🌟 Introduction: The Billion-Dollar Signal from Wall Street

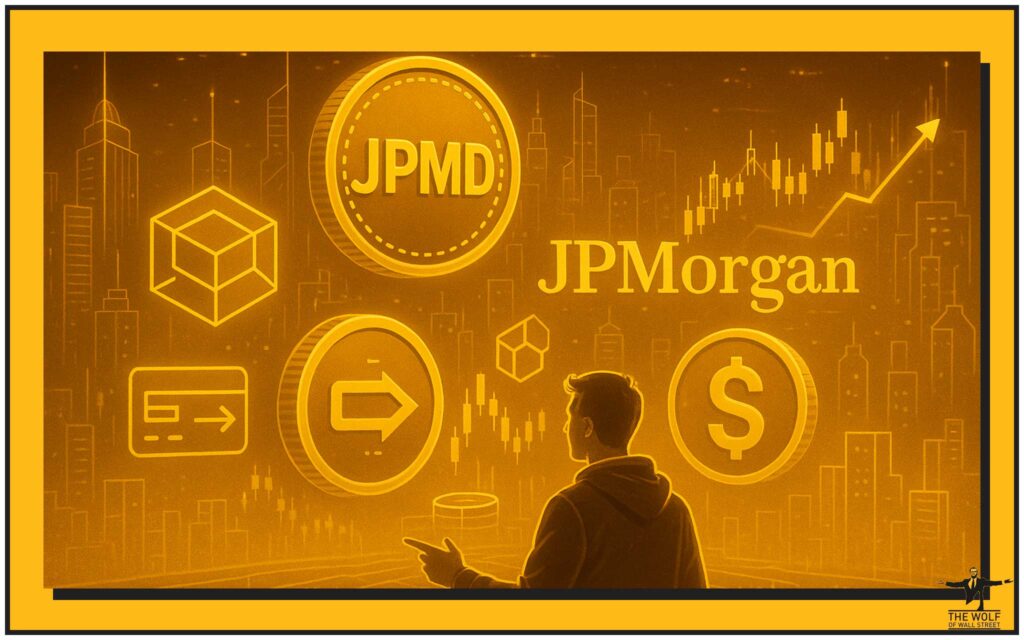

Let me make this crystal clear: when JPMorgan files a trademark for anything in the crypto space, you better sit up and pay attention. This isn’t a whisper in the wind—it’s a damn megaphone. With the “JPMD” trademark filing, the banking behemoth just laid down a serious power move, signalling its intent to dominate the future of digital finance. This isn’t a hobby or side hustle—it’s a full-scale invasion.

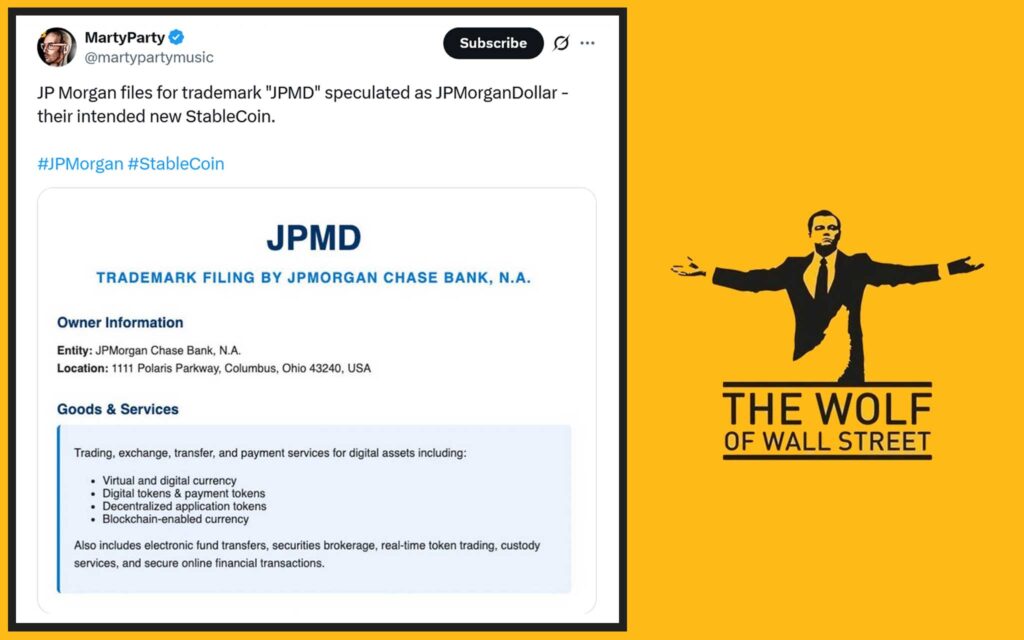

🚀 The Trademark Drop: What “JPMD” Actually Covers

No ambiguity here. JPMorgan’s filing for “JPMD” with the U.S. Patent and Trademark Office screams ambition. Here’s what they’re covering:

- Digital asset trading

- Electronic fund transfers

- Real-time token exchange

- Payment processing

- Custody and brokerage

- Issuance of digital assets

This isn’t one product. It’s an ecosystem. Think Amazon Web Services, but for crypto finance.

