📈 Listen Up! Here’s Why This Isn’t Just Tech Babble—It’s Your Financial Fortress

Listen to me, and listen good. In the world of stocks, you have brokers, accounts, and safety nets. In the world of crypto, you have you. You are the bank, the vault, and the security guard all rolled into one. Get it wrong, and you’re wiped out. Poof. Gone. Another sob story on a forum nobody reads. This isn’t a game; it’s the new frontier of wealth, and if you treat it like a game, the house will always win.

The Brutal Truth About Crypto Security

Every single day, amateurs—wannabes—are losing millions of pounds worth of Bitcoin, Ethereum, and other assets because they don’t grasp the fundamental difference between a private key and a seed phrase. They think it’s just boring technical stuff. Wrong! This is the difference between driving a Lamborghini and crying over a bus pass. It’s the blueprint to your financial fortress. Pay attention, because what I’m about to lay out for you is pure, unadulterated power.

What You’ll Learn: From Zero to Crypto Security Hero

In the next ten minutes, you’re going to learn more about securing your digital fortune than 99% of the so-called “investors” out there. We’re going to break down what these keys and phrases are, why they matter, and how to protect them with the ferocity of a wolf guarding its kill. Forget the jargon. This is a straight-talk, no-nonsense masterclass.

🔑 The Private Key: Your Golden Ticket to the Kingdom

Think of the crypto market as the world’s most exclusive, high-stakes club. Your crypto wallet is your VIP suite, and your private key is the one and only golden ticket that gets you past the velvet rope. Without it, you’re just another face in the crowd, staring at a fortune you can’t touch.

What Exactly is a Private Key? Let’s Cut the Crap

A private key is a monster of a password. It’s a 64-character alphanumeric code that is cryptographically generated. It looks like this: E9873D79C6D87DC0FB6A5778633389F4453213303DA61F20BD67FC233AA33262.

That string of gibberish? That’s not just data. That’s a command. It gives you—and only you—the authority to access and spend the cryptocurrency in your wallet. It’s the signature on the cheque, the final word, the trigger pull.

It’s Not a Suggestion, It’s a Command

When you send crypto, you’re not moving coins around like a bank transfer. You’re using your private key to sign a transaction message, broadcasting to the entire network: “I, the owner of these assets, authorise this transfer.” The network verifies your signature using your public key (which we’ll get to), and if it matches, the deal is done. Irreversible. Final. Powerful.

Where Does This Magical Money Key Come From?

When you create a new cryptocurrency wallet—whether it’s a mobile app, a desktop program, or a hardware device—it automatically generates this private key for you. Most of the time, the software keeps this key hidden away from prying eyes. It does the signing for you in the background so you don’t have to handle this beast of a code directly. Its job is to make things easy for you, but don’t let that fool you into getting lazy.

The Do’s and Don’ts: How to Not Be an Idiot with Your Private Key

- DON’T store it as a screenshot on your phone.

- DON’T email it to yourself.

- DON’T save it in a text file on your desktop named “CRYPTO KEY.”

- DO understand that if someone else gets this key, your crypto is now their crypto. There’s no customer service line to call.

For beginners, the best advice is simple: let your wallet manage it and focus on the master backup, which brings us to the next player in this high-stakes game. For those ready to get their hands dirty, our guide on how to buy crypto is the essential first step. And once you’ve mastered the basics, you can apply them to advanced trading frameworks like the Elliott Wave Theory trading guide.

📜 The Seed Phrase: Your Get-Out-of-Jail-Free Card

Now, if the private key is the golden ticket, what happens if you lose it? What if your laptop gets fried, your phone gets stolen, or your hardware wallet gets smashed? Are you ruined? Most people would be. But not you. Not after today. Because you’re going to have a seed phrase.

So, What’s a Seed Phrase and Why Should You Care?

