Introduction: Welcome to the High-Stakes Table

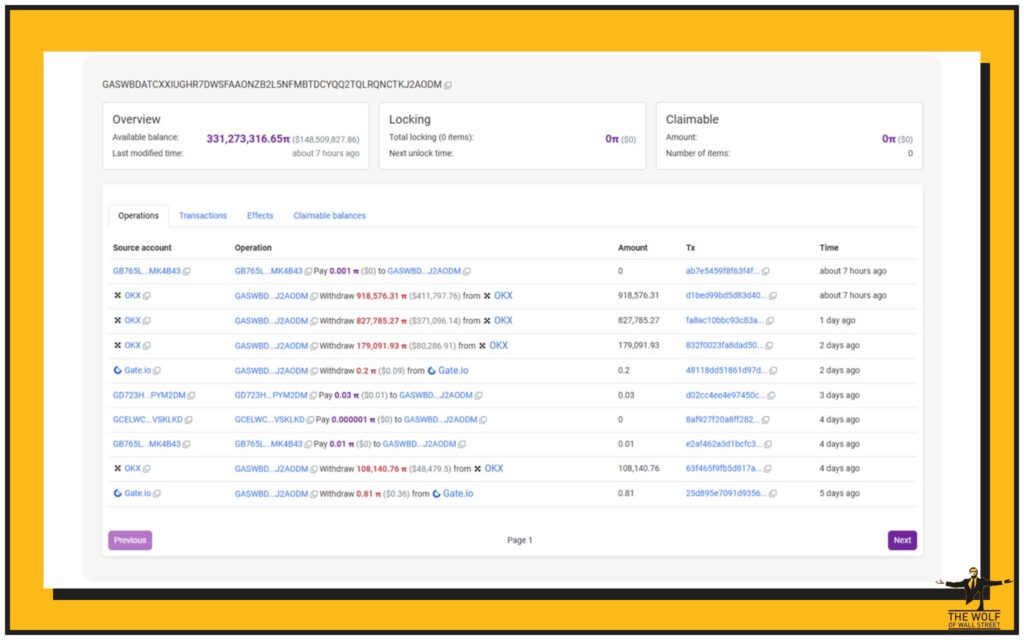

Listen up, because what I’m about to lay out is the type of play that makes legends in the crypto world. A mysterious wallet—known only as GAS…ODM—has quietly stacked up 331 million Pi coins while the crowd was running for the exits. No noise, no drama, just relentless accumulation in a blood-soaked market.

If you’re serious about making money, about mastering market cycles, and about dominating this space, you pay attention to what the smart money is doing—especially when the market’s bleeding. This isn’t just a story about a whale; it’s a blueprint for how power gets built in the digital economy.

🐋 The Whale Emerges: GAS…ODM Wallet Explained

Let’s get straight to the facts. In the shadows of the crypto world, wallets speak louder than words. The GAS…ODM wallet isn’t your average crypto enthusiast stacking a few coins.

This beast quietly scooped up 331 million Pi coins—worth nearly $150 million—over just three months. No media circus, no public declarations. Just consistent, large-scale withdrawals from exchanges, all under the radar.

Here’s the kicker: these weren’t sporadic buys. This was deliberate, calculated, and professional. And today, GAS…ODM sits as the sixth-largest Pi holder, dwarfing even some major exchange wallets.

📉 The Anatomy of a Market Shock: Pi Price Collapse and Accumulation

You want to know what separates the winners from the sheep? They buy when others are paralysed by fear.

During the whale’s buying spree, Pi coin took a savage hit—dropping up to 70% while other altcoins bounced. Most saw a red sea and ran. The whale saw opportunity and bought in bulk.

That’s how fortunes are made. This kind of accumulation in the face of panic isn’t a gamble—it’s a masterclass in market psychology and conviction. The lesson: blood in the streets means it’s time to load up.

🏦 Strategic Withdrawals: Outplaying the Exchanges

This isn’t just about buying coins. The real move here? Taking those coins off the exchanges.

By pulling millions of Pi out of circulation, GAS…ODM squeezed the supply and pushed up the scarcity. Each withdrawal made it harder for retail traders to get Pi, tightening the float, and putting the whale in a position of power.

When you see a wallet leapfrog past exchanges in holdings, pay attention. This is how price floors get established—and how weak hands get played.

🕵️♂️ Two Competing Theories: Who Is the Whale?

Now, let’s address the elephant in the room: Who’s behind GAS…ODM?

Two theories dominate the conversation.

- The Pi Core Team Theory: Some say the network’s own builders are buying back Pi to stabilise price, shore up trust, and prepare for future launches.

- The Major Exchange Theory: Others whisper that a heavyweight exchange is accumulating for a blockbuster Pi listing—think Binance, Coinbase, or another titan.

No official confirmation yet, but both scenarios send a powerful signal: this is a high-stakes player with a long-term agenda. Smart traders are watching every move.

🌐 The Ripple Effects: Pi Network’s Ecosystem Ignites

You don’t quietly vacuum up 331 million coins without making waves. The result?

Pi’s ecosystem went into overdrive—new decentralised applications, developer activity spiking, and staking volume breaking records.

Even as the price lagged, the network was buzzing. It’s the classic case: infrastructure booms when whales show conviction.

Check out how the DeFi ecosystem and Altcoins Market are responding—builders love momentum, and nothing creates FOMO like a big, mysterious buy.

⚠️ Centralisation Fears: Is Pi’s Dream at Risk?

Here’s where it gets controversial. One wallet holding so much Pi? That’s a centralisation risk—no way around it.

The Pi community, always loud on governance, started to worry: “What if the whale calls the shots on price or proposals?”

