🌍 Introduction: Wall Street Just Got a New Sheriff

When Jonathan Gould was confirmed as the new Comptroller of the Currency, the financial world didn’t just get a regulator—they got a rainmaker, a disruptor, a game-changer. In a 50-45 Senate vote, Gould stepped into the spotlight, and believe me, this isn’t business as usual. If you’re in crypto, banking, or you just care about making your money work harder, this is the pivot point you’ve been waiting for.

Let’s break down why the Jonathan Gould OCC confirmation is the only headline you need to read today—and how you can capitalise.

🕴️ Who Is Jonathan Gould?

Jonathan Gould isn’t your typical bureaucrat.

- He’s got public sector cred—having served as Senior Deputy Comptroller and Chief Counsel at the OCC.

- He’s been in the private trenches—as Chief Legal Officer at Bitfury, one of blockchain’s heavyweight firms.

- And he’s worked in Big Law, as a partner at Jones Day.

Translation? Gould understands the rulebook, but he also knows where the opportunities are buried. He’s got both the regulatory know-how and the entrepreneurial hunger that crypto demands.

🏦 What Is the OCC and Why Should Crypto Traders Care?

Let’s cut the jargon. The Office of the Comptroller of the Currency (OCC) is the watchdog for America’s national banks and federal savings associations. They decide who plays, who wins, and who sits out in the \$20 trillion US banking system.

Gould is now holding the keys to the vault. And for crypto traders? That means the future of crypto banking, custody, and regulation is about to shift—fast.

Want to get ahead? Don’t just watch—learn the rules before they change. Check out our deep dive into policies shaping the financial landscape.

Related Reading:

🚀 How Gould’s Appointment Changes the Game: Deregulation, Innovation, and Crypto Moves

Here’s the juice: Gould’s confirmation signals an era where innovation trumps red tape. He’s spoken out against post-2008 “risk-phobia,” arguing that banks need room to take smart risks—not play it safe until their margins die of boredom.

What does this mean for you?

- Banks could get the green light to dive deeper into digital assets.

- Startups and fintechs? Less bureaucracy, more action.

- Traders? Expect new products, faster approvals, and regulatory clarity that drives profits.

If you’re still trading like it’s 2019, you’re missing the boat. Gould is handing out boarding passes to the next generation of crypto-savvy bankers and entrepreneurs.

📊 Crypto at the Core: Digital Assets and Gould’s Playbook

Gould’s not just “crypto-friendly”—he’s crypto-fluent.

As Bitfury’s legal chief, he lived blockchain from the inside, not the ivory tower. That matters, because the OCC now needs a leader who gets custody, charters, and the wild new world of digital assets.

Here’s what to watch:

- Digital asset banking charters: Expect new guidance, not gridlock.

- Crypto custody: Regulations will open doors for secure, compliant holding of Bitcoin, Ethereum, and more.

- DeFi and innovation: Gould’s likely to streamline approvals, bringing more DeFi players into the big leagues.

Ready to play at this level? See how ecosystems are evolving right now.

📢 Reception From Wall Street and the Crypto Community

When Gould got the nod, it wasn’t just backslaps on Capitol Hill.

The American Bankers Association and Blockchain Association welcomed him like a shot of adrenaline—finally, someone who understands both the old school and the new money.

But let’s not sugarcoat it—there are critics:

- Some lawmakers worry a deregulatory push could weaken consumer protections.

- Skeptics ask: Will “innovation-friendly” mean “regulation-light”?

Still, in every wolf’s den, there’s opportunity for those who move smart and move fast.

⚖️ The Power Shift: Regulatory Risks and Rewards

Let’s face it—deregulation is a double-edged sword.

- Reward: More room for profit, faster market evolution, and the chance for US banking to lead global crypto.

- Risk: If the leash comes off too quickly, could weak oversight trigger scandals and market shocks?

Gould has to thread the needle—protect the system, but fuel its growth.

For those with vision? It’s a chance to eat while others sleep.

💡 How This Impacts You: Traders, Banks, and Crypto Entrepreneurs

Here’s where the rubber meets the road:

- For banks: New business lines, new profits—if they have the guts to innovate.

- For crypto founders: A friendlier OCC means clearer rules, faster product launches.

- For traders: More options, more liquidity, and regulatory clarity that’s pure rocket fuel.

Just getting started? Tap our Newbie guide to accelerate your learning curve.

🤝 The Wolf Of Wall Street Crypto Trading Community: Navigating Volatility Like a Pro

You want to win in this new era? You need an edge.

