👋 Introduction: Stop Thinking Small-Time

Forget everything you think you know about raising money. The world of finance has been flipped on its head, and if you’re still playing by the old rules, you’re already a dinosaur waiting for the meteor. The slow, stuffy, back-room deals of Wall Street are being bulldozed by a new breed of capital raising, one that moves at the speed of light, powered by blockchain technology. This isn’t just a minor shift; it’s a seismic revolution, and you’re either riding the shockwave or getting buried by it. We’re going to dissect the three main battlegrounds where modern fortunes are forged and empires are built: the wildcat Initial Coin Offering (ICO), the sophisticated Security Token Offering (STO), and the titan of tradition, the Initial Public Offering (IPO).

Listen closely. The information I’m about to give you isn’t just theory; it’s a playbook. It’s the difference between being a spectator in the stands and a gladiator in the arena. Most people are too scared or too lazy to understand this new landscape. Their loss. For you, this is the opportunity of a lifetime. By the time we’re done, you’ll see the strengths, the weaknesses, and the raw power of each method. You’ll know exactly which weapon to choose for your financial conquest. So, pay attention, because we’re dissecting the critical differences between ICOs vs STOs vs IPOs.

🪙 What the Hell Are Cryptocurrency Tokens Anyway?

Before we dive into the strategy, let’s get one thing straight. You need to understand the ammunition. In this world, the ammunition is the cryptocurrency token. Don’t let the tech jargon fool you; the concept is simple. A token is a digital asset, a piece of programmable code that lives on a blockchain. Think of them as the chips you use at the highest-stakes poker table in the world. They represent value, ownership, or access, and they are the fuel for this entire revolution.

Now, not all chips are the same. You’ve got two main types, and confusing them is a rookie mistake that will cost you dearly.

First, you have Utility Tokens. These are your access passes. They’re like a keycard to a VIP club or a ticket to a blockbuster event. They grant you access to a company’s product or service. You buy the token, you get to use the platform. Simple. They don’t give you a piece of the company, a share of the profits, or a vote in how things are run. They are purely for utility, hence the name. These are the lifeblood of ICOs.

Second, and this is where the game gets serious, you have Security Tokens. These are the real deal. A security token is a digital representation of a traditional financial asset. We’re talking equity in the company, a right to dividends, a share of the profits, or voting rights. It’s a stock certificate on the blockchain. When you buy a security token, you are buying a piece of the action. You become an owner. This is the territory of STOs, and it’s where Wall Street’s money is starting to pour in. Understanding the intricate details of a project’s financial structure is crucial, which is why a deep dive into What is Tokenomics? The Ultimate Guide for Crypto Investing in 2025 is non-negotiable for any serious player.

🤖 Smart Contracts: Your Digital Enforcers

How does this all work without an army of lawyers and accountants bleeding you dry? The answer is one of the most powerful innovations of our time: the smart contract. Forget thousand-page documents filled with legalese. A smart contract is a self-executing agreement with the terms of the deal written directly into code. It’s a digital vending machine. You put in the required crypto, and the machine automatically spits out your tokens. No middlemen, no delays, no “let me check with my team.”

Think of it as your own personal digital enforcer. It lives on the blockchain, meaning it’s immutable—it cannot be changed or tampered with. It automatically executes its instructions when certain conditions are met. If X happens, then Y is automatically triggered. This technology is the backbone of ICOs and STOs. It’s what allows a startup in London to raise millions from investors in Tokyo, Seoul, and Rio de Janeiro in a matter of hours, all without a single banker taking a cut. It’s trust, automated. It’s efficiency, weaponised. If you don’t understand the power of this, you’re already ten steps behind.

🚀 The ICO (Initial Coin Offering): Riding the Rocket in the Wild West

What is an ICO?

The ICO is the enfant terrible of fundraising. It’s the raw, untamed, and brutally effective method that put crypto on the map. It’s crowdfunding supercharged with rocket fuel. Here’s the play: a startup has a revolutionary idea but no capital. Instead of begging venture capitalists for scraps, they create a utility token and a compelling vision detailed in a document called a whitepaper. They then offer these tokens to the public in exchange for established cryptocurrencies like Bitcoin or Ethereum. It’s fast, it’s global, and in its heyday, it was a license to print money.

The Upside: Why It’s a License to Print Money

The beauty of the ICO is its sheer speed and accessibility. There are virtually no gatekeepers. You don’t need permission from any bank or regulatory body. You can take your idea directly to a global market of millions of hungry investors. This unleashes a tsunami of potential liquidity. We’re talking about raising tens of millions of pounds in minutes, not months. The barriers to entry are astonishingly low. If you have a solid idea and the guts to put it out there, the ICO gives you a direct line to the capital you need to build your empire. The process of getting your new asset seen is its own art form, as detailed in our Ultimate Guide to the Crypto Token Listing Process.

The Downside: Navigating the Minefield

Now for the reality check. The same lack of regulation that makes ICOs so powerful also makes them incredibly dangerous. The 2017 ICO boom was the Wild West. For every visionary project, there were a hundred scams, rug pulls, and outright failures. Investors poured billions into projects that were nothing more than a slick website and a plagiarised whitepaper. There is no safety net. If you invest in a dud, your money is gone. Poof. For founders, the regulatory landscape is a minefield. Governments around the world are still figuring out how to classify these assets, and launching an ICO could land you in hot water if you’re not careful. It’s the ultimate high-risk, high-reward play.

👔 The STO (Security Token Offering): The Wall Street Takeover of Crypto

What is an STO?

If the ICO is a street fight, the STO is a sanctioned heavyweight boxing match. It’s the evolution. It takes the power and efficiency of the blockchain and combines it with the rules and regulations of traditional finance. An STO is the process of issuing security tokens. As we discussed, these tokens represent actual ownership in an asset—be it company equity, real estate, or fine art. Because these are classified as securities, they fall under the jurisdiction of financial regulators like the FCA in the UK or the SEC in the US. This means they come with legal protections, disclosure requirements, and a level of legitimacy that ICOs can only dream of.

The Power Play: Why STOs are the Future

This is where the smart money is heading. Why? Because regulation builds trust. By complying with securities laws, STOs open the door to a massive, untapped ocean of institutional capital. Pension funds, hedge funds, and family offices—investors who wouldn’t touch a wildcat ICO with a ten-foot pole—are comfortable with the legal framework of an STO. It provides investor protection, fractional ownership of previously illiquid assets (like a skyscraper), and a clear legal path. For founders, it’s a way to access the benefits of blockchain fundraising while maintaining credibility and attracting serious, long-term investors. It’s the bridge between the old world of finance and the new.

The Catch: Jumping Through Hoops

This level of legitimacy comes at a price. An STO is not a weekend project. It requires lawyers, compliance officers, and a significant upfront investment in legal and technical infrastructure. You have to navigate complex securities laws, which vary by jurisdiction. You need to perform KYC (Know Your Customer) and AML (Anti-Money Laundering) checks on your investors. The process is slower, more methodical, and far more expensive than an ICO. It’s a serious undertaking for serious businesses. But for those building something real, something with lasting value, it’s the only logical choice in the modern era.

🏛️ The IPO (Initial Public Offering): The Dinosaur’s Last Dance

What is an IPO?

This is the granddaddy of them all. The Initial Public Offering is the traditional, time-honoured path for a mature, successful company to raise capital by selling its shares to the public on a stock exchange. Think of giants like Google, Facebook, or Amazon going public. It’s a monumental event, a rite of passage that turns a private company into a publicly-traded behemoth. The process is orchestrated by a syndicate of powerful investment banks that act as underwriters, guiding the company through a labyrinth of regulatory filings, roadshows, and pricing negotiations.

Why It Still Exists

Don’t count the old guard out just yet. An IPO offers a level of prestige and visibility that no other method can match. When you list on the London Stock Exchange or NASDAQ, you are announcing to the world that you have arrived. It provides access to the deepest and most liquid capital markets on the planet. An IPO can raise billions, not just millions, and provides liquidity for early investors and employees. It’s a symbol of stability, success, and corporate maturity.

The Crippling Drawbacks

The IPO process is a beast. It is brutally expensive, with investment banks, lawyers, and accountants taking fees that can run into the tens of millions. It is painfully slow, often taking 12 to 18 months of gruelling preparation. Your company’s entire history, financials, and strategy are put under a microscope. Once public, you live in a fishbowl, subject to the whims of shareholders and the pressure of quarterly earnings reports. It’s a bureaucratic nightmare designed for a bygone era. For the nimble, fast-moving startups of the 21st century, the IPO is often too slow, too expensive, and too restrictive.

🥊 Head-to-Head Battle: ICO vs. STO

Let’s put them in the ring.

- Round 1: Regulation. This is the main event. ICOs operate in a regulatory grey zone, which offers freedom but comes with immense risk and a sketchy reputation. STOs embrace regulation. They are designed from the ground up to be compliant with securities laws. It’s the Wild West gunslinger versus the trained special forces operator.

- Round 2: Investor Rights. With an ICO utility token, your “rights” are often limited to using a future platform. You’re a user, not an owner. With an STO, you are buying a security. You have legally enforceable rights to ownership, dividends, or profits. It’s the difference between being promised a ticket to the movie and owning a piece of the cinema.

- Round 3: The Target Audience. ICOs primarily attract retail speculators and crypto enthusiasts willing to take a gamble on high-risk, high-reward projects. STOs are built to attract a more sophisticated class of investor: accredited individuals, venture capitalists, and institutional funds who demand legal protection and regulatory clarity.

- The Verdict: For a founder looking to build a sustainable, long-term business, the STO is the clear winner. It trades the chaotic speed of the ICO for the rock-solid foundation of legal compliance and access to serious capital. The ICO was a necessary phase of evolution, but the future belongs to regulated digital assets.

💥 Clash of Titans: IPO vs. ICO

This is a mismatch of epic proportions.

- Round 1: Company Maturity. IPOs are for established, profitable companies with years of audited financial history. ICOs are for startups, often at the pre-product or even idea stage. One is a proven champion; the other is a hungry contender who hasn’t even had their first professional fight.

- Round 2: The Asset. An IPO sells equity shares—a direct ownership stake in a functioning business. An ICO sells utility tokens—a voucher for a product that might not even exist yet. The level of tangible value and legal standing is worlds apart.

- Round 3: The Process. An IPO is a year-long marathon through a jungle of regulations, bankers, and lawyers. An ICO is a digital sprint that can be launched in weeks with a small, dedicated team. The difference in complexity and cost is astronomical.

- The Verdict: This isn’t a fair fight. They serve entirely different purposes at entirely different stages of a company’s life. Comparing them is like comparing a battleship to a jet ski. An ICO offers a lifeline of early-stage funding that would be impossible to get through traditional channels, but an IPO represents the pinnacle of corporate achievement.

🏆 The Main Event: STO vs. IPO

Here’s where the real revolution is happening. The STO is a direct challenger to the IPO’s throne.

- Round 1: Cost & Efficiency. An IPO requires paying massive fees to investment banks, lawyers, and stock exchanges. STOs leverage blockchain and smart contracts to automate many of these processes, slashing the costs associated with issuance and administration. You cut out the parasitic middlemen.

- Round 2: Market Access. IPO shares are traded on specific stock exchanges with restricted hours. Security tokens can be traded 24/7 on a global network of digital asset exchanges, creating a truly global and continuous market. This dramatically increases liquidity.

- Round 3: The Middlemen. The IPO process is dominated by a cartel of investment banks that act as gatekeepers. The STO model disintermediates this process, allowing companies to connect more directly with their investors. It democratises access to capital.

