🦁 Introduction: The Wolf’s Take on Layer 1 – Why This Foundation Matters

Listen up—because if you’re still treating Layer 1 coins like just another set of crypto tokens, you’re leaving money, power, and opportunities on the table.

Layer 1 blockchains aren’t just cogs in the system—they’re the entire engine. You want to play with the big boys? You want to run with the wolves and not the sheep? You master the foundation. Because in this market, if you don’t control the base, you’re just a pawn in somebody else’s game.

The foundation coins—Bitcoin, Ethereum, Solana, and their next-gen siblings—set the tempo, write the rules, and dictate the profit flow for the whole ecosystem.

Every DeFi protocol, NFT, and memecoin project is ultimately built on the bones of these Layer 1 titans.

Welcome to the real game. Ready to dominate?

🧱 What is Layer 1? Building Blocks of the Blockchain World

Let’s cut through the noise.

Layer 1 blockchains are the original, independent networks—the “operating systems” of crypto. Think of them as the bedrock on which everything else stands.

Layer 2 solutions? Just plug-ins, apps, and power-ups riding on top.

But Layer 1? That’s where the rules get written, where the blocks get minted, and where real value is stored.

Examples:

- Bitcoin (BTC): The granddaddy, digital gold.

- Ethereum (ETH): Programmable money.

- Solana (SOL): Lightning-fast, high-throughput chain.

These are not side hustles. These are the infrastructure—the skyscrapers, not the coffee shops.

🚦 Foundation Coins: What Sets Them Apart?

So why do foundation coins matter? Simple:

They are the blue chips of crypto.

Foundation coins are native tokens of Layer 1 blockchains—meaning they’re essential, not optional.

- Utility: Pay gas fees, validate transactions, secure the network.

- Store of value: Holders get exposure to the underlying growth of the entire ecosystem.

- Gateway: Want DeFi? NFTs? DAOs? You need ETH, SOL, AVAX, or whatever the foundation coin is.

These coins are the anchors. When the market is on fire, foundation coins often move first—and when the market crashes, they’re the last to capitulate.

That’s why every serious portfolio is built around foundation coins.

🔥 The Crypto Trilemma: Security, Scalability, and Decentralisation

Here’s the classic dilemma, and don’t let anyone sugarcoat it:

You can’t have perfect security, full decentralisation, and massive scalability—at least not all at once. This is the Blockchain Trilemma.

- Security: No one wants a chain that’s easy to attack.

- Decentralisation: The more people running the show, the less likely you get corruption.

- Scalability: Billions of transactions per second? Now you’re talking real adoption.

But if you max out one corner, you sacrifice another.

Bitcoin is a fortress—decentralised, secure, but slow as hell.

Solana? Blazing fast, but sometimes it gets wobbly under pressure.

🏛️ Classic Layer 1 Examples: Titans of the Blockchain Arena

Let’s talk specifics—no theory, just the facts:

- Bitcoin (BTC): The origin story. Proof of Work (PoW), limited supply, the most battle-tested chain. Want digital gold? This is it.

- Ethereum (ETH): Born to do more. From smart contracts to DAOs and DeFi, Ethereum built the playground. Now with Proof of Stake (PoS)—more scalable, less power-hungry.

- Solana (SOL): Insanely fast, built for speed demons. Great for NFTs and high-frequency trading, but you trade a bit of resilience for all that speed.

- Avalanche (AVAX): The multi-chain maestro—flexible, eco-friendly, and scalable.

- Aptos, Near, Sui: The new kids, pushing innovation—focusing on speed, security, and new tech stacks (think Move language).

These are the real sharks, not minnows.

💡 How Does Layer 1 Really Work?

Here’s the engine room.

Layer 1 chains validate and record every transaction—no shortcuts. The network runs on nodes (think: thousands of computers), each keeping a record of the blockchain.

The consensus mechanism is the law of the land:

- Proof of Work (PoW): Miners race to solve puzzles—energy-hungry, but rock-solid (Bitcoin).

- Proof of Stake (PoS): Validators stake their coins to secure the network—efficient, greener, but still decentralised (Ethereum, Solana).

- Hybrid and Novel Approaches: Avalanche consensus, Move language, Proof of Liquidity—innovation never stops.

The result? Trustless, permissionless networks where you don’t need a middleman.

