⚡️ How the US Taxes Crypto (Property, Not Currency)

If you trade crypto in the US and don’t understand the tax rules, you’re gambling with loaded dice. I’m going to make this simple, fast, and brutally practical. For US federal purposes, the IRS treats digital assets as property. That means your crypto behaves like shares: when you dispose of it-sell for dollars, swap coin-for-coin, or spend it on goods-you’ve got a taxable event. When you merely hold it, there’s no tax. That’s the playing field. Master it, and you keep more profit in your pocket.

Key point: the holding period sets your rate. Hold for one year or less and gains are short-term (taxed at your ordinary income bracket). Hold for more than one year and you unlock long-term rates, which are typically lower. This is Tax 101 for crypto-ignore it and you’ll bleed cash. (See the IRS overview on digital assets: IRS Digital Assets.)

For timing clarity (tax year vs tax season) and planning your filing sprints, read our guide on US crypto tax timelines. If you’re completely new, start with the virtual currency primer to ground the basics before you deploy capital.

🧭 The Money Shot: What’s Taxable vs What Isn’t (With Examples)

Let’s strip the confusion. Below is the quick reality check that separates winners from audit bait.

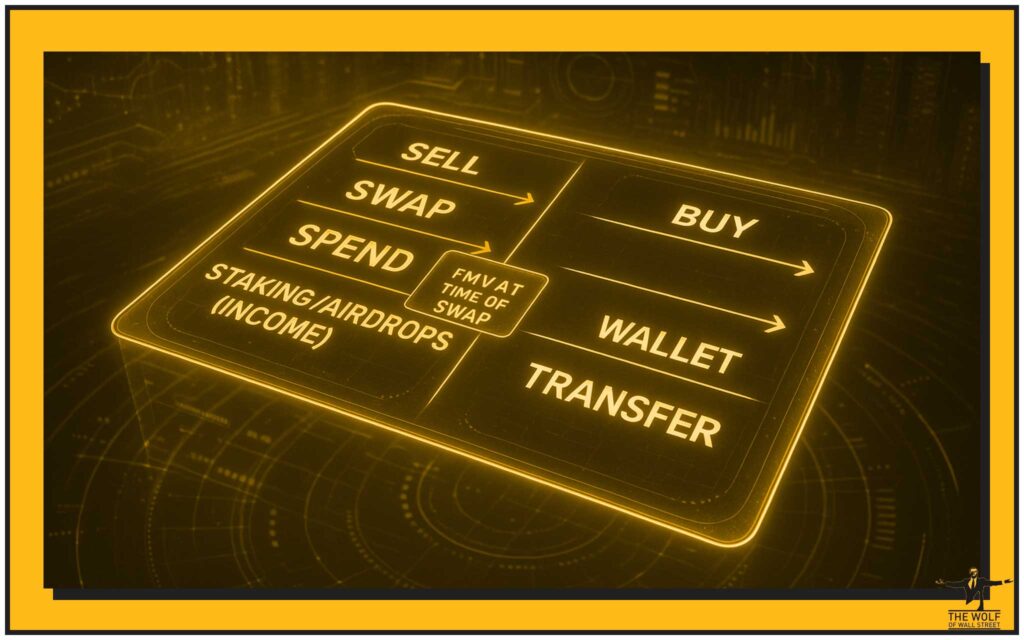

Taxable events (you realise a gain or loss):

- Sell BTC for USD at a profit → capital gain. Sell at a loss → capital loss.

- Swap ETH→SOL → you disposed of ETH and acquired SOL; the ETH leg is a gain or loss.

- Spend crypto for a laptop/flight → you disposed of property at the purchase price’s fair market value (FMV); that creates a gain or loss compared to your basis.

- Receive staking rewards/mining income/airdrops → ordinary income at FMV on receipt; when you later sell, you calculate a separate capital gain/loss from that new basis.

Generally not taxable (but document it):

- Buying crypto with fiat and simply holding.

- Wallet-to-wallet transfers you control (no change in beneficial ownership). Mind the kicker: fees paid in crypto during a transfer are disposals of that fee amount.

Want to get your execution tighter? Brush up on order mechanics with our guide to crypto order types and if you still need an on-ramp refresh, see how to buy crypto like a pro. (IRS FAQs cover these scenarios in plain terms: IRS FAQs.)

💥 Short-Term vs Long-Term: Rate Reality and Strategy

Short-term gains (≤ 1 year) are taxed at your ordinary income bracket. Long-term gains (> 1 year) enjoy reduced brackets. That’s not a suggestion-that’s the edge. If you’re flipping constantly, you’ll pay more. If you plan entries and exits to cross the one-year mark, you legally compress your tax drag. The rate thresholds change by year, but the rule doesn’t: time in asset can beat timing the market. See the capital gains primer here: IRS Topic 409.