💥 Stablecoin in Disguise? You Bet.

Is “stablecoin” explicitly written in the filing? Nope. But if you think JPMorgan is diving into digital asset issuance without aiming to roll out their own stablecoin, I’ve got a bridge to sell you.

Industry reports from May 2025 already whispered about JPMorgan joining forces with Citigroup and Wells Fargo for a stablecoin initiative. That’s not coincidence. That’s chess. Big banks don’t move unless the board’s been studied.

🔗 Related Reading:

🧠 JPMorgan’s Crypto Résumé: Not Their First Rodeo

This isn’t JPMorgan’s crypto debut. JPM Coin has already processed over $1.5 trillion in interbank payments. They accept spot Bitcoin ETFs as collateral and are weaving digital assets into client net worth calculations. This is a juggernaut that’s been warming up for years.

🏩 Timing Is No Coincidence: Regulation Is Coming

Here’s the kicker: JPMD’s filing dropped just as the GENIUS Act moves through the U.S. Senate. This act gives legal teeth to bank-issued stablecoins. It’s not random. JPMorgan is gearing up to capitalise when regulation flips from foggy to clear skies.

📊 Table: JPMD vs JPM Coin – What’s New, What’s Bigger

| Feature/Service | JPM Coin (Existing) | JPMD (Trademark Filing) |

|---|---|---|

| Target Users | Institutional only | Retail + Institutional? |

| Core Services | Settlement | Trading, custody, issuance, payments |

| Blockchain | Quorum (private) | Not disclosed (likely broader) |

| Regulation | Internal use | Public-facing, future-proofed |

👀 Who Should Be Sweating? A Look at Competitors

Ripple? Meta? Apple? They’re watching JPMorgan like hawks. Why? Because the bank has both the cash and compliance muscle to scale faster and safer.

🛠️ Institutional Muscle Meets Retail Scale

Here’s the wildcard: Could JPMD be embedded directly into Chase’s consumer app? Imagine checking your balance and buying stablecoins all in one tap. That’s a user funnel of over 50 million retail accounts.

🔗 Related Reading:

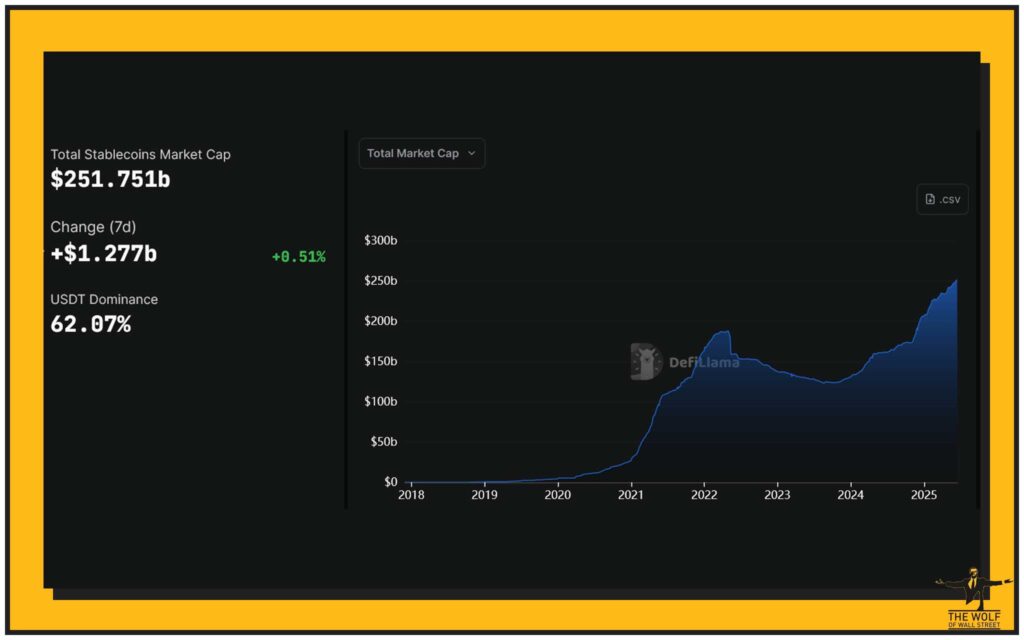

📊 Stablecoins: The Real Market Battlefield

Over $252 billion in stablecoins are already circulating. Monthly volumes are in the trillions. This isn’t niche anymore—it’s core finance. JPMorgan knows this. The real war isn’t just Bitcoin or ETH—it’s who controls the rails of tokenised money.

