💰 Intro – The Big Bet

MARA Holdings, the world’s largest Bitcoin miner, just made a move that screams alpha. Forget slow pivots, this is a $168 million leap into the deep end of artificial intelligence and high-performance computing (HPC). Why? Because staying a one-trick Bitcoin pony in 2025 is like betting your whole bankroll on a single hand — gutsy, but potentially fatal. MARA isn’t playing small; they’re about to redefine their game.

📊 The Deal Breakdown

Numbers Don’t Lie

MARA’s dropping $168 million for a 64% stake in Exaion, a subsidiary of energy giant Électricité de France (EDF). There’s an option on the table to ramp that up to 75% by 2027 for an extra $127 million, but only if certain performance milestones get smashed.

Why Exaion?

Exaion isn’t some unknown startup. They’re a heavy hitter in HPC, AI infrastructure, and enterprise cloud services. With partnerships with Nvidia and Deloitte, they’ve got the kind of credibility and tech stack that lets MARA skip the amateur hour and walk straight into the VIP section of the AI game.

🎯 The Strategic Masterstroke

Diversification with a Purpose

Bitcoin mining is still MARA’s bread and butter, but even the best miners know: when difficulty goes up and rewards go down, you need another income stream. By buying into an established HPC/AI player, MARA sidesteps the costly, time-consuming process of retrofitting mining facilities for AI workloads.

Skipping the “First Wave”

CEO Fred Thiel made it clear: they deliberately skipped the “first wave” of AI expansion. While others scrambled to convert mining rigs, MARA waited for the right partner. The result? They’re walking into the AI arena with a fully kitted-out ally, not a DIY project.

⚡ The Energy Edge

EDF’s Low-Carbon Muscle

Exaion’s affiliation with EDF means access to low-carbon energy. That’s not just good PR — in an energy-hungry industry like AI and crypto, it’s the difference between thin margins and fat profits.

Sustainable AI & Crypto

ESG-conscious investors are flooding into companies that balance profit with sustainability. MARA’s ability to mine Bitcoin and run AI workloads on clean power makes them a magnet for that capital.

🔀 Industry Crossroads

Mining Profitability Squeeze

Bitcoin’s difficulty keeps climbing. More power, more cost, less reward. That’s why miners are scrambling for diversification.

AI/HPC as the Escape Hatch

Enterprise demand for AI processing power is booming. By stepping into HPC, MARA isn’t just surviving — they’re positioning to dominate a parallel gold rush.

