the Dream Alive

Launching your token isn’t the finish line; it’s the starting gun. The real work begins after your token is out in the wild. You need to sustain momentum, deliver on your promises, and navigate the choppy waters of the crypto market.

Liquidity Provision: The Lifeblood of Your Token

If people can’t easily buy or sell your token, it’s dead in the water. You’ll need to provide liquidity on decentralized exchanges (DEXs) like Uniswap (for Ethereum) or Raydium (for Solana). This usually involves pairing your token with a more established cryptocurrency (like ETH, BNB, or SOL) in a liquidity pool. The more liquidity, the less price volatility (slippage) when people trade.

Exchange Listings: Getting Your Token into the Hands of the Masses

Getting listed on centralized exchanges (CEXs) can significantly boost your token’s visibility, credibility, and trading volume. However, listings can be expensive and require meeting stringent criteria. Start with smaller, reputable exchanges and work your way up as your project grows.

Roadmap and Development: Show Your Community You’re Building for the Future

Your initial whitepaper outlined a roadmap. Now you need to deliver. Consistently ship updates, new features, and partnerships. Communicate your progress transparently. A project that stops developing is a project that’s dying.

Managing Expectations: Not Every Token is a Moonshot (But Yours Could Be!)

Be realistic with your community and yourself. The vast majority of tokens fail or fade into obscurity. Success requires hard work, smart decisions, a bit of luck, and relentless dedication. Focus on building real utility and a strong community, and the price will (hopefully) follow. Don’t get obsessed with short-term price action.

The “Educational Experience”: Learning from Every Venture

Even if your first token doesn’t make you a billionaire, the experience of creating and launching it is invaluable. You’ll learn a ton about blockchain technology, smart contracts, marketing, community building, and the crypto market. Every venture, success or failure, is a lesson that makes you sharper for the next one.

🐺 Conclusion: You’ve Got the Keys – Now Build Your Damn Empire!

So there you have it. The raw, unfiltered truth on how to create a crypto token. We’ve walked through the trenches, from understanding the difference between coins and tokens, to choosing your blockchain, minting with no-code tools, diving into custom smart contracts, marketing like a madman, navigating the legal minefield, and keeping your project alive post-launch.

The power of creation is now firmly in your hands. The barriers are down, the tools are accessible. The question is no longer can you do it, but will you? Will you seize this moment, take this knowledge, and forge something out of nothing? Or will you sit on the sidelines and watch others build the future?

Go forth and mint. The world is your oyster. Just remember, with great power comes great responsibility. Build with integrity, build with passion, and build something that lasts. This is your chance to stop dreaming and start doing, now that you truly know how to create a crypto token.

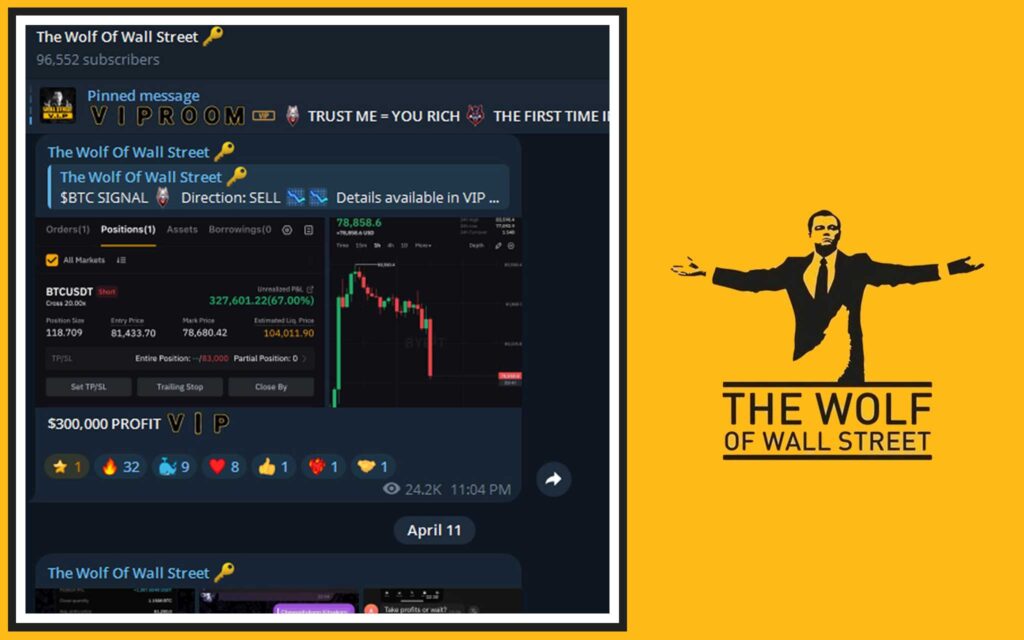

And listen, as you embark on this journey, remember that even the lone wolf needs a pack, or at least the sharpest tools. For those serious about navigating these volatile markets, whether you’re launching a token or trading established giants, having an edge is crucial. That’s where a community like The Wolf Of Wall Street comes into play. Think Exclusive VIP Signals to nail those market entries, Expert Market Analysis from traders who’ve been in the trenches, a Private Community of over 100,000 like-minded individuals for unparalleled insights and support, Essential Trading Tools like volume calculators, and 24/7 Support when you need it most. Don’t just play the game; dominate it. Empower your entire crypto journey by visiting https://tthewolfofwallstreet.com/ and plugging into our Telegram at https://t.me/tthewolfofwallstreet. Unlock your potential.

FAQs: Your Burning Questions Answered by the Wolf

- Can I really create a crypto token with no coding skills?

Absolutely. Platforms like Pump.fun (especially on Solana) or token minting tools on other blockchains (like Cointool.app for EVM chains) allow you to create a basic token by filling out a web form and paying a small gas fee. Customization will be limited, but for a simple token, no coding is needed. - How much does it cost to create a crypto token?

It varies massively. Using a simple no-code platform on a cheap blockchain like Solana might cost you less than $100 in fees. Creating a custom smart contract for Ethereum, getting it audited by a top firm, and handling legal consultations can run into tens of thousands, or even hundreds of thousands, of dollars. - What are the biggest mistakes people make when launching a token?

Ignoring security (no audit), having terrible tokenomics (no utility or unsustainable supply), failing at marketing and community building, promising unrealistic returns, and completely neglecting the legal and regulatory aspects. Oh, and rug pulls – don’t be that scumbag. - How do I make my token valuable?

Value comes from utility, scarcity, demand, and community. Your token needs a reason to exist – what problem does it solve? What can people do with it? Build a strong, engaged community that believes in your project. Create well-thought-out tokenomics. And deliver on your roadmap. There’s no magic button. - Is creating a meme coin a good idea?

It can be a lottery ticket, but it’s incredibly high risk and most meme coins go to zero. If you’re doing it for fun, with money you can afford to lose entirely, and you’re transparent, maybe. But if you’re looking to build sustainable value, focus on utility rather than just hype. The meme coin space is saturated and driven by fleeting trends.