The days of shadow trades and insider whispers are over. Japan’s regulators have finally had enough of the crypto Wild West — and they’re bringing the same heavyweight rules that govern Wall Street to digital assets.

In short? If you thought insider trading in crypto was a grey area, Japan’s about to paint it in black and white.

🚨 The Problem: A $2 Trillion Market with Zero Guardrails

Let’s call it what it is — crypto has been running without a seatbelt. Billions move daily, whales manipulate, and smaller traders get crushed while “insiders” quietly scoop profits before the news even hits the blockchain.

Japan knows this game too well. Until now, crypto wasn’t covered by the same insider trading rules that apply to stocks. The Japan Virtual and Crypto Assets Exchange Association (JVCEA), which oversees exchanges, had limited tools to detect shady trades.

That’s about to change — and not a moment too soon.

When regulation fails, chaos wins. That’s why Japan’s Financial Services Agency (FSA) and Securities and Exchange Surveillance Commission (SESC) are tightening the screws, bringing crypto firmly under the Financial Instruments and Exchange Act (FIEA) — the same legal framework that governs equities.

For readers interested in how compliance shapes profit, see our guide on crypto AML compliance strategies.

⚖️ The Fix: Japan’s FIEA Reform Will Treat Crypto Like Stocks

This isn’t another empty announcement. Japan’s FIEA reform gives the SESC real teeth: the power to investigate, penalise, and even prosecute insider trading in crypto.

Think about it: fines pegged to the profits of illegal trades. Criminal charges. Mandatory monitoring systems for exchanges.

It’s a wake-up call to every exchange and trader operating in the shadows. The era of “anonymous profit” is being replaced with an era of accountability.

This move isn’t just smart — it’s strategic. By aligning crypto with stock market law, Japan’s sending a message to the world: this market is for professionals, not cowboys.

Read more about how global rules are evolving in our breakdown of crypto regulation trends across Latin America.

🏛️ The Politics: Tech-Friendly Leadership, Tough-Minded Law

Every great market reform needs a political heavyweight behind it — and Japan’s got Sanae Takaichi. She’s tech-savvy, pro-innovation, and laser-focused on making Japan the world’s crypto-finance capital.

Her philosophy is pure Wolf: innovation without chaos.

Takaichi is pushing to get these reforms through Parliament by 2026, aligning Japan’s crypto oversight with its securities law. She’s betting that trust and technology can coexist — and she’s right.

For comparison, check how regulation fuels institutional trust in our analysis of digital gilt instruments and DLT integration.

🌍 The Bigger Picture: Japan Joins the Global Crackdown

Let’s zoom out. The EU’s MiCA framework, the US SEC lawsuits, South Korea’s crypto tax regime — the world is finally waking up.

Japan isn’t playing catch-up; it’s stepping into leadership. This is what happens when an old financial powerhouse embraces new-age assets with discipline.

By treating crypto as a financial product, Japan bridges two worlds: the flexibility of digital finance and the accountability of traditional markets.

If you’re curious how these global shifts affect compliance and investor security, explore our insights on crypto travel rule strategies.

💰 The Opportunity: Regulation Builds Trust, and Trust Builds Wealth

Here’s where most traders miss the point. Regulation isn’t the enemy of profit — it’s the foundation of it.

You don’t attract serious capital without rules. You don’t build institutional trust without transparency. Japan’s crackdown isn’t killing opportunity; it’s creating a safer, smarter market where big money can finally move without fear of manipulation.

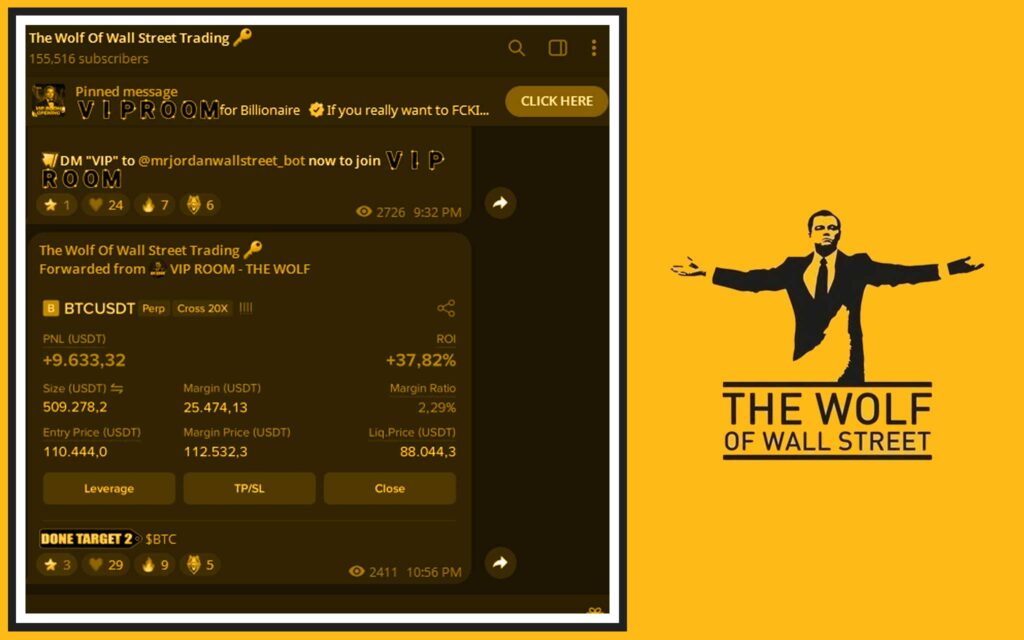

As one trader from the The Wolf Of Wall Street crypto trading community put it:

“Clarity is the new catalyst. You can’t profit in a rigged game — and these rules make the playing field sharper.”

The Wolf Of Wall Street gives traders the edge in this new environment — with exclusive VIP signals, expert market analysis, and a private network of 100,000+ traders ready to capitalise on volatility.

Join the movement, sharpen your strategy, and ride the regulation wave. Visit The Wolf Of Wall Street Service or join the action on Telegram.

Want to learn how institutional confidence transforms markets? Read our guide on crypto hedge fund market shifts.

🐺 The Real Wolf’s Take: Discipline Wins the Game

Let’s be real — this isn’t about politics or policy. It’s about control. The investors who thrive in the new crypto age will be the ones who play with discipline, precision, and information.

You can’t control the market, but you can control your moves. Japan’s reforms prove one thing: the smart money follows the structure.

So stop gambling. Start strategising. And remember — in this market, clarity is profit.

Want to trade like a Wolf?

Learn the art of momentum timing in our guide on mastering crypto dominance strategies.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market.

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: In-depth insights from seasoned crypto traders.

- Private Community: Network of over 100,000 like-minded traders.

- Essential Tools: Volume calculators, technical indicators, and support 24/7.*

Empower your crypto trading journey today: https://tthewolfofwallstreet.com/service | Join Telegram