🕵️ Strategic Silence: Why They’re Playing Coy with Details

JPMorgan hasn’t said much publicly. That’s not fear. That’s strategy. Silence keeps competitors guessing and the press drooling. It’s the oldest Wall Street move in the book.

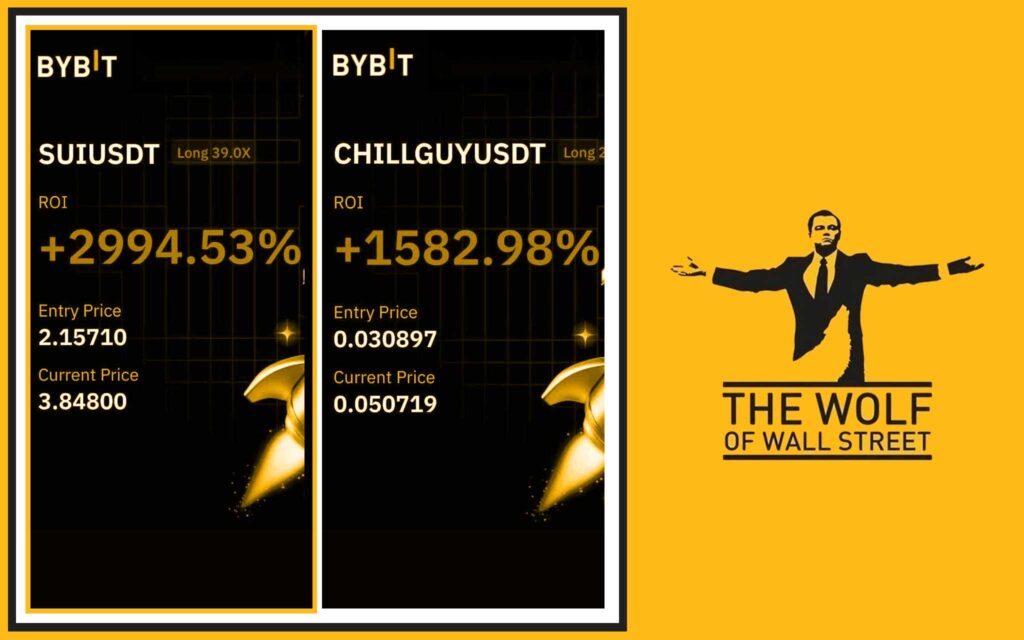

🎯 The Wolf Of Wall Street Perspective: What This Means for Real Traders

If you’re part of the The Wolf Of Wall Street crypto community, this is your edge. You’re not just watching giants move—you’re preparing for seismic shifts. Our VIP signals and expert analysis will track JPMD’s every ripple, helping you stay five moves ahead.

🛠️ The Tools That Put You Ahead

With The Wolf Of Wall Street, you’re not guessing. You’re trading with:

- Proprietary signals built for maximum profit

- Volume calculators that eliminate guesswork

- 24/7 support from crypto veterans

- Access to a Telegram army of 100,000+ active minds

🔗 Related Reading:

🔮 What Comes Next? Predictions and Profit Pointers

Here’s what I see coming:

- Retail rollout: JPMD becomes part of the Chase app.

- Regulatory clarity: GENIUS Act greenlights stablecoins.

- Institutional onboarding: Hedge funds and banks adopt JPMD for settlements.

✅ Conclusion: The Real Power Move Behind JPMD

JPMorgan’s “JPMD” trademark filing is more than a regulatory heads-up—it’s a blueprint for crypto dominance. With digital asset issuance, payments, and trading all under one brand, they’re gunning for total market control. If you’re not preparing to trade this tide, you’re about to get swept.

So remember the keyword: JPMD Trademark for Crypto Payment Services. It’s not just a filing—it’s a financial revolution.

📆 The Wolf Of Wall Street Advantage

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our website: tthewolfofwallstreet.com

- Join our active Telegram community: t.me/tthewolfofwallstreet