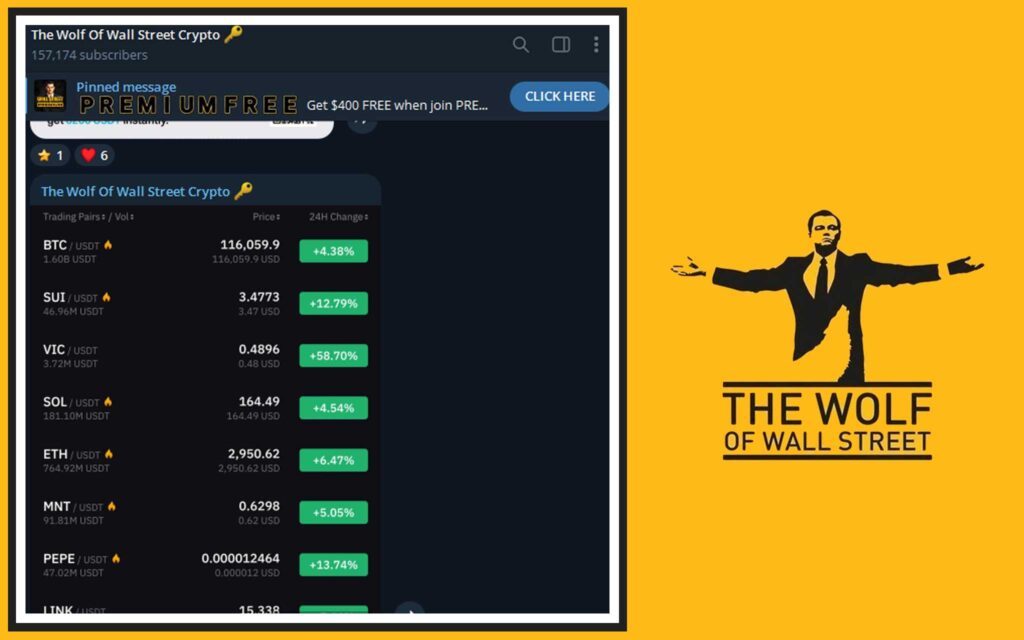

The The Wolf Of Wall Street crypto trading community gives you:

- Exclusive VIP Signals: Proprietary alerts to time your trades like a sniper.

- Expert Market Analysis: Hand-picked insights from seasoned pros, not random Telegram hype.

- Private Community: 100,000+ traders sharing the real alpha.

- Essential Tools: Volume calculators, analytics, 24/7 support. No more flying blind.

In volatile markets, the pack that hunts together, eats together.

Empower your crypto journey:

📜 What Comes Next? The Regulatory Roadmap and Pending Legislation

Gould’s reign begins just as Congress is gearing up to redefine digital asset rules.

- The Senate is targeting September 30 for a comprehensive digital asset market structure bill.

- The House is pushing its own Digital Asset Market Clarity (CLARITY) Act.

- Which way does Gould lean? All signs point to a faster, clearer regulatory framework—meaning fewer grey areas and more green lights.

Bookmark Trending crypto policies for the latest.

🔍 Comparing Past OCC Leaders: Is Gould Really Different?

Let’s not forget:

- Brian Brooks, the “Crypto Comptroller,” broke ground but never went the distance.

- Rodney Hood played it safe, a placeholder in the storm.

Gould? He’s got the blockchain battle scars and the regulator’s pen.

He isn’t just talking change—he’s built for it.

Want to know how leadership shapes markets? Dive into DeFi history.

🔥 FAQs: What You Need to Know About Gould’s OCC, Crypto, and Your Bottom Line

Q: Will the OCC become more crypto-friendly under Gould?

A: Bet on it. With Gould’s blockchain past, expect new rules and more space for compliant crypto innovation.

Q: What does this mean for consumer protection?

A: Gould has critics, but his experience balancing innovation and safety means he’ll tread carefully. More options for traders, but the system stays robust.

Q: How do I take advantage of the changing landscape?

A: Stay plugged in. Join active trading communities, follow regulatory news, and never trade alone—tools like The Wolf Of Wall Street give you the edge.

💥 Final Take: Why Gould’s Confirmation Is a Game-Changer for Crypto and Wall Street

Here’s the bottom line—the Jonathan Gould OCC confirmation marks the dawn of a new era.

Regulation is getting smarter, not just stricter.

Crypto is moving from the fringe to the mainstream.

And if you’re in the know, the upside is enormous.

Don’t sit on the sidelines.

Join the The Wolf Of Wall Street community, stay sharp, and be part of the next financial revolution.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market.

Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service

- Join our active Telegram community: https://t.me/tthewolfofwallstreet

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.

Ready to capitalise on the new OCC era? Don’t just watch the market—lead it.