When sizing exits, combine technicals with tax. If your thesis is intact and you’re 20 days from long-term status, waiting can be pure alpha. Learn smart exit frameworks in when to sell crypto and lock in discipline with the profit-taking playbook.

🧮 Cost Basis, Lot Selection, and Rock-Solid Proof

Your gain or loss = proceeds – adjusted basis. Basis includes what you paid plus eligible fees. If you don’t track basis, the IRS assumes what’s least generous. Don’t give them that satisfaction.

Lot selection methods:

- FIFO (first in, first out): default for many; simple, but not always tax-efficient.

- HIFO (highest in, first out): deliberately sells your most expensive lots first to minimise gains.

- Specific Identification: you pick the exact lot you’re selling-if and only if you can prove it with timestamps, TXIDs, and exchange/wallet records.

Here’s your move: choose a method, document it, and stick to it consistently unless you have a solid reason to change. If you want to go deep, study FIFO vs HIFO vs Specific ID. Keep parallel notes about why you selected certain lots; intent matters in audits.

Pro tip: run monthly reconciliations so you’re not panicking in April. Use trend discipline from our guides to trendlines and MACD momentum to pair exits with tax outcomes.

🧾 Forms and Filing Workflow (Form 8949, Schedule D, 1099-DA)

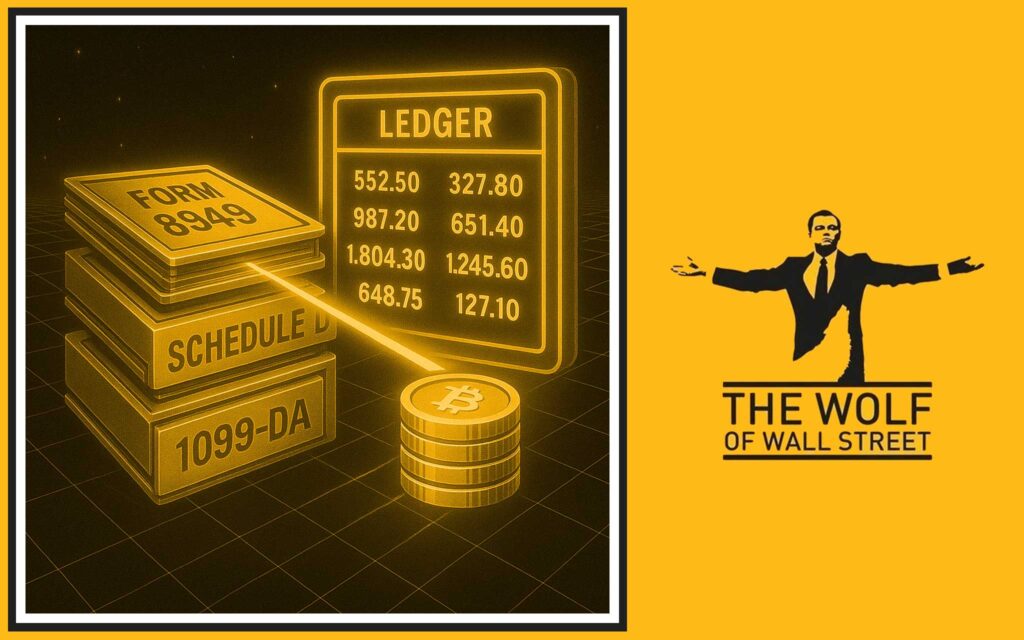

Paperwork wins audits before they start. Your crypto disposals get itemised on Form 8949, summarised on Schedule D, and then folded into Form 1040. And yes, that digital asset question at the top of the 1040 is not optional-answer it accurately.

From 2025 onward, expect more counterparties to issue Form 1099-DA under the broker reporting rules. You’ll reconcile what you receive against your own ledger; never rely solely on a single exchange report. Mismatches happen-fix them before the IRS does. Read the broker-reporting update direct from the source: IRS: Broker Reporting Rules.

For sustained improvement, bookmark this pillar and our complete reporting guide-it maps every step from CSV exports to final filing.

🧠 Income from Crypto: Staking, Mining, Airdrops, NFTs, DeFi

Income is income-at the moment you have dominion and control. For staking rewards, mining payouts, and airdrops, you recognise ordinary income at the USD fair market value on receipt. Later, when you sell that asset, you compute a capital gain or loss using that income amount as your basis. Track it all.

NFTs: If you mint and sell, you may recognise ordinary income on sales/royalties (facts matter: trader vs investor, creator vs collector), then capital treatment on later disposals of inventory or investments. Gas fees can increase basis-log them precisely.

DeFi: Lending, borrowing, LPing, and reward tokens vary by protocol. Token-for-token exchanges are commonly disposals. Interest-like rewards are typically income. Bridges, wrappers, rebasing tokens-document every leg. If you’re pushing into decentralised perpetuals, power up with our deep-dive on dYdX and keep your security tight with ZKP essentials.

