🏁 The Wild West of Web3: Where Audits Separate Winners from Wrecks

In crypto, you’re either secure — or you’re hacked. There’s no middle ground.

Every day, billions in assets move across blockchains through lines of code called smart contracts. These contracts run without human oversight, executing financial logic faster than any bank ever could. But when one mistake slips through the cracks? You’re looking at a multimillion-pound disaster.

A smart contract security audit isn’t some optional luxury. It’s your financial seatbelt in the fastest market on earth. Whether you’re launching a DeFi platform, NFT protocol, or token sale, one vulnerability can erase everything you’ve built.

So today, we’re pulling back the curtain — showing you what audits are, why they matter, and how to dominate the market by securing your code like a pro.

⚡ What Exactly Is a Smart Contract Security Audit?

Let’s strip away the fluff. A smart contract security audit is a deep, forensic review of your blockchain code — a full-scale investigation to detect, dissect, and destroy vulnerabilities before hackers can exploit them.

Think of it as your digital bodyguard — a hyper-intelligent security expert that checks every instruction your contract gives to the blockchain.

Auditors dissect the smart contract’s logic, verify its mathematical integrity, and simulate real-world attacks to expose flaws. Whether written in Solidity, Vyper, or Rust, every single line gets tested under pressure.

The goal? To make sure your project doesn’t end up as another headline on Cointelegraph: “DeFi Protocol Drained in $120M Exploit.”

🧩 Why Smart Contract Audits Are the Backbone of Blockchain Trust

In the blockchain world, trust is currency. Users don’t buy promises — they buy proof.

When you show investors and users that your smart contract is professionally audited, you’re sending one message loud and clear: This project plays to win.

Audits build credibility, protect liquidity, and open the door to institutional partnerships. Without one, you’re gambling in the open.

Consider the 2023 Curve Finance exploit — a single overlooked bug led to losses exceeding £50 million. Or KyberSwap’s 2024 hack, where poor logic validation opened the floodgates to chaos.

If those teams had maintained continuous audit coverage, their stories would’ve ended differently.

For anyone managing compliance or financial flows, explore crypto AML regulations and travel rule strategies — two frameworks that work hand-in-hand with secure auditing.

🧠 How Does a Smart Contract Audit Work?

A proper audit isn’t a single task — it’s a systematic process.

Here’s the full breakdown:

- Initial Assessment

Auditors first analyse your project’s purpose, codebase size, and architecture. They understand what your smart contract should do before testing what it actually does. - Automated Testing

Advanced tools like Slither, MythX, and Oyente run thousands of simulations. They uncover common patterns of failure — buffer overflows, reentrancy issues, or integer bugs. - Manual Review

Here’s where human intelligence reigns supreme. Auditors manually review the code logic to identify design flaws that machines miss — the kind of errors that destroy projects. - Reporting

A professional report highlights each vulnerability, its severity, and step-by-step remediation guidance. - Remediation & Verification

Once developers patch the issues, auditors verify fixes, often issuing a “final clean bill of health.”

The smartest projects in Web3 treat this as an ongoing cycle — not a one-time checkbox.

If you’re serious about scaling your project, read Zero Knowledge Proofs in Crypto for insights on next-gen privacy and verification.

🧱 Automated Tools vs Manual Expertise — The Perfect Combo

Automation is fast — but human insight is lethal.

Automated scanners can analyse code in seconds, identifying syntax and logic bugs. But these tools don’t understand intent. That’s where expert auditors step in, spotting design logic flaws that machines can’t.

A tool might tell you what broke; an expert tells you why — and how to bulletproof it forever.

That’s why platforms like the The Wolf Of Wall Street crypto trading community combine AI tools and human analysis to provide elite-grade insights. Just like in trading, automation enhances speed — but mastery comes from experience.

🔍 Common Smart Contract Vulnerabilities You Must Know

The same attack types keep haunting DeFi — because most projects skip the basics.

