⚡ Introduction – The Shockwave in Crypto

Qubic just pulled off one of the boldest moves in recent crypto history: a 51% attack on Monero. Six blocks reorganised. Exchanges like Kraken panicking. And now, the Qubic community has voted – the next target isn’t some small altcoin.

It’s Dogecoin, the $34 billion meme giant. This isn’t just another news story; it’s a wake-up call for anyone holding proof-of-work (PoW) coins. Let’s break it down.

🔐 The Mechanics of a 51% Attack

Before we talk strategy, you need to understand the weapon. A 51% attack happens when a single entity or coalition controls the majority of a blockchain’s mining power. Control the hash power, control the network:

- They can rewrite blocks.

- They can double-spend coins.

- They can temporarily freeze transactions.

Historically, we’ve seen it with Ethereum Classic and Bitcoin Gold. But Monero? That’s a different beast – known for privacy, speed, and resilience. Or at least, it was.

🤖 Qubic’s Rise: The AI-Driven Powerhouse

Qubic isn’t your typical crypto project. It’s an AI-powered blockchain ecosystem that’s been quietly amassing influence. Founded by Sergey Ivancheglo (Come-from-Beyond), one of the original IOTA developers, Qubic has turned mining into a weaponised strategy.

Their pitch? Use AI to optimise mining efficiency, scale dominance, and push through attacks that normal miners can’t even dream of. The Monero hit is proof it works.

⛏️ The Monero Takeover: Six Blocks Rewritten

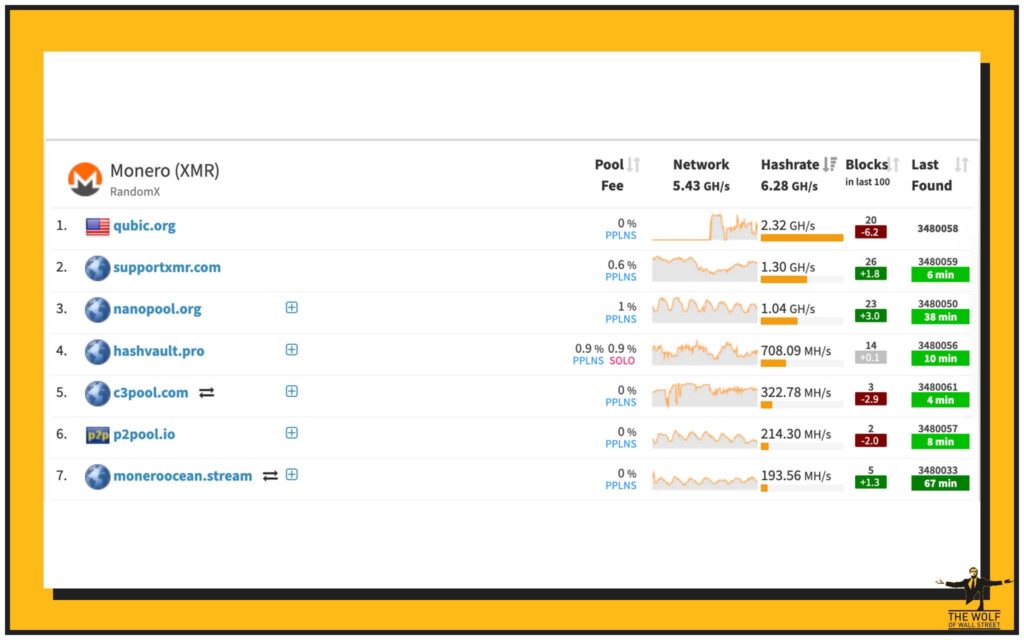

In plain English: Qubic’s miner pool took majority control over Monero’s network, reorganising six full blocks. That’s not theoretical – that’s proof of control.

Numbers don’t lie: Qubic’s pool is now commanding 2.32GH/s of Monero’s hashrate. That’s like showing up to a poker game with a deck stacked entirely in your favour.

🚨 Kraken’s Emergency Response

Crypto exchanges had no choice but to react. Kraken announced it was suspending Monero deposits, citing integrity risks. Withdrawals and trading remained active, but the message was clear: Monero’s trust factor just took a massive hit.

If an exchange doesn’t trust a blockchain, investors won’t either. That ripple spreads fast.

🛡️ Monero’s Core Still Standing?

Here’s the kicker: despite the attack, Monero’s transaction privacy, speed, and usability reportedly remain intact. Qubic themselves said the core experience wasn’t broken. But let’s be real—this is about perception and security confidence, not just functionality.

Would you park your money in a network that just got bent over by an AI-powered miner pool? That doubt alone damages credibility.

🐕 Community Vote: Dogecoin Becomes the Next Target

After flexing on Monero, Qubic’s founder Sergey didn’t hide in the shadows. He threw it back to the Qubic community: Which blockchain should we attack next?

The result? Over 300 votes for Dogecoin – beating every other PoW option. And just like that, the world’s favourite meme coin is officially in Qubic’s crosshairs.

💸 Why Dogecoin Is a Prime Candidate

Dogecoin isn’t just a meme anymore – it’s a $34B+ market cap asset with insane trading volume and Elon Musk-level visibility.

Why target DOGE? Because:

- It has massive PR value – everyone knows it.

- Its meme culture guarantees headlines.