🧯 Losses, Wash Sales (Myth vs Reality), and Harvesting

Losses aren’t failure-they’re fuel. Capital losses offset capital gains; excess losses typically carry forward. Many traders ask about wash sales. The classic wash-sale rule applies to stocks and securities; crypto isn’t explicitly covered the same way in current code-but that doesn’t mean the party’s consequence-free. Regulators can change the rules and the IRS can challenge sham transactions. Don’t play games with circular trades or repurchases that scream “manufactured loss.”

Run a harvesting framework: identify under-performers, rotate intelligently, and avoid instantly rebuying the same position in a way that undermines substance. Document intent and economic reality. Combine these tactics with market structure strategies in our dominance-trading guide.

🛡️ Compliance: Records, Audits, and Staying Clean

Audit defence starts on day one. Keep:

- Exchange and wallet CSV exports

- TXIDs and on-chain references

- FMV sources at the time of each transaction

- Notes explaining transfers between your own wallets

- Fee logs (network + trading)

Common audit flags: answering “No” to the 1040 digital asset question when you traded; mismatches between 1099-DA and your return; big transfers with no notes. Our guides to crypto AML compliance and the Travel Rule help you build a bulletproof paper trail.

🎯 Practical Scenarios (Mini Case Studies)

Casual investor (2 exchanges, 1 self-custody wallet): Buys BTC, swaps to ETH, later spends ETH on a laptop. Tax path: 1) ETH disposal at FMV when spent, 2) report on Form 8949, 3) basis tracked from the original BTC→ETH swap. Mistakes to avoid: mixing personal transfers with trades; forgetting network-fee disposals.

DeFi participant (LP tokens + rewards): Provides liquidity, earns reward tokens, migrates across a bridge. Tax path: income at receipt for rewards; disposals for each token exchange; potential capital gain on exit of LP. Keep all TXIDs; record wrapper and bridge events.

NFT creator/trader: Mints, sells, receives royalties, then rotates into other collections. Tax path: income on sales/royalties; capital results on subsequent disposals; gas fees added to basis where eligible. Maintain separate ledgers for creation vs investment.

Need foundations before you scale? Hit the newbie hub and sharpen your edge in trading insights.

📋 Seven-Step Action Plan (Execute Today)

- Export 2024–2025 CSVs from every exchange and wallet.

- Pick a basis method-default to FIFO unless you’re documenting HIFO/Specific ID.

- Reconcile disposals; tag non-taxable wallet transfers.

- Categorise income: staking, airdrops, mining; log FMV at receipt.

- Populate Form 8949 → Schedule D; prepare for 1099-DA reconciliation.

- Set calendar reminders for tax milestones and monthly reconciliations.

- Create a “close-out” ritual on the last business day each month so April becomes admin, not triage.

For calendar context and deadlines, revisit our tax season explainer.

🐺 The Wolf’s Playbook: Stay Profitable, Stay Compliant

Markets reward speed and discipline. You bring the trades; we bring the edge. Tap into The Wolf Of Wall Street to supercharge both profit and compliance momentum: VIP signals, expert market analysis, a 150,000+ private community, battle-tested calculators and tools, and 24/7 support when you need it most. That’s how you compound.

Start with the The Wolf Of Wall Street service hub for a full breakdown, then jump into the Telegram war room here: The Wolf Of Wall Street on Telegram. Build a repeatable system, trade with intent, and keep the tax man out of your profits.

❓ FAQs (Rapid-Fire)

Do I pay tax if I only hold crypto and never sell? No. You need a disposal or income event. Holding alone isn’t taxable.

How are crypto-to-crypto swaps taxed? As disposals of the asset you give up, using FMV of what you receive to measure gain/loss.

What forms do I use to report crypto? Form 8949 for each disposal, Schedule D to summarise, and Form 1040 to capture totals and the digital-asset question.

Are staking rewards and airdrops taxed when I receive them? Yes-ordinary income at FMV on receipt. Later you’ll have a separate capital gain/loss when you sell.

Do wash-sale rules apply to crypto? Not in the same way as equities right now, but don’t rely on loopholes; focus on substance over form.

Can I deduct crypto losses against ordinary income? You offset capital gains first; excess losses usually carry forward.

How do I choose FIFO vs HIFO vs Specific ID? Choose the method that aligns with your goals and documentation capability. If you can prove Specific ID, it’s powerful.

What is Form 1099-DA and how does it affect me? It’s a broker-issued info form for digital-asset transactions; you’ll reconcile it against your own records to file accurately.

⚖️ Compliance Note (Not Tax Advice)

This guide focuses on US federal rules and is educational, not legal or tax advice. Rules change; consult a qualified professional. Start your research at the sources: IRS Digital Assets, IRS Topic 409, and IRS: Digital-Asset Reporting.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 150,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.