🏆 Introduction: The Bitcoin Elite Club

Picture this: It’s 2025, and owning a single Bitcoin isn’t just impressive—it’s membership to the most exclusive financial club on the planet. There are Ferraris, there are mansions, and then there’s 1 BTC—the asset that proves you’ve made it.

But how rare is this milestone, really? What stands between you and the coveted full coin? By the end of this article, you’ll understand exactly what you’re up against—and how to join the digital elite before the door slams shut for good.

🛠️ The Origin Story: Scarcity by Design

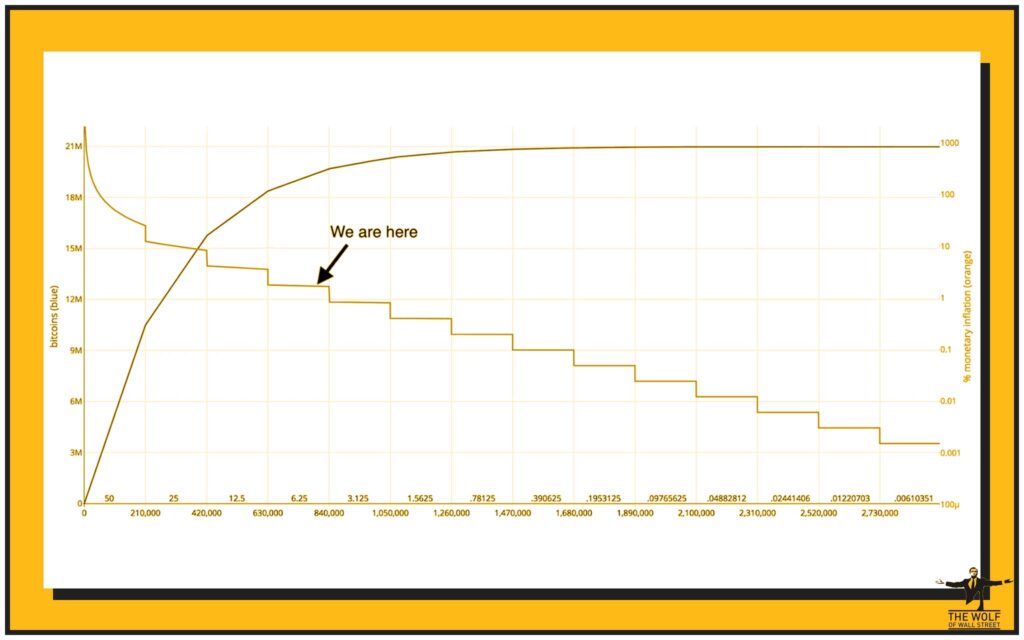

Here’s the deal: Bitcoin isn’t just “scarce”—it’s engineered for scarcity. Satoshi Nakamoto hardwired a strict 21 million coin cap into Bitcoin’s DNA. There’s no money printer, no hidden loophole, no “oops, we found a few more” in the code.

Every four years, the halving event slashes new BTC rewards, making every single coin harder to get than the last. Want to know why the world is obsessed with Bitcoin? Simple: supply is fixed, and demand is a tsunami.

📊 Understanding Bitcoin Supply: The Numbers Game

Let’s cut through the hype—how much Bitcoin is actually out there? As of mid-2025, about 19.7 million BTC have been mined.

But here’s the twist: not all of it’s in play. Lost coins, forgotten keys, and permanently dormant wallets mean the true circulating supply is much lower—some experts peg it closer to 16-17 million.

And it gets better (or worse, depending on your stack). A handful of “whale” addresses control a monster slice of the pie. This isn’t decentralisation; this is the high-stakes casino where only a few players hold the cards.

