Listen to me very carefully. If you’re here to learn the secret to raising serious capital in the crypto world, then you need to understand that an Initial Exchange Offering (IEO) isn’t just another fundraising method; it’s your golden ticket. The game has changed, the rules are different, and if you’re not paying attention, you’re going to be left in the dust, choking on the exhaust fumes of the winners.

Forget ICOs – That’s Yesterday’s News

Remember the Wild West of 2017? The ICO boom? Everyone with a half-baked idea and a poorly written white paper was launching a coin, promising the moon, and nine times out of ten, delivering nothing but a black hole for investor cash. It was a chaotic, unregulated mess. Fortunes were made, yes, but far more were lost to scams, incompetence, and outright fraud. That party is over. The smart money got wise, and investors got burned one too many times.

Why IEOs are the New Stratosphere for Smart Money

Out of the ashes of that chaos rose a new model. A smarter, sharper, and infinitely more powerful way to raise funds: the Initial Exchange Offering. This isn’t about throwing a project at the wall and seeing if it sticks. This is a curated, vetted, and high-stakes launchpad administered by the new kings of the crypto world – the exchanges themselves. They act as the gatekeepers, the bouncers at the most exclusive club in town. They only let the A-listers through, and that credibility is what brings in the flood of capital.

💰 What Exactly is an Initial Exchange Offering (IEO)?

The 30-Second Pitch: Fundraising on Steroids

Let’s cut the jargon. An IEO is a token sale event supervised and conducted on the platform of a well-known cryptocurrency exchange. Instead of a project team trying to manage their own chaotic fundraiser, they partner with an exchange like Binance, KuCoin, or OKX. The exchange lends its platform, its reputation, and most importantly, its massive, ravenous user base to the project.

In return, the project gets instant credibility and access to a pool of millions of eager investors who are already verified and ready to buy. The exchange handles the tech, the security, and the logistics. Your job is to bring a killer project to the table. It’s a symbiotic relationship built for explosive growth.

The Key Difference: The Exchange is Your Gatekeeper

With an ICO, the project team was the judge, jury, and executioner. They controlled everything, which opened the door for manipulation and fraud. With an IEO, the exchange puts its own skin in the game. Their reputation is on the line. They aren’t going to list some worthless project because if it fails, it reflects badly on them.

This single difference changes everything. It shifts the power dynamic. The exchange becomes a filter for quality. They do the dirty work of vetting projects, so investors can participate with a level of confidence that was simply impossible during the ICO frenzy.

Why This Switch Happened: Cleaning Up the Crypto Wild West

The market demanded it. Investor confidence was shattered. Regulators were circling like sharks smelling blood in the water. The industry needed to mature, and fast. IEOs were the answer. They introduced a layer of accountability.

By involving a trusted third party – the exchange – the IEO model brought order to the chaos. It forced projects to be better, to have real products, real teams, and real roadmaps. It was a necessary evolution, separating the serious entrepreneurs from the get-rich-quick dreamers.

🔍 How an IEO Works: The Velvet Rope Protocol

Getting your project into an IEO isn’t a walk in the park. The top exchanges have a protocol, a velvet rope that keeps the pretenders out. If you want in, you have to prove you belong.

Step 1: The Project Audition (Due Diligence)

First, you submit your project for review. The exchange’s team will tear it apart. They’ll scrutinise your white paper, your team’s background, your technology, your tokenomics, and your business plan. They will ask the tough questions you probably haven’t even asked yourself. They’re looking for any weakness, any red flag. If your project is built on smoke and mirrors, they will find you out.

Step 2: KYC/AML – No Amateurs Allowed

While the project is being vetted, the investors are too. The exchange enforces strict Know Your Customer (KYC) and Anti-Money Laundering (AML) procedures on all participants. This ensures that the funds being raised are clean and that participants are legitimate. It’s a professional operation, not some back-alley deal. This regulatory compliance adds another thick layer of legitimacy to the entire process.

Step 3: The Exchange’s Stamp of Approval

If you pass the brutal due diligence process, the exchange gives you their official stamp of approval. They announce the IEO to their community, often with huge fanfare. This announcement is like a starting pistol. It signals to millions of traders that a new, high-potential opportunity has arrived, backed by a name they already trust.

