🚀 Forget the Noise: This is How You Command the Crypto Market

You see those guys, the ones staring blankly at charts, biting their nails, sweating bullets? They’re reacting. They’re hoping. They’re praying. That’s not us. We don’t hope; we act. We don’t pray; we strategise. The difference between a struggling trader and a market dominator isn’t just luck; it’s control. And control in the crypto market comes down to one thing: understanding and executing your orders with surgical precision.

This ain’t rocket science, but it is a science. A science of making money. We’re going to strip away the jargon, cut out the fluff, and give you the direct, value-packed insights you need to turn the volatile crypto market into your personal ATM. You want to make money? You want to minimise risk? You want to seize opportunities that others only dream of? Then pay attention, because this is your blueprint.

🤠 The Wild West Days Are OVER: Welcome to Regulated Riches

Remember the early days of crypto? The wild, wild west, right? It was a chaotic free-for-all, a digital frontier where peer-to-peer transactions ruled, and oversight was a myth. People were buying and selling on forums, trusting strangers with their hard-earned cash, and risking everything on a handshake and a prayer. It was exciting, sure, but it was also a breeding ground for scams, mistakes, and colossal losses. There was no real framework, no safety net, just raw speculation. It was a casino without rules.

From Basement Bargains to Billions: Crypto’s Evolution

But guess what? That era is dead. D-E-A-D. Today, we’re talking about a multi-billion-pound industry, a global financial powerhouse that processes astronomical volumes of trades daily. Crypto exchanges have evolved from shadowy corners of the internet into highly sophisticated, regulated platforms. We’re talking about robust security, advanced trading tools, and regulations that, while still evolving, are bringing a level of legitimacy and professionalism that the early pioneers could only dream of. This isn’t your grandad’s unregulated penny stock market. This is serious business, and if you’re serious about making serious money, you need to play by the new rules.

Why You NEED to Understand the Game Now

With billions flowing through these exchanges, the stakes are higher than ever, and so are the opportunities. But opportunity demands competence. You can’t just throw money at a chart and expect to win. You need to understand the mechanics, the levers, the damn gears that make this machine print money. Knowing your order types isn’t just a suggestion; it’s a mandatory requirement for anyone who wants to not just survive but thrive in this market. It’s the difference between being a spectator and being a player who takes home the trophy.

🗺️ The Order Book: Your Battlefield Map

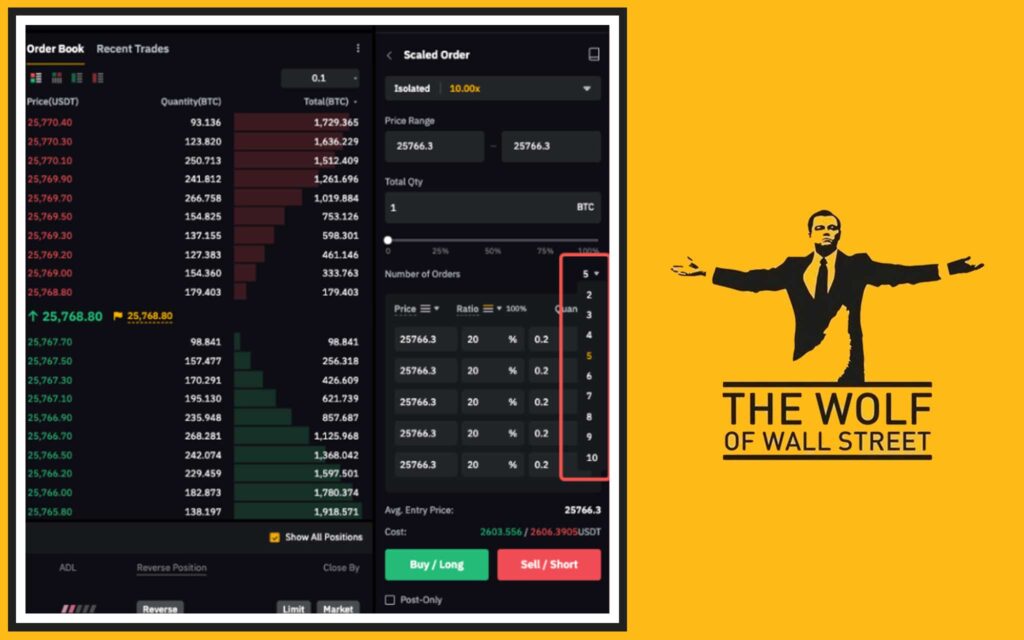

Think of every trading pair – say, Bitcoin against the US Dollar, BTC/USD – as a battlefield. And the order book? That’s your comprehensive, real-time map of every single buy and sell intention in that market. This isn’t some abstract concept; it’s a living, breathing ledger of desire and demand, a pulse of the market’s collective will.

