Listen up, because what I’m about to tell you will decide whether you make it in the crypto big leagues or get wiped out with the rest of the amateurs; it all starts with understanding multisignature wallets. If you’re still using a standard, single-key wallet to protect any serious amount of capital, you’re not investing—you’re gambling with a blindfold on. You’re one hack, one mistake, one lost key away from zero.

In the world of high-stakes digital assets, a single point of failure isn’t just a risk; it’s a death sentence for your portfolio. The pros, the whales, the people who actually move the markets, don’t leave their fortunes to chance. They build fortresses, and the cornerstone of that fortress is a multisig wallet. So, pay attention, because class is in session.

🚀 What the Hell is a Multisig Wallet and Why Should You Care?

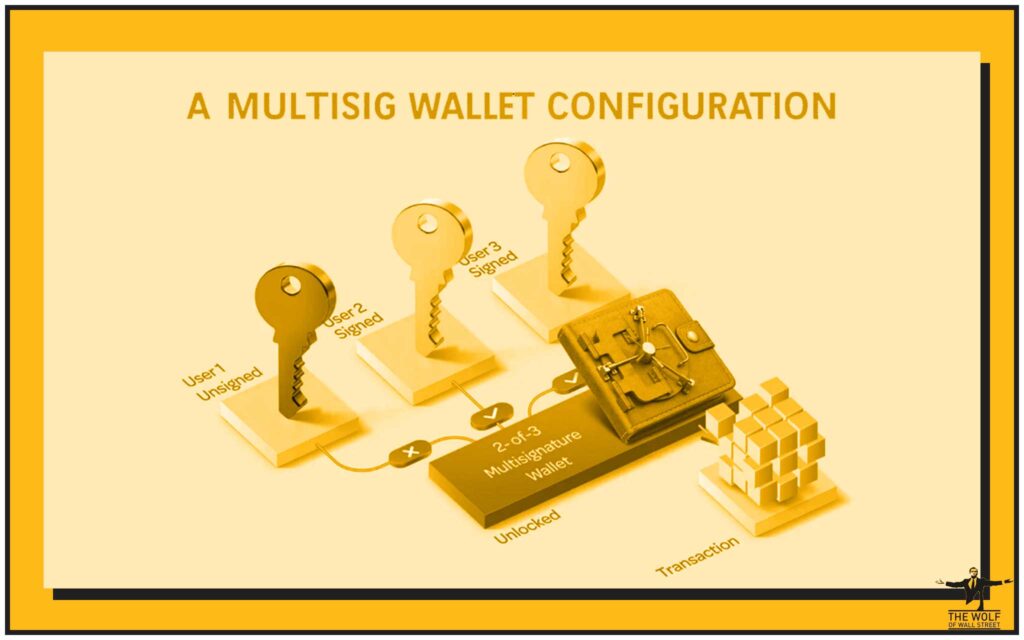

Let’s cut the jargon. A multisignature (multisig) wallet is a cryptocurrency wallet that requires more than one key to authorise a transaction. Think of it like a bank vault in a spy movie. You don’t have one guy with one key; you have two or three executives who all need to turn their keys at the same time to open the door. That’s multisig. It’s a system designed to eliminate the single biggest vulnerability in crypto: human error and individual weakness.

Ditching the Single Point of Failure: The Only Smart Move in Crypto

A standard crypto wallet is secured by a single private key. If that key is lost, stolen, or compromised, your funds are gone. Forever. There’s no customer service line to call, no one to cry to. You’re finished. A multisig wallet obliterates this problem. By requiring multiple approvals, you distribute the power and the risk. An attacker can’t just target one person or one device; they’d need to compromise multiple, separate key holders to get their hands on your assets. It’s the difference between leaving a pile of cash on your desk versus locking it in a vault that requires three different managers to unlock. It’s a no-brainer.

It’s Not Just for Moguls: How Multisig Works for Everyone

You might think this is some high-tech solution only for billion-dollar hedge funds, but you’re wrong. While it’s essential for businesses and DAOs, it’s just as powerful for individuals who are serious about wealth protection. Got a family trust? Use multisig. Going in on a major investment with a partner? Use multisig. It ensures that no single person can act alone, protecting everyone involved from bad decisions or bad actors. Understanding the power of shared access starts with knowing the difference between public and private keys in the crypto world.

A Quick Flashback: How Multisig Became the Gold Standard After Mt. Gox

Multisig technology isn’t new; it’s battle-tested. It first hit the Bitcoin scene back in 2013. But it became the undisputed champion of security after the catastrophic collapse of the Mt. Gox exchange in 2014, where hundreds of millions of dollars vanished into thin air, largely due to shocking security failures. The smart money learned a lesson that day: never, ever trust a single point of failure. The industry evolved, and multisig wallets went from a niche product to an absolute necessity for anyone managing serious funds.