💎 Just How Rare Is 1 Bitcoin? The Cold, Hard Truth

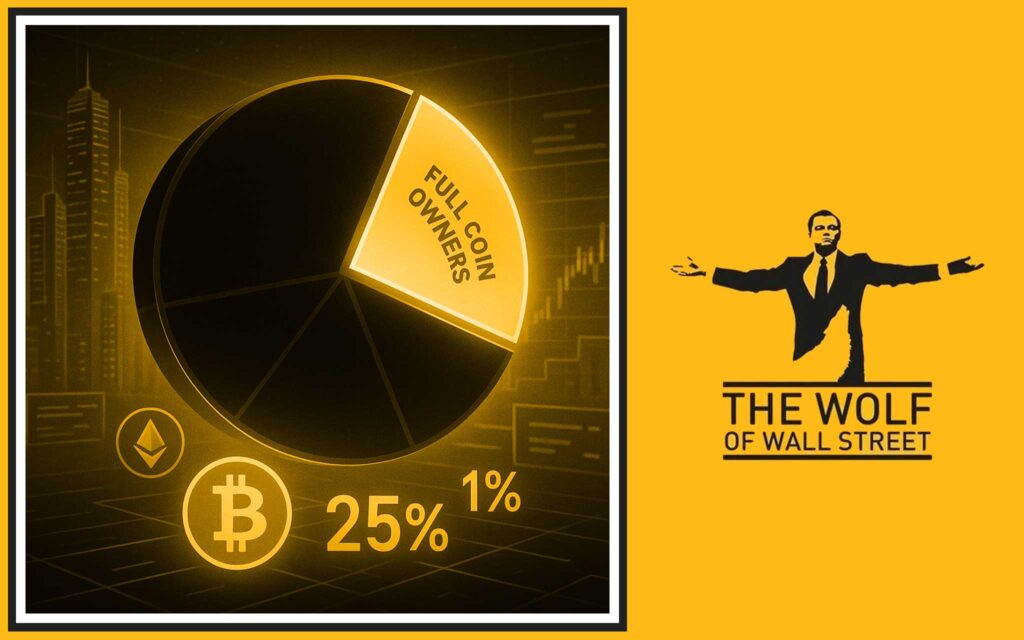

Let’s talk odds. There are around 850,000 unique addresses with at least 1 BTC—that’s about 0.01% of the world’s population. For every 10,000 people on Earth, only one has managed to grab a whole coin.

To put that in context: there are more millionaires in the world than full Bitcoiners. Let that sink in.

The reason? Most never get past the psychological, financial, and practical hurdles. Want to become a statistical outlier? You’re going to need a plan, conviction, and, frankly, balls of steel.

Did you know?

Most Bitcoin addresses don’t even hold 0.1 BTC—never mind a full coin.

Internal links you’ll want to check out if you’re serious about levelling up:

🧠 Psychological Warfare: Why Most People Will Never Own 1 BTC

The biggest roadblock? Your own mind.

Every market dip, every scary headline, every “Bitcoin is dead” tweet—these are designed to shake you out of your position. Volatility weeds out the weak. The smart money? They feed on this fear, buying when everyone else panics.

It’s not just about price. It’s about conviction. It’s about refusing to blink when the whole world screams “Sell!”

Most will never make it—not because they can’t, but because they won’t.

🌍 Infrastructure Barriers: Access Isn’t Equal

Let’s get real—access to Bitcoin isn’t uniform. In developed countries, buying crypto is as easy as clicking a button.

But in parts of Africa, Asia, and South America? KYC roadblocks, limited exchanges, hostile regulation, and unreliable internet make it a different game altogether.

Sure, Bitcoin is borderless. But the playing field isn’t level—yet.

🕳️ Lost Bitcoins: The Ultimate Scarcity Factor

Here’s a stat that’ll blow your mind: An estimated 3-4 million BTC are lost forever.

Early adopters who forgot their wallets, destroyed hard drives, lost seed phrases—these coins are never coming back.

What does this mean for you? It’s simple:

Every lost coin makes every remaining coin more valuable. The real supply crunch isn’t in the future—it’s happening right now.

🐋 Whale Dominance: Who Controls the Game?