Bids and Asks: The Raw Truth of Supply and Demand

On one side, you’ve got the bids – these are the buyers, the guys who want to get in, who believe the price is going higher. They’re putting in orders to buy a specific asset at a specific price, or lower. These are the foundations of the market. On the other side, you’ve got the asks – these are the sellers, the ones ready to offload their assets, perhaps taking profits or cutting losses. They’re putting in orders to sell at a specific price, or higher.

The order book shows you the depth of these intentions: how many people want to buy at £50,000, how many at £49,999, and so on. The same for selling. It’s a transparent, unvarnished look at the market’s true intentions.

What Happens When Orders Clash: The Execution Advantage

Orders stay open on this book, patiently waiting, until one of two things happens: they get filled, or they get cancelled. When a buyer’s bid meets a seller’s ask at an agreeable price, boom – a trade is executed. This is the heart of the market. Understanding this mechanism is vital, because it dictates how quickly your orders will fill, at what price, and whether you’re getting the best possible deal. It’s about reading the market’s heartbeat and knowing exactly when to strike.

💨 Market Orders: When You Demand Immediate Action!

Sometimes, you just need to get in, or get out, now. No waiting, no messing around. That’s when you unleash the power of a market order.

Speed Kills (and Makes Money): The Instant Execution Power

A market order is the simplest, most direct command you can give: “Buy this, or sell that, at the best available price right now.” It doesn’t care about a specific price; it cares about speed. It hits the order book, devours the best available buy or sell orders immediately, and your trade is executed. Guaranteed execution. You want to be in the game instantly? This is your button. When the market is surging, and you don’t want to miss a second of that profit train, a market order gets you on board.

The Slippage Trap: Don’t Get Screwed by Impatience

But listen closely, because even the fastest horse has its quirks. The biggest trap with market orders is slippage. Especially in volatile, low-liquidity markets – where there aren’t many buyers or sellers lining up at every price point – your market order might chew through the best available prices so fast that you end up buying higher or selling lower than you expected. You wanted Bitcoin at £50,000, but your large market order ate through all the offers at £50,000, then £50,050, and ended up filling at an average of £50,100. That difference? That’s slippage, and it eats into your profits. Be aware of it.

When to Go All-In with a Market Order

So, when do you use this blunt instrument? When speed is paramount over price precision. When you see a breaking news event, or a sudden surge, and you must enter or exit a position without delay. If you’re trading highly liquid assets like Bitcoin or Ethereum on major exchanges, slippage might be minimal. But for smaller altcoins or during periods of extreme volatility, use it with your eyes wide open. Don’t be a fool; understand the tool.

🎯 Limit Orders: Precision, Control, and Pure Profit Potential

Now, if market orders are the brute force, limit orders are the precision strike. This is where the smart money operates, where you dictate the terms.

Setting Your Price: The Smart Money Move

With a limit order, you tell the exchange: “I want to buy X amount of Y asset, but only at this specific price, or better.” Or, “I want to sell X amount of Y asset, but only at this specific price, or better.” This gives you absolute control over your entry or exit price. Your order sits on the order book, patiently waiting for the market to reach your desired price. It’s like setting a trap for profit. You decide your battlefield, you decide your price.

The Waiting Game: Patience Pays (But Sometimes It Doesn’t)

The upside? You get the price you want, or you don’t get the trade. This eliminates slippage and ensures you’re buying low and selling high, or at least at your predetermined favourable levels. The downside? There’s no guarantee your order will ever be filled. The market might never reach your specified price, leaving your order unexecuted, and you might miss out on a move. Patience is a virtue, but sometimes the market waits for no one.

Maximising Gains with Surgical Limit Orders

Limit orders are your go-to for strategic entries and exits. Want to buy the dip at a specific level? Set a limit buy. Want to lock in profits when a coin hits your target? Set a limit sell. They’re excellent for executing your trading plan without constant monitoring and are the cornerstone of true trading efficiency. For those looking to fine-tune their approach and make every trade count, explore the detailed insights on strategies that factor in market conditions and precision, similar to those found in our guide on Trading Insights.