Step 4: The Token Sale Frenzy

On the day of the IEO, the sale happens directly on the exchange’s platform. Users who have been whitelisted and passed KYC can purchase the project’s tokens using the exchange’s native currency (like BNB for Binance Launchpad). These sales are often over in minutes, sometimes seconds, due to overwhelming demand. It’s a feeding frenzy, and if you’re the project owner, it’s exactly what you want to see.

🚀 Prepping for Your IEO Launch: The Wolf’s Checklist

Thinking of launching an IEO? Don’t even think about approaching an exchange until you have your ducks in a row. This is the big leagues. Come prepared, or don’t come at all.

Have a Minimum Viable Product (MVP) That Actually Works

The era of raising millions on a white paper and a prayer is dead. You need a working product. A tangible, usable piece of technology that proves your concept isn’t just a fantasy. An MVP demonstrates that your team can execute, not just talk. It’s your proof that you’re building a real business, not just selling a dream.

Show, Don’t Just Tell

A slick landing page isn’t enough. You need a demo, a beta version, or something that potential investors can interact with. Let them touch it, feel it, and see the potential for themselves. This builds more confidence than a thousand pages of technical jargon ever could.

Market Analysis: Know Your Battlefield

You need to know your market inside and out. Who are your competitors? What problem are you solving that they aren’t? Why is your solution ten times better? You need to have clear, concise, and powerful answers to these questions. The exchange will ask them, and so will savvy investors. Come armed with data, not opinions.

Choosing Your Launchpad: The Power of a Top-Tier Exchange

Not all exchanges are created equal. Launching on a top-tier platform like Binance Launchpad is a completely different universe than launching on a small, unknown exchange. The brand recognition, user base, and marketing power of a major exchange can be the difference between a mediocre fundraise and a legendary one. Do your homework. Research which launchpads have the best track record and align with your project’s goals.

The world of token launches is diverse. While IEOs offer security, some projects opt for a more decentralised route. To make the best choice, you should understand all your options, which is why reading an Initial DEX Offering (IDO) Guide is non-negotiable for any serious founder. Furthermore, succeeding in an IEO is only the first step; what comes next is just as crucial. Familiarise yourself with the entire lifecycle by studying a Crypto Token Listing Process Guide.

📝 The White Paper: Your Million-Dollar Sales Script

Your white paper is the single most important document you will create. It’s not a technical manual; it’s a sales document. It’s your pitch, your manifesto, your blueprint for how you’re going to change the world and make your investors a hell of a lot of money.

This Isn’t a College Essay – It’s a Blueprint for Profit

It needs to be compelling, persuasive, and crystal clear. It should grab the reader from the first sentence and never let them go. It must clearly articulate the problem, your unique solution, the technology behind it, the team that will execute it, and the tokenomics that will drive its value. Every word must serve a purpose: to build confidence and create an undeniable urge to invest.

Key Elements of a White Paper That Converts

- Executive Summary: A powerful, one-page summary that sells the entire project.

- The Problem: A clear and relatable description of the market pain point.

- The Solution: A detailed explanation of your product and why it’s a game-changer.

- Tokenomics: A transparent breakdown of the token’s utility, distribution, and economic model.

- Roadmap: A realistic and ambitious timeline of your future development and milestones.

- Team: Bios of your core team members that scream credibility and expertise.

If your white paper is weak, your entire campaign is dead on arrival. If you’re not a master wordsmith, hire one. This is not the place to cut corners. To dive deeper into crafting this critical document, our definitive What is a White Paper Guide is essential reading.

🪙 Tokenomics and Funding Goals: Don’t Get Greedy, Get Smart

Your tokenomics model is the engine of your entire ecosystem. A poorly designed model can sink even the most promising project.

Creating Your Token: The Engine of Your Project

Your token must have real utility. Why does it exist? What can people do with it? Is it for governance, transactions, staking, or accessing services? The utility is what will drive long-term demand. Without it, you’re just selling a speculative asset with no underlying value, and savvy investors will see right through it.

Setting the Hard Cap: Know When to Stop Raising

One of the biggest mistakes projects make is getting greedy with their funding goals. Setting an astronomical hard cap signals that you either don’t have a disciplined plan or you’re trying to cash out. A realistic, well-justified hard cap shows that you’ve done your homework. It tells investors you know exactly how much capital you need to achieve your goals, and not a penny more.

Token Distribution: A Fair Slice for Everyone

Transparency in token distribution is non-negotiable. You must clearly outline what percentage of tokens goes to the public sale, the team, advisors, marketing, and the ecosystem fund. A fair distribution model that doesn’t give an excessive amount to insiders builds trust and shows that you’re focused on the long-term health of the project, not just enriching the founders.

