🗣️ Introduction: Listen Up, Because Opportunity is Knocking

Let me tell you something. The Liechtenstein Blockchain Act isn’t just a piece of legislation; it’s a goddamn gold-stamped invitation to the biggest wealth transfer of our generation. While the rest of the world is drowning in red tape and legal confusion, the titans of industry, the quiet money, the people who really run things, are turning their eyes to a tiny, overlooked country in the heart of Europe. Why? Because Liechtenstein just rolled out the red carpet for the token economy. They’ve built a legal playground for serious players, not for the faint of heart or the perpetually broke.

Forget what you think you know about crypto. This isn’t about memecoins or gambling on the next pump-and-dump. This is about transforming real, tangible assets into digital power. This is about a level of financial freedom and control you’ve only ever dreamed of. Pay attention, because what I’m about to lay out for you isn’t just information; it’s a blueprint. It’s a map to a treasure chest, and I’m handing you the key. In this article, you’re going to learn exactly how to use the Liechtenstein Blockchain Act to get in on the ground floor of a financial revolution. So, put your phone on silent, close your other tabs, and listen up.

🌍 Why Liechtenstein? The Unlikely Titan of the Token Economy

A Global First Mover

Think about it. While behemoths like the United States and the UK are still arguing in committees, trying to figure out what a token even is, Liechtenstein did something revolutionary. They acted. On January 1, 2020, they launched the world’s first comprehensive legal framework specifically designed for the token economy. They didn’t just adapt old laws; they built something new from the ground up. They saw the future coming and instead of building a wall, they built a six-lane superhighway straight to it. This wasn’t a gamble; it was a calculated strike. They positioned themselves as the one place on Earth with absolute legal clarity for tokenising and trading assets. In a world of uncertainty, certainty is the most valuable commodity there is.

Building Unshakeable Trust

The early days of crypto were the Wild West. Let’s be honest, it was a mess of scams, hacks, and broken promises. It was a market built on hype and hope, and a lot of people got burned. Liechtenstein is changing the game. Their entire framework is built on one thing: trust. By bringing blockchain technology under a robust, intelligent regulatory umbrella, they’ve sent a clear message to the world: “The games are over. We’re here for serious business.” This government backing isn’t a restriction; it’s rocket fuel. It gives savvy investors the confidence to pour serious capital into the market, knowing their assets are protected by law, not just by a password. This is how you go from a niche market to a global financial powerhouse.

🔑 The Token Container Model (TCM): Your Golden Ticket to Digital Wealth

What the Hell is the TCM?

Alright, lean in, because this is the core of the whole damn thing. The Token Container Model, or TCM, is the engine driving this revolution. Forget complex legal jargon. Think of it like this: a token is a digital safe deposit box. The genius of Liechtenstein’s law is that you can put anything inside that box. I’m not just talking about digital currency. I’m talking about the deed to your house. The rights to a song. Shares in a private company. A bar of gold sitting in a vault. Your fine art collection. Anything you can own, you can now place inside a digital “container” and manage it on a blockchain. This model gives you the power to fractionalise, trade, and leverage assets that were previously illiquid and locked down. It turns the physical world into a fluid, digital marketplace. If you want to understand the nuts and bolts, a good starting point is learning the basics first; check out this guide on How to Create a Crypto Token: The Wolf’s Ultimate Guide.

Separating the Asset from the Tech

Here’s why the TCM is a masterstroke of genius. The law makes a crystal-clear distinction between the container (the token) and what’s inside it (the asset or right). The token is just the vehicle; the asset is the priceless cargo. This means the legal status of your asset doesn’t change just because it’s been tokenised. Your real estate is still real estate. Your company share is still a share. The technology can evolve, it can change, it can get hacked, but your legal right to the underlying asset remains untouched, anchored in the physical world and protected by law. This separation provides an iron-clad layer of security that simply doesn’t exist anywhere else.

🛡️ The Physical Validator: Your Personal Sheriff in the Digital Frontier

Who is this “Validator”?

If the TCM is the engine, the Physical Validator is the armed guard riding shotgun. This is a unique role created by the Act. Think of them as the legally mandated sheriff responsible for one critical job: ensuring the digital token perfectly mirrors the real-world asset at all times. If you have a token representing a diamond, the Physical Validator’s job is to guarantee that the diamond is real, that it’s securely stored, and that you are the undisputed owner. They are the bridge between the physical and digital worlds, the enforcer who makes sure no one can sell you a token for a bridge they don’t own.

The Power of Accountability

This isn’t some pinky-promise. Physical Validators are licensed professionals registered with the Liechtenstein Financial Market Authority (FMA). If they screw up, they don’t just get a slap on the wrist; they can lose their licence and face severe legal consequences. This layer of human accountability is the missing piece of the puzzle in decentralised finance. It eliminates the counterparty risk that plagues so much of the crypto world. It builds the kind of institutional-grade confidence that attracts the big money. It means you can operate with ruthless efficiency, knowing there’s a professional watchdog guarding the integrity of your assets.