Let’s talk power. The top 1% of addresses control more than a third of all Bitcoin in circulation. These aren’t regular investors—these are entities, institutions, and OG whales with skin in the game since day one.

Is true decentralisation possible? Maybe, but right now, the house always wins.

If you’re stacking to 1 BTC, you’re playing against some of the sharpest players in financial history.

🏦 The New Gold Rush: How Institutions Are Changing the Game

It used to be just tech nerds and libertarians. Now?

Wall Street’s in, public companies hold BTC on their balance sheets, and ETFs are swallowing up supply like there’s no tomorrow.

Institutional FOMO isn’t just hype—it’s a supply shock in real-time. When corporations like MicroStrategy or Tesla buy, they don’t sell. The window for retail to grab 1 BTC is closing—and fast.

💸 DCA and Accumulation: The Only Game in Town?

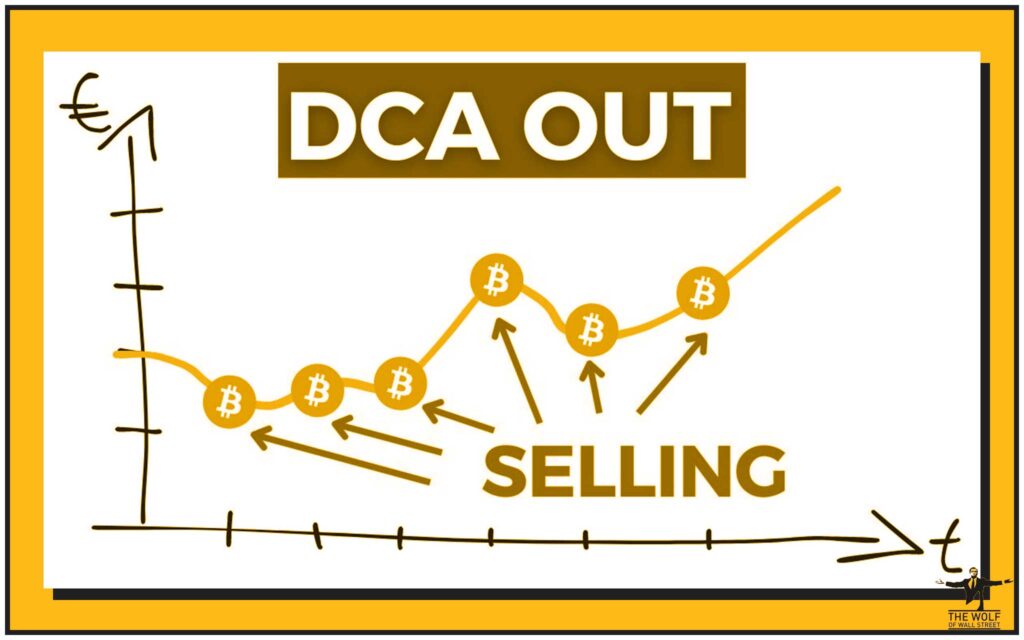

Most people can’t drop £50,000 in one shot. That’s why dollar-cost averaging (DCA) is the sharpest tool in the shed.

Set a fixed amount, buy regularly, ignore the noise. Over time, you build your stack—one sat at a time.

Real-world example:

Odell Beckham Jr. took his NFL salary in Bitcoin. Now, he’s a walking advertisement for long-term conviction.

Slow and steady isn’t sexy, but it works.

💰 Yield, Salaries, and Passive Crypto Income

Want to boost your stack without constant buying? Crypto now offers yield programs, staking, and even full salaries in Bitcoin.

Companies like Coinbase and Binance let you earn passive BTC. Some firms—especially in tech—are paying top talent in crypto.

In DeFi, new products let you earn interest or borrow against your stack, compounding your position even further.

⚖️ Regulatory Storms Ahead: Will It Get Easier or Harder?

Here’s the storm on the horizon. As Bitcoin gets bigger, regulators pay more attention.

