🔥 Introduction: When Chaos Meets Profit

Picture this: a privacy coin built on rock-solid decentralization gets hit with an 18-block attack that nukes 117 transactions… and instead of collapsing, the damn price soars by 7%. That’s Monero (XMR) for you. Traders went wild, the community panicked, and the crypto world was left scratching its head.

This isn’t just another blip on the blockchain radar. It’s a wake-up call. A perfect storm of market psychology, technical fragility, and raw speculation. And if you trade crypto, buckle up — because this lesson is pure gold for your wallet.

🚨 The Shock Event

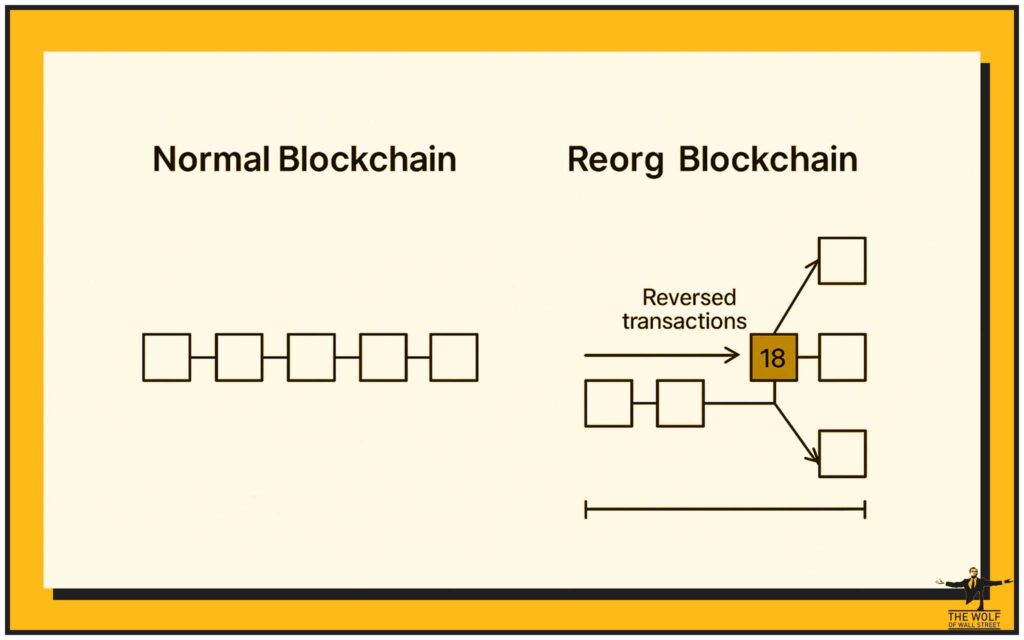

What the Hell is a Blockchain Reorg?

A blockchain reorg (short for reorganization) is no joke. It’s when someone with enough power rewrites history by replacing existing blocks with their own. Transactions get reversed. Funds look like they disappeared. Think of it as Wall Street brokers running a fake ledger — except this time, it’s baked into the tech.

Monero’s 18-Block Nightmare

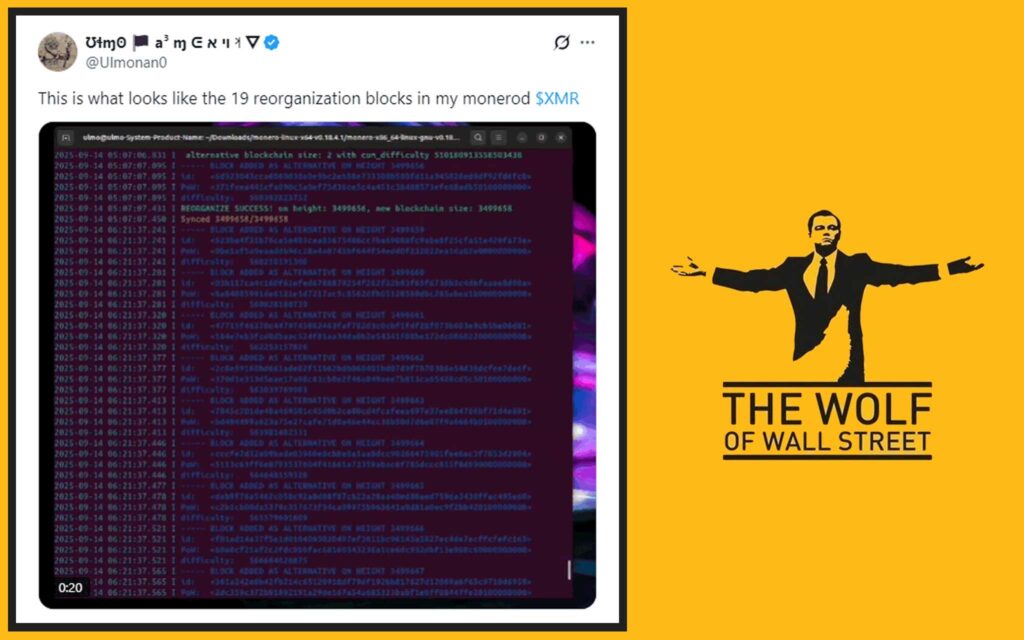

Here’s what went down:

- Attack kicked off at block 3,499,659 and ran until block 3,499,676.

- Duration: 43 minutes of chaos.

- 117 confirmed transactions wiped out like they never existed.

- Attacker: Qubic, a mining pool that flexed its majority hashrate muscle.