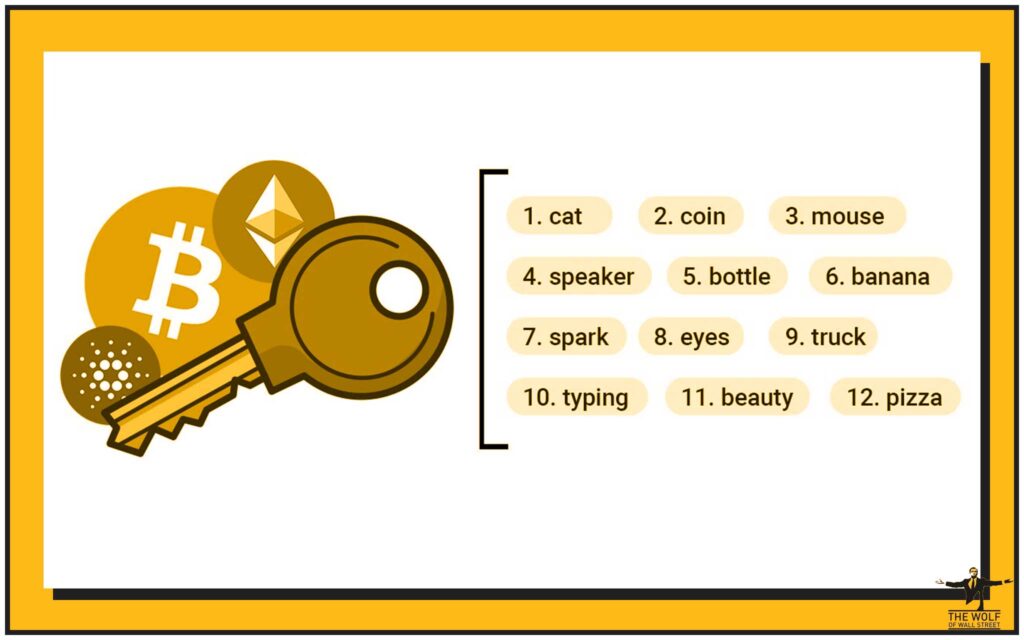

A seed phrase—also called a recovery phrase or mnemonic phrase—is your master key. It’s a list of 12 to 24 simple English words, generated by your wallet when you first set it up. It looks something like this:

glory tiger faculty pulp awesome float draft curious section abstract similar vessel

These words are your ultimate lifeline. They are the Adam and Eve from which all your private keys are born. If your wallet is destroyed, you can take this exact sequence of words, enter it into a new wallet, and voilà—your entire crypto portfolio is resurrected, back from the dead.

The 12-to-24-Word Lifeline

Why words? Because human brains are terrible at remembering 64-character random codes but pretty good at remembering a sequence of words. This system was designed for humans, not machines. It’s a genius-level feature that turns a catastrophic failure into a minor inconvenience.

How a Seed Phrase Rebuilds Your Empire (BIP-39 Standard)

These words aren’t random. They’re pulled from a specific list of 2048 words defined in a protocol called Bitcoin Improvement Proposal 39 (BIP-39). This standardisation means you can use your seed phrase from one wallet brand and recover your funds on a completely different one, as long as they both support the standard. It gives you freedom. It gives you control.

The Cardinal Sin: Storing Your Seed Phrase on a Computer

Listen to me very carefully. Your seed phrase should NEVER touch a device connected to the internet. Ever. The moment you type it into your notes app, save it to your cloud drive, or take a picture of it, you’ve opened a backdoor for every hacker from London to Beijing to walk in and take everything you own.

You write it down. On paper. On metal. You engrave it. You put it in a fireproof safe. You put one copy in that safe and another at your trusted solicitor’s office. You treat it like it’s a bar of gold, because it’s worth more.

🥊 The Main Event: Private Key vs Seed Phrase in a Head-to-Head Battle

Alright, let’s put these two heavyweights in the ring and see how they stack up. This is where the amateurs get confused, but the pros see the strategy.

Functionality: The General vs The Master Key

- Private Key: This is the frontline soldier, the general in the field. It’s used for the day-to-day work of signing transactions. You have a different private key for every crypto account you own within your wallet.

- Seed Phrase: This is the command centre, the master key to the entire fortress. It doesn’t sign transactions directly. Its sole purpose is to regenerate your entire suite of private keys if your wallet goes up in smoke.

Security: Digital Danger vs Physical Peril

- Private Key: The danger here is digital. Because it lives on a device (your phone, laptop, or hardware wallet), it’s vulnerable to malware, phishing, and remote attacks if your device security is weak.