🥊 Competitive Pressure

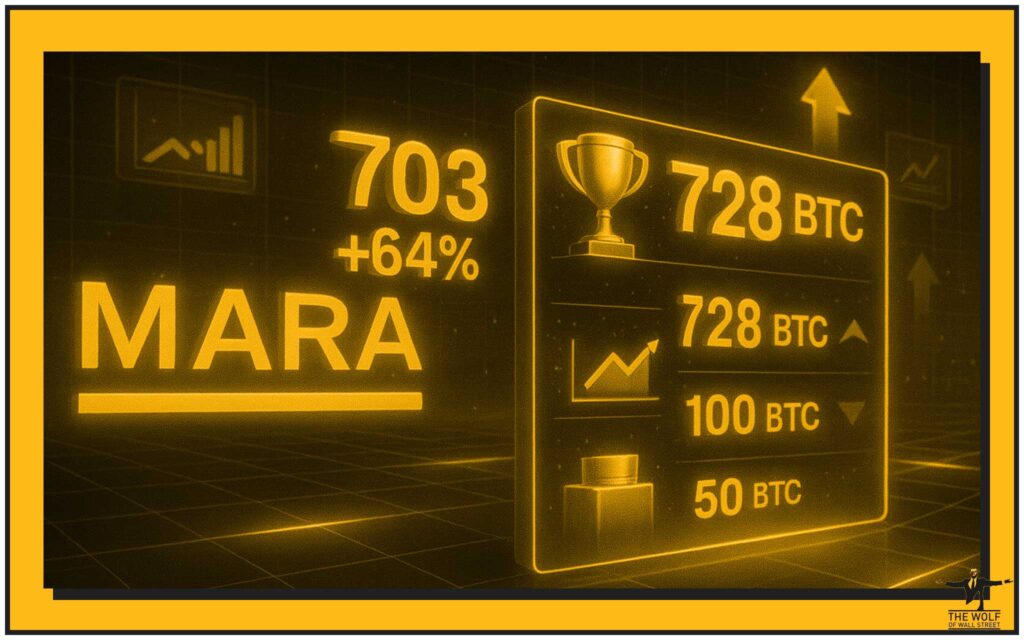

Current Performance

July 2025: MARA mined 703 BTC, trailing competitor IREN’s 728 BTC. But here’s the kicker — Q2 revenue still soared 64% YoY to $238 million.

The Hash Rate Game

With 50,000 BTC (~$6 billion) in reserves, MARA sits on the second-largest corporate Bitcoin treasury, just behind MicroStrategy. That war chest gives them the freedom to make bold plays like this.

🧬 Exaion’s Secret Sauce

Technical Capabilities

Exaion runs high-performance data centres, AI clusters, and enterprise-grade cloud platforms. Their ongoing Nvidia collaborations could give MARA a fast lane to scale HPC services.

Client Portfolio & Market Reach

With clients spanning industries from finance to gaming, Exaion offers MARA immediate market penetration beyond crypto.

📊 The Wolf’s Playbook for Investors

Revenue Mix Shift

If MARA nails this, HPC and AI could become a major slice of their revenue pie, smoothing out the volatility of Bitcoin price swings.

Risk & Reward

Yes, crossing into a new industry carries risk. But the upside — new clients, recurring contracts, diversified cash flow — makes the gamble worth it.

🔍 3 Things to Watch Next

- Deal closing in Q4 2025 after regulatory clearance.

- First big AI/HPC contracts post-acquisition.

- Impact on MARA’s market cap and investor sentiment.

💬 Analyst Insights & Market Sentiment

Analysts are split. Bulls see MARA as a pioneer in merging crypto mining power with AI infrastructure. Bears warn about execution risk in a hyper-competitive HPC market. But even sceptics admit: with EDF’s energy and Exaion’s tech, MARA’s got a fighting chance.

📊 Charting the Opportunity

- BTC Output Trend: Shows MARA’s production staying competitive despite rivals.

- AI/HPC Market Projection: Multi-trillion dollar growth potential by 2030.

- Revenue Split Forecast: Bitcoin vs. AI/HPC earnings within five years.

📝 Lessons for the Crypto Space

Other miners, take note: adaptation isn’t optional. MARA’s pivot shows the smart money moves before the squeeze becomes a choke.

🚀 The Wolf Of Wall Street Crypto Trading Community Plug

In markets this volatile, knowledge is your edge. The Trading Insights section at The Wolf Of Wall Street keeps you ahead of moves like MARA’s. Whether you’re watching Bitcoin or diversifying into AI-linked plays, our Cryptocurrencies coverage keeps your finger on the pulse.

❓ FAQs

Q1: How will MARA’s pivot impact Bitcoin mining?

It should make them less dependent on BTC price swings, giving them a more stable income base.

Q2: What does Exaion bring to MARA?

Expert HPC/AI infrastructure, strong partnerships, and a ready client base.

Q3: Will other miners follow this model?

Absolutely — those who don’t risk being left behind as AI/HPC demand skyrockets.

🔑 Conclusion – The Bottom Line

This isn’t a side hustle. It’s MARA’s power move into the next multi-trillion-dollar frontier. In the Wolf of Wall Street’s words? “Act as if” — and MARA is acting like the king of AI/HPC already. Bitcoin was the first hunt; now they’re stalking bigger prey.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service for detailed information.

- Join our active Telegram community: https://t.me/tthewolfofwallstreet for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”