🛡️ Stop Orders: Your Bulletproof Vest in Volatile Markets

Alright, this is where you stop being a victim and start protecting your empire. Stop orders are your automated risk management, your shield against brutal market downturns.

The “Protect Your Capital” Command: How Stop Orders Work

A stop order is a sleeping giant. It sits dormant until a specific price, called the stop price, is hit. Once that stop price is triggered, it automatically converts into a market order and executes at the best available price. Its primary purpose? To limit your losses. If you bought Bitcoin at £50,000 and set a stop order at £48,000, if Bitcoin crashes to £48,000, your stop order triggers, sells your Bitcoin, and prevents further losses. It’s your safety net.

Automate Your Escape: Minimising the Downside

This is powerful because it takes emotion out of the equation. You don’t have to be glued to your screen, panicking as prices plummet. Your stop order acts as an automatic escape hatch. It’s a critical tool for managing downside risk, allowing you to sleep at night knowing your capital is somewhat protected.

The Stop Order’s Achilles’ Heel: Understanding the Risks

However, remember that once triggered, it becomes a market order. This means it’s susceptible to slippage, especially in fast-moving, volatile markets. If Bitcoin crashes through your £48,000 stop price in a flash, your order might fill at £47,500 or even lower, depending on liquidity. So, while it protects, it doesn’t guarantee your exact exit price. But it’s still a damn sight better than holding on and watching your portfolio evaporate. For deeper insights into managing risks in crypto, consider reviewing our comprehensive articles on Trading Insights.

🔫 Stop-Limit Orders: The Sniper’s Edge for Maximum Control

Now, if you want precision combined with protection, you unleash the stop-limit order. This isn’t for the faint of heart, but for those who demand ultimate control.

The Best of Both Worlds: Trigger AND Price Precision

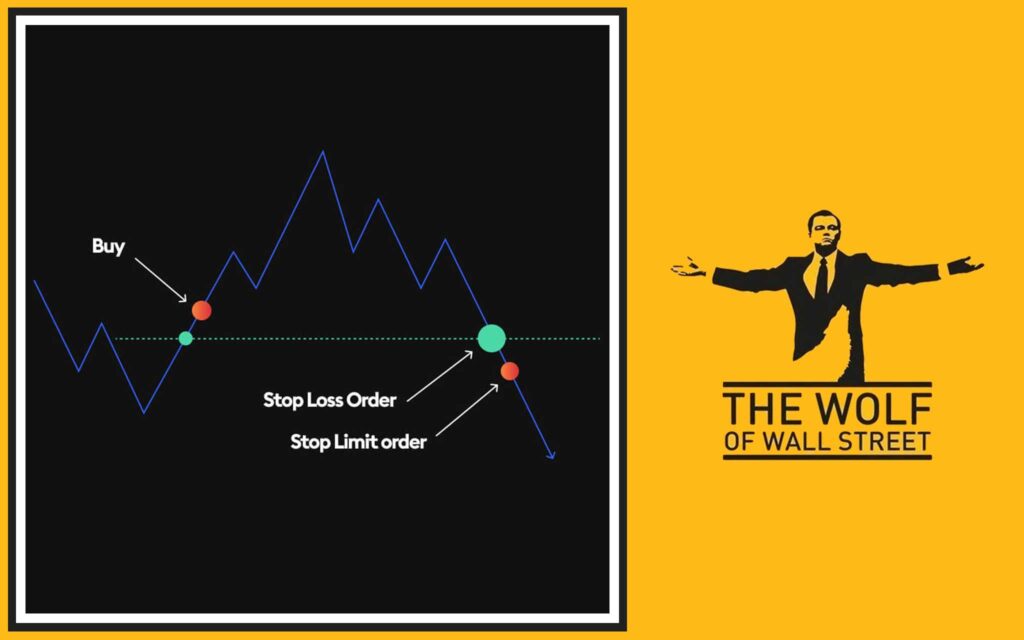

A stop-limit order is a two-part beast: you set a stop price and a limit price. When the stop price is reached, it doesn’t become a market order. Instead, it becomes a limit order at your specified limit price. So, you’re saying, “If the price hits X, then place a limit order to buy/sell at Y.” This gives you both the trigger and the price control.