🕹️ Smart Contracts & DApps: The Engine Under the Hood

Without Layer 1, there is no DeFi, no NFTs, no web3.

Layer 1s provide the raw horsepower for every decentralised application:

- Smart contracts: Self-executing agreements. No lawyers, no paperwork, just code.

- DApps: Decentralised apps—finance, gaming, prediction markets, all powered by the foundation chain.

- Interoperability: Some Layer 1s (Polkadot, Cosmos) are built to connect the dots, making cross-chain action possible.

This is where the action is. If you’re not in the game here, you’re on the sidelines.

⚡ Scaling Headaches: Why Layer 1 Isn’t Enough (Yet)

Let’s be real:

The more people use a Layer 1, the more stress the system takes. When everyone piles in, the network gets congested—transactions slow down, fees skyrocket, and everyone complains.

- Ethereum 2021: $100 gas fees for a simple swap. Brutal.

- Solana Outages: When things get too hot, the chain sometimes trips up.

- Bitcoin: Rock-solid, but try moving $1 during a bull run. Not cheap, not fast.

Layer 1 is the backbone, but it needs help to carry the world.

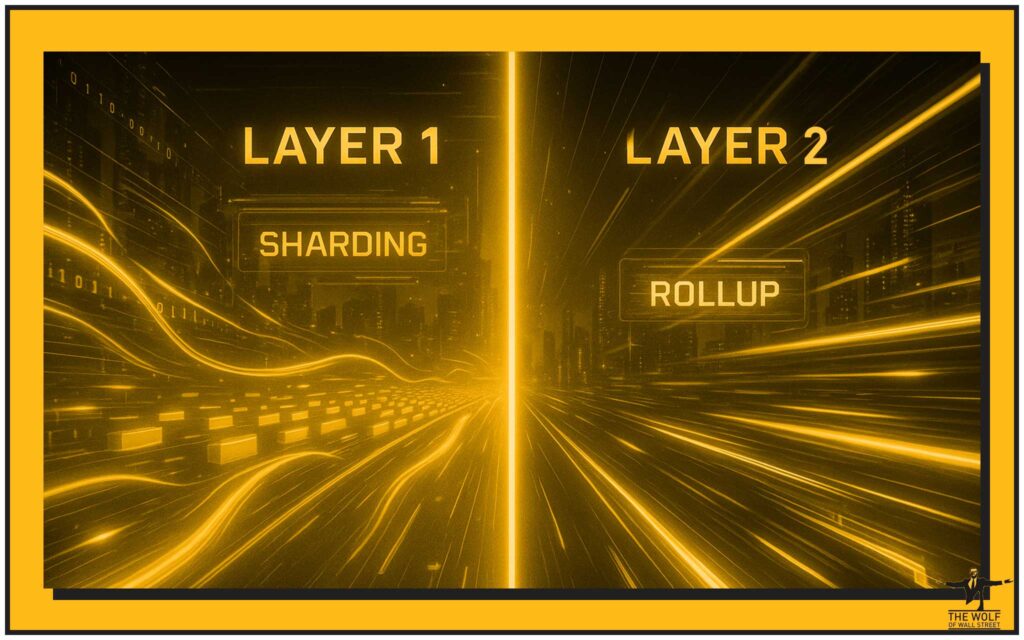

🛠️ Solutions: How Layer 1s Are Evolving

This is where the market’s alpha comes from.

Old chains upgrade, new chains innovate, and only the fittest survive.

- Layer 2 Rollups: Like express lanes—move volume off-chain, settle back on Layer 1. Arbitrum, Optimism, zkSync.

- Sharding: Splitting the network into pieces to boost throughput. NEAR, Polkadot, Ethereum’s roadmap.

- Protocol Upgrades: The Merge (Ethereum PoW ➝ PoS), Solana’s runtime tweaks.

- New Layer 1s: Aptos, Sui—rewriting the playbook with faster consensus, new programming languages (Move).

Stay ahead of the curve, or get left behind.

🆚 Layer 1 vs Layer 2: Know the Battlefield

Understand the game board:

- Layer 1: The foundation. Highest security, decentralisation, but slower and more expensive.

- Layer 2: Built for speed and scale. Cheaper, but relies on Layer 1 for security.

