🧭 Introduction: Privacy, Power, and Profit in the Age of Data Wars

Listen — in crypto, privacy isn’t a luxury, it’s leverage. Every transaction, every private key, every whisper of data — it’s all potential ammunition in the wrong hands. But here’s the kicker: you don’t need to choose between security and collaboration anymore.

That’s where Secure Multi-Party Computation (MPC) steps in — the silent bodyguard of blockchain security. It lets multiple players collaborate, compute, and make moves without revealing their cards. Think of it as poker, but everyone’s winning.

Today, you’ll learn how MPC, SMPC, and AMPC are rewriting the rules of trust, privacy, and profit — and why every serious trader in 2025 should care.

🧩 What the Hell Is Multi-Party Computation (MPC)?

Let’s strip the jargon. Multi-Party Computation (MPC) is a cryptographic protocol that allows several parties to calculate something together — like verifying a transaction or computing a function — without revealing their private inputs to anyone else.

Imagine this: five hedge funds want to compare performance metrics without sharing their portfolios. MPC lets them run the numbers and get the results — but not one fund ever sees another’s private data. It’s privacy at the protocol level.

This is huge for crypto custody, decentralised finance (DeFi), and data integrity. It’s the invisible layer protecting you from leaks, hacks, and that one idiot who writes his seed phrase on a sticky note.

For a foundational breakdown of how wallets use similar concepts, see our Multi-Signature Wallet Security Guide.

⚙️ The Core Mechanics: How MPC Actually Works (No Nerd Jargon Required)

Here’s the playbook — stripped down to the essentials.

- Secret Sharing: Your private key or sensitive data is split into several encrypted fragments.

- Distributed Computation: Each fragment lives on a different machine or participant. They all do the math without seeing the full picture.

- Output Reconstruction: The result is reassembled, producing the correct answer without ever exposing the original input.

It’s like having a safe with multiple keys held by different people — the door only opens when everyone turns simultaneously.

So even if one participant gets compromised, the attacker can’t unlock anything. That’s the beauty of distributed trust — and why MPC wallets are replacing traditional key storage models faster than you can say “seed phrase”.

Learn the difference in our Private Key vs Seed Phrase Guide.

🧠 SMPC: When Security Goes Tactical

Now let’s add teeth.

Secure Multi-Party Computation (SMPC) takes MPC and makes it bulletproof. It’s designed to stay rock-solid even when participants act maliciously. You could have one bad actor in the system — trying to leak, lie, or sabotage — and SMPC won’t flinch.

Think of MPC as a squad of professionals working together. SMPC? That’s the elite unit — trained to operate even under attack.

This is where things move from theoretical crypto magic to real-world financial defence systems. Exchanges, decentralised autonomous organisations (DAOs), and custodians are already running SMPC to manage billions in assets securely — and doing it faster than ever.

💡 Breaking It Down: The 5 Pillars of SMPC Power

Now you’re about to meet the five cryptographic engines that make SMPC tick.

🔹 Secret Sharing

Born from Shamir’s Secret Sharing (1979), it’s the core of the entire operation. Split one secret (like a private key) into multiple shares — only when the right combination comes together does the original secret reveal itself.

🔹 Garbled Circuits

A method first described by Andrew Yao, where computations happen on encrypted data. It’s like passing around a locked briefcase — everyone adds their part, but no one sees what’s inside.

🔹 Homomorphic Encryption

The holy grail. It allows computations to be done directly on encrypted data. No decryption, no exposure, just pure privacy-preserving power.

🔹 Oblivious Transfer

Ensures parties get exactly the data they’re supposed to — nothing more, nothing less. No snooping, no leaks.

🔹 Zero-Knowledge Proofs (ZKPs)

Prove you know something without revealing it. It’s the crypto world’s ultimate “trust me, I got this.”

Dive deeper into this topic in our Zero-Knowledge Proofs Crypto Trading Guide.

Together, these five mechanisms are what turn data privacy from theory into profit-driven reality.

⚔️ AMPC: The Apex Predator of Secure Computation

If SMPC is elite, AMPC (Advanced Multi-Party Computation) is the apex predator.