Navigating the Nuances: When to Deploy This Beast

Let’s say you bought Bitcoin at £50,000 and want to limit losses but avoid slippage. You set a stop price at £48,000 and a limit price at £47,900. If Bitcoin hits £48,000, a limit order to sell at £47,900 is placed. This protects you from selling too low if the market suddenly crashes past your stop. It’s fantastic for managing volatility and minimising losses while still ensuring you get a decent price.

Avoiding the Pitfalls of Complex Orders

The catch? Just like a regular limit order, there’s no guarantee of execution. If the market blows past your limit price before your order can fill, you could be left holding the bag. It’s a powerful tool, but it requires understanding market dynamics and liquidity. Don’t just set it and forget it; be strategic about where you place both your stop and limit prices. It’s the ultimate surgical strike, but only if you know how to wield it.

✂️ Stop-Loss Orders: Locking in Your Gains (or Cutting Your Losses!)

This is a specific application of a stop order, but it’s so critical it deserves its own spotlight. A stop-loss order is your ultimate defensive play. It’s about protecting your capital from disastrous losses.

The Ultimate Risk Management Tool: Don’t Be a Loser!

You bought a coin, it’s going up, great! But what if it tanks? A stop-loss order automatically closes your position at a predetermined loss level. It’s simple: “If this asset drops to X price, sell it, no questions asked.” This prevents emotion from dictating your trades, which is crucial because emotions are the express train to financial ruin. It ensures you never lose more than you’re comfortable with on any single trade. It’s the difference between a minor setback and a complete wipeout.

The Price of Protection: Understanding Fund Lock-ups

One thing to note is that while a stop-loss is active, the funds allocated to that position are essentially “locked up” until the order is either triggered or cancelled. You can’t use those funds for other trades, which can be a minor inconvenience in a fast-moving market where new opportunities pop up. However, the peace of mind and capital protection it offers far outweigh this minor restriction.

Strategic Placement: Where to Set Your Defences

Setting your stop-loss too tight, and you risk getting “stopped out” prematurely by minor market fluctuations, missing out on subsequent rallies. Set it too wide, and you might take a larger loss than necessary. It’s a balance, a strategic decision based on your risk tolerance and market volatility. For those looking to refine their strategies and understand exactly when to exit positions, our guide on When to Sell Crypto is a must-read. It provides actionable advice that complements the effective use of stop-loss orders, giving you the edge you need to succeed.

⏰ Time-in-Force Instructions: Commanding Your Orders Like a Pro

These aren’t order types themselves, but rather crucial instructions that you attach to your orders. They tell the exchange how long your order should remain active on the order book before being cancelled. This is about dictating the lifespan of your financial commands.

GTC: Good ‘Til Canceled – Your Persistent Pursuit of Profit

Good ‘Til Canceled (GTC) means your order will remain active on the order book until it is either completely filled or you manually cancel it. This is the default for most limit orders and is perfect for long-term strategies, where you’re waiting for a specific price point over an extended period. Your order stands firm, a persistent hunter.