- It’s still PoW, meaning it’s technically vulnerable.

If Qubic lands this strike, the media explosion will dwarf Monero’s coverage.

🌍 The Bigger Picture: Proof-of-Work Vulnerabilities

The Monero and Dogecoin storyline isn’t isolated—it’s a flashing warning sign for all proof-of-work blockchains. The weaknesses are systemic:

- High hashrate requirements don’t guarantee invincibility.

- Centralised mining pools tip the balance.

- Now add AI-driven optimisation? The game changes completely.

🧠 The AI Factor in Blockchain Security

Here’s where it gets scary: AI doesn’t just mine better; it strategises better. It allocates resources in real time, optimises attack windows, and scales dominance at speed.

The decentralised dream of PoW starts to crumble when an AI-led pool can outthink and outspend entire communities.

🏦 Exchanges & Developers: How Will They React?

Exchanges like Kraken will act as first responders, suspending services when networks get shaky. Developers, on the other hand, face a harder task: how do you rebuild trust after a public 51% takedown?

The Dogecoin dev team hasn’t spoken up yet, but you can bet they’re running emergency risk assessments.

🗣️ Crypto Community’s Mixed Response

- Qubic supporters? Ecstatic. They see it as proof of dominance.

- Monero faithful? Nervous but trying to downplay.

- Dogecoin’s meme army? Turning fear into jokes – for now.

But underneath the memes, there’s tension. If Dogecoin falls, the joke’s on everyone.

💼 What Investors Need to Know Right Now

If you hold Monero or Dogecoin, this is what matters:

- Short-term volatility is inevitable.

- Exchanges may suspend services, stranding funds.

- Diversification is non-negotiable. Don’t go all-in on vulnerable PoW assets.

📜 Lessons From History: Other 51% Attacks

We’ve seen this before:

- Ethereum Classic lost millions in reorganised transactions.

- Bitcoin Gold faced double-spend chaos.

- Smaller projects have been completely wiped out.

The pattern is simple: once trust cracks, recovery takes years—if it ever happens at all.

⚖️ Where This Leaves Proof-of-Work

PoW was designed to secure blockchains through distributed hashpower. But Qubic’s Monero strike proves concentration of power is back on the table.

If AI-led pools dominate, PoW isn’t decentralised—it’s centralised under a smarter, faster player. The industry may be forced to look at proof-of-stake (PoS) or hybrid consensus as long-term solutions.

🔑 Practical Advice: Securing Your Crypto Assets

Protect yourself before the next attack:

- Use cold wallets over exchange wallets.

- Diversify across PoW and PoS assets.

- Stay plugged into real-time updates—speed is everything in a crisis.

For deeper trading strategies, check out Trading Insights.

🚀 The Wolf Of Wall Street: A Community to Trade Smarter, Not Harder

In chaotic markets, you either react blindly or you act strategically. That’s where the The Wolf Of Wall Street crypto trading community steps in:

- Exclusive VIP Signals: Maximise profits with proprietary trade calls.

- Expert Market Analysis: Learn from seasoned traders.

- Private Community: 100,000+ like-minded members.

- 24/7 Support: Get answers when you need them.

Want to take control? Explore our service or join the conversation on Telegram.

🏁 Conclusion – The New Era of Blockchain Battles

Monero was the warning shot. Dogecoin could be the main event. And if Qubic proves it can steamroll a meme coin with a $34B market cap, then no PoW blockchain is safe.

This isn’t just about Qubic vs. Dogecoin—it’s about the future of decentralisation. Will communities adapt? Or will AI-driven dominance reshape everything we thought we knew about blockchain security? Either way, you better be ready.

❓ FAQs

1. What exactly happened in Qubic’s 51% attack on Monero?

Qubic’s miner pool gained majority hashpower, reorganising six blocks and effectively taking control of the network temporarily.

2. Why was Dogecoin chosen as the next target?

A Qubic community vote picked Dogecoin, with over 300 supporters calling for it as the next 51% target.

3. How can investors protect their holdings from 51% attacks?

By diversifying, using cold wallets, and monitoring exchange risk updates.

4. What role does AI play in blockchain security?

AI optimises mining strategies, making attacks more efficient and harder to stop.

5. Is proof-of-work still a safe consensus model?

It’s under threat. Without decentralised mining and updated security protocols, PoW is vulnerable.

Internal Linking Opportunities

- Stay updated with the latest News.

- Dive deeper into Cryptocurrencies.

- Boost your trading edge with Trading Insights.

The Wolf Of Wall Street crypto trading community offers a comprehensive platform for navigating the volatile cryptocurrency market. Here’s what you gain:

- Exclusive VIP Signals: Access proprietary signals designed to maximise trading profits.

- Expert Market Analysis: Benefit from in-depth analysis from seasoned crypto traders.

- Private Community: Join a network of over 100,000 like-minded individuals for shared insights and support.

- Essential Trading Tools: Utilise volume calculators and other resources to make informed decisions.

- 24/7 Support: Receive continuous assistance from our dedicated support team.

Empower your crypto trading journey:

- Visit our service: https://tthewolfofwallstreet.com/service

- Join our active Telegram community: https://t.me/tthewolfofwallstreet

- Unlock your potential to profit in the crypto market with The Wolf Of Wall Street