💰 The Unbeatable Advantages: Why the Pros Use Multisig

The reasons the top players use multisig are simple, powerful, and irrefutable. It’s about security, control, and flexibility. It’s about winning.

Fort Knox-Level Security for Your Crypto Assets

This is the main event. By requiring multiple signatures, you dramatically slash the risk of theft. A hacker would need to pull off a coordinated, multi-pronged attack to succeed. A disgruntled employee can’t run off with the company treasury. If you lose one of your keys, you don’t lose your funds, because you have backups with your other key holders. It’s the highest level of security you can get without hiring a private army.

Collaborative Control: Building a Financial Empire with Your Team

Multisig is the ultimate tool for collaboration. For business partnerships, it means co-founders must agree on expenditures. For a Decentralised Autonomous Organisation (DAO), it allows for true democratic control over community funds. It replaces blind trust with cryptographic certainty. You no longer have to “trust” your partners not to be reckless; the system forces consensus. This is how you build empires that last.

Flexibility That Annihilates the Competition

You set the rules. The most common setup is “M-of-N,” where ‘M’ is the required number of signatures and ‘N’ is the total number of key holders. You can have a 2-of-3, a 3-of-5, a 5-of-7—whatever configuration suits your operational needs. This adaptability makes it perfect for everything from a small family office to a massive global corporation. For traders looking to secure profits, mastering this is as crucial as mastering crypto profit taking with the wolf’s guide.

⚙️ How It Works: The Nuts and Bolts of a Money-Making Machine

Alright, let’s look under the bonnet. You don’t need to be a computer genius to get this, but you do need to pay attention.

The M-of-N Setup: You Call the Shots

This is the most popular and flexible type of multisig wallet. You decide how many people are on the “board” (N) and how many votes are needed to pass a motion (M).

The Classic 2-of-3 Configuration Explained

Let’s say you, your business partner, and your lawyer set up a 2-of-3 wallet. This means there are three total key holders, and any two of you must sign off on a transaction for it to go through.

- You + Partner: Transaction approved.

- You + Lawyer: Transaction approved.

- Partner + Lawyer: Transaction approved.

- Just You: Transaction denied.

This setup provides a perfect balance of security and convenience. If one person is unavailable or loses their key, the other two can still manage the funds.

The N-of-N Setup: For Maximum Security and Commitment

Here, every single key holder must sign. A 3-of-3 or 5-of-5 wallet offers the absolute peak of security but also the peak of inconvenience. If one person is on holiday or refuses to sign, the funds are frozen. This is used for ultra-high-value assets where no single point of compromise is acceptable.

The Transaction Process: From Zero to Authorised in a Flash

- One person initiates a transaction from the multisig wallet.

- The wallet creates a transaction proposal that is not yet valid.

- This proposal is shared with the other key holders.

- Each required co-signer uses their private key to sign the transaction.

- Once the minimum number of signatures (M) is reached, the transaction becomes valid and is broadcast to the blockchain.

Internal Link Suggestions

Before we dive deeper, you need to master the fundamentals. Understand the critical difference between a private key vs seed phrase—it’s non-negotiable knowledge. And if you’re just starting, learn how to buy crypto the right way before you even think about advanced security.

👑 Choosing Your Weapon: Top Multisig Wallet Providers

Not all wallets are created equal. Choosing the right provider is like choosing the right broker—it can make or break you. Look for reputation, a clean track record, and an interface that doesn’t require a PhD to operate.

- The Heavy Hitters: Argent, Safe, & Trezor: These are names synonymous with security in the crypto space. Safe (formerly Gnosis Safe) is the industry standard for DAOs and businesses on Ethereum and other EVM chains. Trezor offers robust hardware wallet integration for top-tier multisig security.

- Coinbase: The Household Name’s Play in the Big Leagues: Coinbase has integrated multisig into its institutional and retail platforms, offering a more user-friendly path for those already in its ecosystem.

- What to Look For: Don’t Get Sold a Dud: Prioritise wallets with open-source code, a history of security audits, broad blockchain support, and a responsive support team. Don’t cheap out on the vehicle that holds your wealth.

