🔥 Introduction: Why IGOs Are the New Wall Street Hustle

Listen, forget everything you thought you knew about crypto launches. Forget ICOs. Forget boring old IDOs. IGOs—Initial Game Offerings—are where the real action is. Imagine Wall Street on steroids, dressed up in video game skins, NFTs, and tokens that print money while you play. That’s the level we’re talking about.

This isn’t about playing Candy Crush on your phone—it’s about gaming that pays you in crypto, tokens you can trade, and assets that appreciate while you sleep. We’re entering an era where gamers are investors, and investors are gamers.

So buckle up, because by the time you finish this article, you’ll know exactly why IGOs are the most explosive frontier in digital wealth—and how to grab your slice of the action before the rest of the herd catches on.

🎮 GameFi Explained – Where Gaming Meets DeFi

GameFi is short for “Gaming Finance”, and it’s exactly what it sounds like: games that make you money. Not just “fun points” or fake coins—real, verifiable cryptocurrency.

Players complete missions, win battles, or just grind through gameplay, and instead of gold coins that vanish into thin air, they get crypto tokens and NFT assets. And here’s the kicker: those assets can be traded, sold, and cashed out.

This isn’t about killing time—it’s about creating streams of income. If the stock market and esports had a baby, it’d be called GameFi.

🚀 What Exactly Is an IGO?

An Initial Game Offering (IGO) is a crowdfunding event specifically for blockchain games. Think IPO on Wall Street—but instead of buying into a company’s stock, you’re getting in on early-stage game tokens and NFTs.

IGOs are the new fundraising machine. Here’s how they compare:

- ICO (Initial Coin Offering): Fundraising for general crypto projects.

- IDO (Initial DEX Offering): Fundraising via decentralised exchanges.

- IGO: Targeted exclusively at blockchain gaming, giving investors first dibs on in-game tokens, NFTs, and assets.

That specificity makes IGOs deadly effective. You’re not throwing darts at every crypto startup under the sun—you’re aiming at a booming $200+ billion gaming industry fused with blockchain finance.

For more on how these events differ from traditional crypto launches, check out our launchpad vs launchpool guide.

🧩 The Power of NFTs in IGOs

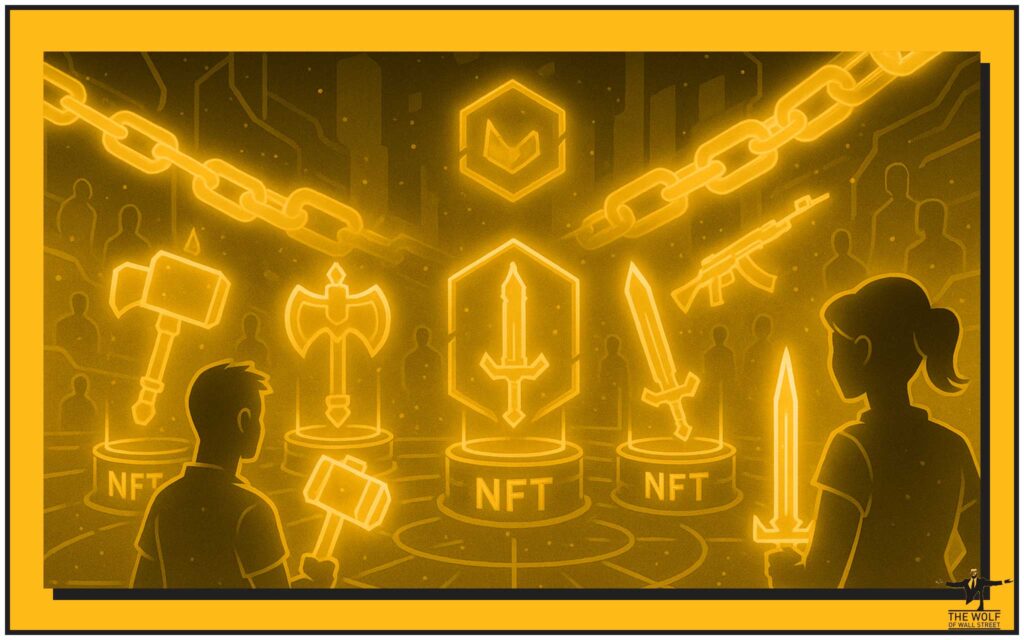

Here’s where it gets wild. NFTs (non-fungible tokens) turn pixels into property.

When you buy into an IGO, you’re not just getting early access to tokens—you’re buying unique, tradeable items:

- Skins that appreciate in value.

