🏁 Introduction: Why the Future of Crypto Needs Hybrid Power

Let’s cut the small talk—crypto’s future doesn’t belong to the timid. The stakes are sky-high, the risks are real, and if you’re not adapting, you’re lunch. Forget the tech-nerd babble for a second: the real edge is about making your capital bulletproof, not just speculating on moonshots. That’s where Proof-of-Activity (PoA) drops the hammer. In a world obsessed with speed and scale, PoA is the Wolf’s blueprint—a hybrid consensus mechanism that fuses the best of Proof-of-Work (PoW) and Proof-of-Stake (PoS), built for relentless security and sustainability.

If you’re a trader, investor, or blockchain builder, this isn’t just another acronym—it’s the difference between leading the pack or getting eaten by it. Get ready for the sharpest, no-fluff breakdown of PoA, and find out why the sharpest players in the market are leveraging hybrid consensus to stay ahead. Ready to run with the wolves? Let’s dive in.

🧠 What Is Proof-of-Activity (PoA)?

Think of PoA as the Wall Street power suit of blockchain consensus. It’s a hybrid, combining the raw horsepower of Proof-of-Work with the skin-in-the-game discipline of Proof-of-Stake. Instead of betting it all on just miners (like Bitcoin) or just stakers (like pure PoS chains), PoA puts both to work—making attacks exponentially tougher and keeping the whole network honest.

Why does that matter? Because in this game, security is everything. PoA is designed so that anyone trying to rig the system needs both massive computational muscle and a serious financial commitment. That’s a double paywall most attackers can’t break through. Want to know who’s leading the charge? Decred (DCR) is the flagship—more on that later.

🔥 The Origin Story: Why PoA Was Born

Here’s a reality check most people miss: Bitcoin’s security model is racing towards a cliff. The moment mining rewards dry up, it’ll be running on fumes—just transaction fees. The original PoA whitepaper, featuring visionaries like Charles Lee, was all about plugging this hole. The goal? Build a model where the network doesn’t crumble as mining rewards disappear. PoA isn’t a cute experiment; it’s the wolf’s answer to the biggest question in crypto: “How do we keep the lights on when the easy money stops?”

⚙️ How Proof-of-Activity Works (Step-by-Step)

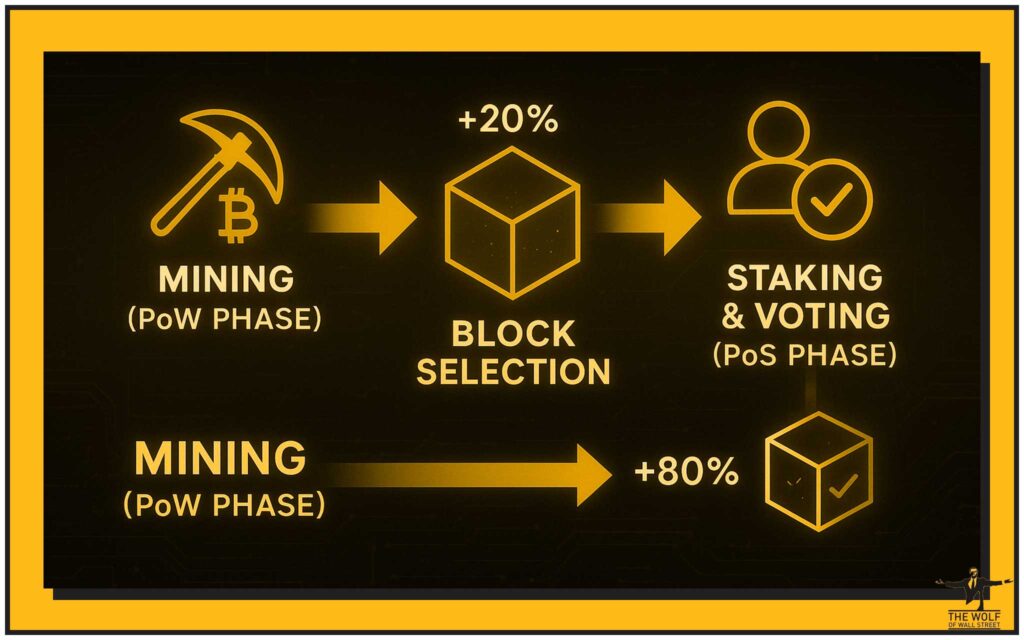

Time to pop the hood. Here’s how PoA brings the heat:

- Mining (PoW phase): Miners compete to find a new block—same old arms race.