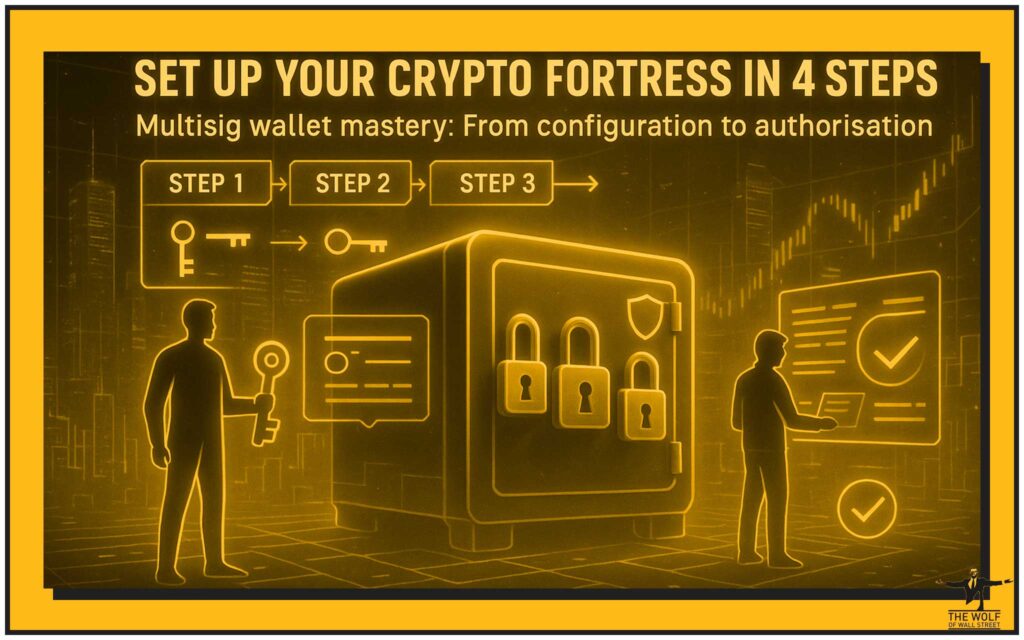

📈 Setting Up Your Fortress: A 4-Step Guide to Dominance

Stop procrastinating. Here’s how you do it. Follow these steps precisely.

- Step 1: Choose Your Configuration – Don’t Mess This Up: Decide on your M-of-N ratio. Think about your security needs versus your operational needs. Who are the key holders? Are they trustworthy and technically competent?

- Step 2: Generate and Collect Your Public Keys: Each co-signer must generate their own unique key pair (public and private). They keep their private key secret and share only the public key with the group.

- Step 3: Forge the Multisig Wallet Address: Using your chosen wallet software, you’ll input all the public keys and the M-of-N rule. The software then generates a new, shared multisig wallet address. This is where you’ll send the funds.

- Step 4: Authorise Transactions Like a Wall Street King: When you need to move funds, one person creates the transaction, and the others sign it using their private keys until the threshold is met. Done.

⚠️ The Downsides: Listen Up, Because I’m Only Saying This Once

I’m not going to sell you a fantasy. Multisig has challenges, but they’re not for you to complain about. They’re for you to overcome.

- Complexity: This Isn’t for Amateurs or Cry-babies: Setting up a multisig wallet requires more steps and more technical know-how than a standard wallet. If you can’t handle that, you don’t deserve the security.

- The Human Element: Don’t Let Weak Links Sink Your Ship: Your security is now dependent on other people. If a co-signer is slow to respond, your transaction is delayed. If they lose their key and you don’t have a backup plan, you could have problems. Choose your partners wisely.

- Platform Support: Not Everyone Can Handle This Level of Play: While widely supported on major blockchains like Bitcoin and Ethereum, not every altcoin or platform offers robust multisig functionality. Do your homework before you commit funds.

💼 Real-World Use Cases: Where the Real Money is Made

This isn’t theory. This is how millions, even billions, are secured every single day.

- Business Treasury Management: Any serious company holding cryptocurrency for its treasury uses multisig. It prevents internal fraud and provides a clear, auditable trail of approvals for all transactions.

- Escrow Services: Multisig is perfect for creating trustless escrow. Two parties in a deal can use a 2-of-3 wallet with a trusted third-party as the third key holder. The funds are only released when both parties agree, or when the arbitrator steps in to resolve a dispute.

- DAO Fund Management: For DAOs, multisig is the technology that makes their governance model possible. It allows thousands of token holders to collectively manage a treasury worth millions without a central authority. It’s the future, and it’s happening right now. For a deeper look, you can explore how dYdX is revolutionising decentralised crypto trading.

🚀 Ready to Join the Big Leagues?