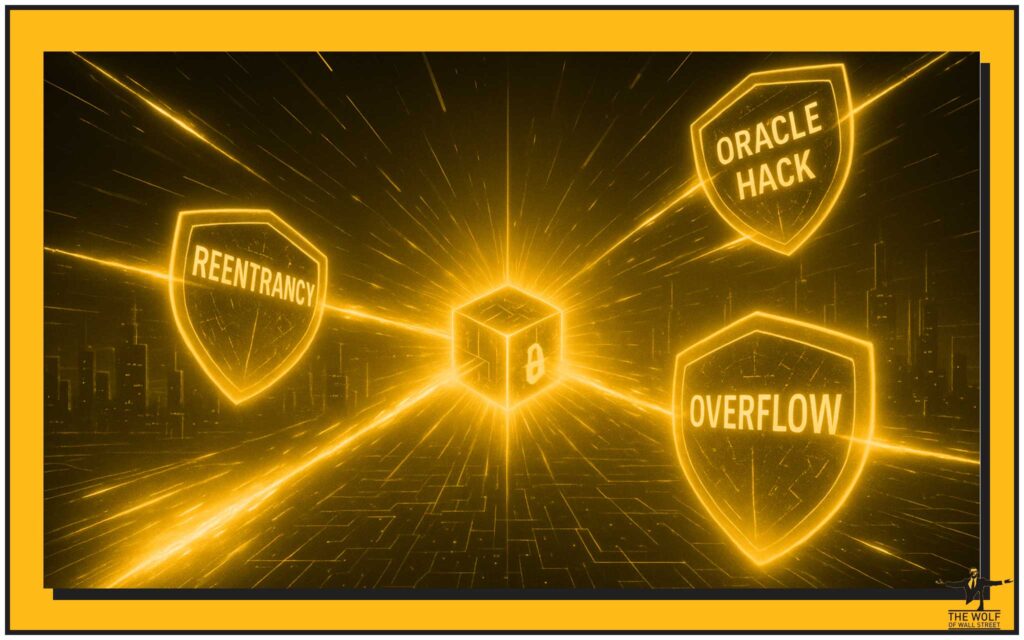

Here are the top five threats that audits uncover again and again:

- Reentrancy: Attackers exploit recursive calls to drain funds (see the infamous DAO hack).

- Integer Overflow/Underflow: Arithmetic errors lead to miscalculations and exploitation.

- Oracle Manipulation: When external price feeds get spoofed, attackers control valuations.

- Denial of Service (DoS): Functions get overloaded to block valid operations.

- Logic Flaws: The human element — when business logic doesn’t match code logic.

Audits catch these red flags before launch, saving your investors, your liquidity, and your reputation.

Want to understand how such flaws impact liquidity metrics? Check out Total Value Locked (TVL) in DeFi.

💰 What Happens If You Skip an Audit?

Let’s talk real consequences.

In 2024 alone, hackers stole over $3.1 billion from unaudited or poorly-audited DeFi projects (SlowMist Report 2025). And here’s the twist — 78% of those incidents could’ve been prevented through pre-launch audits.

Skipping an audit isn’t “saving money”; it’s lighting your capital on fire.

You wouldn’t drive a Ferrari without brakes — so why would you deploy £50 million of DeFi liquidity without a professional code review?

That’s not risk-taking. That’s reckless gambling — and in the blockchain arena, the house always wins.

🧾 The Cost of a Smart Contract Audit in 2025

Audits aren’t cheap, but they’re cheaper than failure.

For most projects, the price ranges from £5,000 to £15,000+, depending on:

- Codebase complexity

- Number of smart contracts

- Audit firm reputation

- Required turnaround time

Major firms like CertiK and Hacken charge more because they back results with reputation. But boutique teams can be ideal for smaller protocols — especially those seeking agility and direct developer collaboration.

Bottom line: if someone offers you a “full audit” for £500, run faster than a rug-pull token.

🧑💻 Choosing the Right Audit Partner — Avoid the Pretenders

Here’s where many founders screw up — they pick the wrong auditor.

A true audit partner doesn’t just run tools. They collaborate, analyse, and teach your devs how to write safer code.

When vetting a provider, check for:

- Transparency: Public methodology and audit reports.

- Experience: Past audits on similar protocols.

- Reputation: Verified clients and no fake testimonials.

- Post-Audit Support: Will they assist with remediation?

That’s why many professionals turn to the The Wolf Of Wall Street crypto community.

With over 100,000 traders and analysts, The Wolf Of Wall Street isn’t just a trading platform — it’s a collective intelligence network. You gain market analysis, VIP signals, and expert insight that help you choose legitimate, battle-tested services.

⚙️ Continuous Security — The Post-Audit Advantage

Here’s the truth: security is never “done.”

After deployment, new threats emerge every month. The smart players integrate continuous auditing into their lifecycle — running automated scans after every update.