📜 Playing by the Rules to Win: FMA, AML, and The Travel Rule

The Big Guns: Liechtenstein’s Financial Market Authority (FMA)

Look, amateurs fear regulation. Professionals leverage it. The FMA isn’t here to slow you down; it’s here to clear the road of cowboys and crooks so you can drive your Lamborghini at full speed. The FMA is the overseer, the regulator that ensures every service provider—from exchanges to validators—is operating to the highest standard. They are the reason Liechtenstein is synonymous with quality and security. A market without a strong referee is a street brawl; a market with a strong referee is the Super Bowl. You want to play in the Super Bowl.

Due Diligence and AML/CTF

Anti-Money Laundering (AML) and Counter-Terrorism Financing (CTF) aren’t just annoying acronyms; they are the bedrock of a stable financial system. It boils down to one simple principle: know your customer and know where the money is coming from. By enforcing these rules, Liechtenstein ensures its token economy remains clean, legitimate, and unattractive to criminals. This is fundamentally important. Dirty money creates instability and invites devastating regulatory crackdowns. By keeping the system clean from the start, Liechtenstein protects your investments and the long-term viability of the entire ecosystem. For a deeper dive, you need to understand the landscape with a Crypto AML Guide: Ensuring Compliance and Security in 2025.

The “Travel Rule” Explained

The Travel Rule is another piece of this puzzle. It simply means that when crypto assets are transferred, identifying information about the sender and receiver must “travel” with the transaction. This creates a transparent audit trail. Why should you care? Because transparency is the ultimate disinfectant. It proves ownership, prevents theft, and makes the entire system accountable to regulators. It’s a non-negotiable requirement for any serious financial jurisdiction, and complying with it is essential. You need to read up on The Crypto Travel Rule: A Strategic Guide to Compliance for 2025 to ensure you’re always ahead of the curve.

💰 Let’s Talk Money: Cryptocurrency Legality and Token Types

Is Crypto Legal?

Let’s get this out of the way. Yes, in Liechtenstein, cryptocurrency is 100% legal. It’s not a grey area, it’s not a “maybe.” It’s a recognised and regulated asset class, overseen by the FMA. This clarity allows you to operate with confidence, building strategies around a stable legal framework instead of worrying about the government changing its mind overnight.

Know Your Tokens: Security vs. Utility vs. Payment

Not all tokens are created equal, and you damn well better know the difference. The law classifies them, and that classification determines how you can trade them and what rules apply.

- Security Tokens: These are the big boys. They represent ownership in an asset, like a stock. They fall under stricter financial regulations.

- Utility Tokens: These grant you access to a product or service. Think of them as a digital key or a voucher.

- Payment Tokens: These are designed to be a means of payment, like Bitcoin.

Understanding which category your token falls into is absolutely critical. It dictates your tax obligations, your trading options, and your entire investment strategy. Misclassify a token, and you’re setting yourself up for a world of pain. Get it right, and you can navigate the market like a pro.

💸 The Best Part: Keeping What You Earn with Smart Tax Strategy

The Tax Advantage

Now we get to the best part: keeping your money. This is where Liechtenstein truly shines for the savvy investor. Due to its forward-thinking tax laws, profits generated from trading certain types of tokens—specifically those classified as representing a participation right, like a stock—are often considered capital gains. And in many cases, for individuals, those capital gains are tax-free. Read that again. Tax. Free. This isn’t a loophole; it’s a feature. It’s a direct invitation to build wealth without seeing half of it disappear into the government’s coffers.

When You Do Pay

Of course, not everything is a free ride. If you’re trading utility or payment tokens as a business, those profits are generally treated as regular income. For legal entities, this means you’re looking at a flat, highly competitive corporate tax rate of 12.5%. When you compare that to the rates in other major financial hubs, it’s an absolute bargain. The key is structure. By understanding the rules and structuring your activities intelligently, you can legally and ethically minimise your tax burden and maximise your take-home profit.