Investor lesson: Don’t put all your chips in one basket. Use Layer 2s for fast trades, Layer 1s for holding value and building real applications.

Get the full lowdown in our Layer 1 and Layer 2 Solutions guide.

📈 Foundation Coin Market Dynamics (Q1 2025 Data)

Time for some hard numbers.

According to CoinGecko (March 2025), there are over 317 active Layer 1 blockchains. But not all are created equal—liquidity, developer activity, and adoption vary wildly.

- Top volume: Bitcoin, Ethereum, Solana—dominate the market share.

- Emerging stars: Avalanche, Aptos, Sui—grabbing attention with fresh tech.

- Trends: Decentralised finance (DeFi), NFTs, tokenisation, AI integration.

Want to catch the next wave? Follow the dev activity, not just price charts.

Our Trending section breaks down the latest action.

🧠 Wolf Wisdom: How to Spot Winning Layer 1 Projects

Don’t get wrecked chasing hype.

Here’s the Wolf’s Layer 1 checklist:

- Team: Experienced, transparent, visionary.

- Community: Big, active, and actually building.

- Real adoption: Is anyone actually using it?

- Tech: Is it just a copy-paste or something truly new?

- Security track record: Hacks? Outages? Beware.

- Tokenomics: Scarce or inflationary?

Red flags? Overhyped partnerships, vaporware, centralised control.

For deeper due diligence, explore our How to Buy Crypto Guide and Crypto Profit-Taking Wolf’s Guide.

🏦 Where and How to Buy Layer 1 Coins

It’s easier than ever to grab foundation coins, but easy doesn’t mean risk-free.

- Centralised Exchanges (CEXs): Binance, Bybit, Coinbase—fast and liquid, but you need to trust the platform.

- Self-Custody: Use wallets like MetaMask, Ledger, Trezor for max control.

- Tips: Always enable 2FA, watch for phishing, double-check addresses.

New to crypto? Our How to Buy Crypto Guide covers every step.

Want more insights? Tap into the Trading Insights hub.

💬 FAQs: What Every Investor Asks About Layer 1 Coins

1. Are Layer 1 coins a safe long-term investment?

Nothing is 100% safe in crypto, but Layer 1s are the least likely to vanish overnight—provided you avoid meme forks and ghost chains.

2. What’s the difference between Layer 1 and Layer 2 coins?

Layer 1 coins secure the entire ecosystem; Layer 2 coins (if any) are for niche uses—scaling, fast swaps, sidechains.

3. Can you earn passive income with Layer 1 coins?

Absolutely—many PoS Layer 1s offer staking rewards. Just research validator reputation first.

4. How can I spot a scam Layer 1 project?

Look for red flags: anonymous team, no working product, fake community, and overpromising marketing.

5. What will drive Layer 1 coin prices in the next bull run?

Tech upgrades, killer DApps, institutional adoption, and—crucially—real user activity.

🚀 Next-Gen L1s & The Future: Where is the Money Flowing?

If you think Bitcoin and Ethereum are the endgame, you’re not seeing the whole board.

Zero-knowledge proofs (zk-rollups), Move programming language, Proof-of-Liquidity—these are the weapons of the next bull run.

Chains like Aptos and Sui are chasing speed and developer ease. Ethereum is going modular, embracing Layer 2s. DePIN (decentralised physical infrastructure networks), AI, and tokenised real-world assets will demand stronger, more flexible Layer 1s.

Who wins? The ones that solve the trilemma, attract builders, and keep the network running when it’s raining money.

💰 Conclusion: The Wolf’s Final Word on Foundation Coins

Here’s the bottom line:

If you want to win in crypto, you don’t chase every shiny token.

You build your foundation on Layer 1. The smart money is always in the infrastructure—the assets that make everything else possible.

Do your homework, pick your horses, and never invest more than you can afford to lose.

Layer 1 & Foundation Coins aren’t just part of the game—they’re the table, the cards, and the casino.

Ready for the next step?

Jump into the Layer 1 and Layer 2 Solutions for deep dives, Trading Insights for strategy, or connect with the most active traders in the game.

Source Context & Bonus: Take Your Crypto Trading to the Next Level

The The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street Service

- Join our active Telegram community: The Wolf Of Wall Street Telegram

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street

Want to keep learning? Explore more: