🦁 Introduction: The Hunt for Passive Crypto Income in 2025

Let’s cut to the chase. Everybody in crypto is chasing passive income, but most are stuck in the hype loop—staking, “set-and-forget” yield farms, or just sitting on the sidelines. You want to know: Can running a Bitcoin Lightning Network node in 2025 make you real money, or is it just another mirage?

In this article, I’m breaking down every angle: setup, profitability, hard costs, the cold reality of centralisation, and insider tips to squeeze every satoshi out of your operation. No fluff—just facts, numbers, and real opportunity.

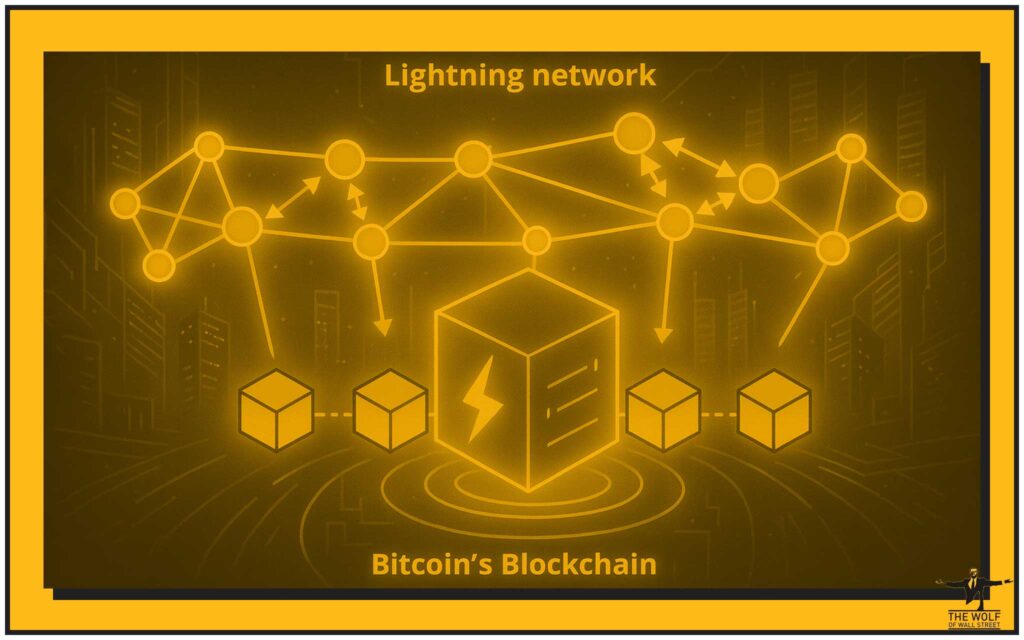

⚡ Lightning Network: What It Is and Why It Matters

The Lightning Network isn’t just another blockchain buzzword. It’s Bitcoin’s secret weapon for instant, dirt-cheap transactions, scaling BTC beyond the reach of slow, expensive on-chain payments.

How it works:

- Opens “payment channels” between users—settles only when you want to cash out.

- Routes payments via the shortest, cheapest path using hashed timelock contracts (HTLCs) and onion-style encryption.

- Major implementations in 2025: LND, Core Lightning (CLN), Eclair.

- Network capacity has exploded: 5,000+ BTC locked up, with hundreds of millions using apps plugged into Lightning.

Bottom line: Lightning is the backbone of Bitcoin’s next-gen utility. If you’re a node operator, you’re not just a middleman—you’re the infrastructure.

💸 Is Passive Income with Lightning Nodes Real or a Mirage?

Here’s the deal: You’ve seen the YouTube hustlers and Twitter threads promising fat profits. Most of it? Hot air.

The hard truth:

- Lightning node earnings come from routing fees—tiny fractions of a percent on transactions you help process.

- Top 10 nodes control ~85% of network capacity (2025 data), hoovering up most of the volume.

- Hobbyists and small-timers? They’re lucky to break even, unless they hustle and optimise relentlessly.

Still, there is a way in—if you play smart and dodge rookie mistakes.

🚀 The 2025 Opportunity: Why Lightning Nodes Are Hot (and Who’s Actually Winning)

Let’s talk timing and market dynamics.

- Mass adoption: Over 650 million users have indirect Lightning access via major wallets and exchanges.

- Institutional players: Big money’s crowding in, driving up channel volumes and squeezing out lazy operators.

- Retail edge: If you’re nimble, strategic, and obsessed with optimisation, you can still carve out a niche.

Internal Links:

- Get more crypto trading insights to stay ahead of market shifts.

- Want to leverage Bitcoin spot and derivatives trading? Pair it with your Lightning node for maximum action.

- Explore how to earn crypto without selling: passive income for alternative strategies.

🛠️ Step-by-Step: Setting Up Your Lightning Node in 2025

Ready to build your own node? Here’s how to do it without burning money on hype hardware.

Hardware:

- Raspberry Pi 5 or equivalent mini-PC (SSD + 4–8GB RAM required)

- Fast, stable internet (no Wi-Fi freeloading—get reliable fibre)

- Uninterruptible power supply (UPS) for uptime

Software:

- RaspiBlitz and Umbrel are the go-to options—plug-and-play, open-source, and well-documented.

- Advanced? Try Core Lightning or Eclair for more control.

Setup checklist:

- Flash your SD card with your chosen OS.

- Sync the Bitcoin blockchain (yes, it takes time—be patient).

- Open Lightning channels—start with reputable peers.

- Fund your node and watch it come alive.

💰 Getting Funded: Channel Opening, Liquidity, and Capital Lock-Up

Don’t just open channels at random. Every satoshi you lock is capital that could be earning yield elsewhere. Here’s how to make it count:

- Channel size: Start with 1–5 million sats per channel; scale up once you find quality peers.

- Balanced liquidity: Don’t dump all your BTC on one side—spread it.

- Pick active nodes: Use tools like 1ML and Amboss to identify the best-connected partners.

- Monitor fees: Opening/closing channels incurs on-chain fees—factor it into your cost structure.

📈 Lightning Node Profitability: The Brutal Truth

Let’s talk numbers, not dreams.

- Small node operators: Routing 0.1 BTC/day? Expect maybe $10–$30/month—often less than your electricity bill.

- Mid-size operators (routing ~2 BTC/day): Realistically, $200–$400/month, but only if you constantly rebalance and optimise.

- Large nodes: They eat most of the pie. Some top nodes clear $1,000+/month, but they’ve invested serious capital, tech, and time.

Key factors that make or break your profits:

- Fee market is cut-throat—lower is not always better, but too high and nobody routes through you.

- Channel uptime and reliability—if you’re offline, you miss revenue.

- Active liquidity management—idle channels earn zero.

🏦 Network Centralisation: Why the Top 10 Nodes Are Cleaning Up

Let’s not sugar-coat it. Lightning in 2025 is top-heavy.

- Centralisation is real: The biggest nodes set the rules, pull the most routes, and dominate profitability.

- Small operators can win—if you’re aggressive:

- Connect directly to big hubs

- Stay online 24/7

- Automate your fee structure

But be honest: This isn’t a set-and-forget yield farm. It’s active management, just like a trading desk.

🧮 Operational Costs and Hidden Fees: The Real Math

Here’s what they don’t tell you on TikTok:

- Hardware: ~$100–$300 (one-time)

- Electricity & internet: $5–$20/month, depending on your country

- On-chain fees: Variable, especially when Bitcoin is pumping

- Maintenance: Time is money—troubleshooting, updates, backups

Unexpected killers:

- Force-closed channels (bad peers or network issues)

- SSD failure (always back up your wallet and channel data)

- Downtime (missed routing = missed income)

🔒 Security, Fraud, and Risk Management: How to Not Get Wrecked

The Lightning Network isn’t risk-free. If you treat it like passive staking, you’ll get smoked.

- Watchtowers: Deploy them or connect to a trusted service—they watch for fraud and bad closures.

- Regular backups: Lose your node, lose your funds. Simple.

- Security hygiene: Harden your OS, keep your keys offline, use multi-factor authentication where possible.

- Continuous monitoring: Alerts for downtime, stuck payments, or suspicious peer activity.

🎯 Best Practices for Maximising Lightning Node Yield

Want to boost your returns? Steal these power plays from the pros:

- Dynamic fee algorithms: Use scripts or built-in tools to auto-adjust fees based on traffic.

- Frequent liquidity rebalancing: Move funds between channels to maximise route potential.

- Diversify channel partners: Don’t stick with one clique—build a network.

- Stay up-to-date: Follow crypto trading insights for shifts in on-chain fees and Lightning updates.

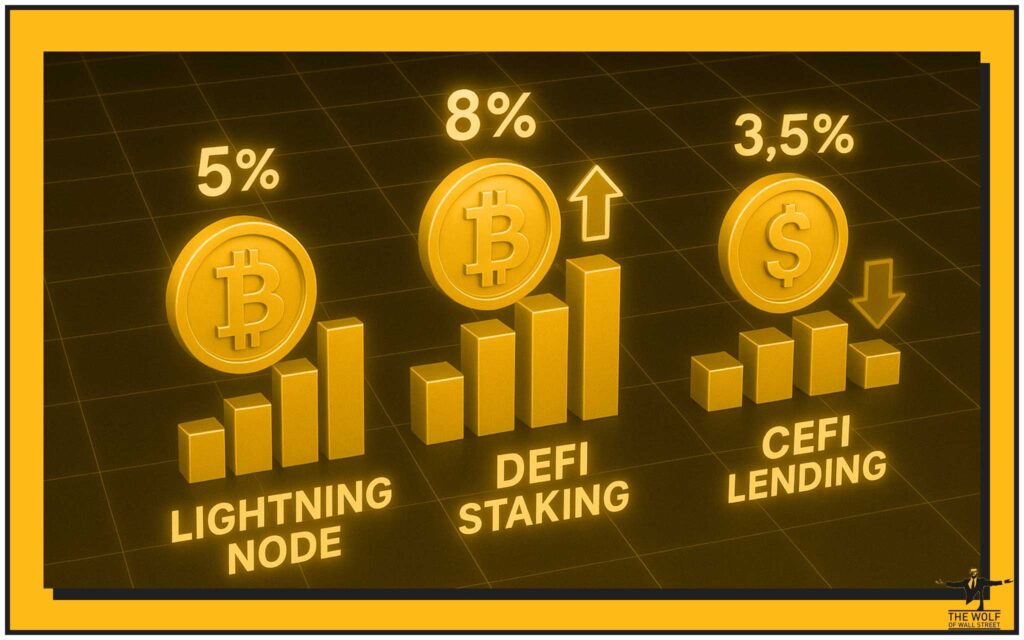

🥊 Lightning Node vs. Other Passive Income in Crypto (DeFi, Staking, Lending)

Lightning Node:

- Pros: No smart contract risk, censorship resistance, supports the Bitcoin ecosystem

- Cons: Low margins for small ops, requires constant management, risk of technical loss

DeFi Staking:

- Pros: Higher APYs (on paper), more “hands-off” platforms

- Cons: Smart contract exploits, centralised risk, higher entry barriers

Centralised Lending:

- Pros: Simpler, fixed rates, low management

- Cons: Counterparty risk, possible asset lock-up

| Method | Typical Returns | Key Risks | Hands-On Time | Capital Needed |

|---|---|---|---|---|

| Lightning Node | 1–5%/year | Technical loss, downtime | High | 0.01+ BTC |

| DeFi Staking | 4–15%/year | Contract bugs, rug pulls | Low–Medium | Token-dependent |

| CeFi Lending | 2–8%/year | Platform insolvency | Low | $100+ |

🏛️ Regulatory and Tax Landmines for Node Operators in 2025

You will have to deal with the taxman.

- Most jurisdictions treat Lightning income as taxable.

- Channel-opening and closing fees? Often considered “expenses.”

- Keep records: Log every channel, every transaction, every fee—trust me, your future self will thank you.

For more on compliance, see Crypto AML Guide: Compliance & Security 2025 and Crypto Travel Rule Compliance Strategy 2025.

👤 Real-World Case Study: A Day in the Life of a Lightning Node Operator

Let’s look at “Sam,” a London-based Lightning enthusiast who set up a node in January 2025.

- Setup: £200 spent, Raspberry Pi 5, Umbrel OS

- First month: Opened 10 channels, 1.2 BTC routed in total, earned £8.20 net after costs.

- Biggest headache: Balancing liquidity and downtime (a single power outage cost him half his monthly income).

- Lesson: Active management and regular rebalancing are essential. Passive? Not a chance. But with experience, he grew monthly profits by 3x in six months.

✔️ Checklist: Should YOU Run a Lightning Node This Year?

Before you dive in, ask yourself:

- Do you have time to manage, rebalance, and troubleshoot regularly?

- Can you risk locking up BTC for months—possibly years?

- Are you comfortable with basic Linux skills?

- Are you looking for a project—not a pure passive income machine?

- Do you want to contribute to Bitcoin’s real-world adoption?

If you answered “yes” to most, this game is for you. If not—consider other passive crypto income methods.

🏁 Conclusion: Lightning Nodes—Hustle or Passive Goldmine?

Let’s call it straight:

Running a Lightning node in 2025 is NOT a passive income goldmine for most people.

But if you treat it as an active hustle—a technical business you optimise and grind—you can build a profitable, scalable revenue stream and help power Bitcoin’s future.

The lazy get nothing. The hustlers win.

Want an edge? Plug into an elite trading community—get the tools, signals, and support you need to play at the highest level.

❓ Frequently Asked Questions (FAQs)

Q1: How much can I earn running a Lightning node?

Most small nodes earn $10–$30/month, with the big profits going to large, well-managed nodes. Your results depend on capital, uptime, and smart channel management.

Q2: Is running a node truly passive income?

No. Expect to spend time on maintenance, liquidity rebalancing, and troubleshooting. Think of it as a side business—not a savings account.

Q3: What’s the minimum investment to start?

You can get rolling for $100–$300 in hardware plus at least 0.01 BTC, but more capital means more earning potential.

Q4: What are the biggest risks?

Technical loss (node failure, data loss), downtime, centralisation squeezing out small operators, and changing fee markets.

Q5: Are there communities to help me level up?

Absolutely—look for professional groups like the The Wolf Of Wall Street crypto trading community or join their Telegram for real-time guidance and peer support.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service for detailed information.

- Join our active Telegram community for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.

Ready to take your trading and earning to the next level?

Tap into the The Wolf Of Wall Street community, connect with the experts, and supercharge your results—because in this market, average is broke and hustlers get rich.

For deeper dives, explore: Bitcoin spot and derivatives trading, Crypto trading insights, Layer 1 and Layer 2 solutions, and more across our crypto knowledge base.