- The Verdict: The STO is the leaner, faster, and more technologically advanced contender. While the IPO still holds the crown for prestige and sheer size, the STO is fundamentally a superior model for the digital age. It offers the regulatory security of an IPO with the technological efficiency of the blockchain. Over the next decade, STOs will relentlessly eat into the IPO’s market share. It’s inevitable.

💎 Crypto Launchpads: Your VIP Access to the Best Deals

The early days of the ICO boom were pure chaos. It was impossible for the average investor to sort the gems from the garbage. Enter the crypto launchpad. Think of these platforms as the velvet rope for crypto investing. They are curation and vetting platforms that do the heavy lifting for you. Projects must apply to be featured, and the launchpad’s team conducts rigorous due diligence, scrutinising the team, the technology, and the tokenomics.

Only the most promising projects get listed. For investors, this provides a powerful layer of quality control. It doesn’t eliminate risk, but it dramatically reduces the chances of investing in an outright scam. Furthermore, launchpads offer a way to participate in presales at the earliest possible stage, often before the tokens are available to the general public. Understanding the nuances between different platforms is key; a deep dive into the difference between a Launchpad and a Launchpool will give you a strategic edge. Ignoring launchpads today is financial malpractice. It’s where the smart money goes to find the next big thing.

🌐 The Arenas: Where are These Battles Fought?

This digital fundraising revolution isn’t happening in a vacuum. It’s being built on powerful blockchain platforms that act as the arenas for these financial contests. Choosing the right blockchain is a critical strategic decision.

- Ethereum: The Undisputed King. Ethereum was the pioneer of smart contracts and remains the dominant platform for ICOs and STOs. Its network is vast, its technology is battle-tested, and its developer community is unmatched. However, its popularity can lead to high transaction fees and network congestion.

- The Contenders: A host of other platforms are vying for a piece of the action. Blockchains like Stellar (XLM) are designed for fast, low-cost asset issuance. Polymath (POLY) is a platform built specifically for the creation and management of security tokens. These challengers offer specialised features that can be more suitable for certain types of projects. The foundation of this entire ecosystem rests on these powerful base layers, also known as Layer-1 Foundational Coins. The choice of arena will significantly impact the speed, cost, and success of your capital raise.

🤔 Which Path is for You? The Wolf’s Final Verdict

So, after all this, which path do you take? There is no single magic bullet. The right choice depends entirely on your situation. Let’s cut through the noise and get to the bottom line.

- Choose the ICO if: You are a very early-stage startup with a groundbreaking idea for a decentralised platform. You need to raise seed capital quickly, you have a high tolerance for risk, and you are targeting a global community of crypto-native early adopters. You must be prepared to navigate a treacherous and uncertain regulatory environment. It’s a high-stakes gamble.

- Choose the STO if: You are building a serious, long-term business and need to raise significant growth capital. You want to offer investors a real stake in your company and are willing to embrace regulatory compliance to attract institutional money. You are building a bridge between traditional finance and the digital asset world. This is the path for the sophisticated builder.

- Choose the IPO if: You are the CEO of a multi-million-pound, established company with a proven track record of profitability. You are seeking massive-scale funding, ultimate prestige, and deep liquidity for your shareholders. You have the time, resources, and stomach for a protracted and expensive battle with the giants of traditional finance.

The choice reflects your ambition and your strategy. Choose wisely.

❓ Frequently Asked Questions (FAQs)

- Can anyone invest in an ICO?

Generally, yes. Most ICOs are open to the public globally, which is part of their appeal. However, some jurisdictions, like the US, have placed restrictions on their citizens’ participation due to regulatory concerns. - Is an STO safer than an ICO?

From an investor protection standpoint, yes, significantly. STOs are bound by securities laws that mandate disclosures, protect against fraud, and provide legal recourse. ICOs offer very few, if any, of these protections. - How long does it take to launch an IPO compared to an STO?

An IPO is a marathon, typically taking 12-18 months from start to finish. An STO is much faster but still requires rigorous preparation, usually taking between 3 to 6 months to ensure full legal and technical compliance. An ICO can be done in a matter of weeks. - What is the biggest risk with crypto fundraising?

Regulatory uncertainty. Governments worldwide are still establishing clear rules for digital assets. The legal landscape can change rapidly, and what is compliant today might not be tomorrow. Navigating this is the single biggest challenge for any project in the space.

🎬 Conclusion: The Choice is Yours – Predator or Prey?

The financial world has split into two camps: the old guard, clinging to their outdated, inefficient systems, and the new breed of innovators leveraging the raw power of blockchain. You are now standing at the crossroads, armed with the knowledge to dominate this new landscape. You understand the chaotic potential of the ICO, the sophisticated power of the STO, and the monolithic prestige of the IPO. The playbook is in your hands.

You can choose to be a dinosaur, sticking to the slow, expensive methods of the past and watching as the world moves on without you. Or, you can become a wolf. You can leverage the speed, efficiency, and global reach of this new technology to build your empire faster and smarter than anyone thought possible. The opportunity is staring you right in the face. The capital is there for the taking. The question is, what are you going to do about it? In the end, a deep understanding of ICOs vs STOs vs IPOs isn’t just knowledge; it’s the power to choose whether you will be the predator or the prey.

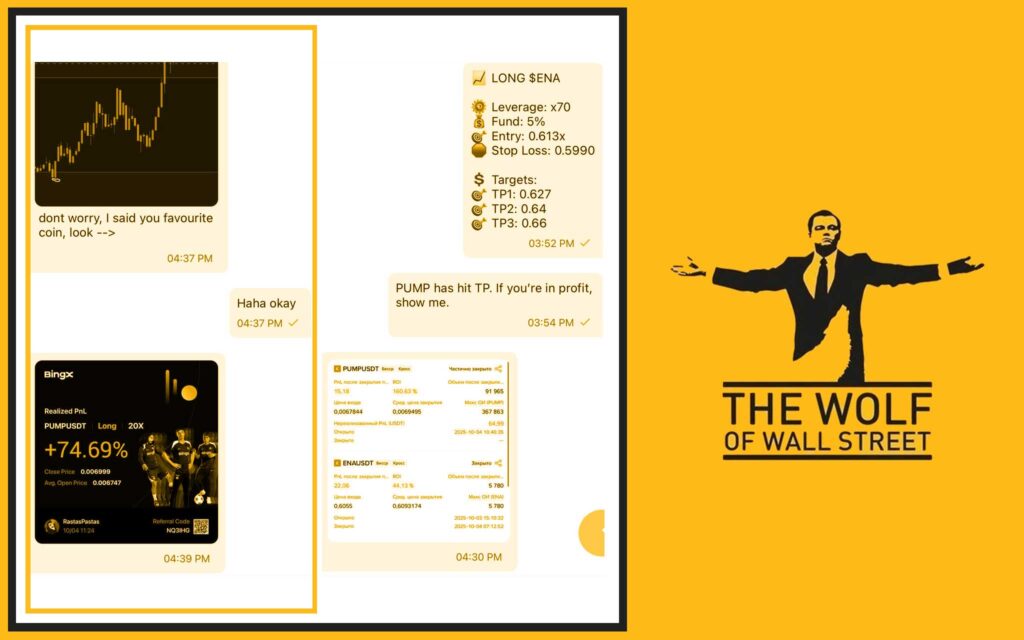

Empower Your Crypto Trading Journey with The Wolf Of Wall Street

Navigating the volatile cryptocurrency market requires more than just guts; it requires an edge. The The Wolf Of Wall Street crypto trading community offers a comprehensive platform designed to give you that edge. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals engineered to maximise your trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from our team of seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and powerful support.

- Essential Trading Tools: Utilise volume calculators and other critical resources to make sharp, informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team, whenever you need it.

Stop gambling and start trading with a strategic advantage.

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.