Understanding these financial mechanics is critical. Don’t move a muscle until you’ve mastered the concepts in our guide on What is Tokenomics?.

📈 The Launch and Beyond: Keeping the Momentum Alive

The IEO sale is not the finish line. It’s the starting gun. The money you raise is fuel, and now it’s time to put the pedal to the metal.

The Big Day: Listing on the Exchange

Immediately after the IEO concludes, your token will be listed for trading on the host exchange. This is a critical moment. The initial price action sets the tone for market perception. A strong opening can create a powerful wave of positive momentum that attracts even more buyers and attention.

Post-IEO Marketing: The Work Has Just Begun

You need a relentless post-IEO marketing strategy. You’ve got the capital, now you need to execute. This means press releases, influencer collaborations, content marketing, social media engagement, and attending industry events. You need to be everywhere, constantly communicating your progress and hitting the milestones laid out in your roadmap. Don’t go silent. Silence is death in this industry.

Building a Community of Fanatics, Not Just Investors

Your earliest investors are your most valuable asset. They are your evangelists, your brand ambassadors. You need to nurture this community. Be active on Telegram, Discord, and Twitter. Host AMAs (Ask Me Anything) sessions. Be transparent about your successes and your challenges. A strong, engaged community will carry you through market downturns and celebrate your victories, creating a powerful network effect.

✅ The Advantages: Why IEOs Are a No-Brainer

Let’s break down why the IEO model crushes the old ways of doing things.

- Instant Trust and Credibility: Partnering with a major exchange is the ultimate endorsement. It tells the world you’re a legitimate project that has passed a rigorous vetting process.

- Access to a Massive, Hungry User Base: You’re not starting from scratch. You’re tapping directly into an exchange’s ecosystem of millions of active traders who are constantly looking for the next big thing.

- Smoother, Faster, and More Secure Transactions: The exchange handles the technical heavy lifting. This means no smart contract vulnerabilities, no crashed websites, and a seamless contribution process for investors.

❌ The Disadvantages: The Price of Playing in the Big Leagues

It’s not all sunshine and rainbows. Access to this exclusive club comes at a price.

- High Listing Fees: Top exchanges charge significant fees to conduct an IEO. This can be a flat fee, a percentage of the funds raised, or a combination. You have to pay to play.

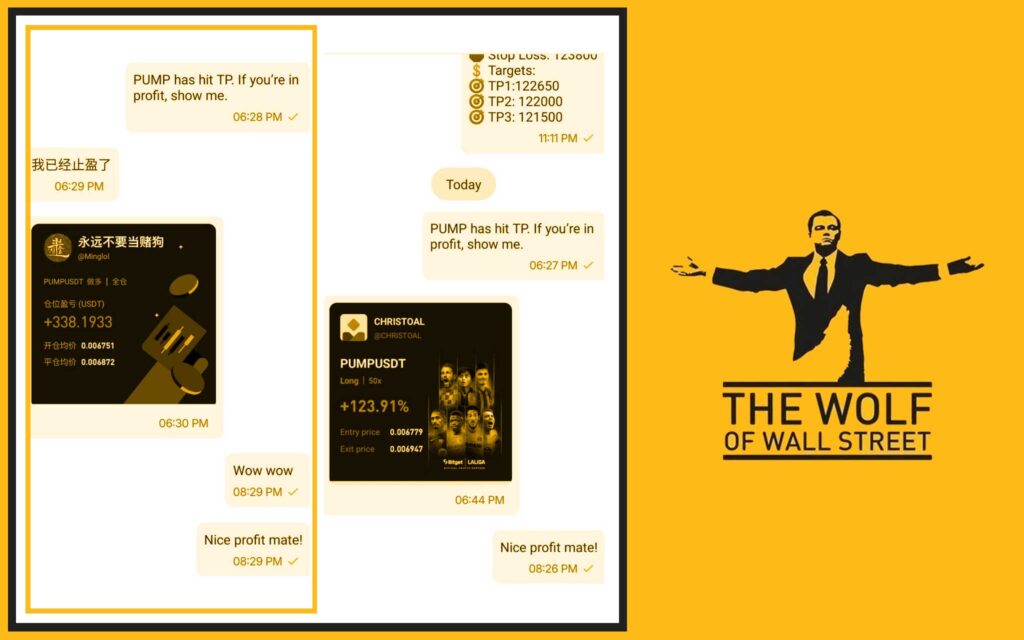

- The Risk of Price Manipulation: Despite the benefits, IEO tokens can still be subject to “pump and dump” schemes after listing. Whales can manipulate the price, leaving smaller retail investors holding the bag.

- Not All Exchanges Are Created Equal: The quality of due diligence can vary wildly between exchanges. A stamp of approval from a less reputable exchange might not mean much and can fail to generate the trust you need.

🆚 IEO Alternatives: Know Your Options

An IEO is a powerful tool, but it’s not the only one in the shed.

- The ICO (Initial Coin Offering): The old way. High risk, high reward, but largely fallen out of favour due to the prevalence of scams and lack of oversight. Only for the brave or the foolish.

- The STO (Security Token Offering): This is a highly regulated fundraising method where tokens are classified as securities. It offers greater investor protection but involves navigating a complex web of legal red tape. It’s slower and more expensive.

- The IDO (Initial DEX Offering): The new challenger. IDOs are conducted on decentralised exchanges (DEXs). They offer immediate liquidity and lower listing barriers but often lack the marketing muscle and perceived security of a major centralised exchange IEO.

❓ Frequently Asked Questions (FAQs)

Let’s cut to the chase with some straight answers.

1. Is an IEO a guarantee of success?

Absolutely not. An IEO gives you a massive head start, but it doesn’t guarantee a thing. If your project is weak, your team is incompetent, or you fail to execute after the raise, you will fail. The IEO gets you in the race; it doesn’t win it for you.

2. How much does it cost to launch an IEO?

There’s no fixed price. For a top-tier exchange, you can expect to pay anywhere from $50,000 to over $1,000,000 in fees and associated costs, plus a percentage of tokens. It’s a serious investment.

3. Can anyone participate in an IEO?

No. Participation is usually restricted based on the user’s country of residence due to regulations. Furthermore, many IEOs on popular launchpads operate on a lottery or first-come, first-served basis, meaning not everyone who wants to invest will get an allocation.

4. What is the main difference between an IEO and an IDO?

The main difference is the venue. An IEO happens on a centralised exchange (CEX) with the exchange acting as the middleman. An IDO happens on a decentralised exchange (DEX) and is generally more permissionless, relying on smart contracts to manage the sale and liquidity.

🏁 Your Move: Seize the IEO Opportunity or Get Left Behind

The Bottom Line: IEOs Are Here to Stay

The crypto market has matured. The days of easy money are gone, replaced by an era of smart money. IEOs represent the new standard for quality, credibility, and high-impact fundraising. They provide a structured, secure, and powerful platform for world-class projects to get the capital they need to build the future. For investors, they offer a curated gateway to some of the most exciting opportunities in the space.

Your Next Step to Crypto Dominance

The choice is yours. You can sit on the sidelines and watch as others build empires, or you can get in the game. You can study the winners, learn their strategies, and position yourself to take advantage of the next wave of innovation. The information is right in front of you. The path is clear. The only question is whether you have the guts to walk it. In the fast-moving world of crypto, hesitation is a death sentence, and the best way to raise capital is through a well-executed Initial Exchange Offering (IEO).

Ready to Move from Learning to Earning?

You’ve just absorbed the masterclass on how new crypto empires are funded. You understand the strategy, the stakes, and the opportunity. But knowledge without action is worthless.

If you’re ready to stop watching from the cheap seats and get in on the real action, the The Wolf Of Wall Street crypto trading community is your next move. This is where theory meets profit. This is where the real wolves trade.

- Exclusive VIP Signals: Stop guessing. Get access to proprietary signals engineered to find profitable trades in this volatile market.

- Expert Market Analysis: Let seasoned pros do the heavy lifting. Benefit from in-depth analysis that cuts through the noise.

- Private Community: Network with over 100,000 traders. Share insights, strategies, and win together.

- Essential Trading Tools: Use volume calculators and other critical resources to make sharp, informed decisions.

- 24/7 Support: The market never sleeps, and neither do we. Get continuous support from our dedicated team.

Your journey into crypto dominance starts now.

- Visit our service for the full breakdown: https://tthewolfofwallstreet.com/service

- Join our live Telegram community for real-time intel: https://t.me/tthewolfofwallstreet

Unlock your potential with The Wolf Of Wall Street. The clock is ticking.