- Activity Check: The block they find is basically a skeleton, no transactions—just a challenge.

- Staking & Voting (PoS phase): Randomly selected stakers (ticket holders) jump in to validate and approve the block.

- Block Finalisation: If a majority votes “yes,” the block becomes part of the chain; rewards get split between the miner and the voters.

It’s teamwork at its most ruthless: both miners and stakers must play by the rules, or the network kicks them to the curb.

💡 Quick Comparison: PoA vs PoW vs PoS

| Feature | Proof-of-Work (PoW) | Proof-of-Stake (PoS) | Proof-of-Activity (PoA) |

|---|---|---|---|

| Consensus Role | Miners only | Stakers only | Miners + Stakers |

| Attack Resistance | Needs 51% hash power | Needs 51% staked coins | Needs 51% hash & 51% stake |

| Energy Efficiency | High energy use | Low energy use | Medium energy use |

| Centralisation Risk | High (mining pools) | High (whales) | Balanced (both groups matter) |

| Example | Bitcoin | Ethereum 2.0 | Decred |

🚦 The Security Stack: Why Attackers Hate PoA

If you want to take down a PoA network, you better bring two nuclear bombs—one for mining, one for staking. That means:

- Hashing Power: You still need brute computational strength, just like in Bitcoin.

- Staking Capital: But now, you also need to control a majority of all staked tokens. Not just own them—stake them, risk them.

That’s a double hurdle. 99.99% of attackers will tap out before they even try. In practice, PoA blockchains like Decred have never faced a full-scale compromise, while smaller, single-layer systems have gone belly-up more than once. When you’re running with the wolves, you want every layer of security you can get.

📉 The Energy Equation: Can PoA Save the Planet?

Let’s get real: PoW burns electricity like there’s no tomorrow. PoA cuts that waste down—but doesn’t eliminate it. Miners still race to find new blocks, but staking spreads the load. The result? Less energy than Bitcoin, more than pure PoS. If you’re serious about trading on eco-conscious platforms or investing in blockchains that might actually last, PoA should be on your radar.

Want to master energy-efficient trading strategies? Check out our guide to money flow index (MFI) strategies and see how smart traders spot low-energy, high-profit moves.

👑 Example in Action: Decred’s Hybrid Dominance

Now, here’s where theory meets reality. Decred (DCR) isn’t just a poster child for PoA—it’s the whole damn billboard. Decred combines:

- Proof-of-Work: Miners start the process.

- Proof-of-Stake: Ticket holders vote on blocks.

- Community Governance: Users propose and vote on major changes, so no single whale can hijack the project.

Decred’s ticket-based voting system is ruthless in its fairness. Miners get paid, stakers get paid, and every block is checked by both sides. No wonder Decred has outlasted dozens of “next-gen” projects.

For a deep dive, head to our Decred hybrid consensus guide.

🏦 Industry Adoption: Why Isn’t Everyone Doing This?

Here’s the million-dollar question: if PoA is so tough, why isn’t every blockchain on the planet using it? Simple—complexity. PoA asks more of everyone: you can’t just plug in your miner or stake your tokens and walk away. Plus, there’s inertia—most new projects chase trends, not long-term resilience.

That’s why adoption is slow, but smart projects are waking up. The ones who get it will run laps around the crowd when market conditions shift and attacks spike. Want to see how real traders adapt? Browse our trading insights and crypto profit-taking guide.

⚖️ Centralisation: The Silent Risk

Every consensus model has a weak spot. For PoA, it’s the risk that a handful of whales could dominate staking—or that mining pools could cartelise hashing power. The solution? Balanced incentives. In Decred, both groups must work together, or everyone loses. That’s a governance model you don’t find in pure PoW or PoS systems.