- Weapons with limited supply.

- Characters that no one else can duplicate.

NFTs lock in digital scarcity. That skin in Fortnite? Owned by Epic. That sword in World of Warcraft? Blizzard’s property. But in GameFi? It’s yours. Verifiable, tradable, sellable.

This is the digital equivalent of buying a Picasso before the world knew who Picasso was.

🏦 How IGO Launchpads Work

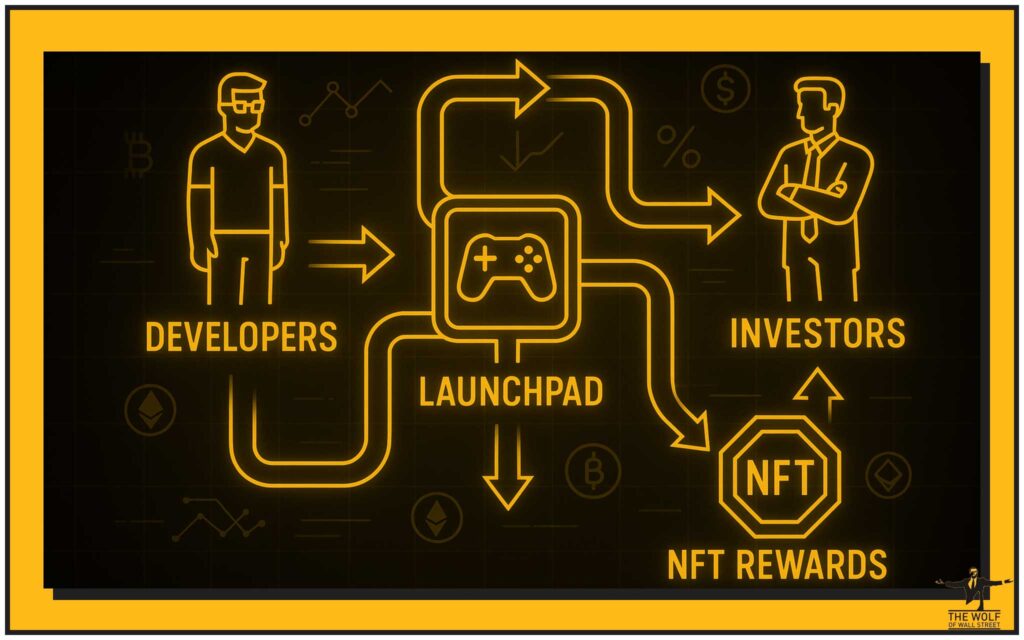

Launchpads are the Wall Street trading floors of GameFi. They connect developers who need funding with investors hungry for the next breakout project.

The biggest players in the game:

- Binance NFT – the heavyweight champ.

- Seedify Fund – high-potential launchpad for up-and-coming titles.

- GameFi – the hub dedicated solely to gaming projects.

- TrustPad – multi-chain support with solid vetting.

- Enjinstarter – laser-focused on metaverse and gaming ecosystems.

Each platform uses tiers or staking models: you lock in tokens for access, sometimes entering lotteries for allocation, sometimes guaranteed depending on your stake.

It’s not random—it’s structured opportunity.

📊 The Numbers Don’t Lie: Market Growth & Adoption

Let’s talk cold, hard stats:

- 52% of all decentralised app activity comes from blockchain gaming.

- In 2021 alone, $4 billion flowed into blockchain gaming.

- January 2022? Over $1.1 billion raised in a single month.

This isn’t a trend—it’s a tidal wave. And those who get in now, before mainstream adoption hits full swing, will ride the wave. The rest? They’ll be crushed under it.

For more insights into crypto market cycles and adoption waves, explore our crypto market research guide.

💰 Why Developers Love IGOs

Developers used to beg VCs for money. Now? They raise funds directly from their future players. IGOs remove the middlemen.

Benefits for devs:

- No gatekeepers – no venture capital roadblocks.

- Instant audience – investors often become the first player base.

- Community trust – projects build loyalty from day one.

It’s lean, it’s efficient, and it’s scalable. IGOs democratise game funding in the same way ICOs once democratised crypto funding.

🔗 Real-World Value: Tokens & NFTs in Action

The beauty of IGOs is liquidity. These aren’t “locked in the game” assets. You can:

- Sell tokens on decentralised exchanges (DEXs).

- Convert them to stablecoins or even fiat.

- Flip rare NFTs for 10x, 50x, 100x returns.