It’s designed for the future — handling massive workloads, AI-driven analysis, and cross-chain data without breaking a sweat. It’s faster, more scalable, and flexible enough for real-time financial systems.

AMPC doesn’t just defend — it adapts.

Dynamic participation means users can join or leave without wrecking the computation. Fault tolerance keeps things alive even under stress.

Picture a high-speed trading system or a DAO with thousands of contributors — all computing safely, simultaneously. That’s AMPC: efficiency, resilience, and raw speed combined.

🔍 MPC vs Multi-Signature Wallets: Which Is the Real Deal?

Let’s talk strategy — because everyone wants to know which is better: MPC or Multi-Sig.

| Feature | MPC | Multi-Sig |

|---|---|---|

| Privacy | ✅ Keys are hidden even during signing | ❌ Public on-chain addresses |

| Speed | ✅ Faster off-chain computation | ⚠️ Slower, multiple blockchain confirmations |

| Flexibility | ✅ Works cross-chain | ⚠️ Protocol-specific |

| Cost | ✅ Gas-efficient | ❌ Higher fees |

Bottom line?

MPC wins on flexibility, privacy, and scalability.

Multi-sig wallets are great for transparency — but in a world chasing both speed and stealth, MPC is the shark that never sleeps.

You can check the full comparison in our Multi-Signature Wallet Security Guide.

🧰 Real-World Use Cases: From Crypto Custody to DeFi Governance

This isn’t theory — it’s happening now.

Institutions are betting big on MPC:

- Fireblocks uses MPC to secure billions in institutional crypto custody.

- Coinbase Custody leverages SMPC for distributed signing.

- Aleo and Zcash combine MPC with zero-knowledge tech for privacy-first DeFi.

DeFi protocols and DAOs are integrating AMPC-style systems to safeguard voting processes and treasury operations. That’s decentralisation with real accountability — no human single points of failure.

You’ll soon see MPC underpinning everything from DeFi governance to cross-chain interoperability.

🧬 Why Performance, Scalability, and Trust Are the Big Three Battles

Here’s the reality check: while MPC is powerful, it isn’t magic.

Running computations across multiple nodes means latency, bandwidth costs, and complexity.

But that’s exactly what AMPC is built to conquer — reducing overhead through optimisation and parallel computation.

As the industry scales, trust frameworks evolve too. The new game?

Hybrid systems that mix MPC with Trusted Execution Environments (TEEs) and threshold cryptography — striking a balance between speed and unbreakable security.

💣 The MPC Playbook for Crypto Traders: Don’t Get Left Behind

Let’s make it personal.

If you’re a crypto trader in 2025 still relying on a single wallet key, you’re a sitting duck. MPC is the upgrade path to total control and zero compromise.

Here’s how to stay ahead:

- Adopt MPC-based wallets to secure your holdings.

- Use AMPC-powered exchanges for faster, safer transactions.

- Integrate SMPC protocols into your own projects to eliminate counterparty risk.

Combine this with AI trading insights from our Trading Bots vs AI Agents 2025 guide, and you’re operating on an entirely different level of dominance.