FATF rules, KYC crackdowns, and tightening rules on exchanges—these are the hurdles of tomorrow.

But regulation cuts both ways:

Tighter compliance means fewer scams, but also higher barriers for the average investor.

Some nations will embrace crypto. Others will fight it tooth and nail. Where you live—and how nimble you are—will matter more than ever.

🧑💼 Expert Perspectives: The Real Voices of Crypto

Let’s hear it from the pros:

- Adam Back: “Owning 1 BTC could be as rare as owning a Picasso.”

- Michael Saylor: “There’s only enough Bitcoin for 0.2% of humanity to own a full coin. If you can, get one.”

- Jameson Lopp: “Don’t chase the top, but don’t wait forever—scarcity is real, and time is ticking.”

If you want to win, you study the winners.

🦸 Case Studies: The Unlikely Bitcoin Millionaires

It’s not just billionaires getting rich. There are countless “Bitcoin Cinderella stories”—ordinary people who stacked sats early and held through chaos.

- Satoshi Nakamoto: Over 1 million BTC, untouched—possibly lost forever.

- Early miners: Some became millionaires just by leaving a PC running.

- Sports stars: NFL, NBA, and even footballers are getting paid in Bitcoin.

Did you know?

In 2023, a pizza shop owner in Argentina quietly became a Bitcoin millionaire just by accepting BTC for two years.

🚀 Actionable Strategies: Get to 1 BTC Before It’s Too Late

No nonsense. Here’s how you get to 1 BTC:

- DCA every month—don’t skip.

- Earn, not just buy: Accept Bitcoin as payment, do freelance gigs, or sell products for BTC.

- Stake and yield: Use trusted platforms to put your crypto to work.

- Stay informed: Markets change—your strategy should too.

- Leverage community tools: The The Wolf Of Wall Street crypto trading community offers VIP signals, expert analysis, and a 100,000-strong network to sharpen your edge. Join the Telegram group for real-time support.

Avoid emotional trading, never leave coins on an exchange, and never chase the next shiny altcoin with your core stack.

🔮 The Future: Will Owning 1 Bitcoin Get Rarer Still?

Every halving cuts new supply in half. Every lost coin ratchets up scarcity.

Institutional buying and global adoption are just adding fuel to the fire.

Some predict that, by 2030, owning 1 BTC will be as rare as owning beachfront property in Monaco.

The question isn’t if it’ll get harder—it’s how fast.

🎯 Conclusion: Join the Few, Not the Many

Bottom line: Owning 1 Bitcoin in 2025 isn’t just rare—it’s the new status symbol.

It means you beat the odds, outplayed the system, and joined an elite group of financial outliers.

Want in?

Get educated. Get aggressive. Get stacking.

The window is closing—but the opportunity is still alive. The question is, what will you do about it?

❓ FAQs: Everything You’re Afraid to Ask About 1 BTC Ownership

Q1: How much does it cost to buy 1 BTC today?

A: Prices fluctuate, but as of 2025, it’s hovering around £50,000–£60,000. Always check a live exchange for the latest rates.

Q2: What happens if I lose my Bitcoin?

A: Lost private keys mean lost BTC—forever. Back up your wallets, use hardware security, and never share seed phrases.

Q3: Can institutions ever take over all the supply?

A: Unlikely—whales and early adopters still control a huge chunk, and regulatory scrutiny keeps things balanced for now.

Q4: Is Bitcoin still a good investment after 2025?

A: The fundamentals of scarcity and global demand remain strong, but always do your own research and understand the risks.

Q5: How does quantum computing threaten or help Bitcoin holders?

A: Quantum tech could, in theory, crack current cryptography. However, the community is already developing quantum-resistant protocols to stay ahead.

Want more? Expand your edge here:

- How to buy crypto: step-by-step

- Trading insights and pro strategies

- Bitcoin’s deeper dive

- Passive crypto income streams

- Market analysis and trending coins

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit The Wolf Of Wall Street services for details.

- Join our active Telegram community for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.