🐺 The Wolf’s Den: Your Invitation to Dominate the Crypto Market

Stop Guessing, Start Winning

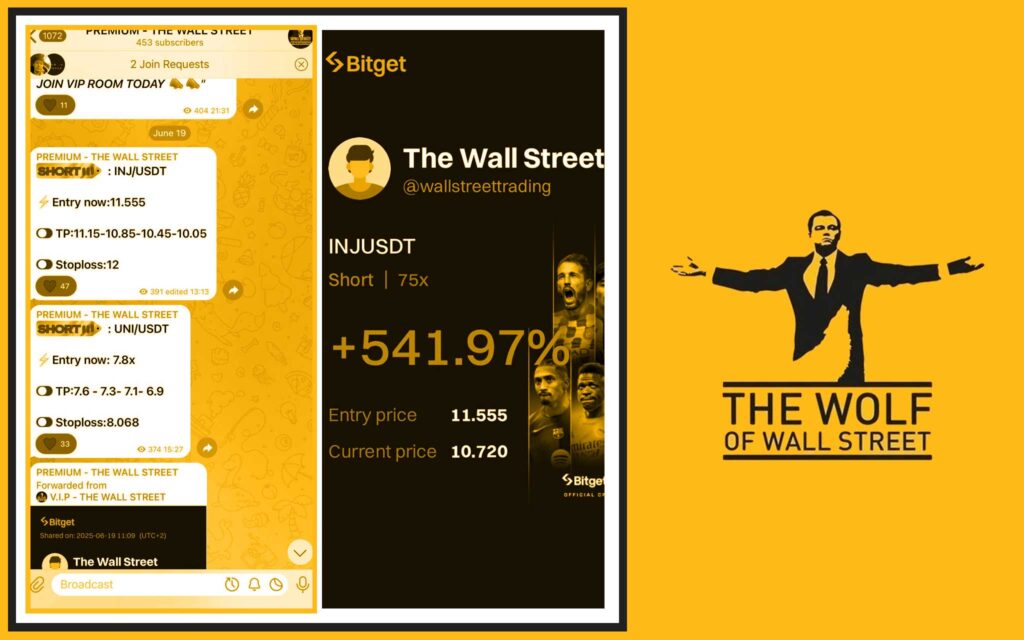

You now have the map to one of the most powerful legal frameworks in the world. But having a map is one thing; having a seasoned guide to navigate the treacherous terrain of the live market is another. The crypto market is volatile. It chews up and spits out amateurs who trade on emotion and guesswork. But for those with the right information, volatility isn’t a risk; it’s an opportunity. It’s the engine of profit. This is where you get your unfair advantage. This is where you join the The Wolf Of Wall Street crypto trading community.

What You Get in the Inner Circle

When you step into our world, you’re not just getting tips; you’re getting a comprehensive arsenal to conquer the market.

- Exclusive VIP Signals: Stop chasing the market. Let the market come to you. Our proprietary signals are engineered for one purpose: to maximise your profits. We tell you when to get in, and more importantly, when to get out.

- Expert Market Analysis: Get daily briefings from traders who have been in the trenches for years. We dissect the market, so you don’t have to. You get in-depth, no-fluff analysis that translates directly into actionable trading decisions.

- A Private Community: You become part of a network of over 100,000 like-minded killers. Share insights, strategies, and motivation with a community that is relentlessly focused on one goal: winning.

- Essential Trading Tools: You can’t build an empire with a shovel. We equip you with volume calculators and other critical resources to ensure every move you make is backed by data, not by hope.

- 24/7 Support: The crypto market never sleeps. Neither do we. Our support team is always on standby to assist you, ensuring you’re never left in the dark.

Your Next Step

The choice is yours. You can take this information and try to go it alone, or you can arm yourself with the best tools and the sharpest minds in the business. Empower your crypto journey. Unlock your potential.

- Get the full details on our service page: The Wolf Of Wall Street Service Page

- Join the real-time conversation and get live updates on our Telegram: The Wolf Of Wall Street Telegram

🏁 Conclusion: The Time to Act is NOW

We’ve covered it all. A revolutionary legal framework. The power to tokenise any asset on Earth. An accountable system policed by professionals. A tax-friendly environment built for wealth creation. Liechtenstein has laid the foundation for the future of finance, and the door is wide open, but it won’t be for long. The smart money is already moving.

Every day you wait is a day you’re leaving money on the table—money someone else is picking up. The choice is simple: you can stand on the sidelines and watch the revolution happen, or you can get in the game and become a part of it. Your launchpad is here, legally secured and ready for takeoff, all thanks to the Liechtenstein Blockchain Act.

❓ Frequently Asked Questions (FAQs)

- Q1: Is Liechtenstein’s Blockchain Act too complex for a new investor?

- A: It’s detailed, but that’s its strength. For a new investor, the key isn’t to memorise the law, but to work with service providers (like those in Liechtenstein) who have mastered it. Its clarity makes it safer for new investors than the chaotic regulations elsewhere.

- Q2: What’s the biggest risk of tokenizing assets there?

- A: The biggest risk isn’t in the law itself, but in the underlying asset. The law provides the framework, but it can’t make a bad investment a good one. The risk is, as always, in picking the right assets to tokenise. The platform is secure; your investment thesis still has to be solid.

- Q3: Can I really trade any asset on a Liechtenstein-based exchange?

- A: Theoretically, yes, once it’s been tokenised via the Token Container Model. However, the type of token (security, utility) will determine which exchanges can list it and what specific rules apply. Security tokens, for instance, have stricter trading requirements.

- Q4: How does the Physical Validator make money?

- A: They are professional service providers who charge fees for their work. This can include initial setup fees for verifying and onboarding an asset, as well as ongoing fees for custody, insurance, and regular audits to ensure the link between the physical asset and the digital token remains secure. They get paid to provide you with peace of mind.