🔥 Introduction: The Wolf Wakes in Web3

OpenSea isn’t pivoting. It’s evolving.

While most Web3 platforms are crawling back into their caves after the NFT winter, CEO Devin Finzer just grabbed the mic and declared, “If it exists on-chain, you should be able to trade it.”

That’s not a retreat – that’s an empire expansion. The marketplace that built the NFT boom is morphing into a universal on-chain trading hub, a platform that doesn’t just move art – it moves everything.

OpenSea isn’t playing checkers. It’s playing multi-chain chess.

🚀 From NFT Boom to Bear – and Back Again

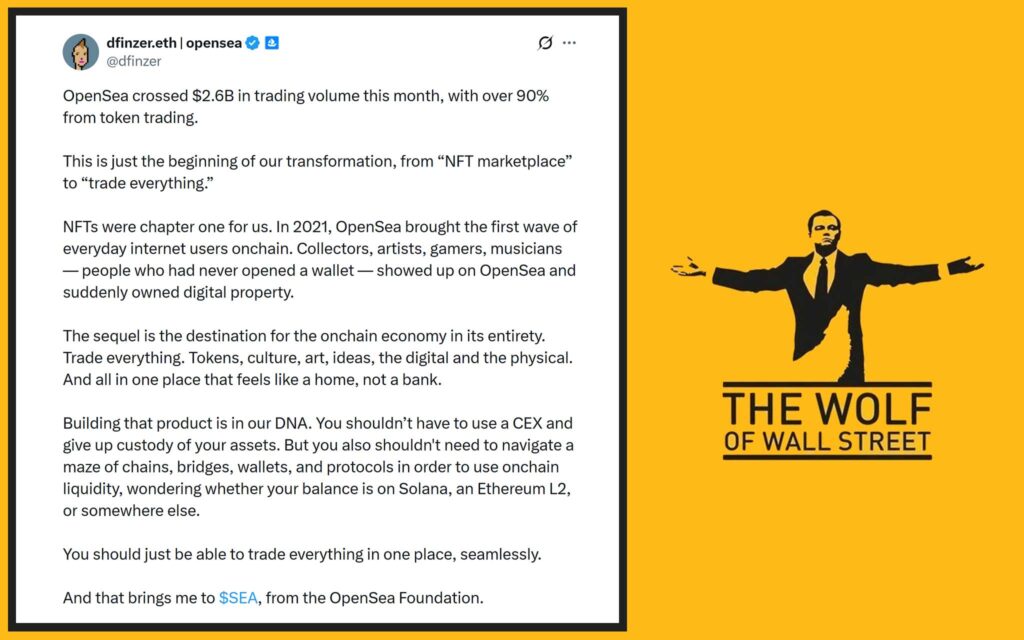

Founded in 2017, OpenSea dominated NFTs like a wolf among sheep – until the competition pounced. Blur sliced market share, volume tanked, and sceptics lined up to call time on NFTs. But October 2025 changed the story: over $2.6 billion in trading volume, with 90 percent coming from token trading, not collectibles (TradingView / Cointelegraph, 2025).

That’s the sound of reinvention – OpenSea proving it can run with the bulls again.

Learn more about OpenSea’s roots in our NFT marketplace guide.

💥 “Trade Everything” – The Next Chapter of On-Chain Power

Finzer’s mantra is simple: “Trade everything.”