Curious how decentralisation works in other top coins? Jump to layer-1 and layer-2 solutions or the Bitcoin section for more.

🔎 Criticisms and Controversies

No one’s immune from critics—not even PoA. Here’s what sceptics throw at it:

- Still burns energy (not as much as PoW, but more than PoS)

- Complexity scares off smaller projects and newcomers

- Centralisation risk if whales dominate staking and mining

Are these dealbreakers? No, but you need to know them. Want the inside track on why some blockchains fail? Study our crypto hedge funds market shift and Bitcoin overtakes Amazon analysis.

🏆 Key Advantages of Proof-of-Activity

Here’s why PoA isn’t just another buzzword:

- Security squared: Harder to attack, easier to trust

- Incentive alignment: Both miners and stakers play to win

- Governance built-in: Real voting power, not just slogans

You want longevity? You want transparency? PoA is the way to build it.

🛑 The Drawbacks: Where PoA Falls Short

Every system has trade-offs. PoA’s are:

- Steep learning curve: If you’re a newbie, prepare to learn fast

- Requires larger, more active communities: Smaller chains can get stuck

- Not a silver bullet: Hybrid isn’t perfect, but it’s powerful

New to crypto? Dive into our crypto newbie section for foundational guides.

🧬 The Future of PoA & Hybrid Consensus

The crypto landscape never stops evolving. PoA was a turning point—but it’s not the final form. New contenders like Proof-of-Authority and Proof-of-Elapsed-Time are pushing the frontier. Will PoA get left behind? Not if developers and communities stay hungry and committed.

Explore the future of consensus models in crypto regulations and innovation and multi-party computation for security.

🚀 Real-World Impact: What It Means for Crypto Traders

You’re not here for theory. You want results. Here’s the Wolf’s advice: PoA blockchains offer next-level resilience and market confidence, which can be a goldmine for tactical traders. But knowledge alone isn’t enough. If you want the edge, you need community, signals, and tools—just like those in the The Wolf Of Wall Street crypto trading community.

The market never sleeps, and neither should you. Join our Telegram channel for real-time updates, and unlock access to exclusive VIP signals, expert market analysis, and essential trading resources.

🛠️ Tools & Resources for Traders

Mastering PoA means mastering your toolkit. Here’s how to get ahead:

- Tap into volume calculators and trading resources

- Stay connected with a 24/7 support community (The Wolf Of Wall Street)

- Learn from over 100,000 fellow traders and never miss a trend

Want to sharpen your game? Check out our trendlines charting guide and MACD momentum signals.

🗣️ Frequently Asked Questions (FAQs)

What makes PoA different from PoS?

PoA is a hybrid: you need to win both the mining race and the staking vote, making attacks exponentially harder than on a pure PoS chain.

Can PoA blockchains be hacked?

Not easily—an attacker needs a majority of both mining power and staked tokens. That’s a wall too high for most to even try.

Why isn’t PoA used everywhere?

It’s more complex to set up and run, but as security challenges mount, more projects may switch over.

How can I get involved with hybrid-consensus projects?

Look for projects like Decred, join active communities like The Wolf Of Wall Street, and keep learning from internal guides.

How do I stay ahead in a hybrid-powered market?

Follow the leaders. Join communities, stay up-to-date with expert analysis, and leverage tools like trading bots vs AI agents.

📝 Conclusion: Is PoA the Wolf’s Secret Weapon?

Let’s bring it home—PoA isn’t a pipe dream, it’s a battle-tested upgrade for serious traders, investors, and builders. In a world where the rules keep changing and security is everything, PoA offers the edge you need to run with the winners. Whether you’re a Decred voter, a miner, or just a sharp trader in the The Wolf Of Wall Street community, hybrid consensus is your ticket to staying one step ahead.

The next move is yours: Join the The Wolf Of Wall Street service, connect in the Telegram community, and unlock your potential to dominate the crypto market.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey: - Visit our service: The Wolf Of Wall Street Service for detailed information.

- Join our active Telegram community: The Wolf Of Wall Street Telegram for real-time updates and discussions.

- Unlock your potential to profit in the crypto market with “The Wolf Of Wall Street”.