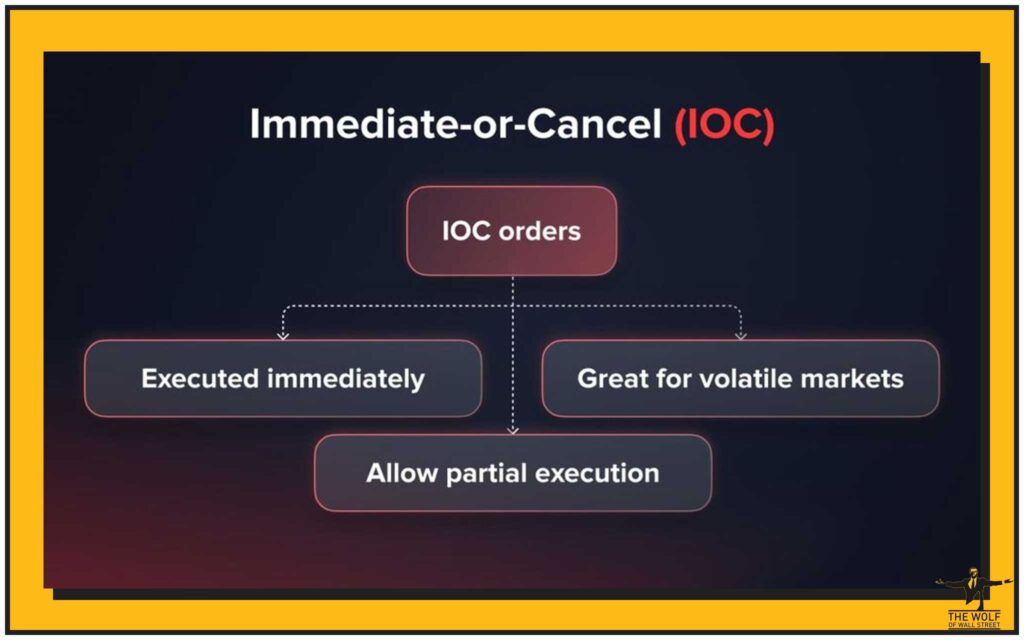

IOC: Immediate or Cancel – Speed is Everything

Immediate or Cancel (IOC) demands urgency. It means any portion of your order that can be filled immediately at the specified price (or better) will be. Any remaining, unfilled portion of the order is then immediately cancelled. You’re telling the exchange: “Fill what you can, right now, or forget about it.” This is for situations where you want to execute a large order but don’t want to leave any lingering partial orders if full liquidity isn’t available.

FOK: Fill or Kill – All or Nothing, Baby!

Fill or Kill (FOK) is the ultimate all-or-nothing instruction. It means your entire order must be filled immediately and completely, or it is cancelled entirely. If even a single unit of your order cannot be filled at the specified price, the entire order is rejected. This is for large orders where partial fills are unacceptable, ensuring you only get the full amount you want or nothing at all. Use it when precision and completion are absolutely paramount.

📈 The “The Wolf Of Wall Street” Advantage: Elevate Your Trading Game

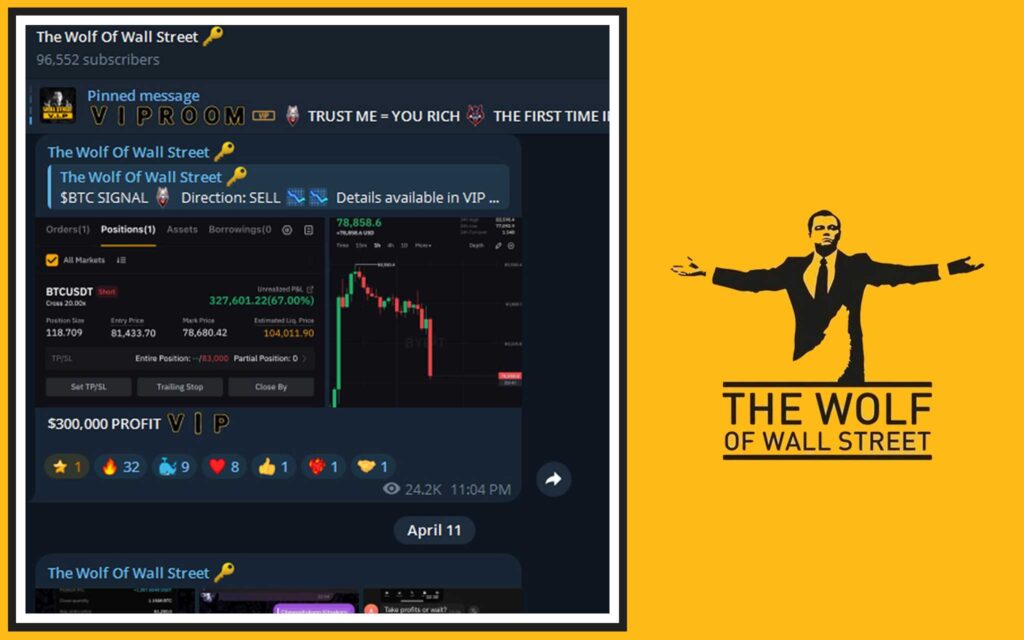

Now, you’ve got the tools, you understand the battlefield. But are you going into this fight alone? Are you going to rely on guesswork and vague hunches? That’s for amateurs. For those of you who are serious about making life-changing money in crypto, you need an edge. You need to join the ranks of those who are truly dominating the market. That’s where the The Wolf Of Wall Street crypto trading community comes in.