Crypto history is full of projects that stumbled when power got too concentrated. But here’s the flip side—big holders bring stability, long-term vision, and can prevent wild dumps.

It’s a balancing act, and every serious trader should understand both sides before placing bets.

💧 Supply Shock: What Happens When Circulating Pi Dries Up?

Let’s break this down—when supply dries up and demand creeps in, you get explosive moves. This isn’t theory; it’s hard market science.

The whale’s accumulation created a classic supply squeeze, taking coins out of weak hands and locking them up. That’s less sell pressure, more stability, and higher potential for the next breakout.

Who’s winning here? The player with conviction, patience, and the guts to zig when everyone else zags.

📊 Technical Analysis: The Road to Breakout or Breakdown?

Serious traders don’t just chase rumours—they look at the data.

- RSI (Relative Strength Index) signalled oversold conditions as Pi crashed.

- MACD (Moving Average Convergence Divergence) started hinting at bullish reversal patterns.

- Key support and resistance levels are forming around whale buys.

Review the strategies at MACD Momentum Signals, RSI Crypto Trading Strategies, and Bollinger Bands Trading Strategy to decode these signals yourself.

The next move could be massive—are you watching the right charts?

💰 Price Speculation: The Smart Money Playbook

Here’s where the rubber meets the road. What could happen next?

- Moderate Breakout: Pi claws back to the $0.75–$0.85 range if accumulation keeps the pressure on sellers.

- Aggressive Scenario: If momentum flips bullish and the whale reveals their hand, Pi could shoot past $1.00 in a blink.

But none of this is random—each move is fuelled by liquidity, sentiment, and the whale’s ongoing activity. If you want to ride the next wave, you need to think several moves ahead.

🚦 Community Response: FOMO, FUD, and Fresh Capital

Let’s talk social sentiment. When a big wallet moves, the chatter explodes—FOMO for some, FUD for others.

Crypto Twitter and Telegram have been lit with speculation, trader hot-takes, and influencer debates.

Want to cut through the noise? This is where expert analysis and VIP trading signals become your unfair advantage.

The The Wolf Of Wall Street crypto trading community is where over 100,000 traders get real-time updates, VIP signals, and 24/7 support—exactly what you need when the market’s moving at lightspeed.

🥊 Pi Network vs. The Rest: How Does It Stack Up?

Think Pi is alone in whale games? Think again.

Bitcoin’s early days were shaped by a handful of giants. Ethereum had its own wallet mysteries.

The common denominator? Big, strategic moves always precede the biggest breakouts.

Want to compare Pi to other coins, see whale activity, and learn from history? Start with Altcoins Market and explore DeFi insights—patterns repeat, and knowledge pays the best dividends.

🛠️ Navigating Uncertainty: Tools Every Trader Needs

Information is your edge.

- Volume calculators, analytics dashboards, and pro trading tools let you see through the fog.

- Want to make informed decisions? Tap into proprietary signals and market analysis delivered by seasoned crypto veterans.

- Don’t play solo—join a network with skin in the game, like The Wolf Of Wall Street crypto trading community, and surround yourself with winners.

From the trading insights to advanced analytics, it’s the difference between hoping and knowing.

🏆 Your Next Move: How to Profit from Whale Moves

Don’t just watch the game—get in and play it. Here’s how:

- Stake your Pi for passive rewards as the network grows

- Trade the volatility with confidence using expert signals

- Participate in new dApps and projects riding the Pi wave

Get instant alerts and join real-time discussions in the The Wolf Of Wall Street Telegram community to stay ahead. Winners don’t wait—they act, fast.

🔥 The Open Secret: Why Speculation Fuels Innovation and Growth

Let’s get real: speculation isn’t a bug, it’s a feature.

Uncertainty, mystery, and narrative keep the community buzzing and drive adoption.

The guessing game about the Pi whale? It’s lighting up forums, chats, and developer channels.

And every discussion, every rumour, every bold prediction—fuels innovation, brings in new blood, and cements Pi’s place at the centre of the crypto universe.

🏁 Conclusion: Don’t Watch from the Sidelines – Get in the Game

Let’s wrap it up, Belfort style. The Pi whale isn’t just making headlines—it’s making history. This is a high-stakes, high-reward play that’s reshaping Pi Network’s future.

So ask yourself: Are you watching from the sidelines, or are you grabbing your share?

Get educated, join a powerhouse community like The Wolf Of Wall Street, and be ready for the next move. The future belongs to those who act—so move fast, think big, and never, ever settle for average.

❓ Frequently Asked Questions (FAQs)

Who is the Pi Network whale?

The identity remains a mystery—top theories include the Pi Core Team or a major exchange. All that’s certain: it’s a heavyweight with long-term vision.

Is Pi Network still decentralised?

While most Pi is widely distributed, one wallet now holds a large share. It’s a debate—big holders can stabilise prices, but also concentrate influence.

How do whale moves affect crypto prices?

Whale accumulation tightens supply, often paving the way for price surges when demand returns. It’s classic market mechanics.

Where can I get expert Pi Network analysis?

Join communities like The Wolf Of Wall Street for expert market analysis, proprietary trading signals, and a private network of savvy traders.

What’s the next big move for Pi Network?

Watch for technical breakouts, ecosystem expansion, and potential exchange listings. Stay alert with real-time updates and signals.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market.

Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey: - Visit our service for detailed information.

- Join our active Telegram community for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street.

Related Reading & Internal Links

- Trading Insights

- DeFi Ecosystem

- Altcoins Market

- MACD Momentum Signals

- RSI Crypto Trading Strategies

- Bollinger Bands Trading Strategy

Ready to dominate? Because the opportunity’s right in front of you.

Let’s make your next move legendary.