- Seed Phrase: The danger here is physical. Since you’re storing it offline, the risk is fire, flood, theft, or you simply forgetting where you hid the damn thing. It can’t be hacked over the internet if it’s not on the internet.

A Side-by-Side Takedown: The Ultimate Comparison Table

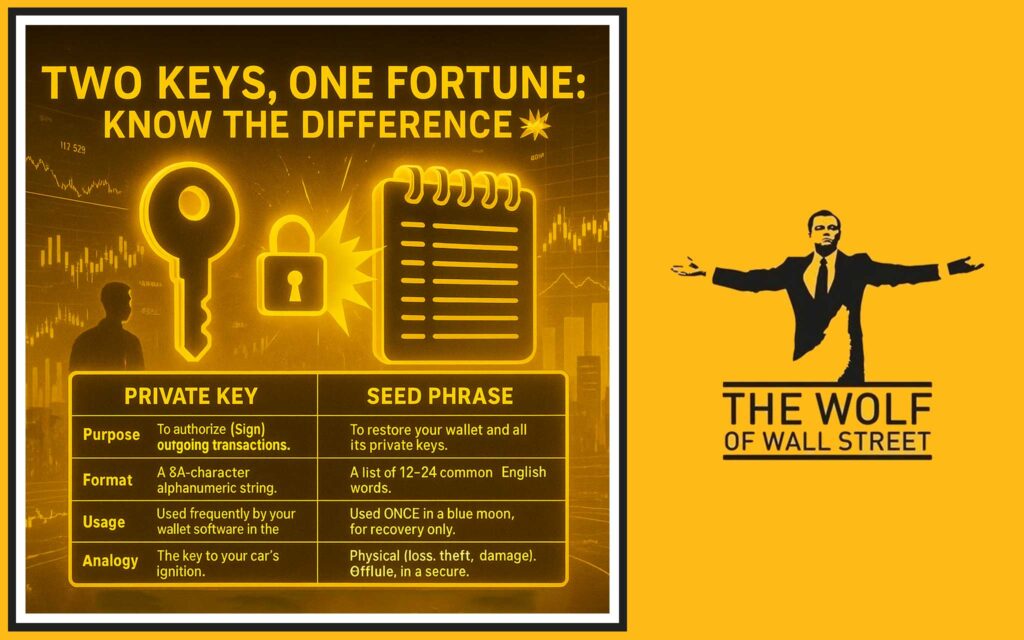

| Feature | Private Key | Seed Phrase (Recovery Phrase) |

|---|---|---|

| Purpose | To authorise (sign) outgoing transactions. | To restore your wallet and all its private keys. |

| Format | A 64-character alphanumeric string. | A list of 12-24 common English words. |

| Usage | Used frequently by your wallet software in the background. | Used ONCE in a blue moon, for recovery only. |

| Analogy | The key to your car’s ignition. | The master blueprint to rebuild the entire car. |

| Primary Risk | Digital (hacking, malware, phishing). | Physical (loss, theft, damage). |

| Storage | On a secure device (preferably a hardware wallet). | Offline, in a secure, physical location. |

🛡️ Advanced Plays for the Big Leagues: Wallets That Work Smarter

Once you’ve mastered the basics, you start to look for an edge. You want smarter, stronger, better security. The standard setup is for the masses. The following is for the future titans of industry.

Tired of Single Points of Failure? Enter Multi-Signature Wallets

A multi-signature (multi-sig) wallet is the nuclear option of security. It requires more than one key to authorise a transaction. Imagine a bank vault that needs two or three different managers to turn their keys simultaneously. A 2-of-3 multi-sig wallet, for example, might have keys on your laptop, your phone, and a hardware wallet. An attacker would need to compromise two of your devices at once—a monumental task.

Hierarchical Deterministic (HD) Wallets: The Power of One Master Seed

This sounds complicated, but it’s what most modern wallets are. “Hierarchical Deterministic” simply means that your one master seed phrase can be used to generate a near-infinite tree of private and public keys. This is great for privacy because you can use a new address for every transaction you receive, making it much harder for snoops to track your total wealth.