This isn’t just some forum; it’s a comprehensive platform designed for one thing: empowering you to navigate the volatile cryptocurrency market and come out on top.

Unlock Exclusive VIP Signals: Your Secret Weapon

Imagine having a direct line to insights that predict market movements, proprietary signals designed to maximise your trading profits. No more guessing, no more relying on outdated news. This is exclusive VIP access to intelligence that gives you a significant edge. It’s like having a crystal ball, but it’s real, and it’s backed by data.

Expert Market Analysis: Knowledge is Power, My Friend

You think you can outsmart the market alone? Think again. Benefit from in-depth analysis from seasoned crypto traders – the guys who live and breathe these markets. They’ve seen it all, they understand the patterns, and they’re giving you their unfiltered insights. This isn’t just news; it’s actionable intelligence that helps you make informed, confident decisions.

Join the Ranks: A Community of Over 100,000 Winners

What’s better than one smart trader? A hundred thousand smart traders, all sharing insights, strategies, and support. This isn’t just a community; it’s a network, a brotherhood of over 100,000 like-minded individuals, all driven to succeed. Shared insights, collective wisdom, and a powerful support system. You’re not alone in this fight; you’re part of a winning team.

Essential Trading Tools: Volume Calculators and More

Forget the guesswork. The The Wolf Of Wall Street community provides you with essential trading tools like volume calculators and other resources. These aren’t just fancy gadgets; they’re practical instruments that help you make informed, data-driven decisions. They strip away the emotion and give you the raw numbers you need to execute precision trades.

24/7 Support: We’ve Got Your Back, Always

Problems? Questions? Don’t get stuck. With 24/7 dedicated support, you’ve got continuous assistance from a team committed to your success. Day or night, someone’s there to help you navigate any challenge. That’s peace of mind, that’s commitment, that’s the The Wolf Of Wall Street promise.

Empower your crypto trading journey and stop leaving money on the table. Visit https://tthewolfofwallstreet.com/ for detailed information and join our active Telegram community at https://t.me/tthewolfofwallstreet for real-time updates and discussions. Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”!

💪 Practical Wisdom: Implement and Dominate!

You’ve got the knowledge, now it’s time for action. This isn’t theoretical; this is about getting your hands dirty and making these concepts work for you.

Don’t Just Read It, DO IT: Experiment and Learn

The only way to truly master these order types is to use them. Start small, experiment on paper trading accounts, or with tiny sums. Understand how each order behaves in different market conditions. See how slippage affects you, how limit orders sit on the book, and how stop-losses protect your capital. Theory is for professors; practice is for winners.

Combining Orders for Superior Strategy

The real magic happens when you start combining these orders. Use a limit order to enter a position at a favourable price, and then immediately set a stop-loss to protect your downside. Or use a stop-limit order to manage a highly volatile position. Think like a chess player, not a checker player. Plan your moves several steps ahead. You can explore advanced trading strategies like Understanding Bollinger Bands for Trading Profit or The Ultimate RSI Guide for Crypto Traders: Dominate Trends Like a Pro to see how combining order types with technical analysis can amplify your results.

Continuous Learning: The Only Way to Stay Ahead

The crypto market is dynamic; it evolves. What worked yesterday might not work tomorrow. Stay hungry, stay foolish, stay learning. Read market analysis, study new strategies, and keep refining your understanding of these fundamental tools. For those just starting out and looking for a solid foundation, our The Wolf’s Guide to Buying Crypto: Unleash Your Inner Trader is an excellent resource to kickstart your journey into the world of digital assets. And if you’re curious about how crypto markets are evolving or the impact of broader policies, don’t miss our sections on News and Policies.

🧠 Beyond the Basics: Advanced Plays and Market Insights

You think you know it all? Think again. The pros go deeper.

Understanding Liquidity and Its Impact on Your Trades

We touched on slippage, but truly understanding liquidity is paramount. High liquidity means there are many buyers and sellers at every price point, meaning your orders fill quickly and with minimal slippage. Low liquidity means fewer participants, leading to wider bid-ask spreads and potentially significant slippage. Always check the liquidity of the asset you’re trading, especially with market orders. It’s the lifeblood of efficient execution. For more insights on market efficiency and different investment avenues, explore our guides on Bitcoin Spot vs. Derivatives Trading: Own the Coin or Play the Contract? and ETPs vs. ETFs: Decoding Your Investment Options for Real Gains.

