🔥 Introduction – The Brutal Reality of Crypto Risk

Listen up. The crypto market doesn’t care about your dreams, your optimism, or your diamond hands. It’s a jungle. You either come armed with the right tools and knowledge, or you get eaten alive. And right now? The Kinto Network just served us a masterclass in what happens when DeFi hype collides with cold, hard reality.

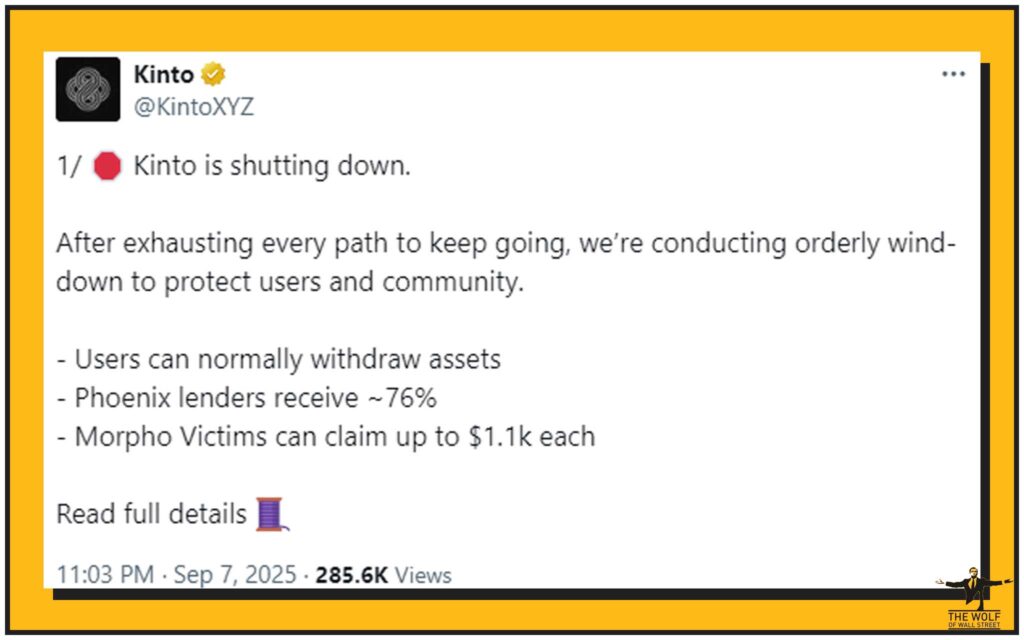

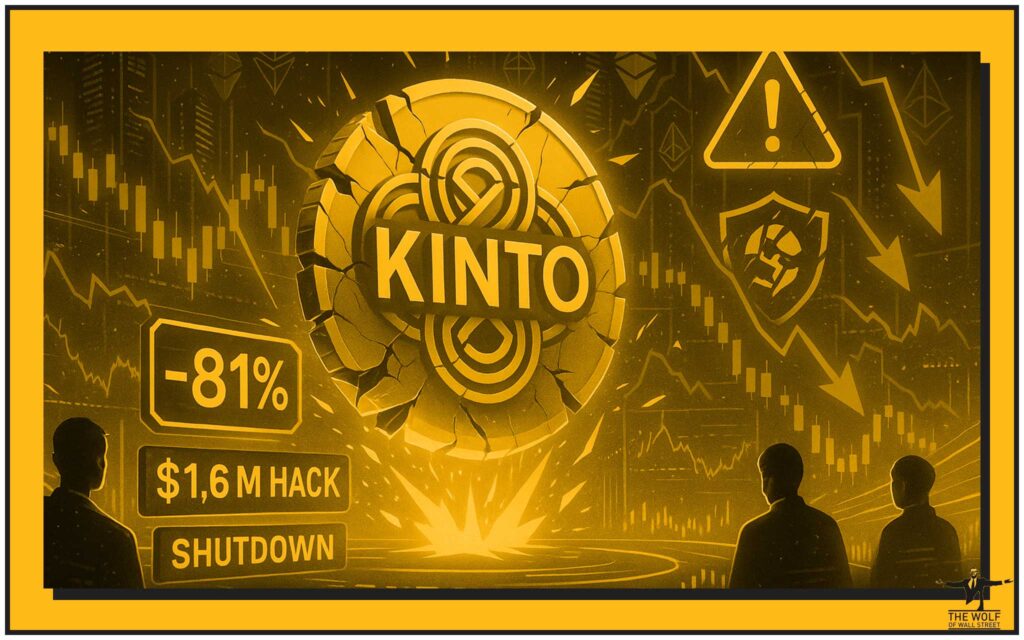

The Kinto token — once the darling of Ethereum’s Layer-2 ecosystem — plummeted over 81% after the team announced a full shutdown by the end of September. Millions of dollars wiped out. Investors left reeling. And here’s the kicker: it all started with a hack that ripped $1.6 million straight out of the project’s vaults.

If you’re not paying attention, you’ll miss the lessons here — and in crypto, ignorance costs real money.

🚀 The Rise and Fall of Kinto