Seedless Wallets: Living on the Edge (For Pros Only)

Some newer wallets are going “seedless,” relying entirely on multi-sig and social recovery mechanisms where trusted friends or devices can help you regain access. This is cutting-edge stuff and eliminates the single point of failure of a physical seed phrase, but it introduces its own complexities. It’s a strategy for the pros who understand the risks. For those building their own projects, our guide on how to create a crypto token offers deep insights into the underlying mechanics.

🐺 The Wolf’s Playbook: Secure Your Fortune Like a Pro

Theory is great. Action is better. Here is your playbook. Don’t just read it. Do it.

Best Practices for Private Keys: Lock It Down

- Get a Hardware Wallet: Stop messing around with software wallets on your main computer. Buy a Ledger or a Trezor. It keeps your private keys in a secure, offline environment, like a digital Fort Knox. It’s the single best investment you will ever make.

- Authorise with Caution: Never sign a transaction from a website you don’t trust 100%. That “Approve” button could be giving a smart contract permission to drain your entire account.

Best Practices for Seed Phrases: Think Like a Spy

- Go Analogue: Write your seed phrase down on paper or, even better, stamp it into a metal plate. Metal is resistant to fire and water.

- Create Redundancy: Make two or three copies. Store them in different, secure, geographically separate locations. A safe at home and a safe deposit box at a bank is a classic play.

- Never Digital: I’ll say it again. Never store it digitally. No photos. No cloud storage. No password managers. The only exception is if you are an expert using high-end encrypted containers, but if you’re reading this, you’re not there yet.

A Word on Responsibility: You Are the Bank

This is the key takeaway. In the world of decentralised finance, there is no one to bail you out. There is no helpline. Responsibility is the price of freedom. Embrace it. If you’re serious about this, you need to understand the rules of the game, including the regulations. Brushing up on our crypto AML guide for compliance and security isn’t just smart; it’s essential.

❓ Frequently Asked Questions from the Trading Floor

Let’s knock these out, quick and clean.

What happens if I lose my private key but have my seed phrase?

You’re golden. You simply get a new wallet, select the “recover” or “import” option, and type in your seed phrase. Your entire fortune is restored.

Can I change my seed phrase?

No. A seed phrase is permanent. The only way to get a new one is to create a brand new wallet and transfer all your assets over to it.

Is it safe to use a digital password manager for my seed phrase?

Absolutely not. Password managers are a target for hackers. They are designed for website logins, not for the master key to your entire financial future. Don’t do it.

What’s the difference between a public key and a private key?

A public key is derived from your private key and is used to generate your wallet address—the one you share with people to receive crypto. It’s like your bank account number. The magic is that you can’t reverse-engineer the private key from the public key. It’s a one-way street.

🚀 Ready to Trade with the Wolves? Stop Gambling and Start Winning

You’ve just absorbed the single most important lesson in crypto security. You’ve learned the difference between the private key vs seed phrase. You’re already ahead of the pack. But knowledge without action is useless. Learning about security is one thing; learning how to make that secure capital work for you is another thing entirely.

Your Next Move to Conquer the Crypto Market

If you’re tired of guessing and ready to start executing with precision, then you need to be in an environment of winners. The The Wolf Of Wall Street crypto trading community is that environment. This isn’t a chatroom for hobbyists; it’s a war room for traders serious about profit. Here’s what you get when you join the wolfpack:

- Exclusive VIP Signals: Stop gambling on Twitter trends. Get proprietary signals engineered to maximise your profits.

- Expert Market Analysis: We cut through the noise and give you in-depth analysis from traders who have been winning in these markets for years.

- A Private Community of Killers: Join over 100,000 like-minded individuals. Share insights, strategies, and get the support you need to win.

- The Tools of the Trade: Access volume calculators and other essential resources that give you a decisive edge.

- 24/7 Support: The market never sleeps, and neither do we. Our team is always there to back you up.

Stop being the sheep. It’s time to become the wolf. Stop wondering how to find home-run trades and start getting the intel you need. If you’re serious about this, your next step isn’t a question, it’s a command.

- Visit our service:

https://tthewolfofwallstreet.com/servicefor the full breakdown. - Join our Telegram community:

https://t.me/tthewolfofwallstreetfor real-time action.

Unlock your potential. Stop leaving money on the table. The only thing holding you back from mastering the private key vs seed phrase dilemma and turning it into real wealth is your own hesitation.