The Psychology of Order Placement: Don’t Let Emotions Rule

Fear and greed are the two biggest killers of trading accounts. Setting your orders in advance – particularly limit, stop, and stop-loss orders – takes emotion out of the equation. You set your plan, and the market executes it. Don’t chase pumps; don’t panic sell. Let your pre-set orders manage your positions. Your brain is for planning, not for impulsive decisions in the heat of the moment. Learning to master your mind is as crucial as mastering the charts.

Leveraging Data for Smarter Decisions

The order book, volume indicators, market depth charts – these aren’t just pretty pictures. They’re data streams, telling you the story of what’s happening in real-time. Learn to interpret them. Understand where the big buy walls and sell walls are, where the support and resistance levels lie. The more data you absorb, the smarter your order placements will be. For those aiming to truly understand market trends, exploring indicators like MACD: Your Edge in Seeing Market Momentum and Moving Averages: Your Compass for Market Trends can provide a significant analytical advantage. Also, don’t forget to check out our Research Crypto Opportunities: Your Roadmap to Real Wealth (Not Hype) to find the next big thing before everyone else.

🎤 FAQs: Straight Answers, No Bullshit!

What happens if my limit order isn’t filled?

If your limit order isn’t filled, it means the market price never reached your specified price. It will remain on the order book (if GTC) until it is filled or you cancel it. You won’t incur any costs, but you might miss the trade entirely. This is a common occurrence, especially in highly volatile markets, which is why understanding different order types is so crucial.

Can stop-loss orders always prevent large losses?

They aim to prevent large losses, but they don’t guarantee execution at the exact stop price. In highly volatile or illiquid markets, significant slippage can occur, meaning your stop-loss order might fill at a price significantly worse than your set stop price. For advanced strategies to mitigate this, consider looking into how to use indicators like The Ultimate 2025 Guide to Parabolic SAR: Master Trend Trading Like a Pro or Master the Stochastic Indicator Like a Pro Trader to inform your stop placement.

How does slippage affect my profits?

Slippage directly eats into your profits (or increases your losses). If you intend to buy at £100 but due to slippage your market order fills at £100.50, you’ve paid £0.50 more per unit. If you’re selling, and your market order fills at £99.50 instead of £100, you’ve lost £0.50 per unit. It’s a hidden cost of immediate execution. Understanding market depth and volume can help you anticipate and minimise slippage.

What are the best practices for setting time-in-force instructions?

Use GTC for long-term strategies where you’re patiently waiting for a specific price, especially for setting up strategic buys or sells on major cryptocurrencies. Use IOC when you need a partial fill immediately but don’t want the rest of the order lingering, common in more active trading. Use FOK only when you absolutely need the entire order filled at once and no partial fills are acceptable – typically for large, institutional-grade trades where precision is paramount. Knowing these instructions allows you to exert maximum control over your trading execution.

Why is understanding order types so crucial in crypto?

The crypto market is highly volatile and moves fast. Without understanding order types, you’re trading blind. They are the fundamental tools for managing risk, maximising entry/exit prices, and executing precise trading strategies. They give you control in a chaotic environment, turning potential losses into managed outcomes and missed opportunities into seized profits. For beginners, getting a grip on these fundamentals is key to building a robust trading foundation, as highlighted in our Newbie section.

👑 Conclusion: The Bottom Line – Master These Orders, Master the Market

You want to be a crypto legend? You want to be one of the few, the proud, the profitable? Then you need to stop guessing and start dominating. The difference between the winners and the losers in this market isn’t just about picking the right coin; it’s about executing your strategy with precision, control, and an iron will.

Understanding market, limit, stop, stop-limit, and stop-loss orders, along with your time-in-force instructions, isn’t just academic. It’s the blueprint for making serious money and protecting your hard-earned capital. These are the levers you pull, the buttons you press, the commands you issue to make the market bend to your will.

Don’t just read this; apply it. Experiment, learn, adapt. And when you’re ready to truly elevate your game, remember the The Wolf Of Wall Street crypto trading community. They’re not just selling hope; they’re offering the tools, the insights, and the community to help you unlock your true potential in the crypto market. Visit https://tthewolfofwallstreet.com/ and join our Telegram at https://t.me/tthewolfofwallstreet. It’s time to stop leaving money on the table and start living like the king you were meant to be. The market is waiting. Go get it.