From Promise to Collapse

Kinto wasn’t just another DeFi project. It promised something bold: the efficiency of a centralised exchange combined with the security of a decentralised one. Built on Arbitrum, it positioned itself as a cutting-edge Ethereum Layer-2 solution.

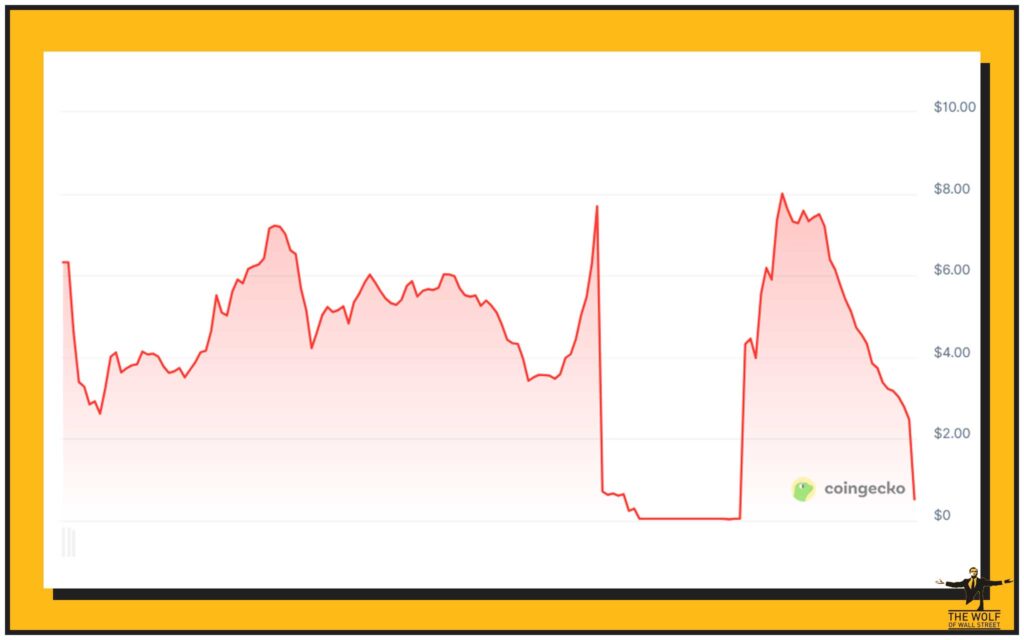

Investors flocked. Speculators piled in. At its peak in mid-August, the token hit a market cap of $14.5 million. Hype was in overdrive.

But when ambition isn’t backed by rock-solid execution, you’re not building an empire — you’re building a house of cards.

The 81% Price Crash

Fast forward to September, and that house came crashing down. Once news of the shutdown hit, Kinto’s token nosedived, erasing nearly all its gains. Market cap? Down to just above $1 million.

Think about it: if you threw in $10,000 in August, you’re now sitting on less than $2,000. That’s not a dip. That’s an implosion.