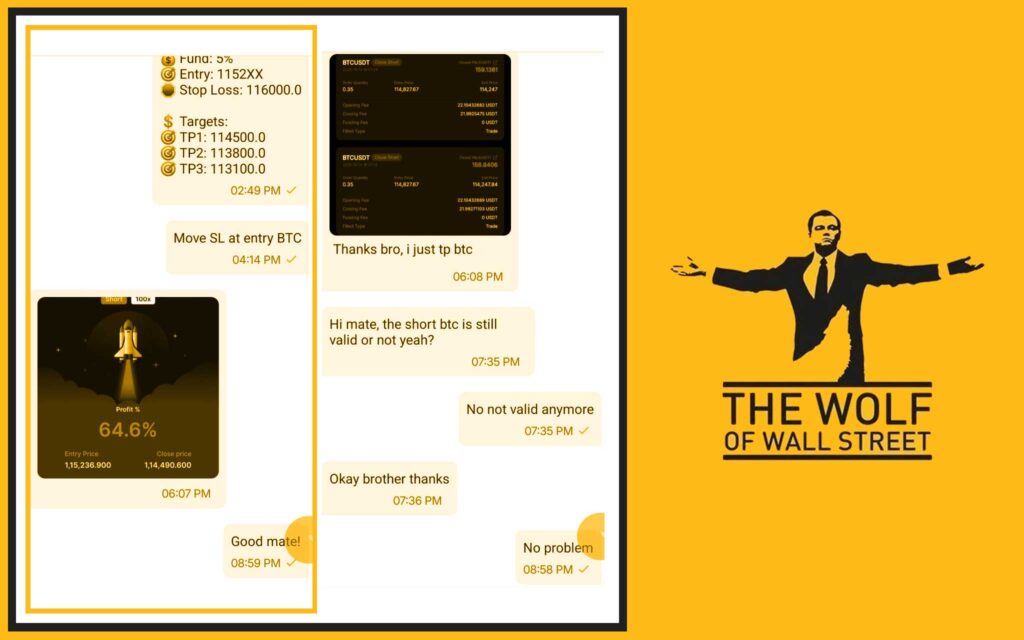

🐺 How The Wolf Of Wall Street Crypto Community Is Turning MPC Theory into Profit Reality

Now let’s talk results — The Wolf Of Wall Street isn’t playing by the old rules.

They’ve built a crypto trading community where security meets profitability head-on.

Here’s what their 100,000+ members gain:

- Exclusive VIP Signals: High-accuracy trade entries powered by deep market analysis.

- Expert Market Analysis: Veteran traders dissecting data, trends, and probabilities.

- Private Community: Real-time collaboration, no noise, all value.

- Essential Trading Tools: From volume calculators to strategy trackers.

- 24/7 Support: Because opportunity never sleeps — and neither do they.

The Wolf Of Wall Street embodies what AMPC stands for: collaboration without compromise.

Unlock your potential and join the movement at tthewolfofwallstreet.com/service or in their Telegram hub at t.me/tthewolfofwallstreet.

🔮 The Future: AMPC, AI, and the Rise of Trustless Economies

Here’s where the game goes next.

We’re entering a world where AI, blockchain, and cryptography fuse into one unstoppable ecosystem — and AMPC is the glue.

Imagine machine-learning algorithms crunching global data without violating privacy laws. Banks coordinating settlements without central clearinghouses. Traders leveraging shared AI insights without giving away strategies.

That’s not sci-fi. That’s 2026.

AMPC is the foundation of a trustless, borderless, and data-sovereign economy — one where power belongs to those who understand how to control information without exposing it.

❓ FAQs: The Wolf Answers Your Questions

Q1: Is MPC better than hardware wallets?

Not “better” — smarter. MPC decentralises risk; hardware wallets centralise it. Combine both and you’ve got elite-tier protection.

Q2: Can SMPC prevent exchange hacks?

It drastically reduces attack surfaces. Even if servers are compromised, your keys stay fragmented and encrypted.

Q3: Is AMPC real or just theory?

AMPC is emerging — think of it as SMPC 2.0. It’s being tested by AI and DeFi firms pushing scalability limits.

Q4: Do I need coding skills to use MPC wallets?

Not anymore. Modern MPC solutions integrate seamlessly — one tap, enterprise-grade protection.

Q5: Where can I learn more about crypto security?

Explore Multi-Party Computation Crypto Security and Privacy in Web3: Digital Sovereignty Guide.

💬 Conclusion: Privacy Is Power — and Power Pays

The wolf doesn’t beg for privacy — he takes it.

In the next wave of crypto evolution, Secure Multi-Party Computation isn’t optional — it’s essential.

It’s how institutions protect billions, how traders guard alpha, and how innovators future-proof their profits.

So whether you’re coding the next DeFi protocol or trading the next altcoin breakout — MPC, SMPC, and AMPC are the difference between playing the game and owning it.

Join the movement.

Join The Wolf Of Wall Street.

Trade smart, stay invisible, and own your edge.