In other words, you’re not buying Monopoly money. You’re investing in assets with real-world financial legs.

For strategies on knowing when to take profit, study our crypto profit-taking guide.

⚠️ The Dark Side: Risks & Red Flags in IGOs

Now, don’t get starry-eyed. Here’s the truth: not every IGO is a rocket to the moon.

Risks you need to watch:

- Rug pulls – devs vanish with the cash.

- Unfinished projects – games that never launch.

- Overhype – tokens that tank post-launch.

The antidote? Due diligence. Look at the team. Study the tokenomics. Ask: does this game actually make sense, or is it smoke and mirrors?

For more on recognising manipulation, check out our crypto spoofing guide.

🥊 IGO vs ICO vs IDO – What’s the Real Difference?

Think of it like this:

- ICO = Wild West of fundraising.

- IDO = Slightly more controlled, happening on DEXs.

- IGO = The sniper rifle—laser-focused on blockchain gaming.

And here’s the key: IGOs often have stronger vetting processes. Platforms don’t want rug pulls on their reputation, so they filter projects harder.

That’s why IGOs are carving out their own space. They’re not just another fundraising acronym—they’re a niche powerhouse.

🔮 The Future Outlook of IGOs

We’re still early. Very early. Here’s where it’s going:

- More institutional investors sniffing around.

- Higher quality games hitting the market.

- Adoption expanding beyond crypto natives into mainstream gamers.

IGOs aren’t just “a trend.” They’re shaping up to be the backbone of blockchain gaming finance.

📚 Case Studies: Winners & Losers in IGOs

Let’s cut to the chase: real examples make this clear.

- Success Story: Axie Infinity’s early supporters saw life-changing gains as the game exploded in popularity.

- Failure Story: Countless projects that raised funds and never delivered. Websites offline, communities abandoned.

The lesson? The upside is massive—but only if you know how to separate the wolves from the sheep.

🛠️ Tools Every IGO Investor Needs

To play this game, you need the right arsenal:

- Portfolio trackers to monitor your assets.

- Volume calculators to understand market depth.

- Risk management frameworks so you don’t blow your bankroll.

Pro traders don’t gamble. They prepare.

👥 Community Power in GameFi Investments

You want to know the biggest edge in this market? Information.

The best IGO players don’t trade alone—they’re plugged into private groups, Discord servers, Telegram channels. Communities where information flows faster than the public market.

That’s where the real alpha lies.

For comparison, see our Telegram vs WhatsApp security breakdown.

🦾 The The Wolf Of Wall Street Advantage

Now let me drop the ace up your sleeve: the The Wolf Of Wall Street crypto trading community.

If you’re serious about navigating the chaos of IGOs and crypto markets, The Wolf Of Wall Street gives you:

- Exclusive VIP Signals – designed to maximise your profit.

- Expert Market Analysis – insights from seasoned traders.

- Private Community – 100,000+ sharp minds in one network.

- Essential Tools – calculators, frameworks, all in one place.

- 24/7 Support – you’re never left stranded.

👉 Check out the The Wolf Of Wall Street Service for full details.

👉 Join the The Wolf Of Wall Street Telegram for real-time updates.

This is how you stay ahead of the herd.

❓ FAQs About IGOs

1. How do I join an IGO as a beginner?

Start by creating an account on a trusted launchpad like Binance NFT or Seedify. Stake the required tokens, verify your eligibility, and apply for allocations.

2. What’s the difference between IGOs and NFT mints?

NFT mints often release collectibles directly. IGOs bundle both tokens and NFTs into a structured launch event.

3. Can you cash out profits from IGO tokens?

Absolutely. Tokens can be traded on DEXs and CEXs, or converted into fiat.

4. Are IGOs better suited for gamers or investors?

Both. Gamers get assets and early access; investors get exposure to high-upside projects.

5. What’s the safest way to research an IGO?

Analyse the team, tokenomics, roadmap, and partnerships. Cross-reference with market analysis from communities like The Wolf Of Wall Street.

🏁 Conclusion: Your Next Move in the IGO Gold Rush

Here’s the bottom line: IGOs are the Wall Street of Web3. They’re explosive, lucrative, and open to anyone who’s got the guts to jump in.

But remember—it’s not just about getting in. It’s about getting in smart. Do your due diligence, lean on the right tools, and surround yourself with communities that give you the edge.

Because in this game, fortune doesn’t just favour the bold—it favours the prepared.

So don’t just watch from the sidelines. Step into the arena. The IGO gold rush is on, and it’s your turn to claim a piece.