Qubic didn’t just test the waters — they proved they owned them. And the worst part? They blew right past Monero’s built-in 10-block safeguard.

📈 The Price Pump Paradox

You’d expect Monero’s price to fall off a cliff. Wrong. The market laughed in the face of risk and sent XMR up 7%, jumping from $287 to over $308 in hours.

Why? Three theories:

- Retail ignorance – most traders don’t even know what a reorg means.

- Whale manipulation – big players pushed liquidity to trap shorts.

- Narrative psychology – privacy coins attract diehards who treat bad press as a buying opportunity.

👉 For more wild market reactions, check trending crypto insights.

😬 Community Fallout & Trust Crisis

Merchants Bailing

One prominent voice in the Monero community straight-up said: “I’m not accepting XMR payments until this is fixed.” That’s a red flag the size of Times Square’s billboard. Trust isn’t easy to earn — but it’s damn easy to lose.

Investors Split

- Decentralization Maxis: “This is just FUD, stay strong.”

- Realists: “We need fixes now, even if it means centralization.”

👉 Stay on top of these debates with news updates on cryptocurrencies.

🔐 The Security Dilemma

DNS Checkpoints – A Quick Fix with Big Trade-Offs

Developers floated a temporary fix: DNS checkpoints. That means fetching trusted block data from community-run servers. Translation? Less chaos, more stability.

The trade-off? It’s centralization. For a coin built on privacy and trustlessness, that’s like a vegan sneaking burgers at midnight.

Long-Term Options on the Table

- Overhaul PoW algorithms – make mining harder for a single pool to dominate.

- Localized mining hardware – spread control, decentralize power.

- Hybrid consensus – combine PoW with other mechanisms to secure the chain.

👉 Explore more on layer-1 and layer-2 solutions.

⚔️ Monero vs. Qubic: The Rivalry Explained

So who the hell is Qubic? They’re not just a mining pool. They’re a layer-1 blockchain project with serious hashing firepower. By hitting Monero, they proved two things:

- They control the majority hashrate.

- They can bend the network to their will.

Was it about money? Influence? Or just a flex? Doesn’t matter. The message was clear: Monero isn’t untouchable.

🧠 Market Psychology: Why Traders Shrugged it Off

Markets don’t always care about fundamentals. Traders are wired for fear and greed, not logic. Here’s why XMR kept pumping:

- Herd mentality: “If price is going up, it must be fine.”

- Buy-the-dip addicts: any red candle is just fuel for their next gamble.

- Privacy narrative: Monero fans treat attacks as battle scars, not wounds.

👉 Get sharper insights in trading insights.

💰 What This Means for Traders

This is the Wolf’s cut-to-the-chase truth:

- High risk = high reward. Attacks create volatility. Volatility = money.

- Don’t trust price action blindly. Fundamentals eventually catch up.

- Watch the hashrates. If one pool dominates, you’re sitting on a ticking bomb.

📊 The Wolf Of Wall Street: How to Stay Ahead of Chaos

Here’s where most traders get slaughtered: they fly blind. You don’t have to. The The Wolf Of Wall Street crypto trading community hands you the weapons to dominate the market:

- Exclusive VIP Signals – real trade setups designed for profit.

- Expert Market Analysis – not hype, real breakdowns from pros.

- Private Community – 100,000+ traders sharing knowledge.

- Essential Trading Tools – calculators, resources, strategy builders.

- 24/7 Support – because the market never sleeps.

👉 Want in? Join our Telegram community and stop trading like an amateur.

🔄 Historical Echoes

This isn’t Monero’s first dance with 51% attack fears. The community has debated algorithm changes for years but never pulled the trigger. Other blockchains — Bitcoin, Ethereum, even Ethereum Classic — all faced similar challenges.

Lesson? If you don’t evolve, you get eaten.

🌍 Key Takeaways for the Crypto Industry

- Privacy coins are fragile. If decentralization cracks, the whole premise falls apart.

- Markets are irrational. Price pumps don’t equal safety.

- Regulators are watching. Attacks like this give governments ammo to call privacy coins “unreliable.”

🐺 Conclusion: The Wolf’s Verdict

Here’s the bottom line: Monero just faced a monster security breach and came out richer in price but poorer in trust. That’s not resilience — that’s market delusion. Traders made money, yes. But long-term, the decentralization vs. security war is heating up.

Ignore fundamentals and you’re a gambler. Use events like this as fuel, and you’re a strategist. That’s the difference between sheep and wolves.

❓ FAQs

1. What is a blockchain reorg and why is it dangerous?

It’s when a chain’s history gets rewritten, reversing confirmed transactions. In crypto, that’s a nightmare because it enables double-spending.

2. Who is Qubic and why did they attack Monero?

Qubic is a blockchain and mining pool that gained majority hashrate control over Monero. Their reorg showed they could dominate the network.

3. Why did XMR’s price go up after the attack?

Traders ignored fundamentals, whales manipulated liquidity, and Monero fans treated it as a buying opportunity.

4. Could Monero be forced into centralization?

Yes. Short-term fixes like DNS checkpoints mean relying on trusted servers — centralization creeping in.

5. How can traders protect themselves from similar risks?

Diversify, monitor hashrates, follow pro analysis, and never trade blind without tools and signals.

📌 The Wolf Of Wall Street Crypto Trading Community

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximize trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilize volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: The Wolf Of Wall Street Service for detailed information.

- Join our active Telegram community for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.