Modern protocols also adopt tools like the ERC-7265 DeFi Circuit Breaker — an emergency switch that halts suspicious behaviour before it drains liquidity.

Learn more about this breakthrough in our ERC-7265 security guide.

🔐 Smart Contract Security and Compliance in 2025

In 2025, audits are no longer optional — they’re becoming legally expected.

The EU’s MiCA regulation demands that crypto platforms demonstrate risk management, code integrity, and third-party security checks. The US OFAC guidelines follow suit, requiring traceability for DeFi operations.

That means projects without verifiable audits could lose listings, banking relationships, or even regulatory clearance.

Compliance isn’t red tape — it’s your ticket to mainstream legitimacy.

If you’re managing compliance for your protocol, check out crypto AML frameworks for deeper insights.

🚀 Smart Contract Audits & DeFi — The Future Is Audited

The DeFi boom of 2020–2023 created a gold rush. But by 2025, only audited projects attract serious liquidity.

Institutional investors demand security proof — not promises. A verified audit certificate can be the difference between a £100K and a £10M liquidity pool.

Just look at TVL growth across audited ecosystems: platforms with recurring audits see up to 4.5x higher retention rates compared to unaudited ones.

Curious about the link between audits and liquidity dominance? Read Mastering Crypto Dominance Strategies.

💼 Real-World Case Studies — Lessons from the Frontline

Let’s put theory aside — here’s proof.

- Curve Finance (2023): After its exploit, the team integrated continuous audit coverage and regained over 70% of lost liquidity within weeks.

- KyberSwap (2024): A reentrancy bug led to over £40M drained. Their post-incident audit revamped internal processes, restoring user confidence.

Both cases prove the same truth — you pay for audits now, or you pay hackers later.

The Wolf Of Wall Street analysts routinely dissect these incidents in real-time, empowering traders to react before markets do. Join their Telegram community to see how elite traders interpret these moves.

🧮 The The Wolf Of Wall Street Advantage — Navigating Crypto with Confidence

In trading — just like auditing — you need precision, speed, and insight.

The The Wolf Of Wall Street crypto trading community gives you that edge:

- Exclusive VIP signals to maximise profit opportunities.

- Expert market analysis from veteran traders.

- Private forums with over 100,000 members exchanging strategies.

- Advanced tools like volume calculators for smarter entries.

- 24/7 support, because markets never sleep.

The Wolf Of Wall Street empowers traders to dominate volatility — just as smart contract security audits empower developers to dominate risk.

👉 Join The Wolf Of Wall Street today and make your trading journey as bulletproof as your code.

🧭 FAQs — Quickfire Answers

1. What’s included in a smart contract audit?

A complete code analysis — covering logic flaws, security exploits, and gas optimisations, with a detailed report outlining each vulnerability’s severity.

2. How long does an audit take?

Anywhere from a few days to several weeks, depending on project complexity and the audit team’s bandwidth.

3. Are all vulnerabilities fixable?

Most are, but some require redesigning core logic. Auditors prioritise fixes based on severity and feasibility.

4. How do I verify an auditor’s credibility?

Check past clients, GitHub activity, and transparency reports. Legit firms like CertiK and Hacken publish public audit histories.

5. What happens after the audit?

The real work begins — implement recommendations, reverify, and establish continuous monitoring.

🦾 The Audit Mindset — Secure Your Empire

In crypto, security isn’t a choice — it’s your competitive edge.

A smart contract security audit doesn’t just protect your assets; it proves your project belongs among the elite. The developers who win in Web3 are those who play defence as hard as offence.

And when it comes to trading the aftermath of market exploits, the The Wolf Of Wall Street community is where the sharpest minds turn volatility into victory.

Join, learn, and build — because the future of blockchain belongs to those who prepare, not those who panic.

🧩 The Wolf Of Wall Street Crypto Trading Community

The The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market.

- Exclusive VIP Signals: Access proprietary signals to maximise trading profits.

- Expert Market Analysis: In-depth insights from seasoned crypto traders.

- Private Community: Join over 100,000 like-minded individuals.

- Essential Tools: Volume calculators and advanced analytics.

- 24/7 Support: Dedicated assistance around the clock.

Empower your trading journey:

👉 Visit The Wolf Of Wall Street Service or join the The Wolf Of Wall Street Telegram Group for real-time updates.