💥 The Hack That Sparked It All

ERC-1967 Proxy Vulnerability

The domino that tipped it all? A vulnerability buried in the ERC-1967 Proxy standard, a core piece of Ethereum infrastructure. Hackers pounced, draining $1.6 million not just from Kinto, but also from several other projects.

For investors, that wasn’t just a technical bug — it was a confidence killer. Because if the foundation is weak, the whole building crumbles.

Impact on Trust and Fundraising

Once the hack hit headlines, fundraising efforts stalled. Investors pulled back. Even after raising $1 million in debt to relaunch the modular exchange, Kinto couldn’t secure additional capital. The crypto winter wasn’t forgiving, and lenders weren’t in the mood for second chances.

💸 The Financial Strain

Operating Without Salaries

Here’s a brutal fact: the Kinto team stopped taking salaries in July. They tried to push forward without pay, grinding day and night to keep the vision alive. Admirable? Yes. Sustainable? Not even close.

Failed Fundraising Attempts

Fundraising in 2023–2024 has been bloodsport. And with the hack fresh in everyone’s mind, Kinto’s deck looked toxic to investors. Without new capital, the runway vanished. Game over.

🛠️ The Recovery Plan

Uniswap Liquidity Distribution

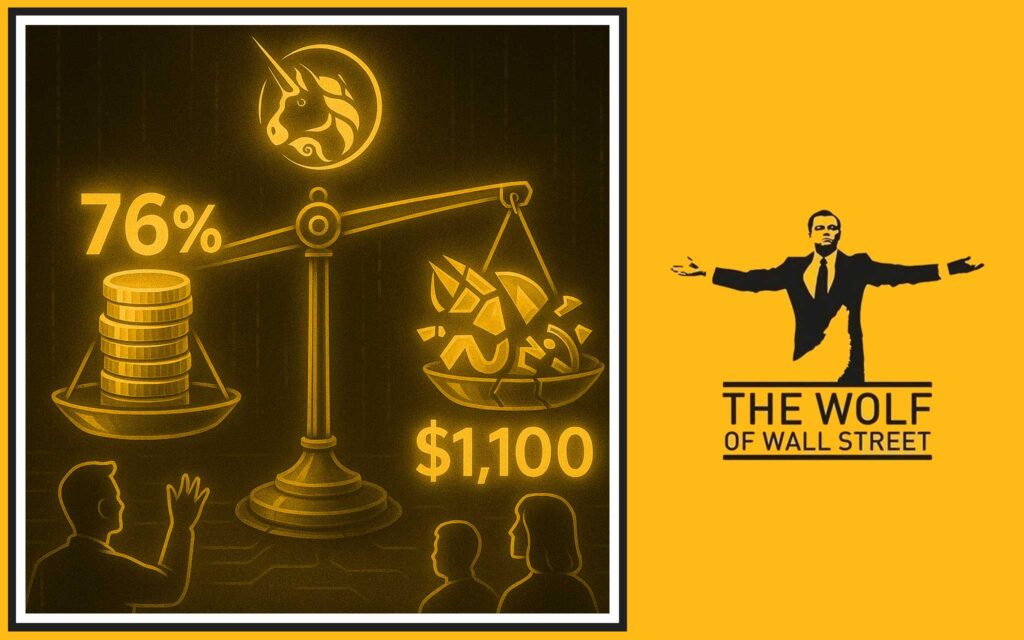

Kinto didn’t just vanish into the night. To their credit, they laid out a recovery strategy: about $800,000 in Uniswap liquidity will be distributed to lenders, with an estimated 76% loan principal recovery. In DeFi terms, that’s practically responsible behaviour.

Goodwill Grant

Founder Ramon Recuero also stepped up personally. He’s funding part of a “goodwill grant” that’ll hand out $1,100 per affected address to hack victims. Does it erase the pain? No. But in a market full of rug pulls and vanishing founders, this accountability stands out.

⚖️ The High-Yield Illusion

Unsustainable Promises

Let’s call it what it is: 130% annual USDC yields are fantasy land. They look sexy on a Twitter post, but they’re about as sustainable as a Ponzi scheme.