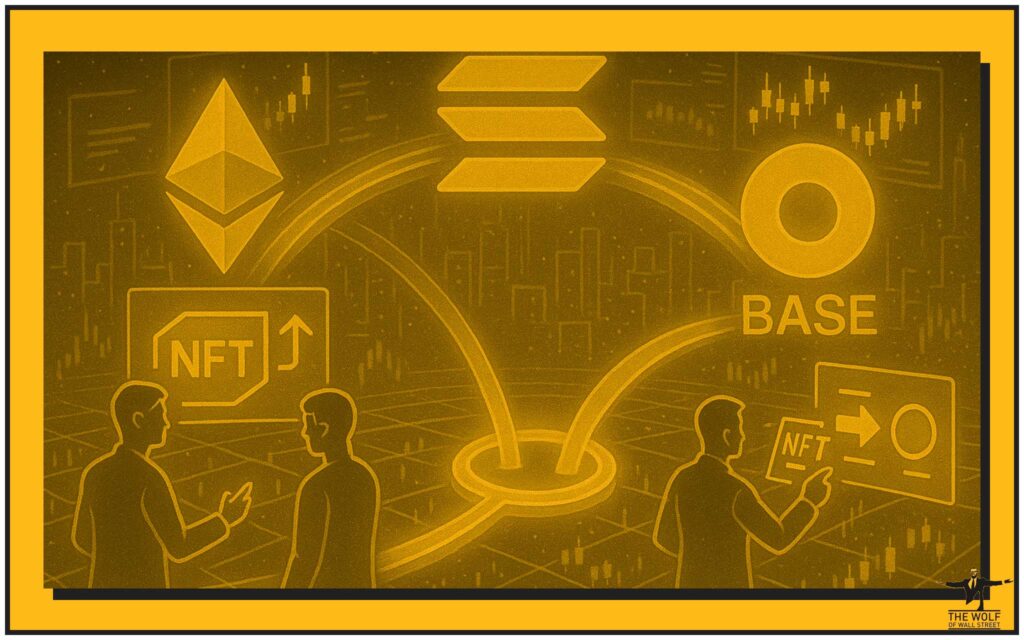

It’s not marketing fluff – it’s infrastructure ambition. The platform now supports 22 blockchains, from Ethereum to Solana to Base, aiming to unify fragmented liquidity into one seamless experience.

This is the next layer of DeFi evolution, the bridge between NFTs and real-world tokenised assets. Think of it as your all-access terminal for the on-chain economy, where swapping art for altcoins or tokens for treasuries happens in seconds.

OpenSea isn’t just adapting; it’s defining what a cross-chain marketplace should be.

Check out our guide to Layer 1 and Layer 2 solutions to see why this matters for scalability.

⚙️ The Tech, the Token, the Takeover

Now the meat of the strategy: OpenSea’s upcoming SEA token and mobile app, both rolling out in Q1 2026 (BeInCrypto, 2025).

The token brings governance, staking rewards, and a buy-back model that smells a lot like Wall Street meets Web3. Meanwhile, the app makes trading smoother than a market maker on espresso – one tap, one wallet, any chain.

OpenSea wants to abstract the tech so users don’t wrestle with bridges or gas juggling. The future? Tap → Trade → Profit.

If you’re new to token mechanics, explore our crypto token listing process guide.

🧠 Strategic Play – Owning the “Everything Market”

Let’s cut through the noise. This isn’t diversification; it’s a land grab.

NFTs will stay core to OpenSea’s DNA, but the platform is now powered by fungible trading, perpetual futures, and tokenised assets. With most of its latest volume coming from token swaps, OpenSea’s already halfway to being a DEX aggregator in disguise (Forbes, 2025).

In the Wolf’s words? That’s turning volatility into velocity.

For deeper analysis, check our trading insights section.

💼 The Bigger Picture – Web3’s On-Chain Renaissance

This move is bigger than OpenSea. It’s the dawn of asset-agnostic trading.

Web3 is shedding its silos: NFTs, DeFi, RWAs – they’re all merging under one roof. Platforms like OpenSea are becoming liquidity routers for the entire digital economy.

We’re watching the same transformation that turned Wall Street into a unified marketplace – except now, it’s trustless, borderless, and 24/7.

Want to ride this wave? Read the crypto profit-taking Wolf’s guide.

🦾 The Wolf’s Take – Winners Play Bigger

Finzer’s “trade everything” strategy isn’t just about expansion – it’s about survival through dominance.

OpenSea is building the infrastructure layer of ownership, not chasing hype. While rivals play short-term volume games, OpenSea’s building rails for the next decade of digital commerce.

That’s not evolution. That’s empire-building.

Because in the Wolf’s world, the rule’s simple – go big, or get eaten.

🔥 Power Move

While OpenSea builds the tech empire, The Wolf Of Wall Street builds the traders who profit from it.

Join the The Wolf Of Wall Street crypto trading community to access exclusive VIP signals, real-time market analysis, and a private network of 100 000 + traders locking in gains daily.

Get 24 / 7 support, smart tools, and a Telegram hive that never sleeps – join here.

Empower your trading journey and move like a Wolf.