Reading about this stuff is one thing. Having the guts to apply it and trade with a real edge is another. If you’re tired of guessing and ready to start making calculated, powerful moves, then you need to surround yourself with winners. The The Wolf Of Wall Street crypto trading community is your ticket to the inner circle. Here’s what you get when you stop being a spectator and become a player:

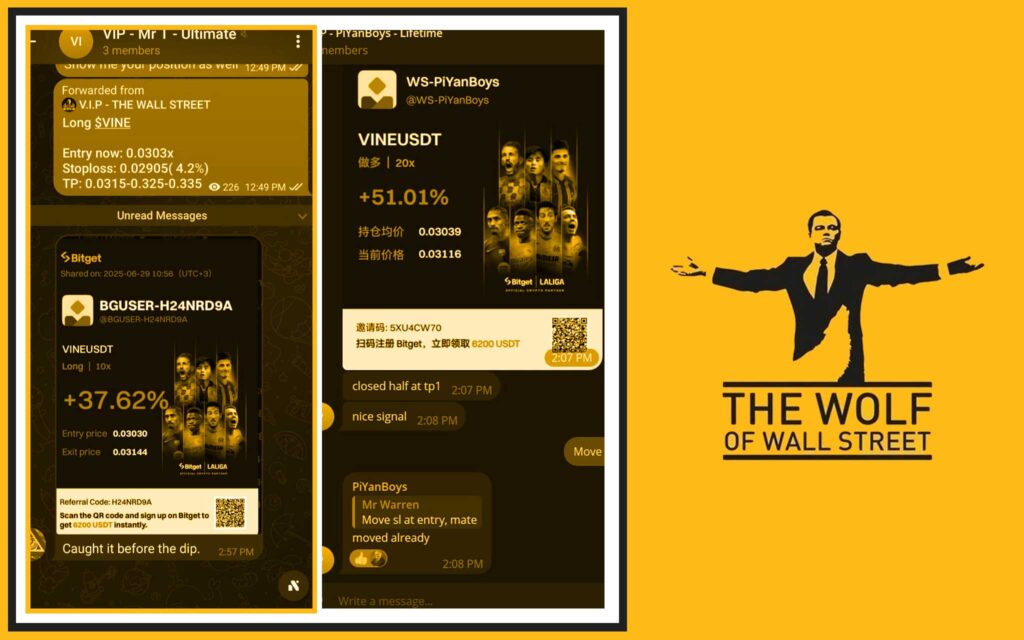

- Exclusive VIP Signals: Stop chasing pumps. Get proprietary signals designed to maximise your profits.

- Expert Market Analysis: Let seasoned crypto traders show you the charts and tell you what really matters.

- A Private Community of Killers: Join over 100,000 traders in our network. Share insights, strategies, and get the support you need to crush it.

- Essential Trading Tools: Use our volume calculators and other resources to make decisions backed by data, not emotion.

- 24/7 Support: The market never sleeps, and neither do we. Our team is always there to back you up.

Empower your trading journey. Visit our service at https://tthewolfofwallstreet.com/service for the full breakdown. Join our active Telegram community at https://t.me/tthewolfofwallstreet for real-time intel. It’s time to unlock your potential to profit in the crypto market with The Wolf Of Wall Street.

❓ Frequently Asked Questions from the Trading Floor

Let’s clear up the last few things holding you back.

Is a multisig wallet better than a hardware wallet?

Wrong question. It’s not an “either/or” scenario. You use them together. A hardware wallet stores your private key offline. The ultimate setup is a multisig configuration where each of the private keys is stored on a separate hardware wallet (like a Trezor or Ledger). This is the gold standard of crypto security.

Are there legal or compliance headaches I need to worry about?

For businesses, yes. You need to consider the regulatory implications of how you manage your treasury. Using a multisig wallet provides a clear audit trail, which is a huge advantage for compliance. But you should always stay informed about the rules, like the crypto travel rule compliance strategy for 2025.

What happens if one of the key holders loses their key?

This is exactly why you use a multisig wallet! In a 2-of-3 setup, if one person loses their key, the other two can still access the funds and set up a new wallet, transferring the assets and replacing the lost key holder. It turns a potential catastrophe into a manageable inconvenience.

💼 Conclusion: Are You Going to Step Up or Get Left Behind?

The choice is yours. You can stick with the flimsy, single-key wallets that leave your entire net worth exposed, praying that you never make a mistake or get targeted. Or you can adopt the tools the professionals use to protect and grow their wealth.

The market is a ruthless battlefield, and it will chew up and spit out anyone who comes unprepared. Securing your assets is the first, most critical step to building real, lasting wealth in this space. So, the question remains: are you serious about this, or are you just here to play games? The only way to win is to secure your foundation, and that foundation is built with multisignature wallets.