Kinto dangled those numbers, and investors couldn’t resist. But if you’re chasing triple-digit APY without questioning where the yield comes from, you’re not investing — you’re gambling.

DeFi’s Addiction to Yield

This isn’t just a Kinto problem. The whole DeFi space is hooked on insane yields. Protocols use high APY as bait, but when the market turns, those promises collapse. We’ve seen it before. We’ll see it again.

🧠 Lessons From the Collapse

Security First

Crypto isn’t forgiving. Smart contracts are only as strong as their weakest line of code. The ERC-1967 mess shows that every vulnerability is a ticking time bomb. Auditing isn’t optional. It’s survival.

Sustainable Economics

If your business model relies on endless high yields, it’s already dead. Sustainability > hype.

Founder Track Records

And let’s be real: this isn’t Recuero’s first rodeo. His last project, Babylon Finance, also collapsed after a hack wiped out $3.4 million. Investors should’ve done their homework. Track records matter.

🌍 Ripple Effects Across Ethereum L2

Impact on Arbitrum Ecosystem

Arbitrum’s reputation takes a hit here. Kinto was meant to showcase innovation on the network. Instead, it showcased fragility.

Investor Confidence in ETH Layer-2

The bigger question: how many investors now hesitate before throwing money into the next shiny Layer-2? This isn’t just about Kinto — it’s about the whole Ethereum scaling narrative.

📉 Market Psychology and Investor Behaviour

When panic sets in, rationality exits the building. Investors saw Kinto’s shutdown and stampeded for the exit. Selling fed more selling. Prices tanked.

This is classic market psychology. Emotional traders get crushed. Disciplined traders? They thrive.

🚀 How to Navigate These Volatile Waters

Red Flags to Spot

- Yields that defy common sense.

- Lack of transparent audits.

- Founders with repeat failures.

Smart Investor Playbook

- Diversify. Spread across L1s and L2s.

- Stay informed. Market moves fast — blink and you’re wrecked.

- Use tools. Volume calculators, real-time analytics, and trading communities are your edge.

🔑 Why Community is the Ultimate Edge

No one wins this game solo. The smartest traders surround themselves with networks that share insights, strategies, and signals. When the market shifts, you don’t want to be guessing — you want to be plugged into a hive mind of experts.

That’s why communities like The Wolf Of Wall Street exist:

- Exclusive VIP Signals to catch profit opportunities.

- Expert market analysis to avoid traps like Kinto.

- 24/7 support and 100,000+ traders backing you up.

If you want to survive — and profit — in this chaos, community isn’t optional. It’s mandatory.

👉 Join the The Wolf Of Wall Street service and plug into the Telegram group for real-time action.

📊 FAQs

1. Why did Kinto shut down?

Because a $1.6M hack gutted the project’s finances and destroyed investor confidence.

2. What was the ERC-1967 Proxy issue?

A vulnerability in Ethereum’s contract design that hackers exploited.

3. Will lenders get their money back?

They’ll recover around 76% of their principal through Uniswap liquidity distribution.

4. Is investing in high-yield DeFi projects safe?

Not unless yields are realistic and security is airtight.

5. What should crypto investors do now?

Stay educated, diversify, and leverage communities like The Wolf Of Wall Street to get ahead.

🏁 Conclusion – The Hard Truth

Kinto’s story is simple: sky-high ambition, sky-high yields, and a crash landing. The token went from $14.5 million to near worthless in weeks. Investors who chased promises instead of fundamentals paid the price.

The lesson? Don’t get seduced by shiny numbers. Focus on security, sustainability, and community. In a volatile game like crypto, the winners aren’t the gamblers. They’re the ones who prepare, connect, and act with discipline.

So, here’s your choice: do you want to be the guy who watches his portfolio evaporate overnight, or the one who’s plugged into the right signals, the right tools, and the right network?

Because in this market, hesitation is death.

👉 Get ahead. Stay sharp. Join The Wolf Of Wall Street today.